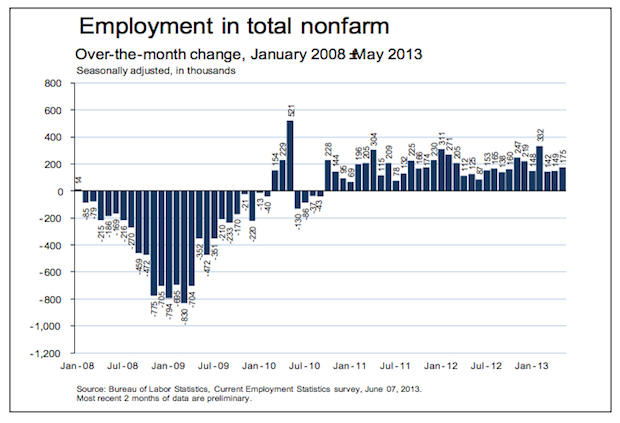

Rates Hit 2013 Highs After May Jobs Report

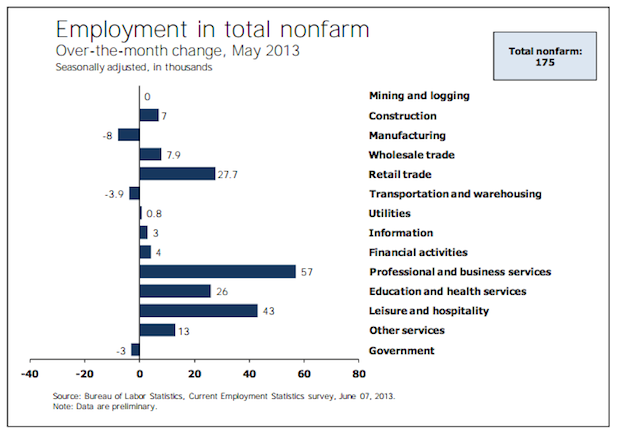

Rates hit 2013 highs today after a BLS report showed the U.S. economy added 175k nonfarm payrolls in May, right around expectations of 170k, and April was revised down from 165k to 149k. Also March was revised up from 138k to 142k.

This non-farm payrolls figure is from the ‘Establishment Survey’ component of the jobs report which doesn’t count actual people, but rather counts how many companies opened or closed, then uses that data to estimate the number of jobs gained or lost.

Unemployment rose from 7.5% to 7.6% according to a different component of the jobs report called the ‘Household Survey’ which counts people. There are 11.8 million people unemployed. Plus another 7.9 million people are working part time because their hours were cut or they can’t find a full time job.

RATE REACTION

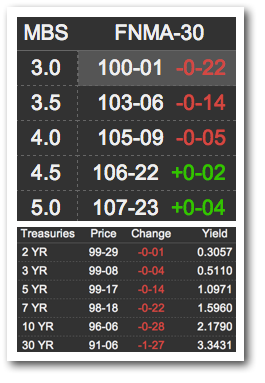

Rates rise when bond prices drop in a selloff, rates were up about .125% today as mortgage bonds (MBS) and Treasuries sold all day.

Rates rise when bond prices drop in a selloff, rates were up about .125% today as mortgage bonds (MBS) and Treasuries sold all day.

The MBS coupons that lenders use to price consumer rates follow trends of the 10yr Note, and the 10yr Note yield tried most of today to cling to a technical support level of 2.14%. But the selling was too strong and it closed at 2.18%—and MBS selling followed suit all day.

The Fannie 30yr 3% MBS coupon was sharply down 22 ticks (a tick is 1/32) to 100-01, which continues a month-long selloff triggered by the April jobs report a month ago when this coupon was at 104-03.

2013 RATE RECAP

Extreme rate volatility defines 2013. Rates started rising January 3 when markets interpreted December Fed meeting minutes as indicating that the Fed would end quantitative easing (aka QE, which is Treasury and mortgage bond buying to keep rates low) by the end of this year.

There was a brief reprieve as MBS recovered and rates touched all-time record lows (of 3.25% for a 30yr fixed loan up to $417k) for two days on January 15-16.

Then the “end QE early” chatter gained steam and speculation about the timeline has expanded—guesses now range from late summer to end of the year.

The speculation has caused some miscellaneous rate dips on single trading days, but otherwise it’s been a steady march higher for rates. We’re now .75% to .875% higher than those record lows of mid-January.

This rate spike is real and consumers should act accordingly. But it’s also worth noting that the extreme volatility is driven by markets trying to interpret what the Fed might do. For example, look at what bond king Bill Gross said today:

“I don’t think today’s report says anything about tapering at all with unemployment going higher and metrics in terms of the work week and wages being very” dire, Pacific Investment Management Co.’s founder Gross said in a radio interview on ‘Bloomberg Surveillance’ with Tom Keene and Mike McKee. Fed Chairman Ben S. Bernanke “won’t taper. But I think ultimately in order to get a more normal economy, the Fed has got to move interest rates up to more normal levels.”

Gross’ comments arguably move markets as much as Bernanke’s do, and this comment takes strong positions on both sides. First he suggests the Fed isn’t likely to pump the brakes on QE because the employment situation isn’t good, then he suggests the Fed needs to elevate rates.

This environment means more volatility—which means rates are likely to continue trending upward this year, with some miscellaneous dips along the way.

JUMBO RATES MORE STEADY

It’s also critical to note that the rate spike is predominantly focused on conforming loans, and rates for jumbo loans above $417,000 are holding more steady.

Quantitative easing is focused buying MBS that are comprised of conforming loans, so the conforming MBS market has seen artificial inflation (rates down) by the Fed that’s now deflating (rates up). But the jumbo MBS market is faring much better because the Fed doesn’t intervene in that market. Read today’s WSJ piece (featuring me) on the state of the jumbo mortgage market.

___

Reference:

– A Deep Dive On The May Jobs Report

– Jobs report CHART FEST – by FloatingPath

– Investors Show Renewed Interest In Jumbo MBS Market (WSJ – with me)

– $MBB, $TLT, $TBT, $ZN_F, $TNX, $MACRO

*Tables used with permission from MortgageNewsDaily