WeeklyBasis 4/16: Awesome Rates, FHA Fee Hike

Rates ended last week down .125% after mortgage bonds rallied huge Friday (FNMA 30yr 4% coupon +62 basis points) on tame March consumer inflation (CPI) data. Rates drop when bond prices rise on such a rally, and perception of low inflation encourages bond buying.

But that perception is likely to be short-lived because, as discussed last week, bonds are on inflation alert. In the meantime, borrowers have seen incredible rates this past week. Rates should hold reasonably to start next week, then rise a bit. Here’s why.

Friday’s giant bond rally came after March CPI was reported at .5%. But if you remove volatile food and energy costs, the “Core” reading came in at .1% which was below expectations of .2%. This Core figure is what the Fed studies, and as Fixed Income Advisor noted Friday (in a simple, short piece worth reading), the Fed has won “for now.”

Rate consumers win for now too, but you must proceed with caution because markets swing huge each day on conflicting data.

Friday’s CPI-driven bond buying mood was a continuation of Thursday’s reports of higher jobless claims and less-than-expected business inflation (PPI), both of which suggest a weaker economic picture.

But then Friday we also had the Fed’s April Empire State Manufacturing survey which showed 5 straight months of growth and the highest manufacturing activity—but also the highest inflation—in 1 year.

Next Thursday’s Philly Fed Index will likely show similar results for another key U.S. manufacturing region.

And the rest of next week is mostly focused on home sales with the homebuilder’s index Monday, March housing starts and building permits Tuesday, existing home sales Wednesday, and a Federal home price report Friday.

These numbers have been weak in recent months, which is why rates may hold to start the week, but then bond markets may start precautionary selling to prepare for a monster data week April 25-29 which includes:

First quarter GDP, a Fed meeting and press conference, PCE (the Fed’s favorite inflation measure), Case Shiller home prices, new home sales, personal income/spending, and Chicago area manufacturing index.

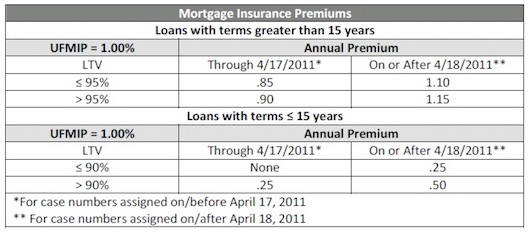

FHA FEE HIKE ALERT: Also on Monday, April 18, the FHA is increasing its monthly mortgage insurance premiums by .25%. The table of the increases are below. All FHA borrowers need to talk to their advisors to understand what these changes mean for them.

CONFORMING RATES ($200,000 to $417,000) 0 POINT

30 Year: 4.875% (4.99% APR)

FHA 30 Year: 4.75% (4.87% APR)

5/1 ARM: 3.375% (3.49% APR)

SUPER-CONFORMING RATES ($417,001 to $729,750 cap by county) 0 POINT

30 Year: 5% (5.12% APR)

FHA 30 Year: 4.75% (4.87% APR)

5/1 ARM: 3.75% (3.87% APR)

JUMBO RATES ($729,751 to $2,00,000) 1 POINT

30 Year: 5.375% (5.49% APR)

10/1 ARM: 5% (5.12%)

5/1 ARM: 4.25% (4.37% APR)