LIVE BLOG From Top U.S. Mortgage Conference – MBA Annual 2023

The Basis Point is live at MBA Annual 2023, the mortgage industry’s biggest conference. This is where everyone gets the latest on the state of the U.S. mortgage market, fintech, housing, and regulations. Below are quick posts on all of these topics. Please use the comments to share any notes you’re seeing on the ground, or to point out items we should add!

CreditXpert Takes Over MBA Annual 2023!

[by Robyn]

CreditXpert is a company that helps people improve their credit scores so they can qualify for a home. It’s a tool that lenders brand as their own, and use it to show borrowers detailed scenarios of how their scores would improve fast — often within 30 days.

CreditXpert powers lenders to do this using “What If” simulators to show how credit would improve if someone paid down a credit card by X dollars. They also help automate the dispute process for borrowers who have derogatory items on their credit reports that shouldn’t be there.

And most important, it doesn’t just model these scenarios or get the processes started on pay-downs or disputes. It helps lenders and borrowers track these processes until credit scores are actually improved per the goals established.

Cool stuff to let lenders take over the process of credit improvement for their borrowers.

And speaking of takeovers, CreditXpert is totally taking over MBA Annual 2023 with their marketing on site.

As The Basis Point’s resident Trade Show Pro, I’ve got to shout out this pro takeover.

Check out these photos!

Also check out how CreditXpert can help mortgage borrowers.

And keep checking back into our Live Blog for more…

The MBA Annual 2023 Stage In Philly Is Giant

[by Julian]

Love this giant stage in Philly!

And very honored to be on this list (in lower right) of show speakers.

If you’re here, The Basis Point will hosting 16 demos of the latest mortgage technology.

Each company will demo for 8 minutes, and then I’ll join them on stage for live commentary and reaction for 2 minutes.

I’ll also kick off both days with some fun slides and analysis on the state of mortgage and fintech.

The first 8-pack is Tuesday, October 16 at 2:30, and the second 8-pack is Wednesday at 1:30.

