What Homebuyers Must Know About 2022 Home Price Headlines & Winning Bidding Wars

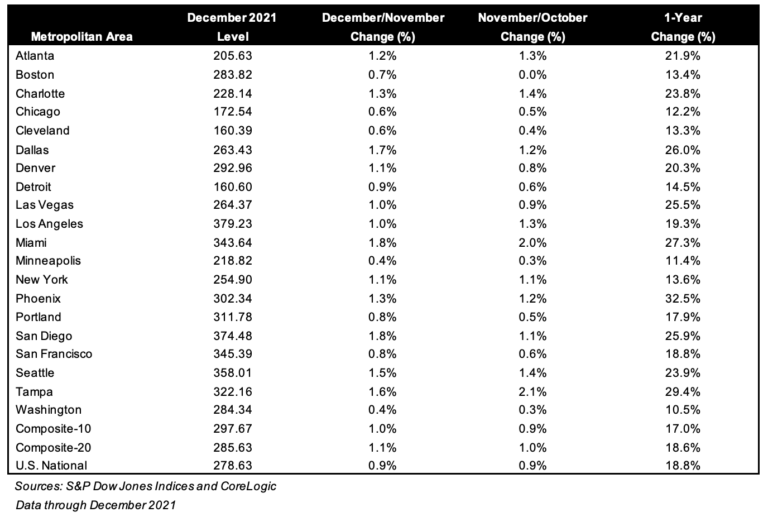

Here’s a table released yesterday showing 2021 home prices up 18.8% nationally for the widely followed S&P Case Shiller home price index. This creates tons of alarmist headlines. Below are notes about how these home prices calculated, and tips for winning bidding wars.

– Top 3 cities with biggest home price increases in 2021: Phoenix (+32.5%), Tampa (+29.4%), Miami (+27.3%).

– Bottom 3 cities on home price increases — but note these are still very healthy increases: Washington (+10.5%), Minneapolis (11.4%), Chicago (12.2%).

– “City” composites aren’t cities, they’re regions.

– So for example, “Washington” in the table above is a 22-county region where property types and especially prices vary wildly.

– Homebuyers using Case Shiller to price a home is like investors using stock index or even sector data to price a stock. It’s one macro input, but local analysis is more important for property selection and offer price strategy.

– Think about how different pricing is across your county (or counties), let alone across neighborhood or even street to street.

– Then ask a local real estate pro to do some pricing analytics for you in the areas you care about. The larger your Case Shiller region, the larger your local numbers will differ from the table above.

– It’s also critical to note that Case Shiller data is on a 3-4 month lag.

– It can take 30-60 days to close home purchase deals, then they hit public record, and that’s what Case Shiller mines for prices. So December’s closed sales are largely reflecting market activity from October and November.

– So if you’re a homebuyer who needs to figure out what offer price will win a bidding war, you need real-time (and truly local) price data that you’ll get from your realtor.

– Also, when the market is intense like this, you must hang in closely with your lender who will make ongoing adjustments to your pre-approval based on home price and rate movements.

– Having your lender customize each pre-approval letter to each offer you make shows sellers your offer is serious. And it will likely take a few tries to get an accepted offer in this market.

– And final pro tip to break through to sellers in bidding wars: a great lender will work with your realtor to contact the seller’s realtor and personally brief them on how strong your pre-approval is.

– Listing agents love hearing from lenders who are doing the loans for incoming offers. This helps them advise their sellers on how your offer is ready to close. Of course sellers care about price, but they also care about certainty of closing fast.

– You WILL find deals as a homebuyer if you study the situation on the ground instead instead of headlines that don’t understand the ground game in your area.

Good luck out there, and please comment below or hit me with any questions.

___

Reference:

– Average earners can still afford typical U.S. homes. Here’s how to calculate home affordability.

– S&P Case Shiller Home Prices For 2021 – released Feb 22, 2022