Size of U.S. Mortgage Market In 2020 (January edition)

Let’s look at 2020 housing and mortgage market predictions. These stats change monthly, and I’ll keep updating them for you. Below are these key stats and why they matter: home sales, home prices, new home construction, mortgage rates, and size of U.S. mortgage market in 2020.

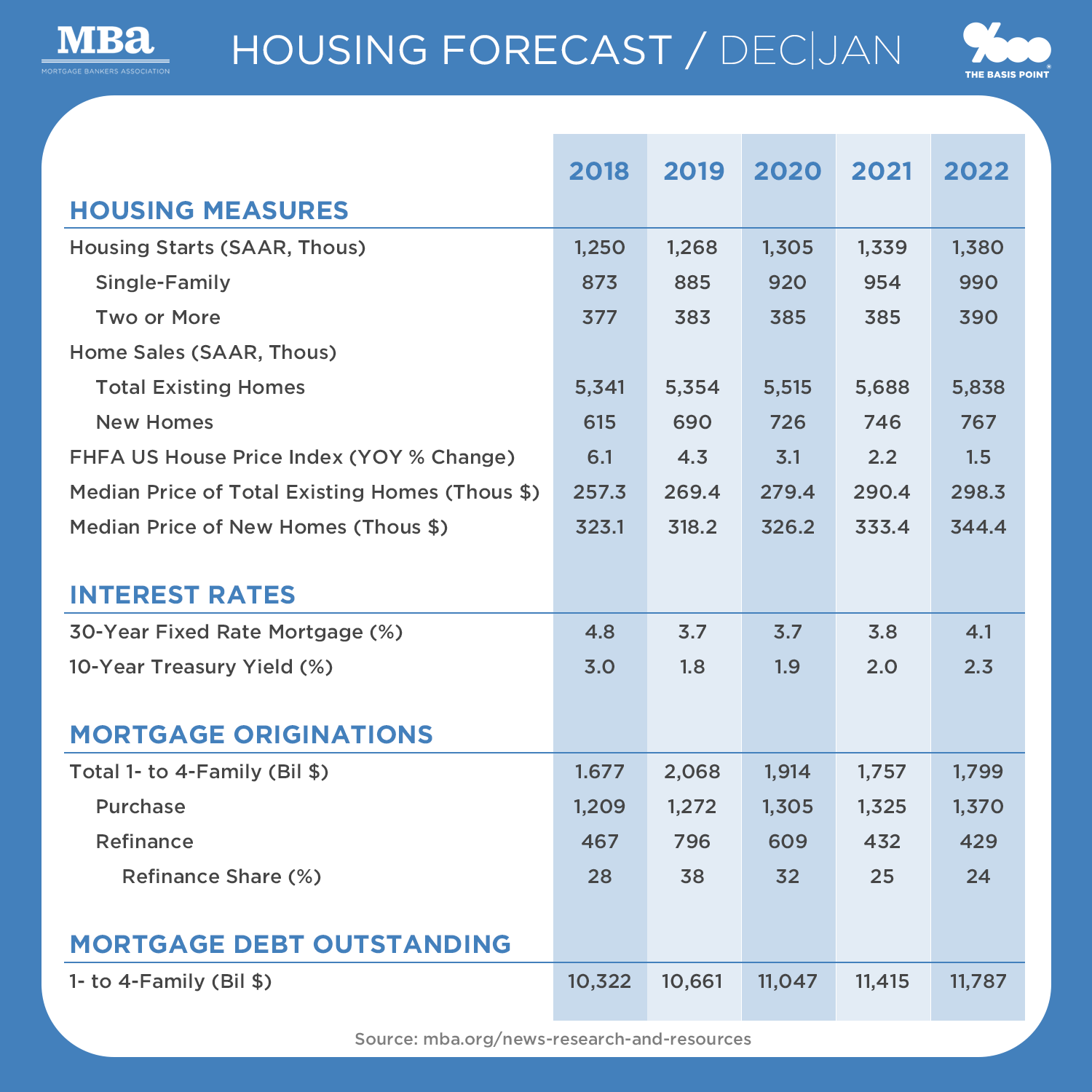

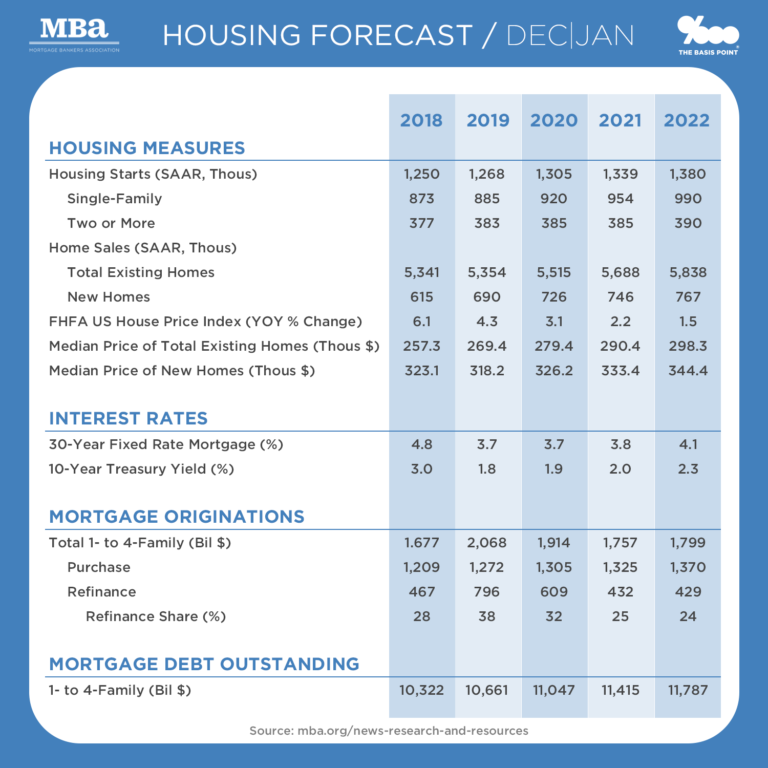

The housing market is healthy, and image above shows the three-year outlook is pretty good too. Not scorching but steady, which best for avoiding boom and bust cycles.

SIZE OF U.S. MORTGAGE MARKET IN 2020 IS $11 TRILLION

– In 2020, the size of the U.S. mortgage market is $11.05 trillion as measured by outstanding mortgages.

– And there will be $1.91 trillion new mortgages funded in 2020.

– This is down slightly from $2.07 trillion from 2019 because refinances from the 2019 rate dip will wane.

– But also home purchase mortgages (as opposed to refinances) will increase from $1.27 trillion in 2019 to $1.31 trillion in 2020.

– This is positive as most of the mortgage volume is from people buying (as opposed to refinancing) homes.

6.24 MILLION HOME SALES IN 2020

– There will be about 6.24 million home sales in 2020.

– This total is comprised of about 5.52 million sales of existing homes, and 726,000 sales of newly constructed homes.

NEW & EXISTING HOME PRICES IN 2020: $326,200 & $279,400

– The median price of a new home at this moment in 2020 is $326,200.

– If you put 10% down on a home of this price, your monthly payment would be $1871.

