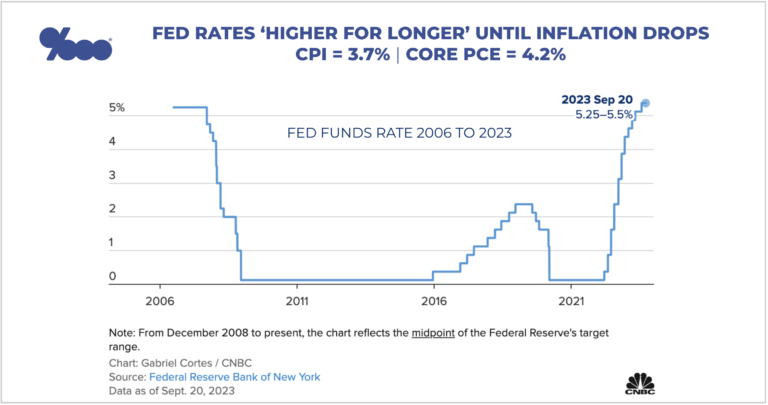

Fed has hiked rates 5.25% at 11 of 13 meetings since March 2022. How long is this Higher For Longer phase?

The Fed held rates steady on September 20, keeping its overnight bank-to-bank lending rate at 5.5%, and indicating it’ll hold near this higher level for longer.

Of the last 13 Fed meetings since March 2022, the Fed has hiked 11 times for a total of 5.25% as follows:

+0.0% September 20, 2023

+0.25% July 26, 2023

+0.0% June 14, 2023

+0.25% May 3, 2023

+0.25% March 22, 2023

+0.25% February 1, 2023

+0.5% December 14, 2022

+0.75% November 1, 2022

+0.75% September 21, 2022

+0.75% July 27, 2022

+0.75% June 15, 2022

+0.5% May 1, 2022

+0.25% March 15, 2022

Here’s what the key inflation, rate, and employment indicators look like now vs. their peaks:

– Headline CPI peaked 9% in June 2022, latest 3.7% in August 2023

– Core PCE peaked 5.2% in March 2022, latest 4.2% in July 2023 (Aug numbers due Sept 29)

– 30yr mortgage rates peaked August 22, 2023 at 7.5%, are 7.375% September 20, 2023

– Unemployment peaked 14.7% April 2020, latest 3.8% in August 2023

Inflation remains elevated, but is making progress toward the Fed’s 2% target.

We don’t have to get to 2% for mortgage rates to start dropping, but if CPI and Core PCE show multi-month trends near 3%, the mortgage bond market would rally, bringing mortgage rates down.

The MBA and Fannie Mae estimate 6.3% and 6.7% mortgage rates by year-end, respectively.

Strong employment is good for consumers but still a challenge for the Fed’s balancing act of slowing inflation without killing the economy.

Please reach out directly with questions or add your comments below, and links below have other worthwhile data.

___

Reference:

– Fed declines to hike, but points to rates staying higher for longer (CNBC)

– Wells Fargo economics team on Fed outlook