Your financial data’s always been for sale. Where’s your cut?

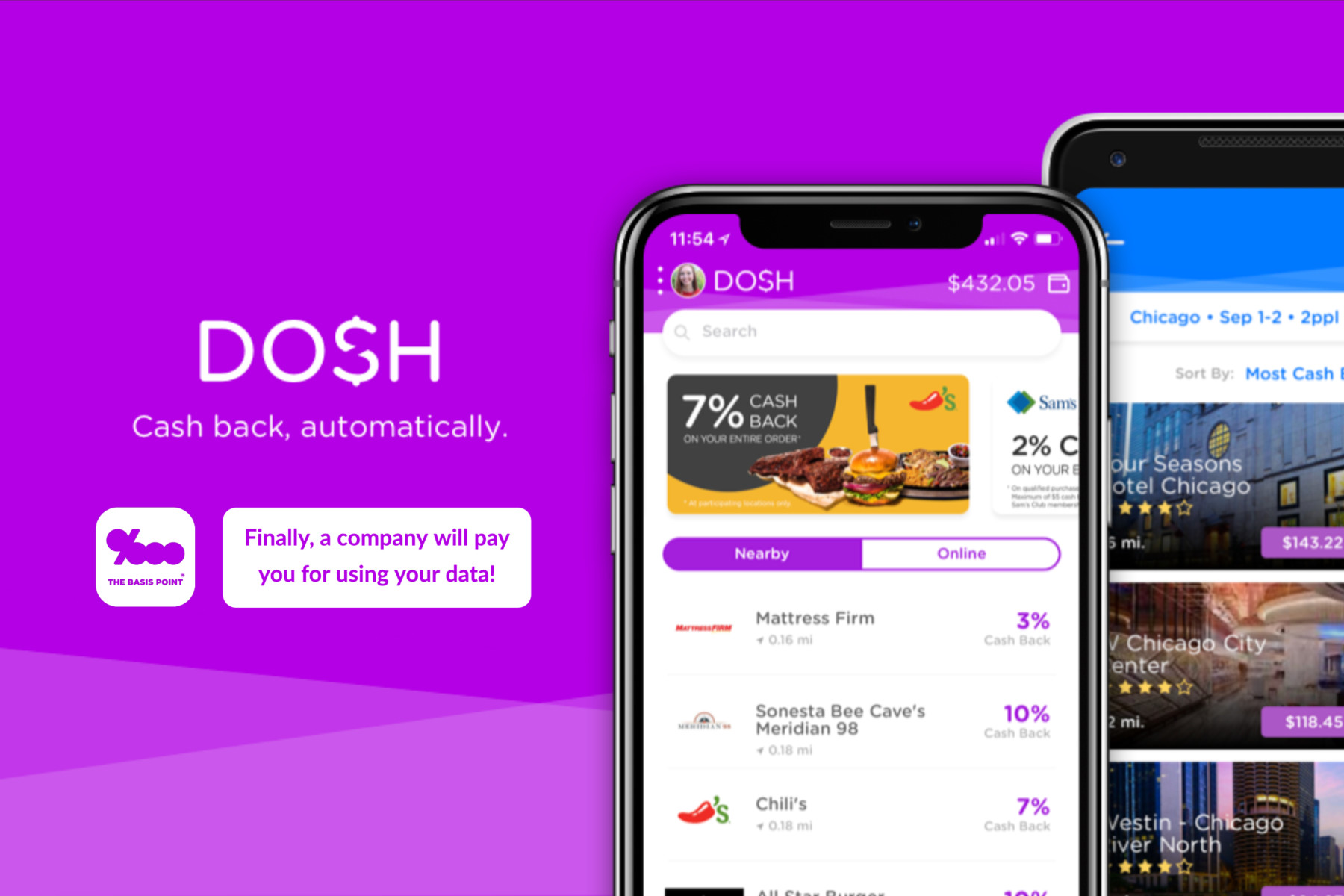

I want to turn your attention to some tech news out today—Dosh, an app that links your card to retailers to give you cash back, raised a ton of venture capital money and says it’s worth a cool $300 million.

A lot of you (3 million, actually) were all over the app in the 2018 holiday season and the company says it’s given out $50 million in cash back so far.

The tech industry loves to hear who’s getting money, and paying attention to these stories can tell you what the people with big money think the world of the future will look like.

In this case, Dosh’s investors are salivating over the idea that the app will be able to track your spending habits and use that data to target you with better ads and offers.

[Dosh plans to build] more technology into the platform to make the offers you get more targeted to what you might be most likely to buy, and to use the same tech to increase rewards to entice you to buy things that you may be less likely to naturally buy.

The company’s viewpoint is that a direct cash reward is a much stronger driver for retail intent than advertising can ever be, and because of how Dosh links up with card providers, it’s much easier to see how an offer is linked to an actual purchase.

Your initial response to that might be “Ugh, more targeted ads? And more of my data in the hands of a third party who might get hacked?” And you’d be right to think that.

However, tech like Dosh’s might become the standard in financial services. Think about it like this—your bank already has all the info Dosh might collect on your spending. They just don’t use it to to help you.

Someone’s got your data already. Why not get cash back on it while you’re at it?

That’s Dosh’s idea, and the rest of the industry is following this model.

Data collection is the future of finance. That’s why Dan Gilbert, the head of the largest lender in the country says that data aggregation is his business, not mortgages. Financial services companies want to use this data to give you more personalized service.

Right now, merchants are working to use tech to get you to buy as much stuff as possible—think about how Amazon wants you to buy stuff with Alexa.

Companies like Dosh are realizing that you’ll be a happier camper if you’re buying more stuff that you need or want and getting better deals on the stuff that you don’t want as badly. That translates into more long-term business, and this experience will start to be the norm everywhere from shopping to getting a mortgage.

Pray Dosh is investing in cybersecurity, because with all that cash it won’t go anywhere for a while.

___

Reference:

– Dosh raises $40m on $300m valuation (TechCrunch)