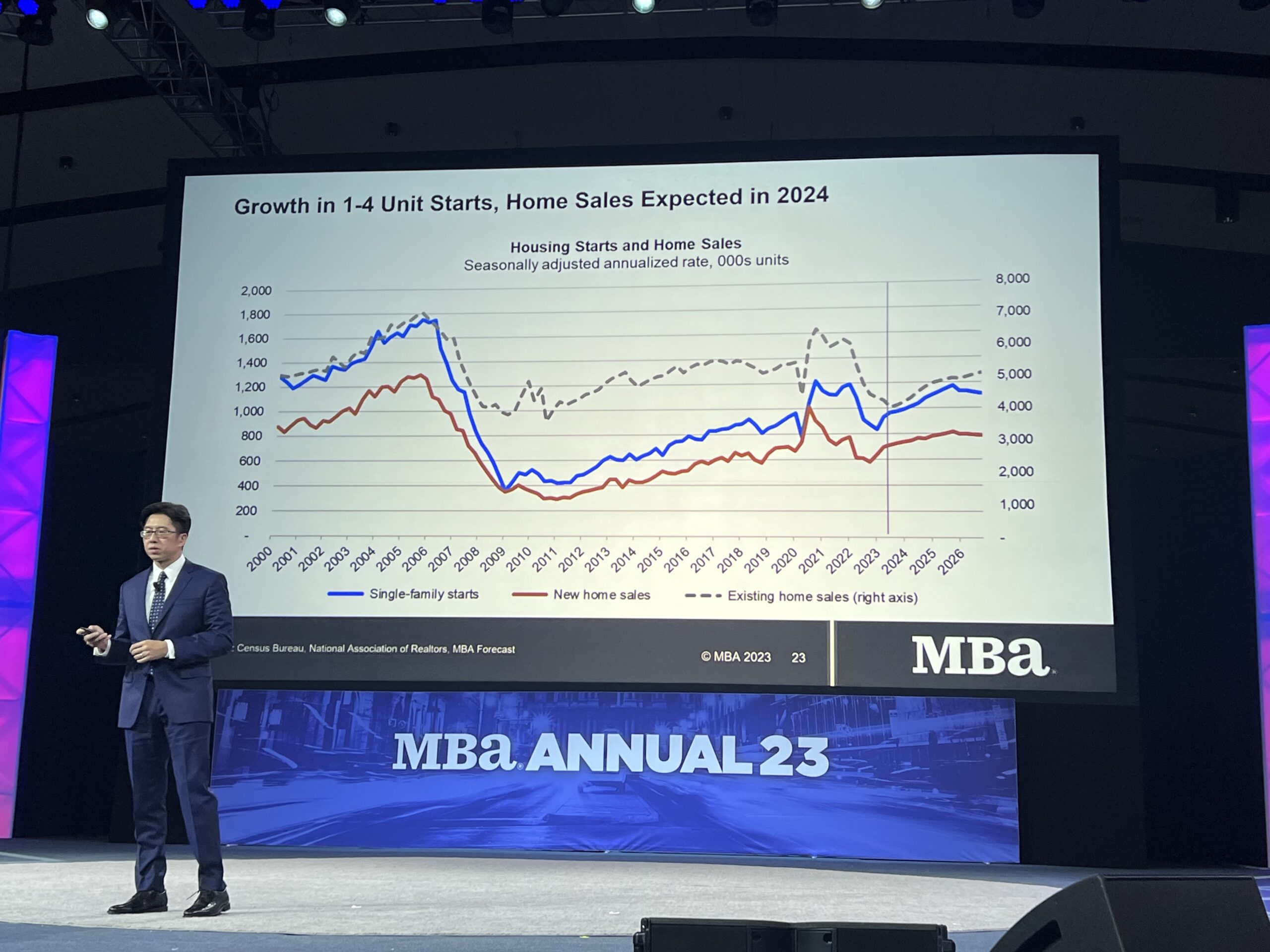

Most Encouraging Housing Chart Ahead Of 2024

[by Julian]

At MBA Annual 2023, economist Joel Kan shared an update of the outlook for housing starts (new construction beginning), and sales of both new and existing homes.

You can see that in 2024, we start moving up in all 3 of these areas.

This is one of the most encouraging housing charts ahead of 2024.

The Basis Point Downtown Philadelphia!

