Does Mr. Cooper’s Homepoint deal make it America’s largest mortgage servicer with $937b portfolio?

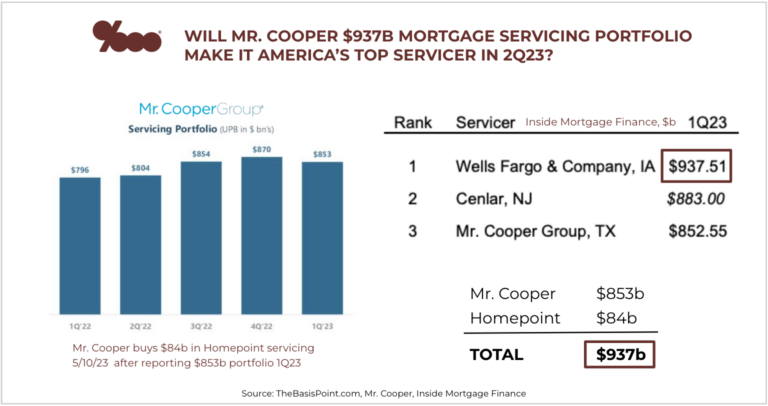

Mortgage servicing giant Mr. Cooper had $853 billion in servicing and 4.1 million customers as of March 31. Now they’re adding $84 billion in servicing and 301,000 more customers with their acquisition of Homepoint. This may make Mr. Cooper the largest mortgage servicer in America. Here’s a rundown.

HOMEPOINT FROM STARTUP TO MR. COOPER

– Homepoint was founded in 2015 as a mortgage originator and servicer.

– They grew into a player in both segments super fast and did an IPO in January 2021.

– In 2022, Homepoint was the 17th largest originator per Inside Mortgage Finance with $27.7 billion in originations.

– In 2022, Homepoint was the 23rd largest servicer per Inside Mortgage Finance with $88.7 billion in servicing.

– In April 2023, Homepoint sold its originations unit to The Loan Store.

– Today Homepoint sold the rest of the firm, which is primarily comprised of $84 billion in servicing, to Mr. Cooper.

MR. COOPER HOMEPOINT DEAL CREATES LARGEST U.S. SERVICER

Mr. Cooper adding $84 billion in Homepoint servicing to its $853 billion portfolio puts the Mr. Cooper portfolio at $937 billion.

As of 1Q23, here’s how Inside Mortgage Finance Ranked the top 3 U.S. servicers:

– $937 billion: Wells Fargo

– $883 billion: Cenlar

– $853 billion: Mr. Cooper

As you can see, Mr. Cooper at $937 billion ties them with Wells Fargo as America’s top mortgage servicer.

There are two other factors that support Mr. Cooper as America’s largest mortgage servicer.

First, Mr. Cooper said in 1Q23 earnings it had $57 billion in mortgage servicing rights (MSR) acquisitions pending. If you add this to the $937 billion, you get $994 billion.

Second, in January, Wells Fargo said it’s shrinking both its originations and servicing businesses. When I detailed how and why, I said this about servicing:

Wells Fargo reducing servicing is an opportunity for other servicing players, and any servicing market share Wells will no longer go after will be absorbed happily by other players.

And now here we are.

Based on these two factors, it’s likely Mr. Cooper becomes America’s biggest servicer when 2Q23 rankings come out — or soon after.

WHAT FINTECH POWERS TOP U.S. MORTGAGE SERVICER?

As for the fintech that’s powering Mr. Cooper, it’s Sagent.

And make no mistake: when you have 4.4 million customers and almost $1 trillion in servicing, software is critical in creating much of the experience for borrowers and servicers.

Servicing software is crazy complex as it powers all the good times and hardships for consumers, plus all compliance, investor, and operational details for servicers.

This is an important part of the story because you can’t be a truly great servicer at this scale without modern tech helping you nail all these details.

Last year, Sagent added Mr. Cooper as a customer and acquired key servicing tech and teams from Mr. Cooper.

In exchange, Mr. Cooper got 20% equity in Sagent and 2 board seats — for Mr. Cooper CEO Jay Bray and President Chris Marshall.

Now Sagent is building the industry’s first cloud-native mortgage servicing platform, and Mr. Cooper will be the first customer on that platform before rolling it out to the rest of the industry.

Yesterday, Sagent announced the opening of their India operation where 120+ fintech pros specializing in mortgage servicing are working in this project.

Most of these folks were former Mr. Cooper team members that came over in the deal, as Sagent CEO Dan Sogorka noted:

Three key Sagent operational milestones this year are hiring Fannie Mae vet Marianne Sullivan as COO, hiring Wells Fargo vet Perry Hilzendeger as EVP, Servicing, and opening our Chennai, India operation to accelerate our cloud-native mortgage servicing software development. In our landmark 2022 deal with Mr. Cooper, they became a Sagent customer, plus we acquired their highly experienced mortgage servicing fintech team, many of which are in India. We’re the only major fintech firm with a global team dedicated to building core, default, and consumer mortgage servicing platforms for top banks and lenders.

This is what Mr. Cooper CFO Kurt Johnson said about the Sagent deal on the company’s 1Q23 earnings call last month:

Sagent is in the process of integrating the IP it acquired from us on the cloud-based core processor. Once the integration work is complete, they will go to market with the industry’s first and only cloud native platform, offering customers significant benefits in cost and speed to market compared to other servicing platforms.

And here’s what Mr. Cooper president Chris Marshall said on the company’s 4Q22 earnings call in February:

Our application suite we sold to Sagent is a very modern native cloud set of applications that are way ahead of the competition. The one thing that was missing was a core. Now Sagent is going to replace the core in every application they have with this new core that completes the platform. It will be a massive differentiator.

Links below have more on this topic.

Please reach out with questions, and subscribe to our newsletter.

___

Reference:

– Mr. Cooper Acquires Homepoint for $324M (Mr. Cooper)

– What’s up with Wells Fargo exiting position as largest U.S. mortgage player? (TBP)

– Mortgage servicing giant Mr. Cooper hires Sagent to power servicing (TBP)

– Sagent adds 120+ mortgage tech pros to build servicing platform (Sagent)