WAKE UP CALL: Mortgage Rates Already .375% Higher Than New Year

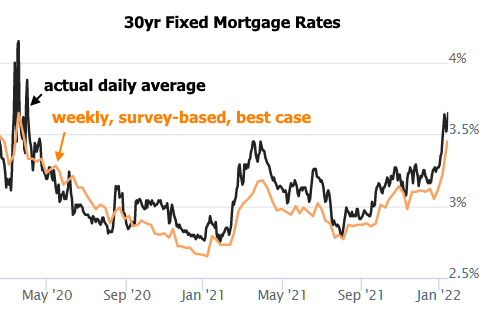

Here’s the deal with mortgage rate headlines: they’re based on old data. All headlines and stories this week say 30-year fixed mortgage rates are 3.45%. But rates are actually 3.625% going into the holiday weekend, which is up .375% from New Years. Here’s why January 2022 mortgage rates have spiked…

WHY MORTGAGE RATES SPIKED JANUARY 2022

Rates in the media are mostly based on a Freddie Mac weekly survey of lenders that comes out Thursdays.

Freddie Mac is an absolutely critical backer of America’s giant mortgage market — which has $11.7 trillion in mortgage debt outstanding — and Freddie Mac’s weekly rates are a critical mortgage rate bellwether.

This weekly survey tells the world — global investors and the public at large — how rates are doing in America’s mortgage market.

Because America’s mortgage market funded $3.93 trillion in new mortgages last year alone (per MBA), “the world” needs to know this stuff every week from an ultra-credible source.

Freddie Mac is ultra-credible since they — along with Fannie Mae — provide lending rules for all American lenders, and also buy most of the new loans all lenders make so that lenders can keep making new loans.

That’s why investors, the public, and the media all rely so heavily on Freddie Mac rates as a weekly touchpoint.

But if you’re a homebuyer — or a refinance fence-sitter waiting for lower rates — you can’t rely on headlines that rely on Freddie Mac rates.

Why? Because they’re outdated the moment they hit the media via Freddie Mac each Thursday. Freddie Mac’s survey looks back one week to get those rates, but rates you get as a borrower are based on real-time daily trading of mortgage bonds.

Here’s the short version of that rabbit hole:

Rates rise when mortgage bond markets sell off, and inflation threats have caused bond markets to sell off since New Years. That’s why rates are up .375% since the year started.

HOW MUCH DOES A .375% RATE SPIKE HIT MORTGAGE PAYMENTS?

On a $500,000 home purchase with 10% down, rates that are .375% higher make your payment $94 higher.

On a $400,000 refi, rates that are .375% higher make your payment $83 higher.

Some or all of this rate spike may have happened since the last time you got a quote.

WAKE UP CALL TO HOME SHOPPERS & REFI WATCHERS

So now it’s time to get a new quote, and remember: it’s not your lender’s fault. They’re just the messenger of how the market has moved.

Good luck out there, and here are 3 pro tips:

1. Headlines & Web Forms Aren’t The Rate You Get. This includes my headline above. You must get a lender quote to get an accurate rate quote. And you must give up some personal information to get an accurate rate quote. A web form will give you a range, but until you lock a rate based on your exact profile (which includes letting a lender run your credit), the rates will move daily.

2. Higher Rates May Disqualify Homebuyers. If you’re a homebuyer who was on the cusp of qualifying, then mortgage rate spike in January 2022 can change your qualifications. Lenders use a ratio of your monthly debt payments (including a new home payment) to your income to qualify you. A higher rate makes your qualifying ratio higher, and could disqualify you. So ask your lender to rework your pre-approval to make sure you’re cool. And below is a link on how to calculate home affordability yourself.

3. Mortgage Rates Rising Different Than Fed “Hiking Rates.” When the Fed hikes or cuts rates, those aren’t mortgage rates. The Fed adjusts overnight bank-to-bank rates, and while the sentiment behind these moves influences mortgage bond trading, it doesn’t hit mortgages directly. Headlines saying “the Fed will hike rates in March” are true, and in the link below, Matt Graham explains how this relates to mortgages and the economy overall.

Hit me directly or comment below with any questions.

___

Reference:

– Here’s How To Calculate Home Affordability

– MND’s Matt Graham on how mortgage rates move ahead of Fed actions

– Freddie Mac’s Weekly Mortgage Rate Data, released very Thursday

– Is The Worst Over After Early 2022 Rate Spike?