13 Reasons U.S. Real Estate Market Is Stronger Than You Think

Every month, data masters Black Knight analyze the most important numbers in housing finance.

The work of our friends there is essential reading for home buyers, sellers, renters who wish they weren’t renters, loan officers, realtors, and anyone else interested in real estate.

Here are key mortgage and housing highlights you need to know from Black Knight’s just-released May 2019 data.

+++

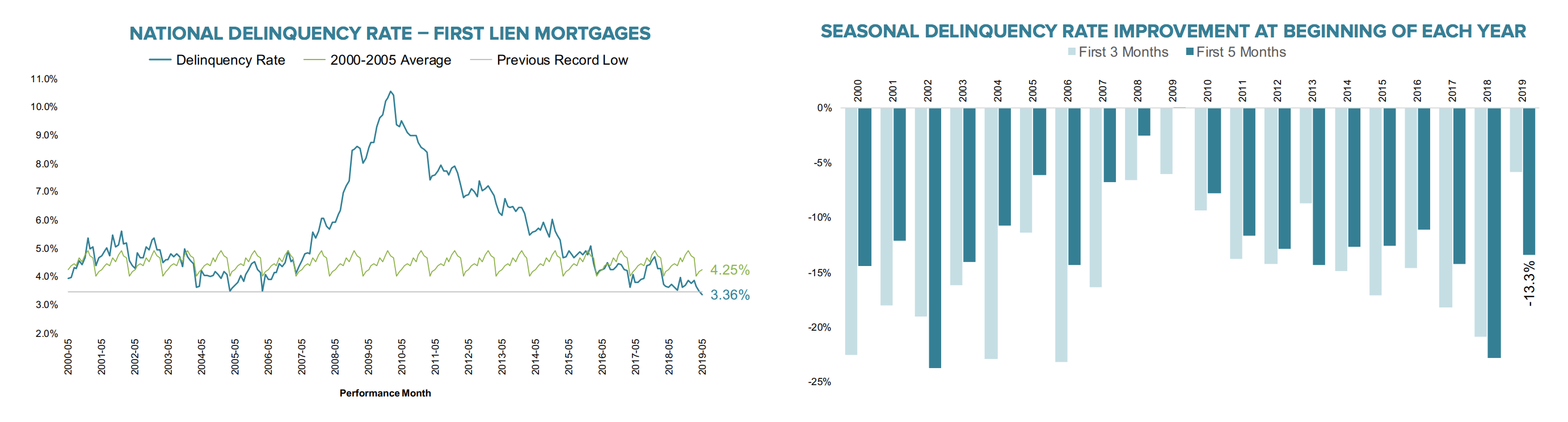

DELINQUENCIES AND FORECLOSURES DOWN

– Mortgage delinquencies (loans 30 or more days past due, but not in foreclosure) down 3% in May

– Delinquencies at lowest level since January 2000

– 39k foreclosure starts—lowest number in 18 years

– Number of loans in active foreclosure lowest in 13 years

– However, 9 states saw increases in delinquencies, such as Mississippi and Nebraska

– Expensive real estate markets of San Francisco, San Jose, and Seattle have lowest delinquency rates

