CPI still double Fed inflation target, but we’re getting very close to rate relief

Inflation is still double the Fed inflation target of 2%, but we’re getting very close to rate relief. Here’s a quick update after the October 2023 CPI inflation report this week.

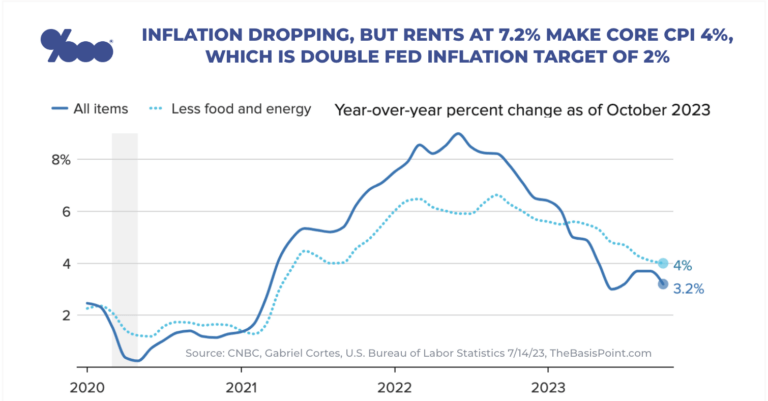

– Headline CPI is down from a 9% high in June 2022 to 3.2% in October 2023.

– Core CPI is down from a 6.6% high in September 2022 to 4% in October 2023.

– This is double the Fed inflation target of 2% for Core CPI.

– A key culprit holding Core CPI inflation higher is home rent inflation at 7.2%.

– Still, the downward trend in the chart above for headline CPI (‘All items’) and Core CPI (‘Less food and energy’) is positive.

– Mortgage bond markets like this trend, and 30-year fixed rates have dropped from 8% late-October to 7.5% now, per Mortgage News Daily.

– Mortgage rates dropping 0.5% in less than a month is a good sign that the worst may be over.

– Mortgage bonds rallying on this inflation downtrend is evidence we won’t have to wait for Core CPI to get all the way to 2%.

– As long as Core CPI drops steadily from today’s 4%, we should see mortgage rates drop accordingly.

– Just don’t hold out for 3%. That was a pandemic anomaly.

– But it is realistic 2024 mortgage rates could drop to upper-6% range in first half of year.

___

Reference:

– Here’s the inflation breakdown for October 2023 — in one chart