WTF?! 1 in 8 people making $250,000+ per year have issues paying bills

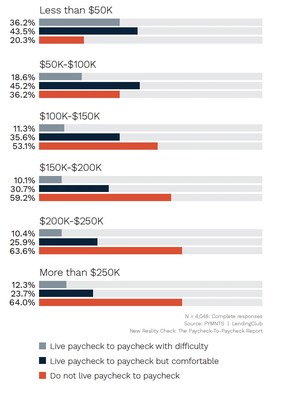

LendingClub’s latest paycheck to paycheck report shows 1 in 8 (12.3%) of people making $250k or more per year have “issues paying their bills.”

Definitely a WTF stat from this survey, but I haven’t dug into whether these high earners who struggle to pay bills are located in higher priced cities. That’s the only thing that comes to mind that would justify this.

Otherwise it sounds a lot like profligacy.

Here’s LendingClub’s Anuj Nayar on the topic:

“Earning a quarter of a million dollars a year is more than 5x the national median and is clearly high income. The fact that a third of them are living paycheck to paycheck should surprise you. These high-income earners have an average FICO score of 758. They are creditworthy but they have higher financial obligations and are more likely to leverage their capital to finance their lives.”

If LendingClub or anyone else has more info on where these earners are located or what “issues paying bills” means, please chime in.

___

Reference:

– 1/3 of Consumers Earning a Quarter of a Million Dollars are Living Paycheck to Paycheck

– UPDATE: see below for definition of “issues paying bills” from LendingClub.