Mortgage Layoff Alert & 4 Shakeout Bets – after refi apps drop 45% in last 6 months

A Bloomberg story by Carmen Arroyo today underscores the cost-cutting focus I’m increasingly hearing from mortgage lenders this month. Mortgage layoffs and cost cuts are normal as rates rise, but lenders will still fund $2.6 trillion in 2022. Here are some bullet points on which lenders will thrive vs. struggle as this plays out.

– 30yr fixed rates spiked a full 1% since December — to 4%, the highest since May 2019 — and while a Russia/Ukraine war can help rates, the spike slows loan volume materially.

– Refinance applications are down 45% in the last 6 months, per the Mortgage Bankers Association (MBA). And refis mostly drove record loan volume in 2020 and 2021 (see below).

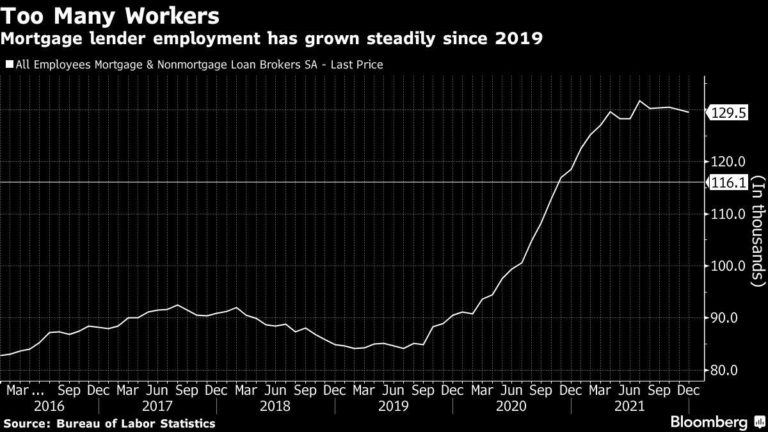

– Arroyo astutely noted that BLS jobs data show “the number of people working as brokers for mortgages and other kinds of loans, a proxy for total home lending employment, has surged more than 50% to around 130,000 since late 2019.”

– So mortgage jobs surged 50% to accommodate record volume the last 2 years, and now refis driving that volume are down 45% the last 6 months.

– Most headline writers aren’t used to this extreme mortgage cyclicality, but most of the mortgage industry is.

– Scaling mortgage operations (and jobs) up and down per rate market conditions is jarring for the uninitiated, but it’s a normal mortgage lender function.

– The U.S. mortgage industry funded $4.1 trillion in new loans in 2020 (64% refis, 36% purchases), and $3.9 trillion in 2021 (57% refis, 43% purchases), per MBA.

– This was fueled by rates dropping in response to the pandemic.

– A more normal mortgage market is around $2 trillion in newly funded loans per year.

– For example, total U.S. mortgage fundings were $1.68 trillion in 2018 (28% refis, 72% purchases), and $2.25 trillion in 2019 (44% refis, 56% purchases), per MBA.

– Now the MBA projects $2.60 trillion new mortgage findings in 2022 (33% refis, 67% purchases), and $2.53 trillion in 2023 (27% refis, 73% purchases*).

– So it’s normal that lenders had to ramp employment and other operational costs to handle the 2020 and 2021 volume spike.

– And it’s also normal that lenders adjust cost — including mortgage layoffs — when markets shift.

– It’s also worth noting that retail and broker lender models prove resilient in cost-cutting cycles because they rely on highly-experienced, full-commission loan officers (with commissions highly-regulated at the Federal level) so there’s less fixed cost for lenders.

– Direct lending models typically employ salaried loan officers and lead buying costs rise in refi-to-purchase market shifts.

– So direct lending models get squeezed. Lead costs rise. Purchase leads are harder/longer to convert. Balancing these priorities often leads to mortgage layoffs.

– Many VC-backed mortgage startups — mostly focused on direct lending models — created lots of clever headlines about “fixing a broken system” in recent years.

– But long-game mortgage operations are the real headline now.

– HERE ARE 4 MORTGAGE SHAKEOUT TRENDS TO WATCH:

– Look for early stage startup lenders with heavy cost models to come under strain.

– Look for “boring” retail and broker models to lead the way on full-cycle success.

– Look for well-capitalized multi-channel strategies — that have or seek to run retail, broker, and direct models simultaneously — to make smart M&A deals.

– And finally, look for fintech (aka digital native) banks to participate in M&A to acquire great mortgage operations for cheap during this cycle.

I’ll comment more on these 4 trends shortly.

Please comment below or hit me with questions.

___

Reference:

– Mortgage Businesses Seen Laying Off Thousands as Volume Drops (Bloomberg)

– GREAT: 2022 Jobs Growth — NOT GREAT: Mortgage Rates 1% Higher

* CRITICAL TREND NOTE: In 2018, when the market was comprised of 72% purchase loans, the purchase volume was $1.21 trillion. In 2023, the 73% purchase market predicted by MBA is comprised of $1.85 trillion purchase loans. This is $640 billion more purchase volume in a majority purchase market, implying healthy home sales ahead (the MBA predicts 7.6m new and existing home sales in 2023). And retail/broker models are better at converting much-longer-lead purchase loans than direct models. Refis and purchases are different sports, and broadly speaking, retail/broker lenders excel at purchases while direct lenders excel at refis.