Can 2021 Mortgage Market Thrive With $1 Trillion Less In Refis?

Yesterday I noted how America’s mortgage refi market drops $1 trillion in 2021. Now let’s look at quarterly refi figures from our friends at the MBA to see how it winds down. This helps refi consumers cut through alarmist headlines about “Higher Mortgage Refi Rates Today!”, and helps banks/lenders plan for a material market shift.

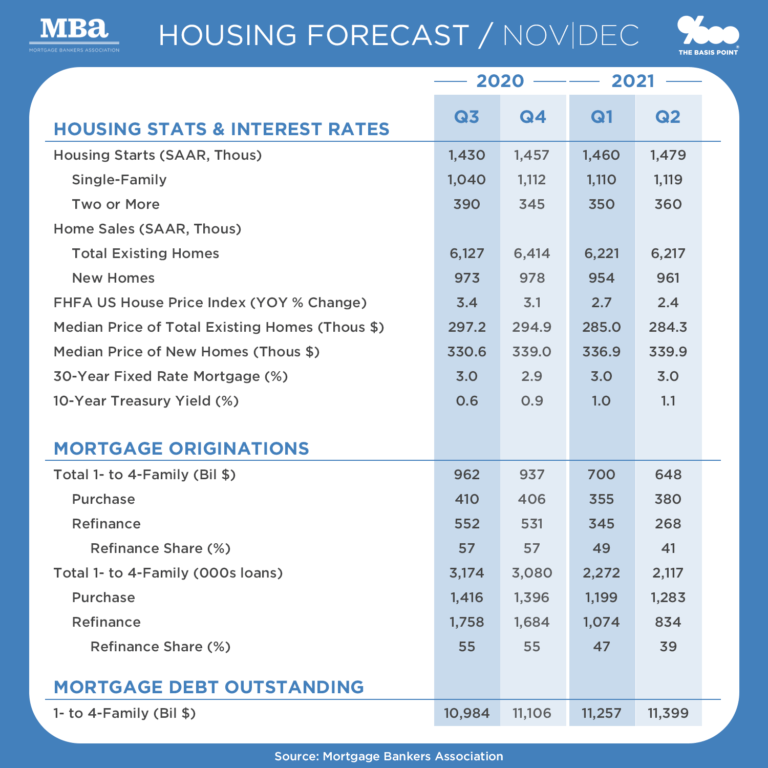

In the table above, we zoom in on this shift using the last 2 quarters of 2020 and first 2 quarters of 2021. And below I note how refis might play out in these periods. Let’s start with exact numbers on next year’s refi decline.

HOW REFIS WIND DOWN BY QUARTER IN 2021

– The MBA projects funded refi volume to drop from $1.969t in 2020 to $971b in 2021.

– That’s how I get the “$1t” decline, but the actual projected decline is $998b.

– These are 11/16/20 MBA projections and get revised monthly. More on revision tracking below.

– Here’s $1.97b of 2020 refi volume by quarter: $306b (Q1), $580b (Q2), $552b (Q3), $531b (Q4)

– Here’s $971b of 2021 refi volume by quarter: $345b (Q1), $268b (Q2), $204b (Q3), $154b (Q4)

– Consumer headlines and lender mindsets are focused on half-a-trillion dollar quarters right now.

– No question this is amazing. Consumers save tons and lenders make piles.

DON’T SLEEP ON MORTGAGE REFI RATES TODAY

– So are lender mindsets ready for this sharp refi decline?

– I say yes for 3 reasons.

– (1) Refi consumers get complacent when rates stay low this long. Lenders will wake up these consumers in December and January by reminding them mortgage refi rates today will rise by about 0.5% next year.

– (2) Lenders’ locked refi pipelines are so full right now, many fundings will carry into 1Q21.

– (3) We still have $1 trillion in refis next year ($971b to be exact). That’s still giant!

– Also, reasons 1 and 2 may mean 1Q21 refis exceed $345b, making the 4Q20-to-1Q21 drop off less stark.

– Which brings us to how projections get revised monthly.

– In January, the MBA projected $609b in 2020 refis, then revised up to the current $1.97t level as the pandemic drove rates down.

– That’s why we track it monthly. Markets change. Still, lenders can’t sleep on 2021 refi decline projections.

– Yes there’s still $1t of refis next year.

– But wise lenders will still plan for refi volume and units being cut in half by 2Q21.

– Here are 4Q20-to-2Q21 refi projections: volume drops $531b to $268b, units drop from 1.68m to 834k.

– Lenders who thrive during this period will thrive as the purchase loans outweigh refis by the second half of 2021.

MORTGAGE REFI RATES TODAY: MID-2% RANGE

– And you refi consumers can’t sleep either.

– 30-year mortgage refi rates today are between 2.5% and 2.75%.

– All projections above are based on rates going to 3% in 1Q21 and 2Q21.

– So if you want mortgage refi rates today that are 0.5% lower, you need to wake up.

===

Next up, I’ll go deeper into purchase vs. refi volume for 2020, 2021, and 2022.

This is where the real lender planning comes in.

And it’s where I’ll explain how home buyers can make their play.

I teased it in the first reference link below, and expand on it shortly.

Please comment and ask questions below, or hit me on twitter @thebasispoint.

___

Reference:

– Size Of Mortgage Refi Market Drops $1 trillion in 2021

– Size of U.S. mortgage market (January 2020 edition)