Philly architecture is amazing 🙂

Some shots of Julian and Robyn downtown…

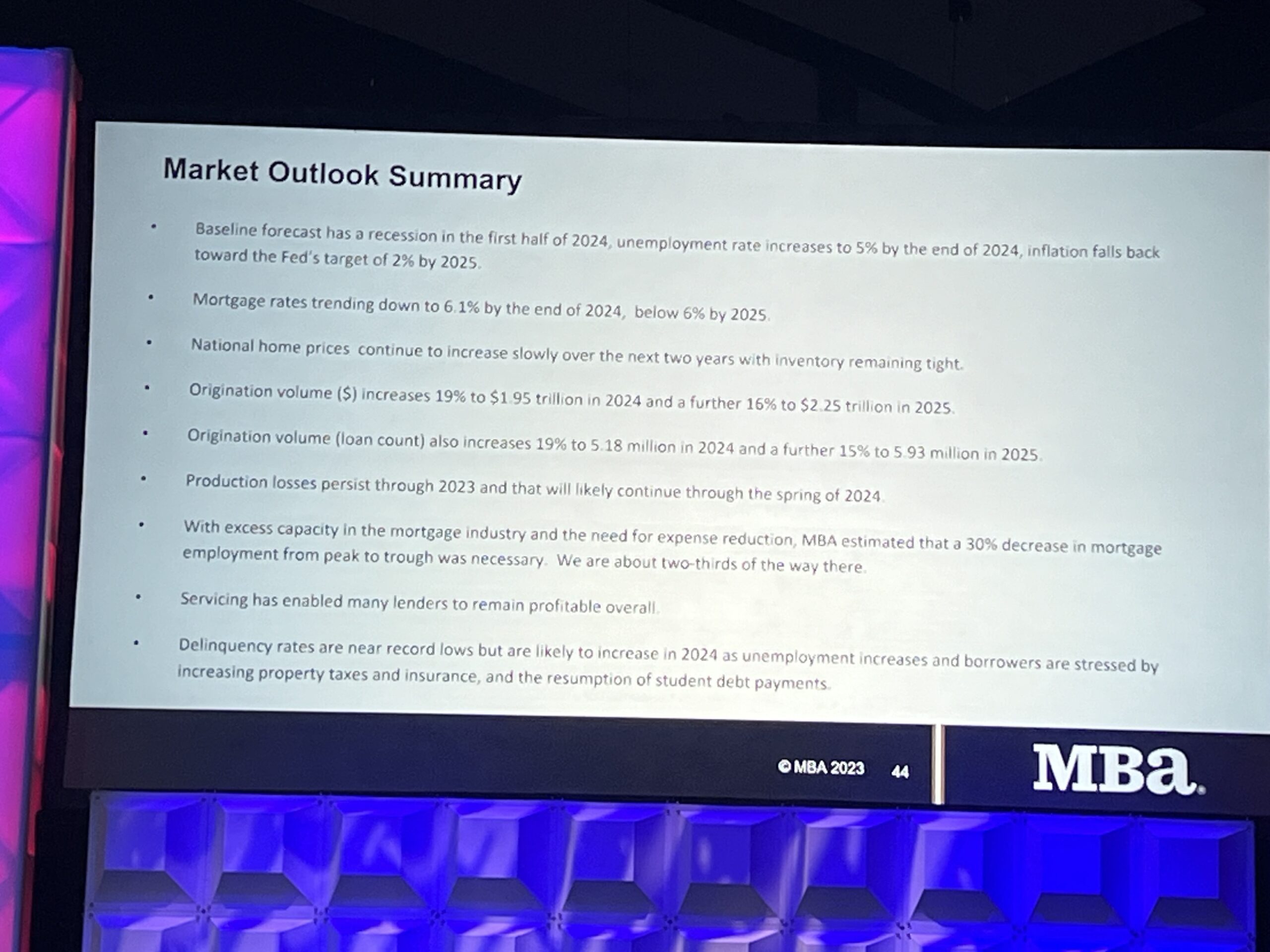

MBA Mortgage Market Outlook For 2023 and 2024 Summarized On One Slide

Here’s MBA Chief Economist Mike Fratantoni summarizing his MBA team’s mortgage and housing outlook on one slide.

