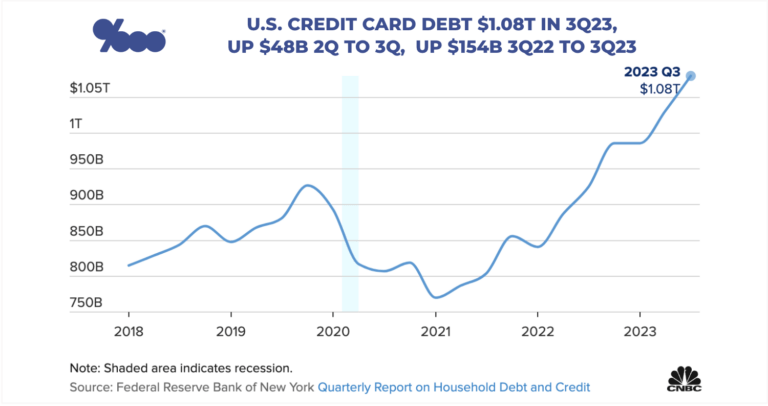

3Q23 credit card debt at $1.08 trillion record, and 90-day-late payments rise to 5.78%

At $1.08 trillion for 3Q23, 2023 credit card debt is now at a record level. And here are a few other key notes from today’s New York Fed release of these numbers:

– Credit card debt rose $48 billion from 2Q23 to 3Q23, a big jump for one quarter.

– Credit card debt rose $154 billion from 3Q22 to 3Q23, a notable jump for one year.

– The percentage of credit cards 90-days or more late rose to 5.78% for 3Q23.

– This 90-day late percentage is up from 3.55% in 3Q22.

– This shows that some strain is rising in the U.S. consumer.

– Concurrently, the average annual percentage rate is now more than 20% on credit cards.

– This will also cause strain as the Fed keeps rates ‘higher for longer’ to squash inflation.

Credit card balances jumped $48b in 3Q23 and rates on credit card balances topped 20%, which drove up late payments

___

Check It Out:

– Credit card balances spiked in the third quarter to a $1.08 trillion record. Here's how we got here