Why mortgage rates down despite strong +311k Feb jobs & 3.6% unemployment

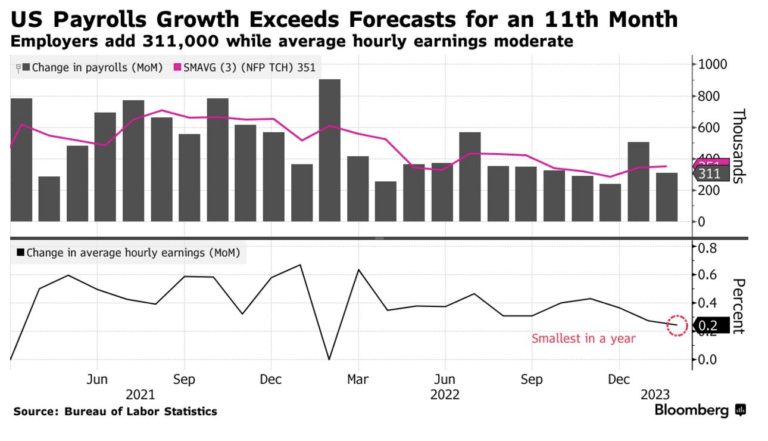

Today’s jobs report showed the U.S. economy added 311k new jobs in February, which exceeded expectations for the 11th straight month. Job gains were largely concentrated in leisure, healthcare, and retail sectors. Mortgage rates, after being around 7% so far in March, may end the week in the upper 6s if today’s mortgage bond rally holds. Normally rates would rise on a stronger jobs report, but not today. Here’s why.

February began with 6% mortgage rates, then rose to 7% during the month as stronger jobs and higher inflation data for January rolled in. Today is different for a couple reasons.

First, a stock selloff caused by worries about the banking sector (triggered partly by a run on Silicon Valley Bank) is driving investors into the safefy of mortgage bonds. And rates drop when bond prices rise in a buying rally.

Second, bond investors would normally sell on strong jobs data, pushing rates up, but they don’t love the jobs data. Unemployment rose from a 5-decade low of 3.4% to 3.6%, which is a meaningful one month move. And wages are lower than expected (+0.2% vs. +0.3% expected).

These stats aren’t great for workers but decent signals in the inflation fight.

Ahead of the March 22 Fed rate policy meeting, this moderately less hot inflationary pressure may mean they only hike overnight bank-to-bank lending rates 25 basis points instead of 50. But we also have February CPI Inflation reporting March 14, which will be a key input to Fed strategy — and how rate markets react in March.

The Fed has a dual mandate to have their policy actions foster both maximum employment and price stability, aka low inflation.

At least for now, mortgage rate traders believe today’s jobs report reasonably strikes this balance.

Below are two other useful reference images.

