Does Sixty Bucks A Year Really Separate 127,000 Families From Their Dream Homes?

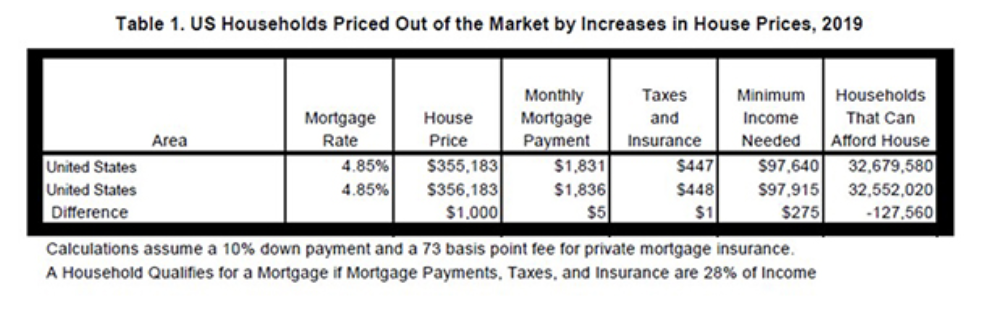

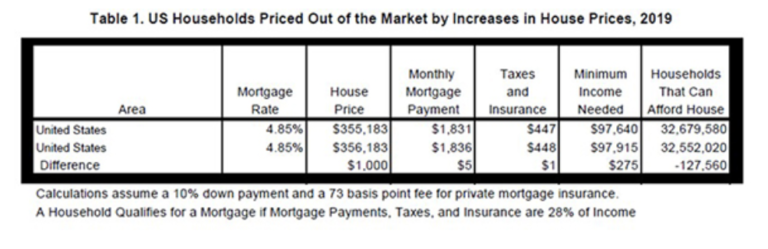

The National Association Of Home Builders (NAHB) says a $1,000 increase in the median U.S home price* in 2019 would exclude 127,000 households from qualifying for a mortgage for a home of that price.

Think about that, and think about the fact that a mortgage payment for a median value home after a $1,000 price increase would only cost $5 a month more.

NAHB also said that if rates go from 4.85% to 5.10%, a million households can get priced out of the market.

The Bad News

As I think about getting into the housing market amid what experts are calling an affordable housing crisis, I imagine how it would feel to be one of those 127,000 households. Imagine not qualifying for a mortgage for your dream home because it’s barely out of your price range. If you’re buying a $355,000 house, you could find an extra five bucks a month for the mortgage payment, right?

Couple that fact with Zillow’s analysis that the median income of a first-time homebuyer is $30,000 more than the national median income.

From a layperson, it seems that a lot of people who want to get into housing are doing so on shaky ground because prices are high, or, they’re getting in with significantly more of an income cushion than most people.

If young people understand the value of real estate as an investment and want to build wealth, and relatively minor increases in home value can shut them out of the market, that raised alarm bells for me.

The Good News

I ran this by Julian, and he referred me to this piece which dives into exactly how lenders qualify you for a home purchase.

Turns out it’s not just about your income when home values change. There’s something called a deb-to-income ratio that all lenders use to qualify you for a home purchase. This piece discusses the nuance that goes into both the income and the debt side of the loan qualifying game when lenders are looking at debt-to-income ratios.

I’m much more relieved having read this, and will get into more detail on it shortly.

___

Reference:

– Rent vs. Buy: The Most Important Housing Decision Of All Time (The Basis Point)

– NAHB Priced-Out Estimates for 2019 (NAHB)

– First-Time Buyers Earn $30,000 More Than Their Peers Who Didn’t Buy a Home (Zillow)

*NAHB uses a median value of $355,183 because they’re focused on newly constructed homes. And the latest Census data says median price of a new home is $309,000, but that’s slightly out of date. The Census hasn’t released the latest new home sales and price numbers due to the government shutdown. By comparison, the latest median price of an existing home is $257,700 according to the NAR. Existing homes account for about 90% of the roughly 6 million home sales in America each year, and new home sales account for the other 10%.