Inflation & Retail Sales Data Confirm Consumer Caution, Keeps Rates Low

After a better rate day yesterday due mostly to a well-received 30yr bond auction, rates are even today after consumer inflation, retail sales, consumer confidence, and bank earnings figures. Following yesterday’s slightly hotter than expected business inflation report, today’s consumer inflation report confirms a relatively flat inflation environment—which helps keeps rates low. December’s consumer inflation (measured by the Consumer Price Index, or CPI) was .5%, the highest monthly increase since mid-2009, but If we exclude volatile food and gas prices from that reading, the “core” rate for December was flat at .1%. Also consumer inflation since December 2009 was +1.5%, which is within the Fed’s comfort zone of 1-2%.

After a better rate day yesterday due mostly to a well-received 30yr bond auction, rates are even today after consumer inflation, retail sales, consumer confidence, and bank earnings figures. Following yesterday’s slightly hotter than expected business inflation report, today’s consumer inflation report confirms a relatively flat inflation environment—which helps keeps rates low. December’s consumer inflation (measured by the Consumer Price Index, or CPI) was .5%, the highest monthly increase since mid-2009, but If we exclude volatile food and gas prices from that reading, the “core” rate for December was flat at .1%. Also consumer inflation since December 2009 was +1.5%, which is within the Fed’s comfort zone of 1-2%.

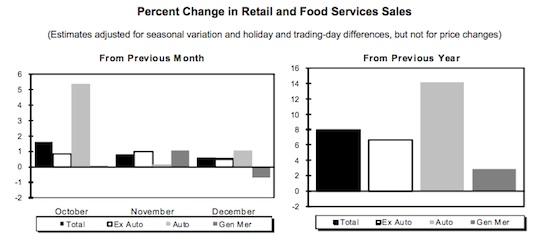

December Retail Sales were .6%, less than expected and less than November’s .8%. This helps keeps rates even because it suggests the consumer is still tentative and the economic recovery still needs more time to mature. Excluding sales of cars, retail sales it was +.5%. For the year Retail Sales were up 6.6%. JP Morgan Chase reported better than expected earnings this morning ($1.12 EPS vs. $1.00 est.), they said 4Q revenue was stronger and that credit losses and non-performing loans declined. We also learned this morning that consumer sentiment came in lower than expected, which is reflected in the inflation and retail sales figures. Below is a chart of the retail sales report.