Good reference material…

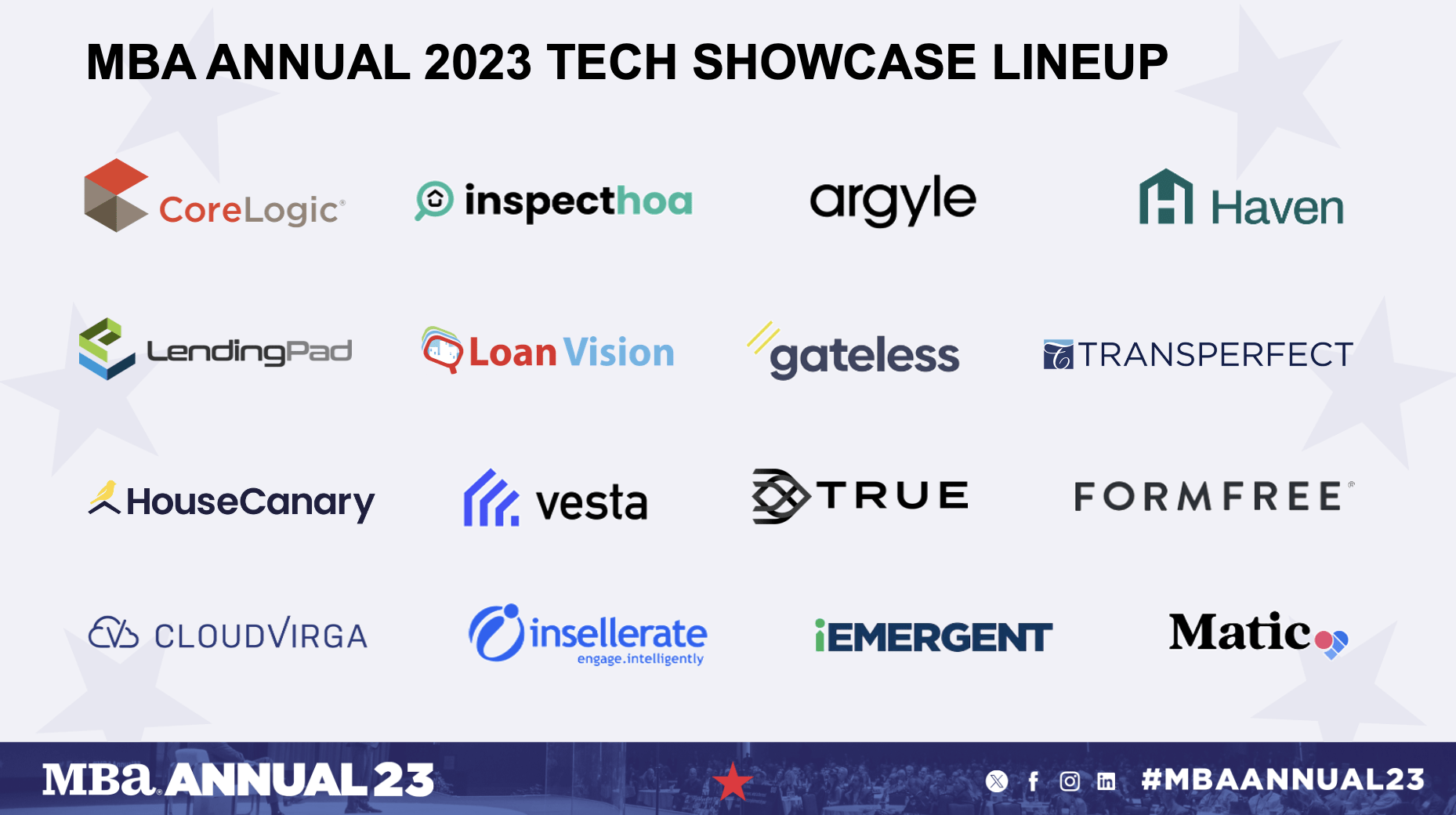

16 Mortgage Fintech Firms Who Are In MBA Annual 2023 Tech Showcase Hosted By The Basis Point

[by Julian]

The Tech Showcase I’m hosting at this show begins today at 2:30 pm ET, and it’ll feature 16 firms over today and tomorrow. Here’s a list of all the firms and what each firm is presenting.

NOTE: We’ll come back and do more detailed profiles of each firm later, but this is the list with simple product descriptions for now.

