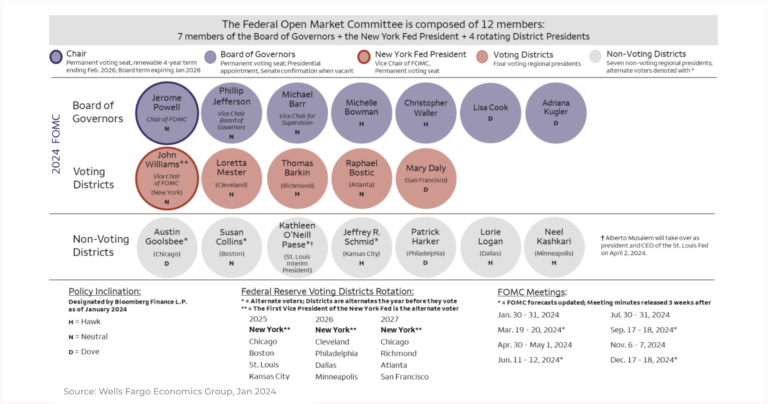

FOMC 101 – Fed meetings, voting members, and their policy bias in 2024

This FOMC 101 graphic from Wells Fargo’s Economics Group is handy as the first Fed policy meeting of 2024 hits this week. It’s a good briefing on 2024 Fed meetings, 2024 Federal Open Market Committee members, and whether the FOMC voting members are hawkish (H), dovish (D), or neutral (N) in their policy positions.

Hawkish and dovish policy positions reflect how voting FOMC members approach the Fed’s dual mandate of maximum employment (keeping unemployment low) and price stability (keeping inflation low). Doves tend to focus on decisions that minimize risks to the job market. Hawks tend to focus decisions that control inflation.

As for the inflation fight, here are some outcomes since the Fed hiked overnight bank-to-bank lending rates by 5.25% since March 2022:

– Headline CPI inflation peaked at 9% in June 2022, and the latest is 3.4% as of December 2023.

– Core PCE inflation figure peaked 5.2% in March 2022, and the latest is 2.9% as of December 2023.

– 30-year mortgage rates peaked October 18, 2023 at 8%, are 6.875% January 31, 2024.

– We’re getting closer to the Fed’s 2% target for Core PCE which has helped mortgage rates.

– The Mortgage Bankers Association predicts rates dropping further this year as follows: 6.9% for 1Q24, 6.6% for 2Q24, 6.3% for 2Q24, and 6.1% for 4Q24.

– Lower rates will likely mean more demand and rising home prices in a low-inventory housing market.

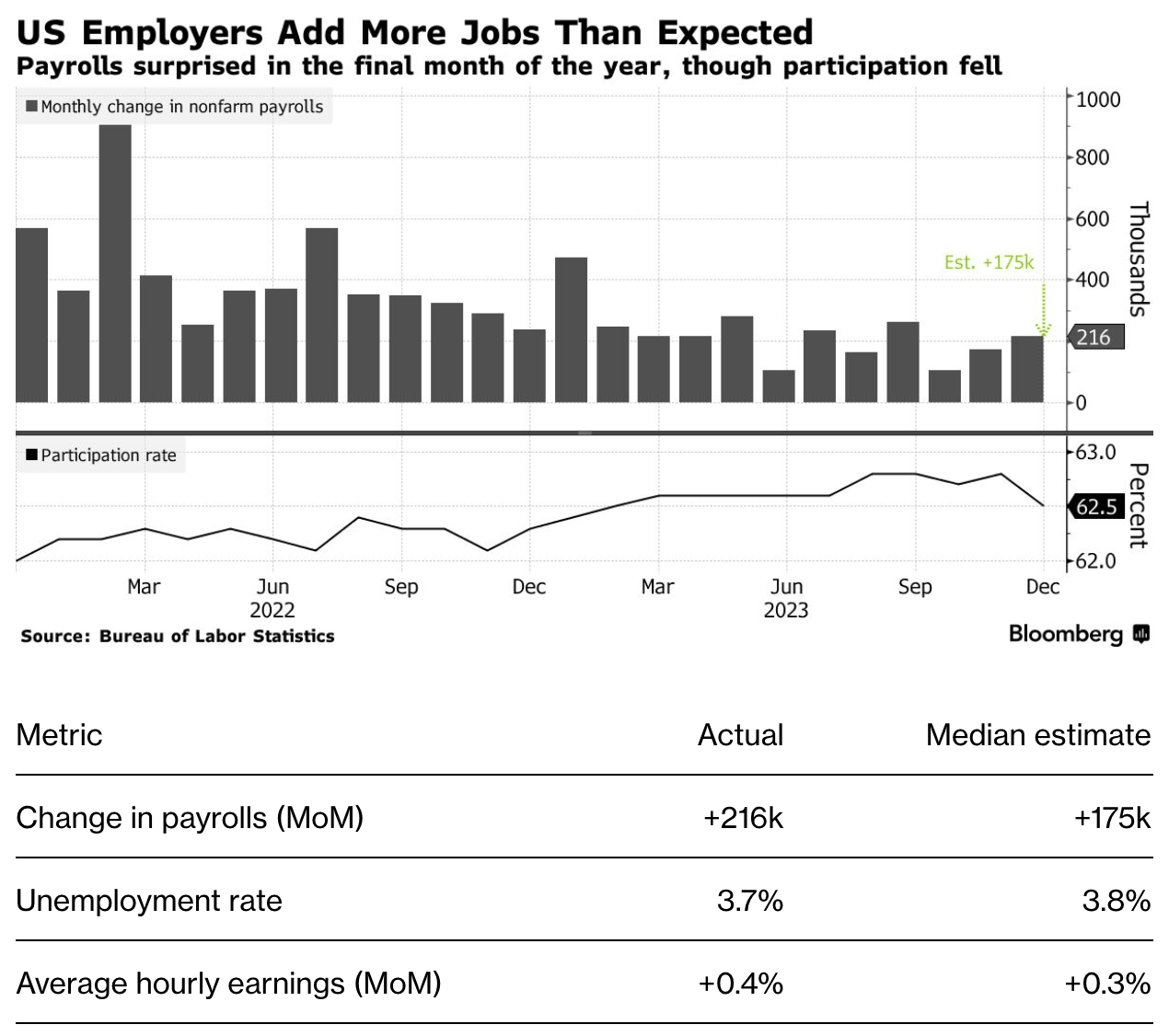

As for the maximum employment mandate, unemployment is 3.7%, which is near a five-decade low.

Here’s a summary of the latest jobs report.

The job market is so strong that hawks won’t want to reignite inflation with premature rate cuts.

Right now, the FOMC’s voting members consist of 3 doves (Lisa Cook, Adriana Kugler, Mary Daly), 4 hawks (Michelle Bowman, Christopher Waller, Loretta Mester, Thomas Barkin), and 5 neutrals (Jay Powell, Phillip Jefferson, Michael Barr, John Williams, Raphael Bostic).

Fed hiking is basically done, even by hawk standards, but the hawks plus neutrals may outweigh the doves on holding until at least March 20 before any cuts.

Below is a link to the full size FOMC 101 infographic with all details on Federal Open Market Committee members.

Please reach out and add your comments.

___

Reference:

– FOMC 101 Infographic – Wells Fargo Economics (FULL SIZE)

– In Higher For Longer inflation war, how does Fed chief Jay Powell stay so calm?