WalMart Economic Indicator, Bond Bubble Update, Commercial Real Estate Revival?

Bond Bubble?

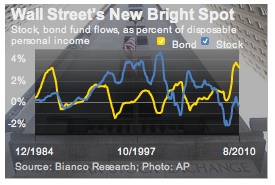

WSJ has the latest bond bubble talk, saying bond markets are growing riskier as investors seeking steady returns bid up prices and ignore some early warning signs similar to those that flashed during the credit bubble. Last week, prices on high-yield, or junk, bonds hit their highest level since 2007, nearly double their lows of the credit crisis, and companies are selling record amounts. We’re seeing a declining rate of corporate defaults lately and a belief that, as long as the economy doesn’t relapse into recession, default rates will continue to decline. “The financial crisis purged many weak borrowers from the system, and corporate balance sheets are generally stronger today than before the crisis.” Interest rates paid by companies with strong credit ratings have tumbled this year, falling to 1.8 percentage points above the yields on comparable U.S. Treasury bonds, which themselves are among the lowest yields in decades.

WSJ has the latest bond bubble talk, saying bond markets are growing riskier as investors seeking steady returns bid up prices and ignore some early warning signs similar to those that flashed during the credit bubble. Last week, prices on high-yield, or junk, bonds hit their highest level since 2007, nearly double their lows of the credit crisis, and companies are selling record amounts. We’re seeing a declining rate of corporate defaults lately and a belief that, as long as the economy doesn’t relapse into recession, default rates will continue to decline. “The financial crisis purged many weak borrowers from the system, and corporate balance sheets are generally stronger today than before the crisis.” Interest rates paid by companies with strong credit ratings have tumbled this year, falling to 1.8 percentage points above the yields on comparable U.S. Treasury bonds, which themselves are among the lowest yields in decades.

WalMart Economic Indicator

One anecdotal economic indicator comes from WalMart’s head of U.S. operations Bill Simon. When asked about their efforts to serve customers whose spending around payday has been volatile, he said:

“And you need not go further than one of our stores on midnight at the end of the month. And it’s real interesting to watch, about 11PM, customers start to come in and shop, fill their grocery basket with basic items, baby formula, milk, bread, eggs, and continue to shop and mill about the store until midnight, when government electronic benefits cards get activated and then the checkout starts and occurs. And our sales for those first few hours on the first of the month are substantially and significantly higher. And if you really think about it, the only reason somebody gets out in the middle of the night and buys baby formula is that they need it, and they’ve been waiting for it. Otherwise, we are open 24 hours – come at 5 a.m., come at 7 a.m., come at 10 a.m. But if you are there at midnight, you are there for a reason.”

Commercial Real Estate Recovery?

There has been some recent news about the commercial mortgage market, and some big firms think it’s time to start securitizing those mortgages again. J.P. Morgan Chase has taken an early lead in the race among big banks to revive the commercial mortgage backed securities (CMBS) business, moving ahead of Goldman Sachs, Wells Fargo, Bank of America, and Morgan Stanley. A WSJ report says they are all ramping up or rebuilding CMBS operations. Wall Street is expected to sell about $10 billion of CMBS this year, versus $230 billion at the peak in 2007 but “way up” from virtually $0 over the last two years. Current deals have fewer loans and tranches, and are more “investor-friendly” by being less confusing. The pickup in the market is good news for owners and developers, along with the banks that collect the fees for securitizing the loans.

Friday Market Roundup

Thursday mortgage prices lagged the initial strong improvement in Treasuries as the yield on the 10-yr neared 2.50%. Not only do we not have the Fed buying MBS’s, but buyers seem a little reluctant at these price levels for fear of refinancing, and $2.8 billion seemed a little too much in MBS’s for the market. Current rate sheet mortgage prices ended the day worse by about .125 and the 10-yr at 2.56% after the better-than-expected Existing Home numbers. This morning, besides New Home Sales, we already had Durable Goods, and most economists believe that the manufacturing recovery that fueled economic growth a little more than a year ago is losing steam as global demand slows and the inventory cycle continues to wind down. Advance orders for durable goods rose only 0.3 percent in July, which was less than expected. Sure enough, Durable Goods were -1.3%, worse than expected, although ex-transportation it was up for the month, and there were also some back-month revisions. Right after the number we find the 10-yr yield up to 2.57% and mortgage prices are worse .125-.250.

Friday Humor … Job Descriptions:

1. A banker is a fellow who lends you his umbrella when the sun is shining and wants it back the minute it begins to rain.

2. An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.

3. A statistician is someone who is good with numbers but lacks the personality to be an accountant.

4. An actuary is someone who brings a fake bomb on a plane, because that decreases the chances that there will be another bomb on the plane.

5. A programmer is someone who solves a problem you didn’t know you had in a way you don’t understand.

6. A mathematician is like a blind man in a dark room looking for a black cat that isn’t there.

7. A topologist is someone who doesn’t know the difference between a coffee cup and doughnut.

8. A lawyer is a person who writes a 10,000-word document and calls it a “brief.”

9. A psychologist is someone who watches everyone else when a beautiful girl enters the room.

10. A professor is one who talks in someone else’s sleep.

11. A consultant is someone who takes the watch off your wrist and tells you the time.

12. A committee is a body that keeps minutes and wastes hours.