ATTN California Refinancers: Property Taxes Due At Closing!

Attention anyone currently refinancing in California. You may be refinancing now and in the rush to lock rates, you may not be aware that most counties issue tax bills during October. If your property tax bill has been issued and you don’t have an impound/escrow account that you pay taxes into monthly, then you must pay your first installment property taxes when your refi closes. All open tax liens must be clear before any bank will fund a loan.

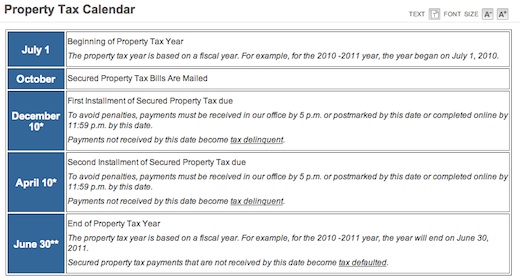

So check with your lender to see if your tax bill is currently due or will be due by the time you close. If so, you need to plan for that extra cash consideration. Note: first installment 2011-2012 taxes cover the period from July 1, 2011 to December 31, 2011 and are due November 1. There’s a grace period until December 10 (shown in table below) UNLESS you’re doing a refi in which case all tax liens must be settled at closing.

___

California Property Tax Schedule