Almost half (45%) of student loan borrowers think they’ll default after payments resume in October

Nearly 37 million Americans will resume student loan payments this October after a 3+ year hiatus. Here are some Credit Karma & The Harris Poll results of how this might play out.

– 90% of student loan borrowers who will resume payments say they’ll need to adjust budgets to afford these resumed payments

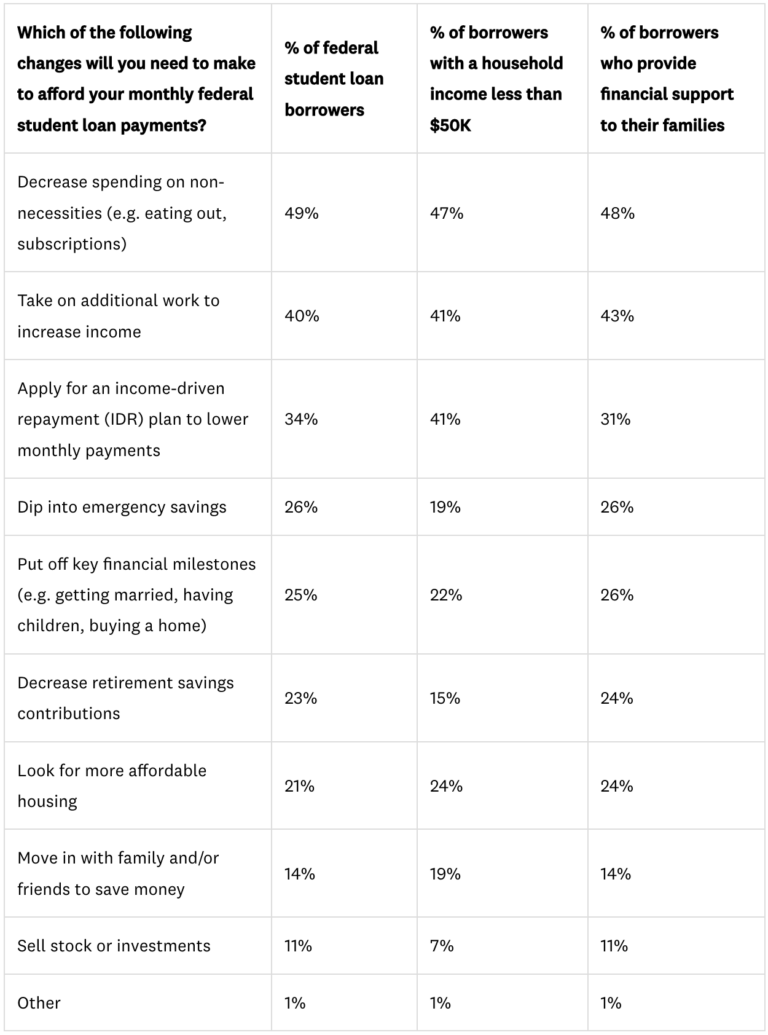

– The image above is a breakdown of changes people say they need to make

– 45% of student loan borrowers say they expect to go delinquent on their student loans once forbearance ends in October

– 53% of student loan borrowers say they’re struggling to pay other bills (e.g. auto loan, mortgage, credit cards)

– This could explain why 37% say they haven’t saved money in anticipation of resuming student loan payments

– 44% of student loan borrowers don’t think the return on investment for higher education in America is worth the expense

– 75% of student loan borrowers support their families, whether that be paying for their food, clothes, rent or other bills

– October will mark the first time 36% of borrowers have ever had to make payments toward their student loans

Check out the link below for more stats on this Credit Karma survey.

Credit Karma and The Harris Poll surveyed U.S. adults on student loan payments resuming in October, and there are some grim results. Here are details.

___

Check It Out:

– Federal student loan borrowers are struggling to make ends meet, before payments resume in October