CoreLogic with LoanPass – AI Powered Digital Mortgage Platform

InspectHOA – Condo Project Review & Approval

Argyle – Income and Employment Verification

Haven – Servicing Connect With Consumer Engagement

LendingPad – Loan Origination System, Lender Edition

Loan Vision with Teraverde – Loan Vision For Lender Intel/Analysis

Gateless – Smart Underwrite Automated Underwriting and Extracting Data From Docs

TransPerfect – On-Demand Language Access Program To Translate Docs For Lenders

HouseCanary – ComeHome Direct Home Buyer & Owner Engagement, Property Valuation

Vesta — Modernized Loan Origination System

TRUE – QC Platform & Data Intelligence to Automate Underwriting

FormFree – Passport To Let Consumers Apply To Any Lender Fully In One Touch

Cloudvirga – Horizon Point of Sale System

Insellerate – CRM and Marketing Automation

iEmergent – Mortgage MarketSmart

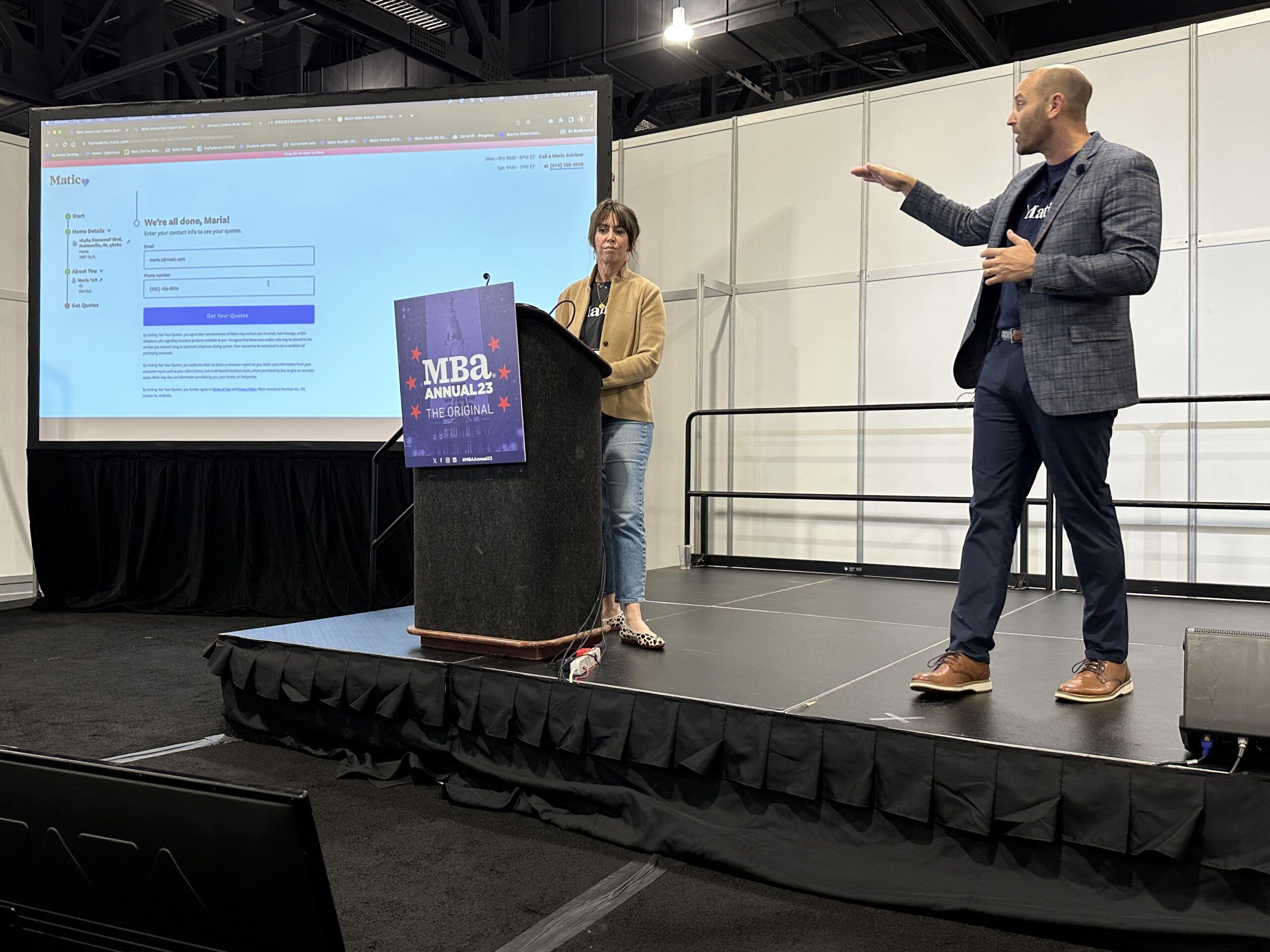

Matic – Embedded Home Insurance Marketplace

And here’s the list of the first 8 of these companies who’s going on this afternoon.

The Calm Before Fintech Takes MBA Annual By Storm

[by Robyn]

Tech checks? Check! Don’t forget to check back later for recaps from the 8 Day 1 demos.

