Job market so hot right now. Which means higher mortgage rates.

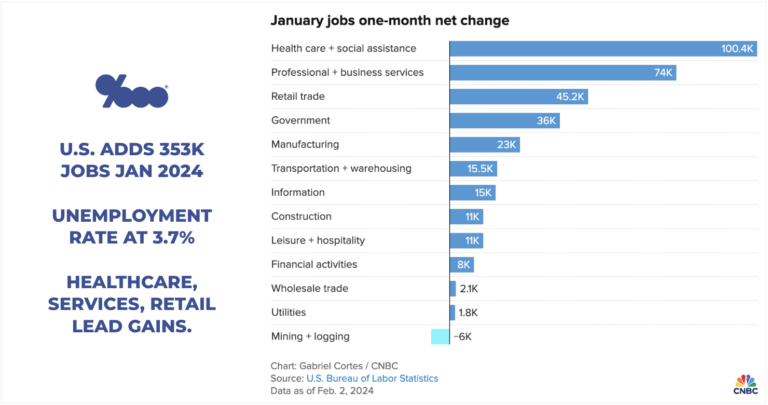

The job market is so hot right now, with the economy adding 353k jobs in January, and unemployment holding near multi-decade lows of 3.7%. The chart above shows which sectors led January job gains to crush expectations of 180k.

This strong jobs report led mortgage bonds to sell sharply so far today, with the benchmark 5.5% UMBS coupon down 55 basis points per MBS Live.

Mortgage rates rise when bond prices drop like this, and vice versa. Here’s a recap of this wild rate week:

– On Wednesday 3/31, the Fed indicated cuts to overnight bank-to-bank lending rates will come this year.

– Mortgage bonds rallied for 2 days on this news, bringing 30-year fixed mortgage rates down from 6.875% to 6.625%, per Mortgage News Daily.

– But mortgage bonds sold sharply today (as noted above) on the strong January jobs report, and if this selloff holds, rates may rise back to their pre-Fed meeting levels.

Overall, the trajectory for rates is down this year as the Fed eases off its inflation-fighting policy stance.

But for today, good jobs news is not-so-good rate news.

For homebuyers, it’s also a mixed sentiment.

On the one hand, job and economic stability is the core of longevity for your financial plans.

On the other hand, a stronger economy usually means higher rate levels.

Overall, this is a net positive for anyone making long-term life plans.

___

Reference:

– Here’s where the jobs are for January 2024 — in one chart

– Rates from Mortgage News Daily