===

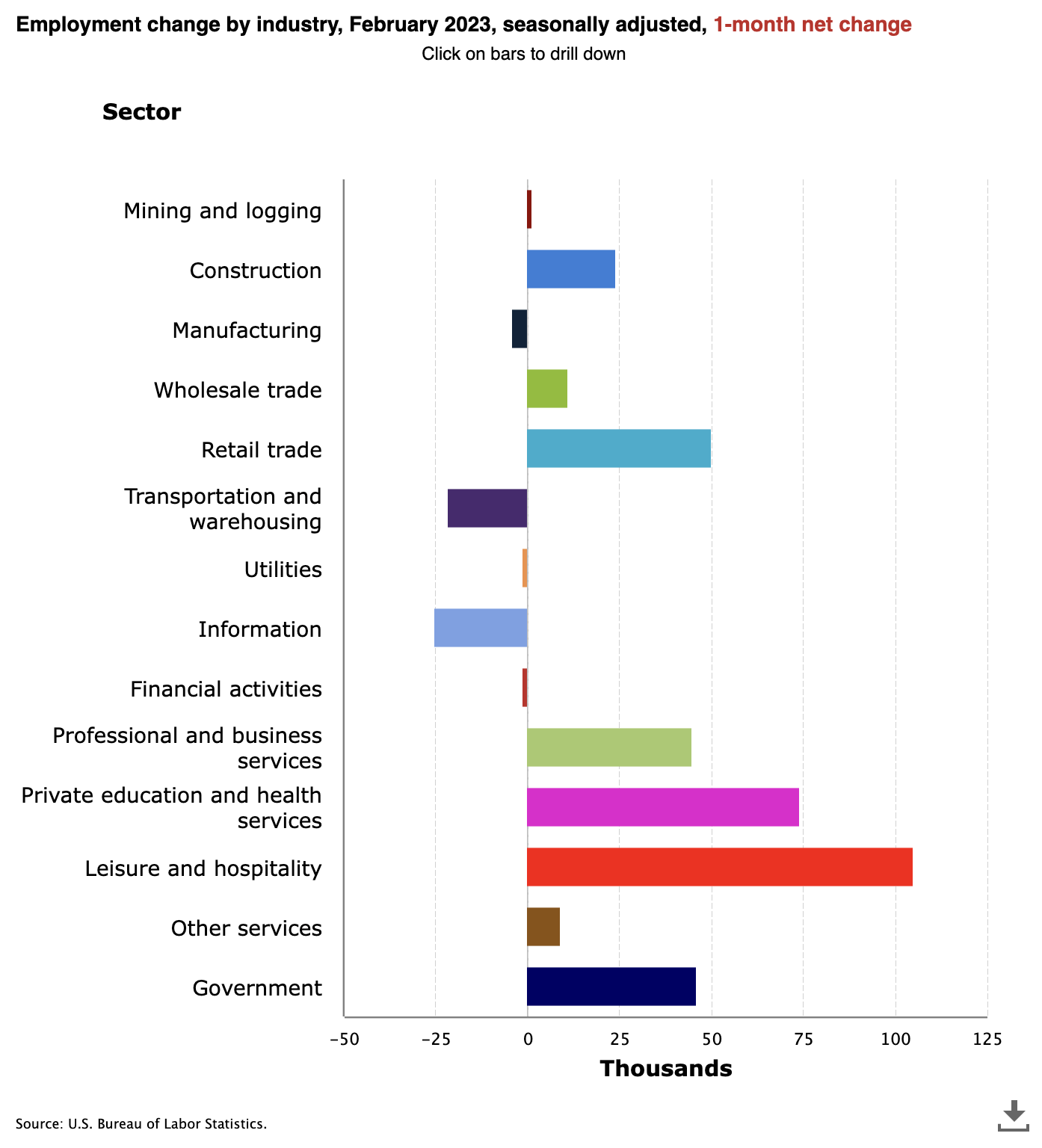

Here are the industries where February jobs grew the most. Leisure, healthcare, and retail led the gains.

===

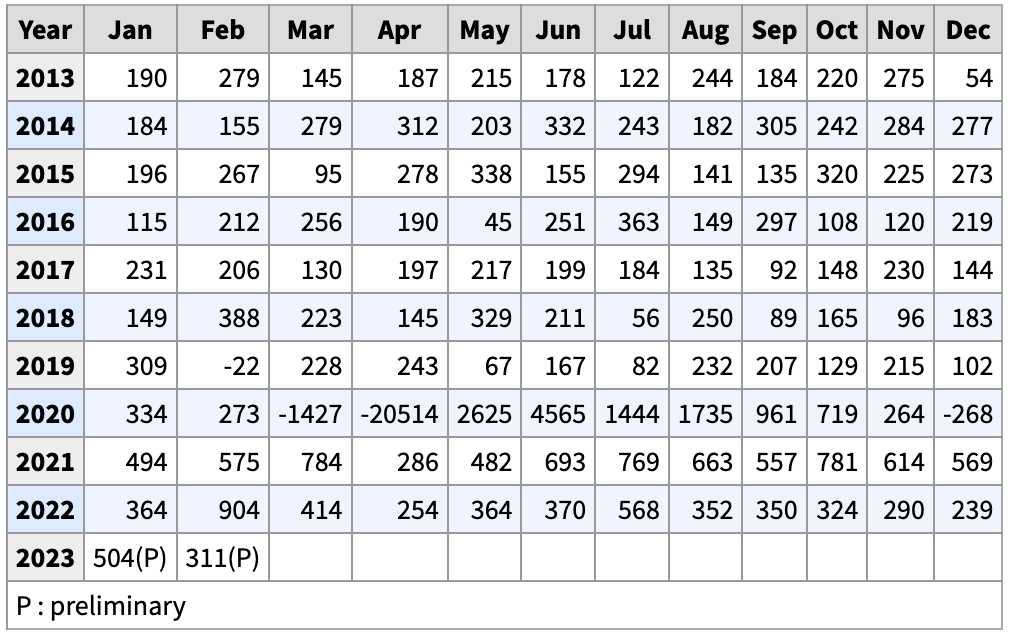

And here’s a handy Bureau of Labor Statistics table showing monthly job gains 2013 to present.

===

Please comment below or reach out with questions.

___

Reference:

– February Jobs Report Shows 311k jobs added, 3.6% Unemployment (BLS)

– Are Mortgage Rates Just 7% Forever Now?

– Broader implications of a bank run on Silicon Valley’s top bank to startups

– US Payrolls Top Estimates, Wages Cool in Mixed Signal for Fed (Bloomberg)

– The Basis Point works with our friends at MBS Live to track rate markets