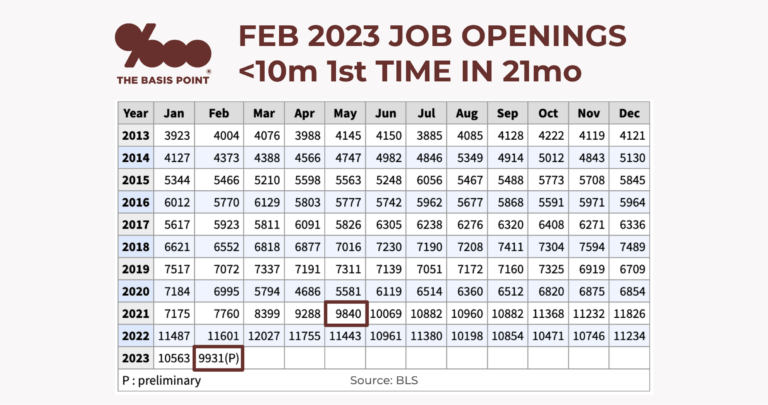

Is Fed inflation fight killing jobs? Feb 2023 openings below 10m 1st time in 21mo.

Some politicians love to blame the Fed for killing jobs while also blaming the Fed for not moving aggressively enough on inflation. The Fed’s dual mandate of price stability and maximum employment is a thankless job. Especially when the inflation fight seems to be working, but at the cost of job openings in February 2023 dropping below 10 million for the first time since May 2021.

The table above shows this trend, and unemployment is now at 3.6% with consensus estimates calling for this to hold steady when the March jobs report is released tomorrow.

Meanwhile the Fed’s preferred Core PCE inflation measure never got higher than 5.2%, and this level was reached twice, in March 2022 and September 2022.

Headlines exclude this because they focus on CPI Inflation. But even Core CPI peaked 7 months ago at 5.9% (now 5.5%), and headline CPI peaked 10 months ago at 8.9% (now 5.9%).

We begin 2Q23 with mortgage rates down 0.25% after the latest Core PCE (released last day of 1Q23) dropped to 4.6%.

The Fed medicine tastes bitter, but it’s working.

It’s going to get especially bitter when the lowest unemployment rate in 5 decades ticks up as a result of the inflation fight.

But as long as job openings 2023 don’t spike, we might strike the balance of lower prices and good job opportunities.

This is the Fed’s rough job, but who ever said important jobs were easy.

___

Reference:

– Official February 2023 job openings report from BLS

– Why mortgage rates down despite strong +311k Feb jobs & 3.6% unemployment