How Does Rent-To-Own Home Buying Work?

Before the 2008 financial crisis, rent-to-own was mostly offered to renters by individual landlords. But Wall Street landlords helped mainstream rent-to-own homeownership as the crisis played out. Wait, what?! Sounds crazy and raises questions: Does Wall Street seriously help you as a renter and homebuyer? How does rent-to-own work? How can you find a rent-to-own home? And can you do a rent-to-own deal on your current home?

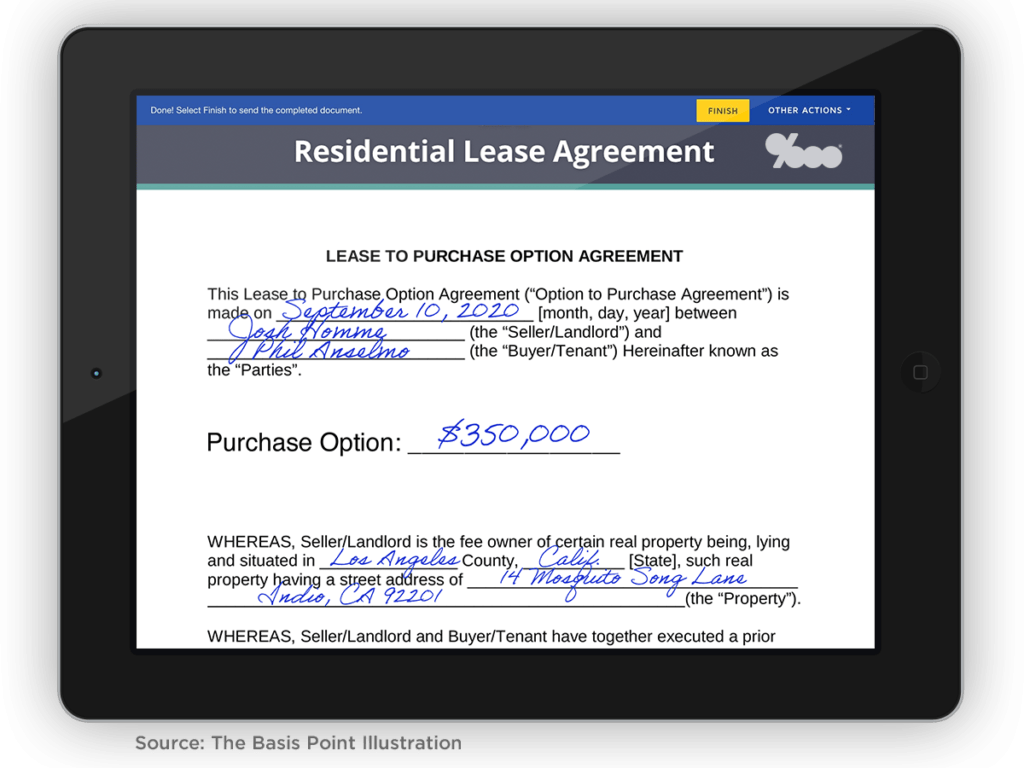

Let’s take a look, starting with a quick history lesson so you know how rent-to-own works for you right now. But first, check out the artwork above to see if you can find the pop culture easter eggs!*

HOW RENT-TO-OWN WORKS NOW VS. POST-2008 CRISIS

When housing prices started crashing in mid-2006, Wall Street investors bought homes in bulk hoping to sell at a profit soon after. But prices kept dropping for years after that. So they started renting the homes to generate cash flow until home prices rose again and they could sell at a profit.

Paradoxically, this led to a win for you, the renter who’s on a slower home buying path and doesn’t want home prices to spike while you save.

Why? Because these big money investors were in a financial position to be more creative than individual landlords offering rent-to-own.

They offered tenants rent-to-own contracts giving renters an option to buy later, and also allowed up to 10% of rental payments to accrue toward a down payment.

