Newly built home prices $420,800 to start summer 2023. Can you afford this?

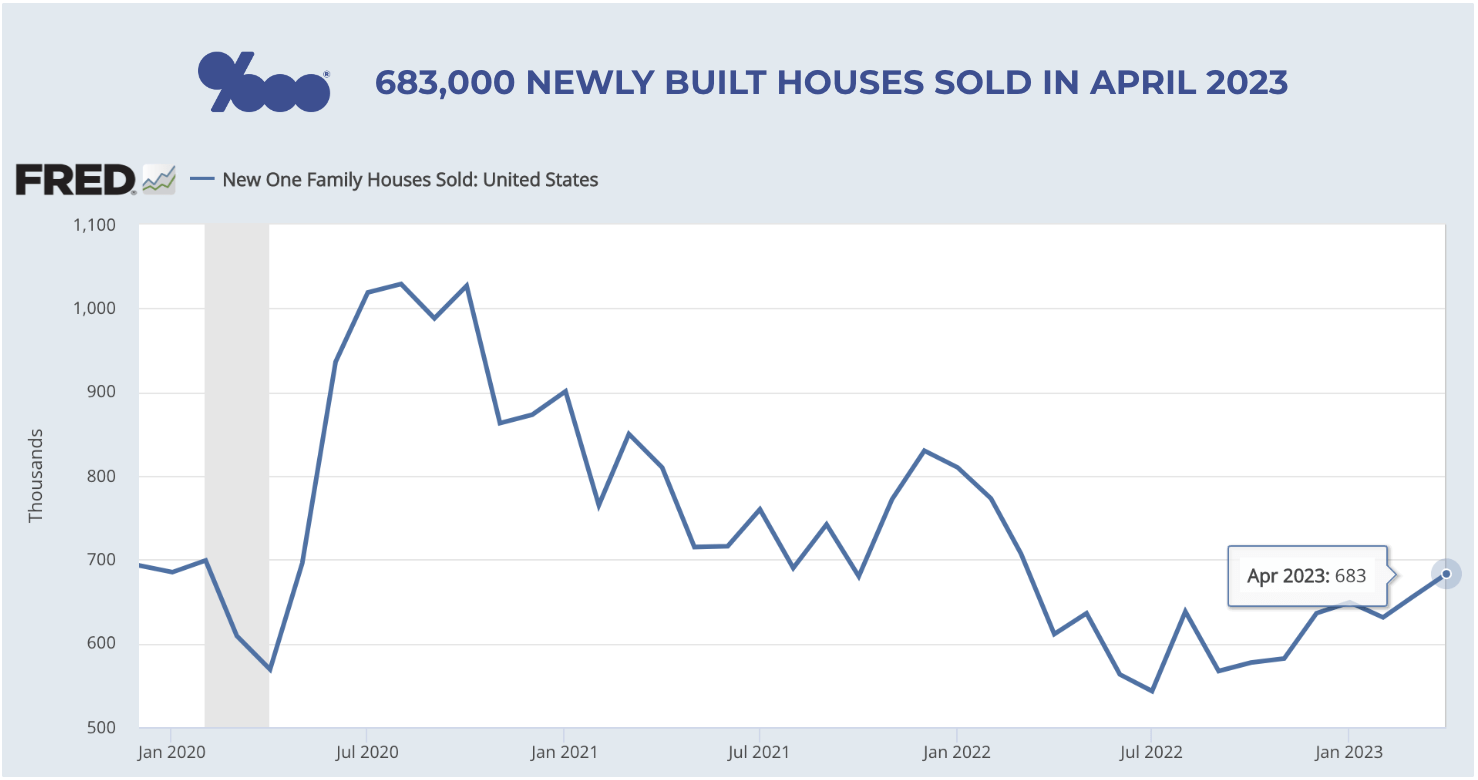

Time for a new home sales 2023 update. The latest Census/HUD report shows 4.1% more sales of newly built homes in April than March, and 11.8% more than April 2022. Total April new home sales was 683k annualized, which is 14% of all sales — sales of existing homes are the other 86%.

