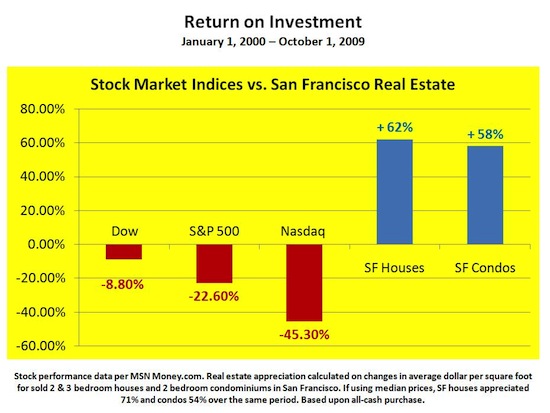

Return on Stocks vs. San Francisco Property: Jan 2000 to Oct 2009

Someone sent the graph below comparing stock indices to San Francisco Real Estate form 2000 to present. Obviously there are a lot of assumptions here and this cannot dictate any individual’s property investment decision, but worthy of debate. One of The Basis Point’s investment management contributors had this to say about it:

Makes me want to short bay area real estate and buy stocks, don’t think that’s the desired effect of the graph though. Perhaps some multi decade return charts would work better? Alternatively could look at corporate earnings vs rents.

The person who made this comment often makes the last part of the comment when we debate this very topic: why not use a price-to-rent ratio when evaluating the affordability of a home? A price-to-rent ratio should indeed be used by buyers of investment property because the fundamental tenet of stock investing is determining intrinsic value: calculating a present value of future cash flows. But what if the buyer isn’t buying the property for cash flow? What if they’re buying a primary residence in which to raise their kids and retire? Should the same investment management theory apply?