This was especially useful to folks who had lost homes they owned pre-crisis. It let them get back on their feet, repair their credit, stabilize their income, and eventually buy the homes they’d been renting post-crisis.

This is how the modern rent-to-own model was born. It’s evolved since then, as described in the sections below.

TWO KINDS OF RENT-TO-OWN CONTRACTS FOR TENANTS

Rent-to-own is great for aspiring renters who aren’t ready to buy a home just yet. Rent-to-own means that you sign a rental agreement that includes an option to buy, typically within three years.

The contract spells out your rental payment, whether any of that payment accrues toward a purchase down payment, and how much you can buy the home for.

It’s critical to understand the two main types of rent-to-own contracts.

THE LEASE OPTION CONTRACT means you’re renting the home with an option to buy it within the dates — and for the price — noted in the contract.

You don’t need to get pre-approved for a mortgage before signing a Lease Option rent-to-own contract. But you should because it’ll help you know your buying power and make you a better negotiator of rental payments, how much of your rent (if any) can accrue toward a down payment, and the pre-agreed purchase price and date.

THE LEASE PURCHASE CONTRACT means you’re renting the home and (usually) must buy it within the dates — and for the price — noted in the contract.

You must get pre-approved for a mortgage before signing a Lease Purchase contract. Why? Because you’re signing a lease and purchase agreement simultaneously. You’ll know if you’re working with a company that’s offering a Lease Purchase contract, because they’ll require you to get pre-approved up front. But read the next section below for nuances on this contract.

HOW DO I AVOID BEING FORCED TO BUY A RENT-TO-OWN HOME?

The Lease Option contract described above doesn’t require you to buy a home, but the Lease Purchase contract usually does.

You will most likely see a Lease Purchase contract from a Wall Street or Silicon Valley fintech firm rather than an individual landlord.

Many of these firms’ websites will tell you how they’ll just buy the home (or they already own it), rent it to you, and give you the option to buy it — or not.

This model is a great deal for you, but you must find the contract details that specify whether you must buy the home or can walk away when your lease is over.

If you can walk away, that means you’re signing a Lease Option contract. If you must buy the home, that means you’re signing a Lease Purchase contract.

It’s important to know what to look for because not all contracts specify what type of contract they are.

DO I BENEFIT FROM HOME APPRECIATION WHEN I RENT-TO-OWN?

If you’re serious about buying a rent-to-own home, you need to know how much upside you get during your initial rental term.

The easiest way to figure this out is to find the part of the contract that states when you can buy the home and for what price.

Let’s say your initial lease term is two years and you have the option to buy any time after year one. Both Lease Option and Purchase Option contracts will have a date and price at which you can buy.

And you can always negotiate your price.

This is your chance to set a price in advance so home appreciation won’t run away with you while you’re saving up enough down payment to qualify for a home purchase loan (see How Does Wall Street Help Me As A Homebuyer section below).

DOES ANY OF MY RENT GO TOWARD DOWN PAYMENT WITH RENT-TO-OWN?

Some Lease Option and Purchase Option rent-to-own contracts allow a portion of your down payment to accrue toward your down payment.

This is less common with individual landlords and more common with rent-to-own companies.

Let’s say you’re renting a home for $1750 per month. If your rent-to-own agreement says 10% of rent goes toward a down payment to buy the home for $350,000 after two years, you’d accrue $4200 toward your down payment.

This is only 1.2% of the $350,000 purchase price and most loans require a minimum 3% to 3.5% down.

It’s not a game-changer, but a nice bonus if your rent-to-own landlord allows this.

The downside risk is that many rent-to-own agreements let the landlord keep the accrued amount if you don’t buy the home.

So to simplify things in your favor, you can also negotiate the rent to be 10% lower. In this example, that would make the rent $1575.

This way you’re saving $175 per month on your own, and there’s no grey area of your landlord keeping the accrued 10% per month.

HOW DOES WALL STREET HELP ME AS A RENTER?