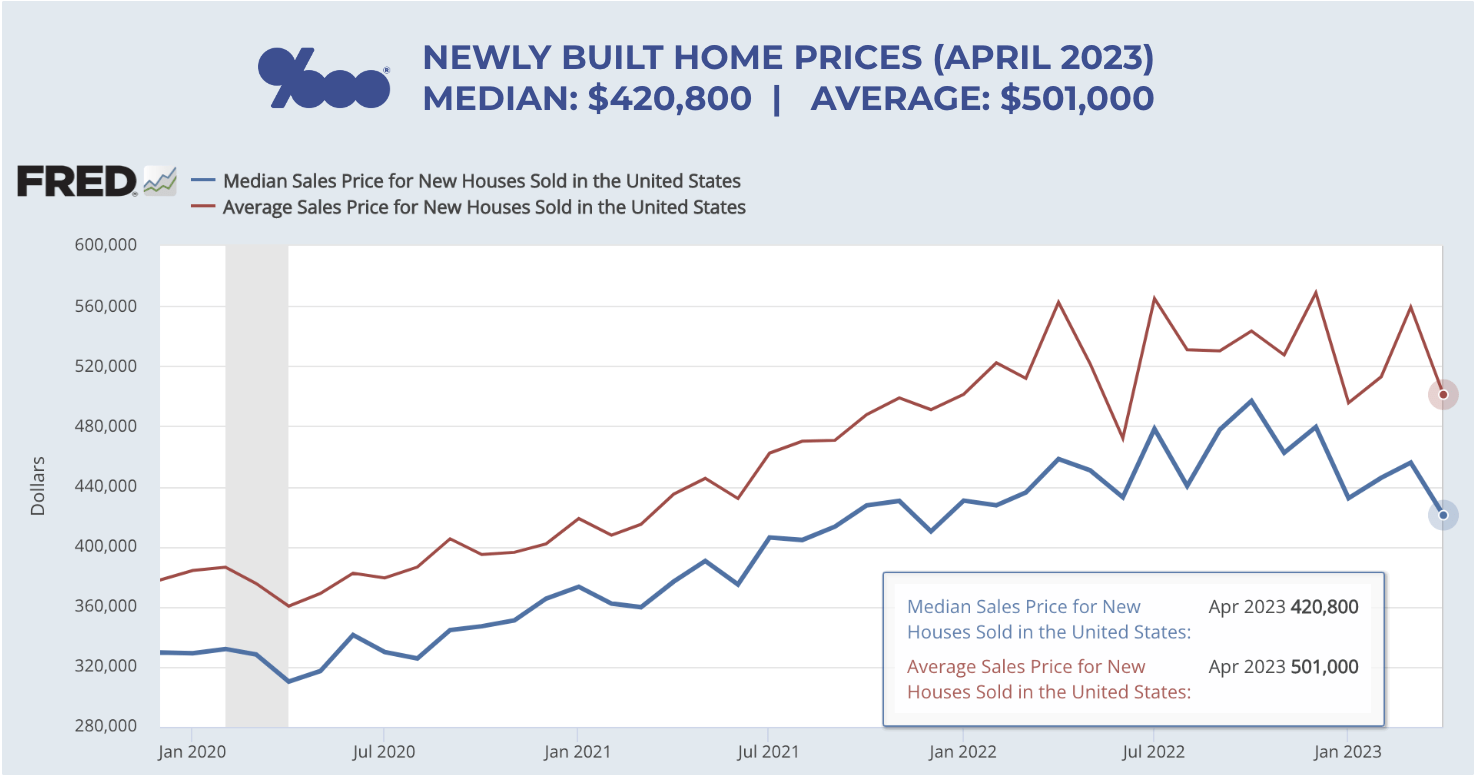

More important to you as a buyer is that median 2023 new home prices (blue line in first chart above) are $420,800.

Current new home prices of $420,800 are down $76,000 from the October 2022 peak of $496,800.

Also, April new home prices are down $35,000 from March after rising 2 straight months.

This leads to 2 key questions:

1. Are builders offering good deals to buyers right now?

2. Can you afford this new home price of $420,800?

NEW HOME SALES 2023: ARE BUILDERS MAKING DEALS?

The good news is builders continue to make deals.

Builder confidence is up 5 straight months because they have good pipelines of new units they’re building.

Confidence in stocks of homebuilders is commensurate.

But short-term, builders are less confident in how fast they can sell completed homes.

This is good for homebuyers.

Here are deals builders offered in May:

– 27% of builders reduced prices in May, compared to 30% in April and 31% March.

– Average price reduction in May was 6%, and has been 6% for 4 straight months.

– 54% of builders offered some kind of incentive to bolster sales in May, compared to 59% in April and 58% in March.

Incentives are things like seller credits at closing and home upgrades.

So you can make deals with builders.

You just need to ask.

2023 NEW HOME PRICES & AFFORDABILITY

Can afford today’s new home price of $420,800?

Here’s the answer:

– Monthly all-in cost on a $420,800 home purchase with 5% down and today’s rates of 6.875% would be $3528 (mortgage payment, insurance, taxes, mortgage insurance).

– If you had no other monthly debt, you’d need to make $98k* per year to qualify.

– If you had $600 in credit card, auto, and other monthly debt, you’d need to make $115k* per year to qualify.

Affordability is stretched but doable here, especially if there are two household incomes qualifying.

Also note: we show median instead of average because select outsized high prices skew the average higher.

As for existing homes, the median price is $388,800.

The link below contains affordability math on existing homes, which are 86% of all for-sale inventory.

Also see links with more on this new home sales 2023 topic.

Hit me with questions on new home prices and affordability.

___

Reference:

– Existing home prices now $388,800. Is this affordable?

– 27% of homebuilders reduced prices and 54% offered buyer incentives in May

– April New Home Sales: Census/HUD report and NAHB econ team notes

*To arrive at these qualifying income numbers, The Basis Point uses 43% deb-to-income ratio that Federal regs allow for all mortgages of this size in America. We use Mortgage News Daily for rates.