CoreLogic

CoreLogic with LoanPASS – Digital Mortgage Platform

Paula Clifton, CoreLogic

Derek Long, BlockGen Corp

InspectHOA

InspectHOA – Condo Project Review

Marina Hubenova

Vishrut Malhotra

Argyle

Argyle – Income and Employment Verification

Brian Geary

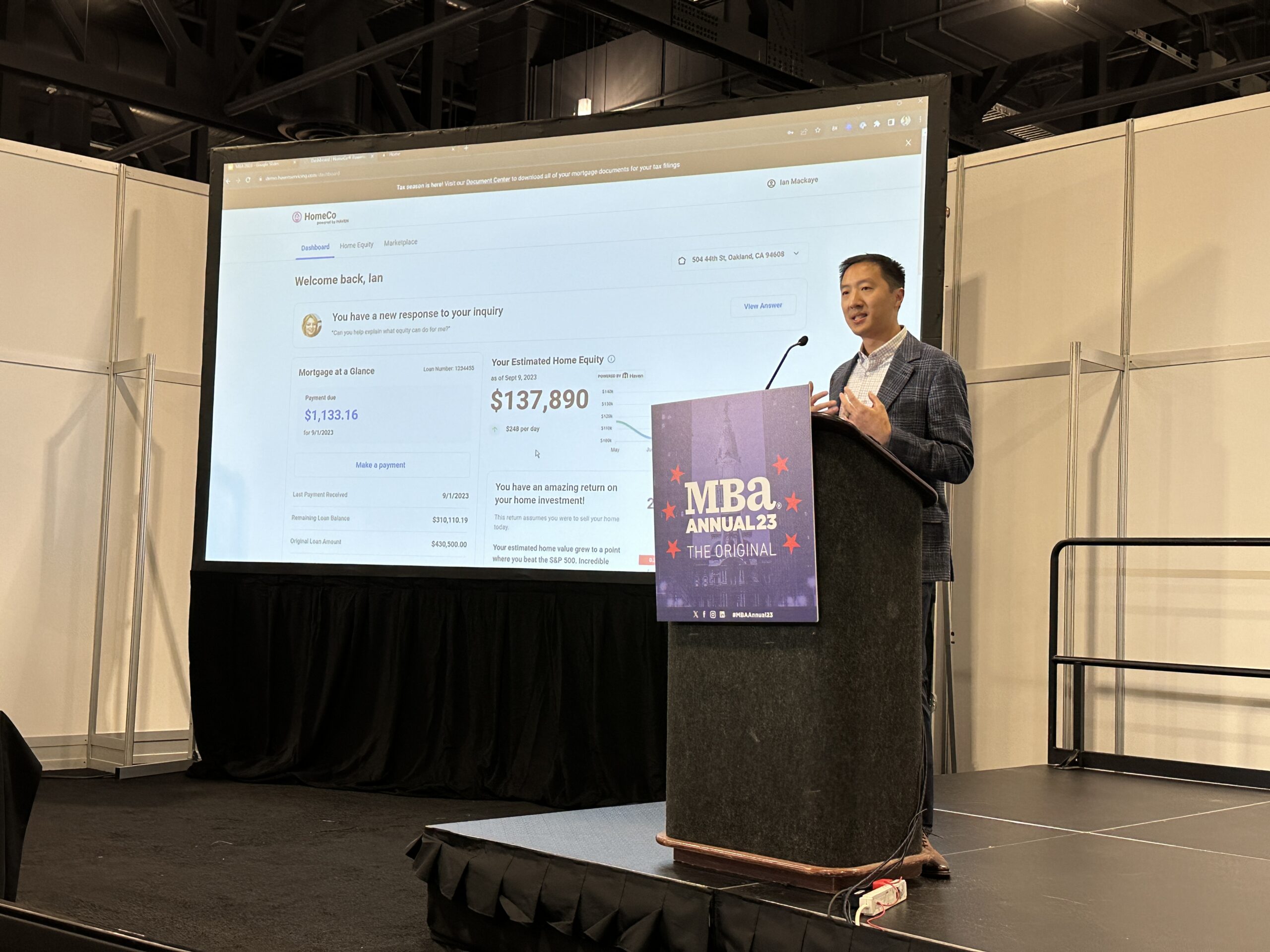

Haven

Haven – Servicing Connect

Jonathan Chao

LendingPad

LendingPad – Lender Edition

Dan Smith

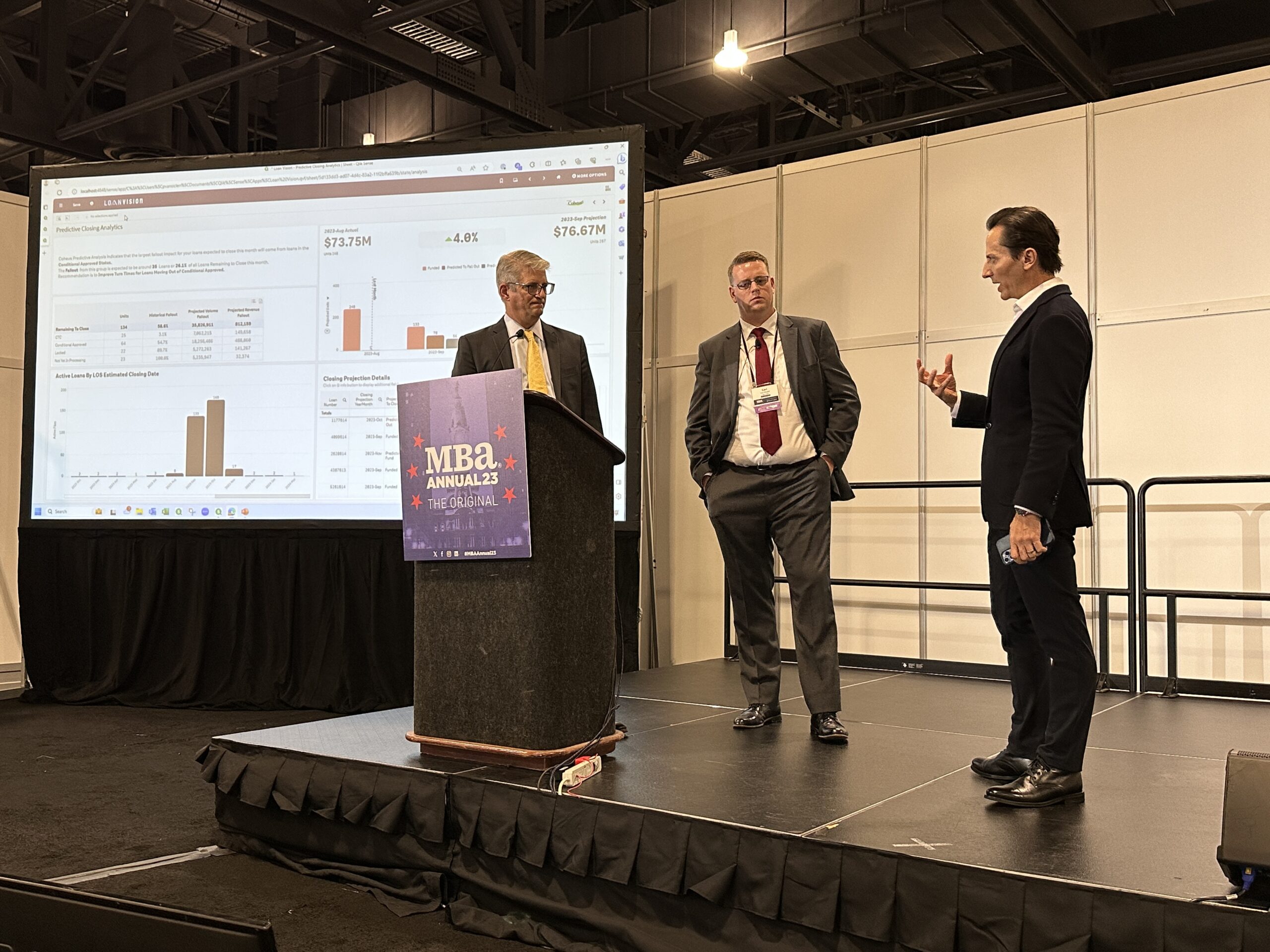