In the opening sections above, I noted Wall Street actually helps renters because they can be more creative with rent-to-own.

Unlike some individual landlords, big firms can offer longer rent-to-own leases and allow a portion of your rent to accrue toward a down payment.

For example, some big institutional landlords can offer you a two to three year initial rent-to-own term and then extend it for a few more years after that.

This can give you up to six years to exercise your purchase option.

As long as you can negotiate a set purchase option price that favors you, this could be a good option to give you time to save up for a down payment.

HOW DOES WALL STREET HELP ME AS A HOMEBUYER?

When it comes to home buying, Wall Street and Main Street are inextricably linked.

A mortgage company that approves and closes your loan might seem like a local shop. But a big Wall Street and government-backed machine enables them to make these loans to you.

This is a good thing. Without Wall Street and government backing, we wouldn’t have the low-down-payment, and long-term 30-year fixed loans we have in America.

The good news for you is you just need to find a lender you’re comfortable with. They’re all extremely highly regulated by state and federal authorities, and all licensed mortgage lenders must follow the same rules.

Here’s a brief rundown on how to get a mortgage.

SHOULD I RENT-TO-OWN FROM AN INDIVIDUAL LANDLORD OR A COMPANY?

As noted in the How Does Wall Street Help Me As A Renter section above, big companies can often offer longer rent-to-own terms.

But individual landlords have advantages too.

You’ll be much more likely to negotiate with an individual landlord. This is critical when it comes to things like setting a good purchase price in advance or nuances about down payment accruals (as described in the down payment section above).

Lots of landlords like rent-to-own because it expands their rental pool to people who’ll treat the property like their own.

This puts you in a strong negotiating position.

But they’ll often draft a rent-to-own agreement with an attorney who has their best interest in mind. So here are things to look out for:

– Does any of your rent go toward the down payment?

– Do you have to make a down payment by a certain time before the purchase?

– Do they get to keep part of your down payment if you decide not to buy?

– Do you get the home appreciation before and/or after your rental period?

– How long before you can buy? And how long do you have to buy in total?

The answers to these questions as well as negotiating tips are covered in the sections above.

HOW DO I FIND A RENT-TO-OWN HOME?

The simple answer to this question is: ask your current or potential landlord if you can do a rent-to-own deal with them. More on this in the last section below.

The rest of the answer is there are many variations of rent-to-own offerings. When you search for these, you’ll find many national and local options.

Most of what you’ll find when you search will be sophisticated companies offering rent-to-own.

All of the sections above describe what to look for, because no matter how complicated a certain model gets it all comes down to the two types of contracts: A Lease Option contract or a Lease Purchase contract.

Both of these contracts are described above, and here’s a basic summary of what you need covered for any type of rent-to-own home contract you enter into:

– Your monthly lease amount

– Your lease term, including how long you must lease before you can buy

– Your purchase price and first date you can buy the home for that price

– Whether you must buy the home or can walk away at the end of your lease

– Whether any percentage of the rent accrues toward a down payment

– Whether you must use the landlord’s financing resources when buying or your own

CAN I DO A RENT-TO-OWN DEAL IN MY CURRENT HOME?

You just have to ask!

Many landlords are willing to make rent-to-own deals.

Some are sophisticated and know how to get this done.

Others will need help, and local real estate attorneys know how to write rent-to-own contracts.

If you have any questions, please comment below, or reach out to me directly.

___

Reference:

– What If Mortgage Rates Drop After I Lock My Loan?

– How To Get A Mortgage – for new AND experienced borrowers

* Easter egg alert!: Seller and buyer in the rent-to-own contract image above are Queens of The Stone Age and Pantera frontmen Josh Homme and Phil Anselmo. Josh is renting/selling his home to Phil. The Palm Springs address is 14 Mosquito Song Lane, named after the 14th track on Songs For The Deaf. May this deal go through so we can get an epic collaboration going between these two legends 😉