Are we within 3 months of CPI inflation dropping enough for Fed to chill out?

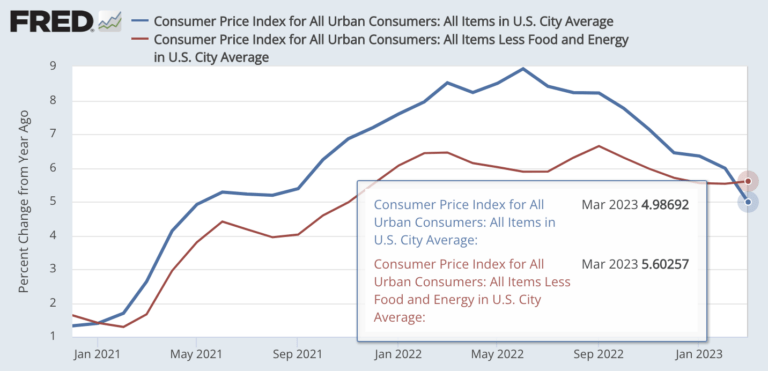

Today, annual March CPI headline inflation dropped meaningfully from 5.9% to 4.9%. But annual Core CPI, which excludes volatile food and energy costs, is stubbornly high at 5.6%, up slightly from 5.5% last month. This makes a May 3 Fed hike likely, but the inflation outlook looks decent from there. Here are a few key takeaways.

Annual headline CPI dropped as early Ukraine war gas price spikes rolled off.

But the Fed follows Core CPI more because it excludes this type of volatility.

The February-to-March monthly Core CPI level is 0.4%.

Good news is if you annualize this, it’s 4.8%, which is trending down.

Bad news is the actual annual number is still 5.6% (see chart above).

More good news:

Peak headline CPI inflation was 8.9% in June 2022 vs. 4.9% in March 2023.

Peak Core CPI inflation was 6.6% in September 2022 vs. 5.6% in March 2023.

So what’ll it take for Core CPI inflation to drop from here?

Hint: lower housing costs may help.

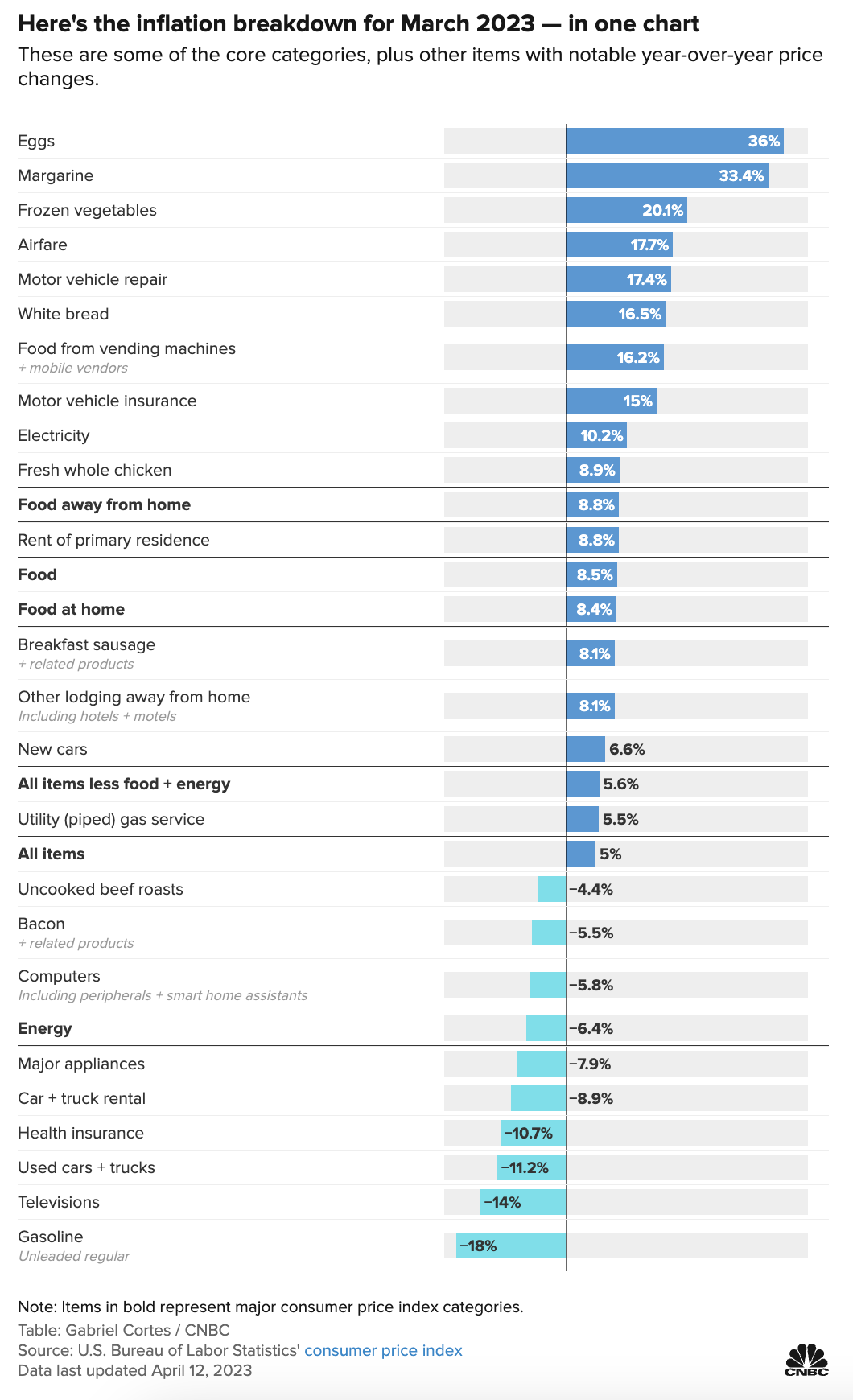

The rent component of CPI is still 8.8%, which is keeping these inflation readings high.

But CPI measures existing rents people are paying, using leases signed up to a year ago.

Meanwhile, Redfin reports the year-over-year change in advertised rents has been dropping 9 straight months through February 2023.*

Advertised rents indicate what we’d pay to rent today.

So if this trend continues a few more months, the rent component of CPI should come down.

This would in turn bring Core CPI down.

Here’s what this means for mortgage rates:

We don’t have to get to the Fed’s 2% Core CPI target for mortgage rates to drop.

If the market sees Core CPI drop closer to 5%, mortgage rates may begin to drop too.

Mortgage bonds will rally as they perceive inflation is coming under control.

This rally will happen long before Core CPI ever gets to 2%.

And rates drop when bonds rally like this.

Here are next data hits the Fed will watch closely:

We’ll get Fed signals at their May 3 and June 14 policy meetings.

And the next Fed-critical inflation reading is March’s Core PCE on April 28.

The highest Core PCE got as 5.2% on both March 2022 and September 2022.

The February 2023 Core PCE level was down to 4.6%.

To track how this plays out, please subscribe to our newsletter.

And please reach out with questions.

___

Reference:

– Inflation Peaked When Rapper Ice-T’s Gas Station Robbery Went Viral (TBP)

– Redfin shows rents dropped 9 straight months through Feb 2023 (Redfin)

– All March inflation categories in one chart (CNBC)

* NOTE: There are exceptions to rent declines. For example, NYC apartment rents hit a record high in March.