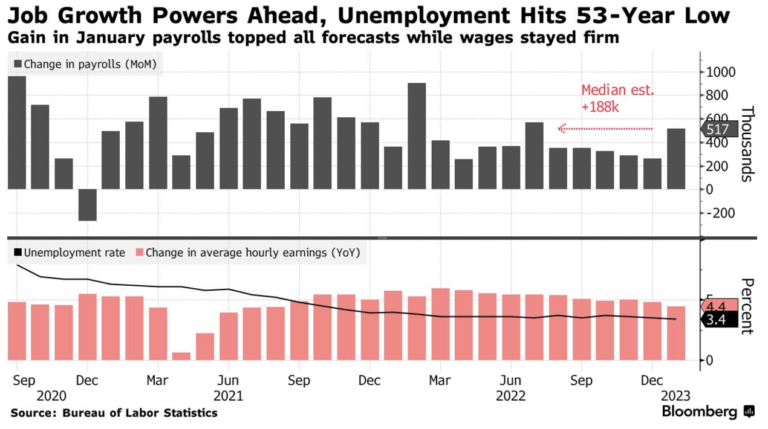

Spirits up but so are rates as hot economy adds 517k new jobs with crazy low 3.4% unemployment

Today’s jobs report showed the U.S. economy added 517k new jobs in January, which exceeded expectations for the 10th straight month. Mortgage rates, after briefly dipping into the upper 5% range this week, are now back above 6%, but still WAY lower than the 7.375% peak on October 20, 2022.

Naturally, we’re now getting jobs report headlines about how this complicates the Fed’s role.

But does it really?

The Fed has been explicit about keeping their inflation-fighting rate hikes going, albeit at a slower pace. They’ve also been explicit about why: because of strong employment data like this.

The Fed has a dual mandate to have their policy actions foster both maximum employment and price stability, aka low inflation.

Today’s jobs report showing 3.4% unemployment — the lowest since 54 years ago in 1969 — and hot jobs growth certainly hits part 1 of that mandate, and their FOMC meeting statement Wednesday underscores their commitment to part 2 without blowing out part 1.

Goldman Sachs said fewer end-of-year layoffs likely contributed to the January jobs surge, and they expect more trend-like gains in February and March.

Below are two other useful reference images.

