Next lending wave: 10m homeowners will open HELOCs 2018-2022

TransUnion, a credit bureau with data on the borrowing habits of 220 million U.S. consumers, recently released a study of 60 million consumers to understand American homeowners’ propensity to open a home equity line of credit (HELOC). Below are the findings and charts that jumped out at me, as well as links to their full report.

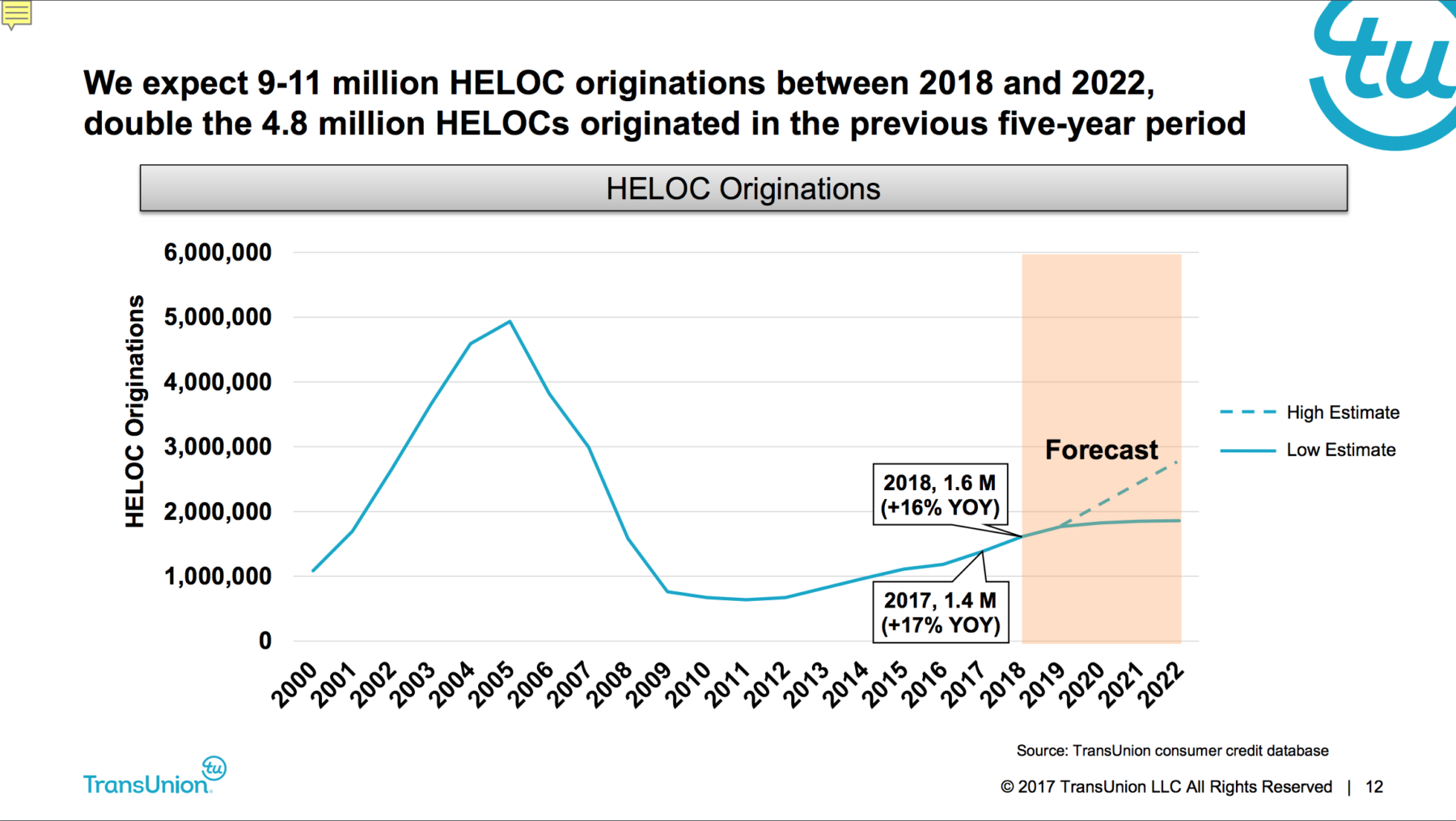

– There were 4.9 million HELOCs opened in 2005 when home equity stood at $13.3 trillion. HELOC openings dropped to 600,000 in 2011 as home equity declined to $6.3 trillion. Home equity rose back to $13.3 trillion in 2016, yet HELOC originations continued to be low at 1.2 million.

– About 10 million consumers will open a HELOC between 2018 and 2022. This would more than double the 4.8 million HELOCs opened 2012-2016. Here’s a breakdown by year.

– Two-thirds of homeowners are eligible for HELOCs, and credit scores of these homeowners skew strongly to the lowest risk tier. This amounts to 65 million potential borrowers who meet HELOC approval requirements, like having at least 20% equity in their home.

___

Reference:

– Number of consumers opening HELOCs may double next 5 years (Transunion)

– Return of HELOCs presentation and charts/tables (Transunion)