– However, early-stage delinquencies (6 months after loan closes) are rising

+++

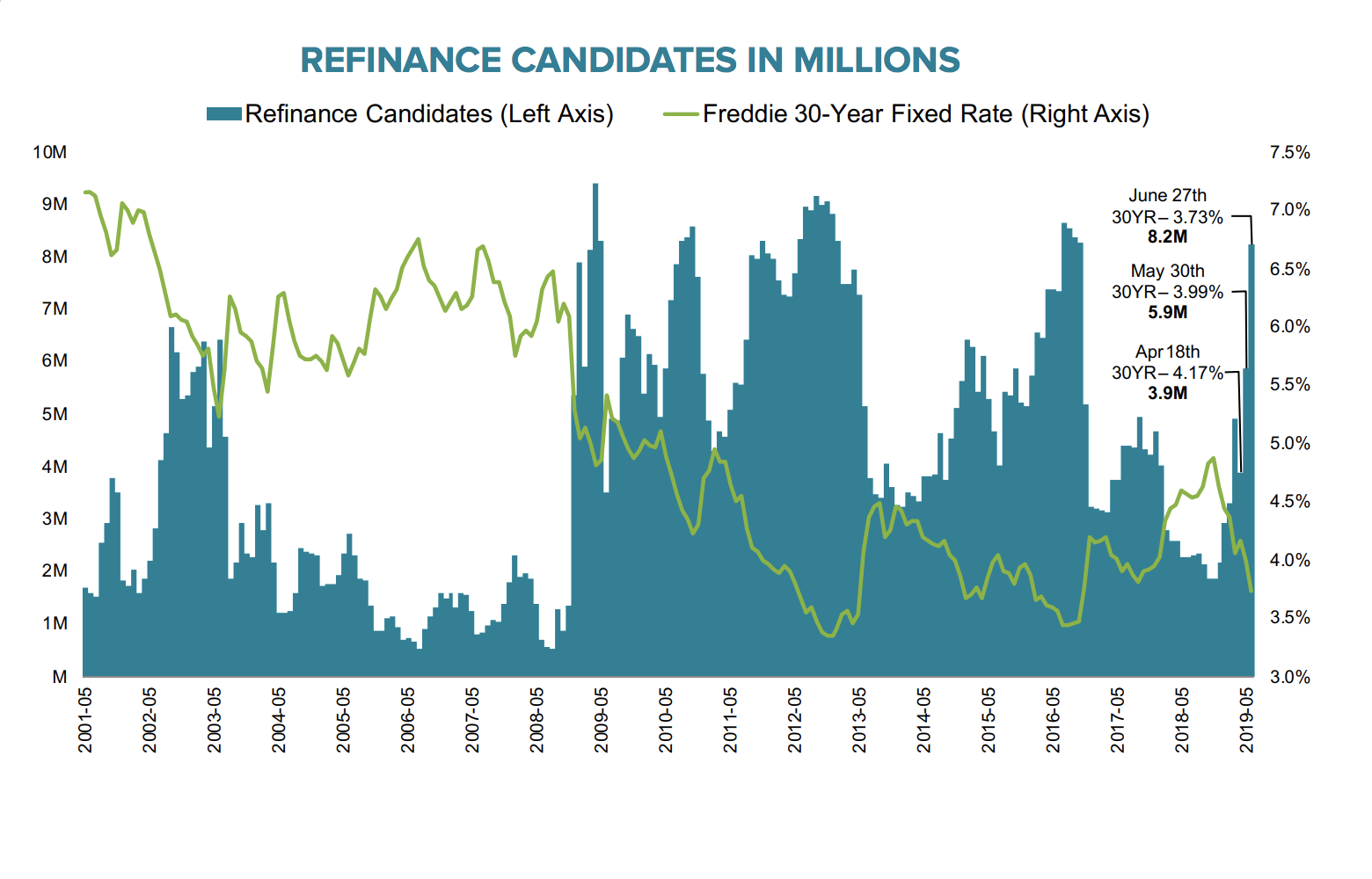

REFI, REFI, REFI

– At the end of June, 8.2m homeowners were eligible for refinancing

– Largest # of refi candidates since late 2016

– 6.3m more refi candidates than when interest rates peaked in November 2018

– 35% of borrowers who took out mortgage in 2018 could save 0.75% off first lien rate

+++

HOW MUCH OF YOUR HOME DO YOU OWN?

– Nearly 44m homeowners have more than 20% equity in their home

– $5.982 trillion in tappable equity

– (Tappable means your total outstanding home loans don’t exceed 80% of your home’s value)

– $54b in equity tapped in Q1 2019, the lowest share of total equity since 2008

– More reading on the state of home equity here

+++

WHAT’S IT ALL MEAN FOR ME?

– Most Important: Don’t forget all real estate decisions you make are neighborhood and street level. You’ll get this granular data from your local real estate and mortgage advisors.

– That said, the national and regional picture from Black Knight shows a robust housing market. Low foreclosures and delinquencies mean the housing market is way less risky than it was in the 2000s, strong loan approval standards means a 2006-style housing crash is highly unlikely, and a home is a good long-term investment right now.

– High numbers of refi candidates mean housing can get more affordable for many millions of people, who are going to put that money back into the economy by spending.

– Record home equity means more of you homeowners have access to home equity financing products, which are way cheaper than credit cards.

– Basically real estate is in a good spot, especially when you look at forward-looking economic indicators.

– If you’re planning out your financial life right now, knowing this macro background helps you know what trends are going in your favor.

– Now that you know the high-level stuff is going well, get back to the neighborhood-level stuff, which is where you really make all your decisions.