===

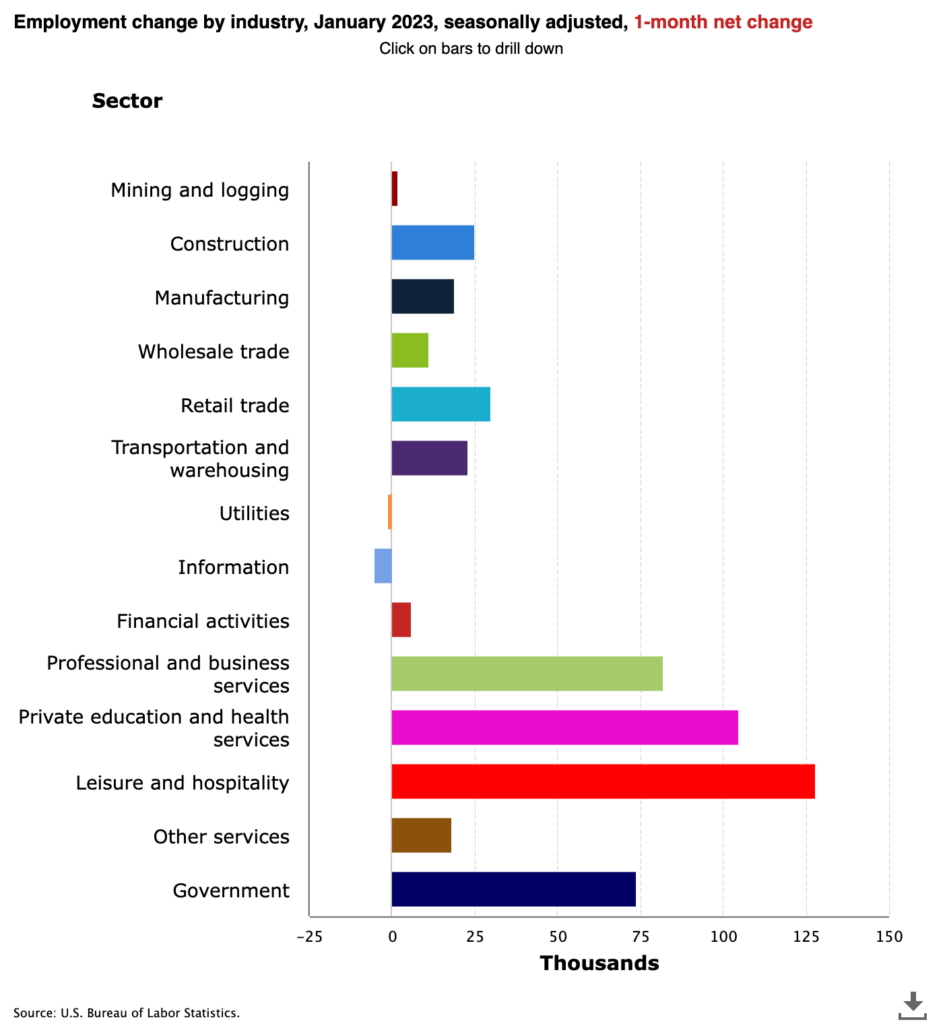

Here are the industries where January jobs grew the most. Hospitality spiked as pandemic fears wane and people get back to work, leisure, and travel for business and fun.

===

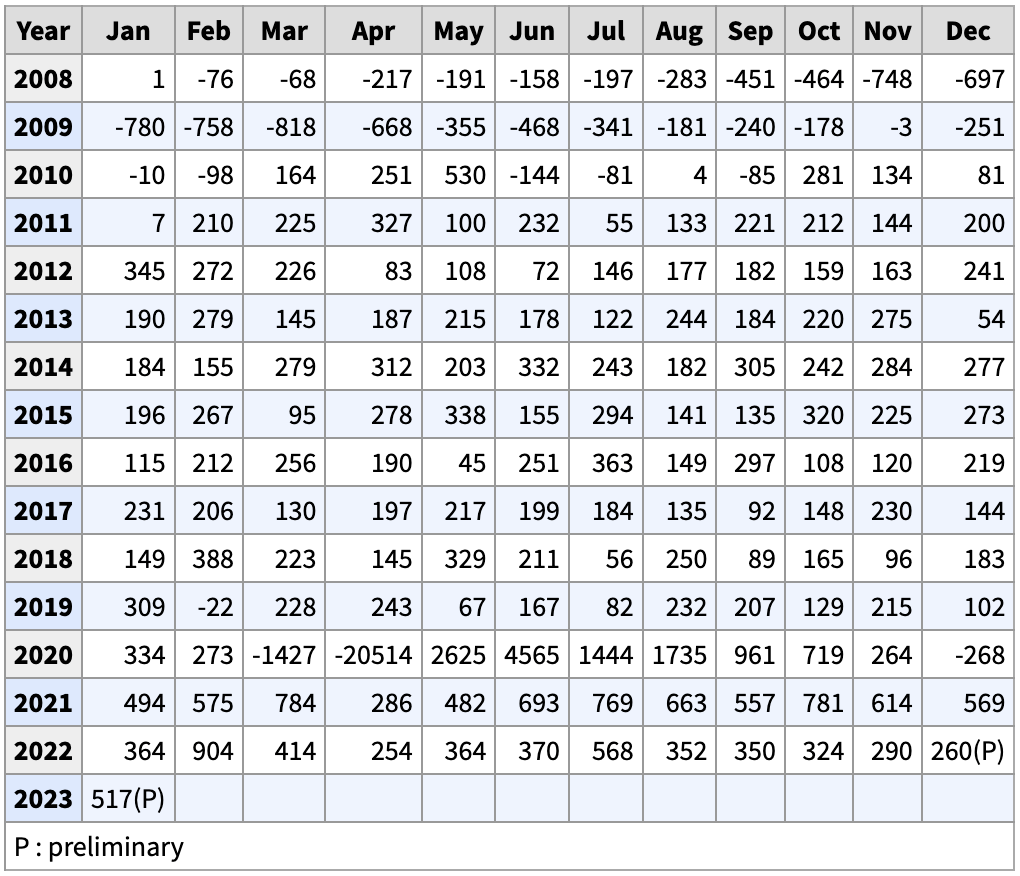

And here’s a table I pulled from the BLS site showing monthly job gains from 2008 to present.

===

Please comment below or reach out with questions.

___

Reference:

– January Jobs Report Shows 517k jobs added, 3.4% Unemployment (BLS)

– 50%+ of all workers back in office, and real estate & finance way higher than that

– Is January 2023 Jobs Report ‘Too Good To Be True’? (Bloomberg)