– And the median price of an existing home at this moment in 2020 is $279,400.

– If you put 10% down on a home of this price, your monthly payment would be $1619.

– This assumes today’s 30-year fixed rate of 3.75% and mortgage payment, taxes, insurance, and mortgage insurance.

MORTGAGE RATES WILL AVERAGE 3.7% IN 2020

– As you see from the previous section, today’s 30-year fixed rate is 3.75%.

– The MBA predicts — for now — that rates will remain at this level for 2020.

– But it’s an election year, we’re entering what looks like a war right now.

– So rates will be volatile all year, but unrest and conflict usually means lower rates.

– And as I noted above, I’ll update this monthly.

1.3 MILLION NEW HOMES CONSTRUCTED IN 2020

– New construction and remodeling of single family and multifamily homes only contributes about 3-5% of GDP, but has broad ripple effects in the economy.

– Why? Because tons of materials must be bought to build homes. Lots of salaries must be paid to build them. And buyers must spend a lot to buy, move into, and furnish them.

– The item called Housing Starts on the table above and shows how many homes where construction has actually begun.

– It’s an important indicator because this is economic activity in motion, that will set off the ripple effects — as opposed to other indicators like building permits which don’t directly set spending wheels in motion.

– Housing starts are currently 1.36 million annualized, but the MBA’s 2020 prediction is now at 1.3 million.

___

Reference:

– Source: MBA Economics Team Forecast

– Size Of U.S. Real Estate Market In 2019