What Is LIBOR?, Where Is Housing Worst?, Retail Sales Up, Rates Up

Last weekend I took my daughter hot-air ballooning for a present for her graduation from 8th grade – and because I’d always wanted to do it. Aside from getting yelled at by the pilot for dropping my gum in someone’s pool from 500 feet, we had an enjoyable time. That is, until the others found out that I was in the mortgage business. Suddenly I was deluged with questions about late payments, whether or not someone’s short sale will impact their credit rating, if I knew that “mortgage” was French for “slow death”, and if I knew Angelo Mozilo. It made me long for the days when this was a respectable profession…

WHAT IS LIBOR?

By some estimates there are $360 trillion (with a “t”) in securities tied to LIBOR (London Inter-Bank Offered Rate). The London-based British Bankers Association, which isn’t regulated, asks member banks once a day how much it would cost to borrow from each other for 15 different periods, from overnight to one year, in currencies from dollars to Euros and yen. It then calculates averages, throwing out the four highest and lowest quotes, and publishes them at 3:30AM PST. Sixteen banks contribute to the setting, three of which are based in the U.S. There is talk of the BBA increasing the number of banks that set the LIBOR, and possibly also adding a second survey of members to reflect U.S. trading hours when it sets the rate.

MORTGAGE INDUSTRY ROUNDUP

- Countrywide Securities announced that they were closing their securities trading desk in a few weeks, and moving operations to BofA.

- Wells Wholesale group’s last day to register SIMO loans before they reduce the CLTV’s by another 5%. (“SIMO” being a “simultaneous” 1st and 2nd, as opposed to the common abbreviation for the Sapelo Island Microbial Observatory.)

- Thornburg Mortgage is reporting a $3.31 billion loss for the first quarter, and says loan delinquencies are likely to continue to increase “modestly” for the rest of the year.

- Lehman Brothers, certainly in the news lately, just lost their chief financial officer (CFO) and chief operating officer (COO).

- Following Freddie Mac, Franklin American Mortgage Company (FAMC) is suspending Freddie Mac Alt 97 loan products.

MARKET ROUNDUP

Are we in a recession? You might be hard pressed to find someone that doesn’t think so. Yesterday’s results of the Fed’s Beige Book report showed recent economic growth as “generally weak” as consumer spending slowed and manufacturers in several regions passed on higher raw material costs to their customers. The unemployment rate has risen by over 1% from its lows, private payrolls have fallen for 6 months in a row, and continuing jobless claims are up 600k year-to-year. This morning’s Jobless Claims rose more than expected last week, with Initial claims for state unemployment insurance benefits jumping to 384,000 from a revised 359,000 for the prior week. The four-week average of new jobless claims climbed to 371,500 from a revised 369,000 in the prior week. This means that all three of the major sources of US labor market data (the household survey, the establishment survey, and the unemployment insurance data) are now showing weakness. No job = reduced spending = slowing economy, or so the logic goes.

On the other hand, to muddy the waters, this morning’s Retail Sales rose a full percentage point in May as many consumers apparently had more spending cash in their wallets from government rebate checks. The Commerce Department reported an increase last month that was twice as much as expected. Removing pesky gasoline prices did little – sales were still +.8%, the biggest increase in a year. And excluding autos, sales rose 1.2%, the biggest rise in six months. Unfortunately the market has focused on this surprise retail sales number, and the yield on the 10-yr is up to 4.17% and mortgage prices are worse by .375 than yesterday afternoon.

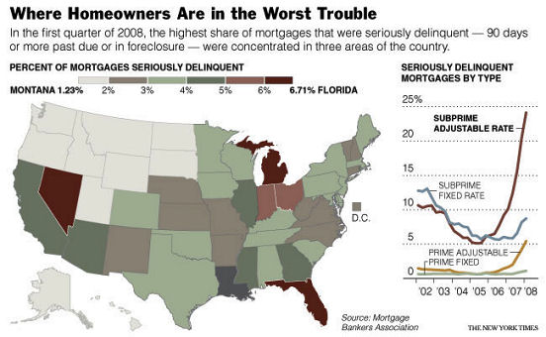

WHERE ARE HOMEOWNERS IN WORST TROUBLE?

What states are making servicers and investors nervous? The mortgage delinquency rate in the United States now stands at a postwar high, having climbed more than ½ percentage point to 6.35% in the first quarter of 2008. See the chart below, thanks to the NY Times:

JOKE OF THE DAY

The new doctor was about to arrive at the mental institution to begin his new position and as he pulled near the gate, one of the rear wheels of his car came off along with all the lug nuts. A number of the patients were in the yard and saw this happen.

One moved close to the fence and yelled out to the doctor, “Why don’t you take one lug nut off each of the other three wheels, jack up the car and attach the wheel with them so you can drive.”

The doctor was stunned by hearing this from a mental patient. He turned to the patient and said, “Why that’s a great idea! Why are you in the institution?”

The patient yelled out to him, “I may be crazy, but I ain’t stupid!!”