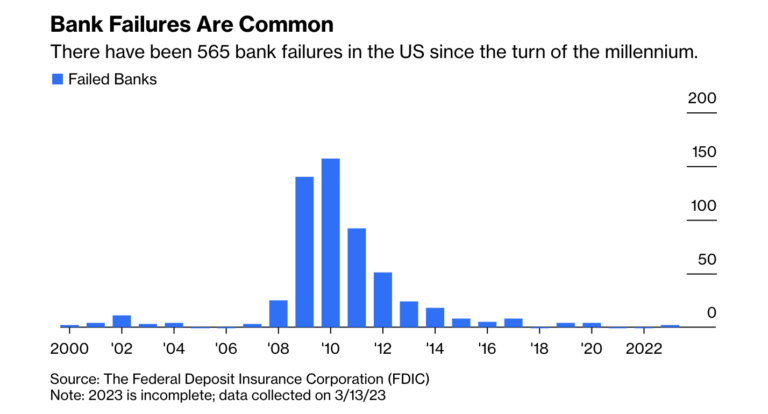

Banks Fail A Lot: 565 banks failed 2000-2023, and only 55% of deposits are insured

Marc Rubenstein has been doing great work on the banking crisis. His latest Bloomberg Opinion piece has critical notes about bank failures and how FDIC insurance isn’t what it once was:

– There have been 565 of them in the US since the turn of the millennium.

– Between 2011 and 2020, banks collapsed at a rate of around two a month.

– Prior to Silicon Valley Bank entering receivership on Friday, the last bank to fail was Almena State Bank, of Almena, Kansas, in October 2020.

– The 868-day lull between the two failures was the second-longest stretch on record.

– In 2008, Washington Mutual lost $17 billion of deposits over two weeks before being shut down by regulators as the largest bank failure in U.S. history.

– Silicon Valley Bank (the second largest bank failure in U.S. history) lost 2.5 times that in a single day.

– Since 2008, US depositors have enjoyed a guarantee on their first $250,000 of deposits.

– The cap was raised from $100,000 during the financial crisis, initially as a temporary measure before being made permanent two years later.

– At the time, it was hugely valuable. But as memories dimmed, it began to lose its luster.

– When the cap was raised, it covered 98% of depositors and 80% of domestic deposits.

– By 2022, only 55% of domestic deposits were covered by insurance.

– In the past three years alone, uninsured deposits have grown by over $2.2 trillion.

___

Reference:

– SVB Clients Get a Painful Lesson: Bank Failures Are Common

– The Demise of Silicon Valley Bank – by Marc Rubenstein