Loan Vision

Loan Vision with Teraverde – Loan Vision

Carl Wooloff, Loan Vision

Paul Van Siclen, Teraverde

Gateless

Gateless – Smart Underwrite

Rick Lang

David Fulford

TransPerfect

TransPerfect – On-Demand Language Access Program

Thomas Emery

HouseCanary

HouseCanary with Ally – ComeHome Direct

Chris Rediger

Brandon Snow, Ally

Vesta

Vesta

Zander Steele

TRUE

TRUE – The TRUE QC Platform, powered by TRUE Data Intelligence

Bob Noble

Tim Watkins

FormFree

FormFree – Passport and FormFree Exchange

Brent Chandler

Martin Prescher

Cloudvirga

Cloudvirga – Horizon

Chris Cunningham

Charlie Gunn

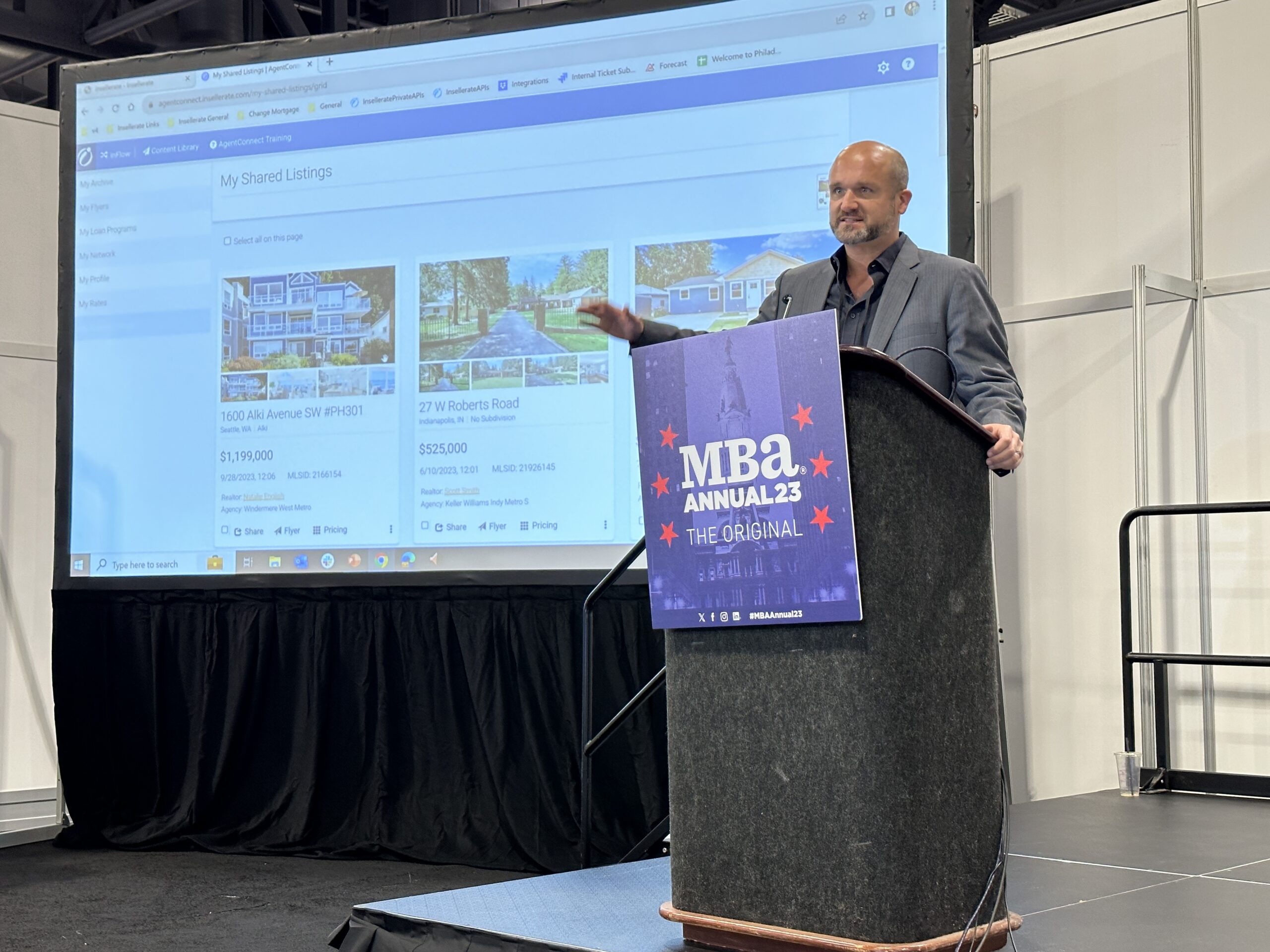

Insellerate

Insellerate – CRM and Marketing Automation

Josh Friend

Scott Roberts

iEmergent

iEmergent – Mortgage MarketSmart

Bernard Nossuli

Matic

Matic – Embedded Home Insurance Marketplace

Tony Farnsworth

Maria Taft