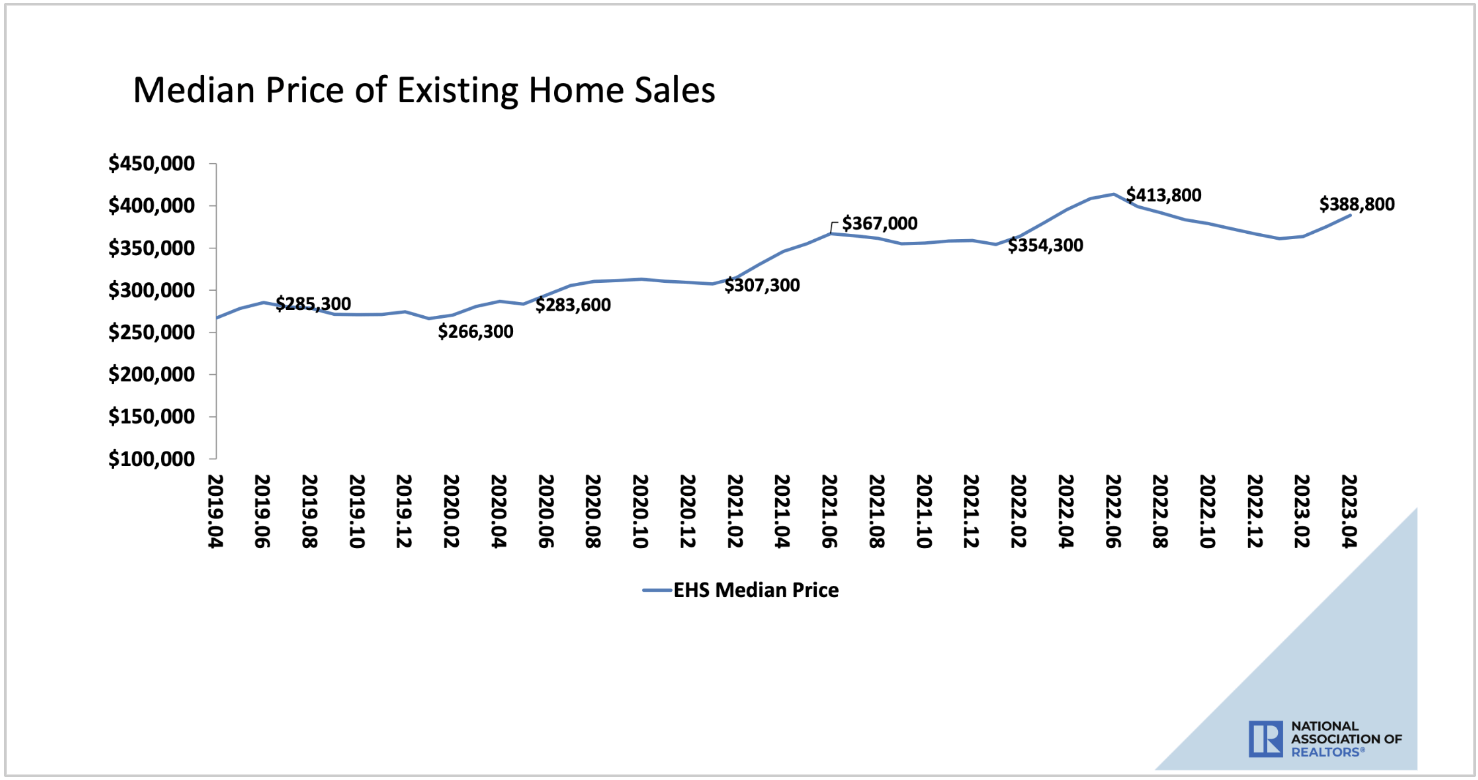

Existing home prices down $25k from June 2022 peak to $388,800. Is this affordable?

Sales of existing homes declined 14 of 15 months through April. Besides rising in February, existing home sales declined in all of the previous 12 months and the 2 months after. Per the latest NAR data, existing home prices are $388,800. Is this affordable? Let’s take a quick look at this and other key stats.

EXISTING HOME SALES & PRICES APRIL 2023

– Annualized sales of existing (as opposed to newly built) homes was 4.28 million for April (annualized, seasonally adjusted).

– This is down 3.4% from March and down 23.2% from one year ago.

– Available inventory of homes to buy is super low at 1.04 million units, but up decently (7.2%) from March.

– Median existing home prices rose $13,400 from $375,400 in March to $388,800 in April.

– The $388,800 median home price has dropped $25,000 from the June 2022 peak of $413,800.

– Lower prices since last June is an important trend because existing home sales are 86% of all sales (sales of newly built homes are the other 14%).

– So a strong majority of homes for sale in America are lower in price since last summer.

– NAR uses median prices because they say average prices are skewed higher by a small share of high-priced sales.

– This downward price trend should give some relief to buyers even as inflation keeps rates high.

– Rates as of now are 6.875%.

– Existing homes typically remained on the market for 22 days, and 73% of them sold within a month.

– This means low inventory is still causing a lot of competition in the housing market.

– First time buyers were 29% of sales, cash buyers were 28% of sales, and individual investors or second home buyers were 17% of sales.

HOME AFFORDABILITY SUMMER 2023

– Speed of sales — April deals closed in 22 days — suggests consistent demand for low inventory.

– Organized, pre-approved buyers can compete in this market.

– Monthly cost on a $388,800 home purchase with 5% down and today’s 6.875% rate is $3170 (mortgage payment, insurance, taxes, mortgage insurance).

– If you had no other monthly debt, you’d need to make $88k* per year to qualify for this.

– If you had $600 in credit card, auto, and other monthly debt, you’d need to make $105k* per year to qualify.

– Buyers holding for a home price crash may not see that because of buyer demand and low inventory.

– This might be the best this cycle gets for 2 reasons.

– First, demand will rise as stubbornly high inflation wanes and mortgage rates follow.

– April CPI inflation is down to 4.9%, but Core CPI stayed stubbornly high at 5.5%.

– The Fed remains committed to beating inflation, and rates will follow inflation down.

– Housing demand will rise as rates fall, and this will challenge affordability.

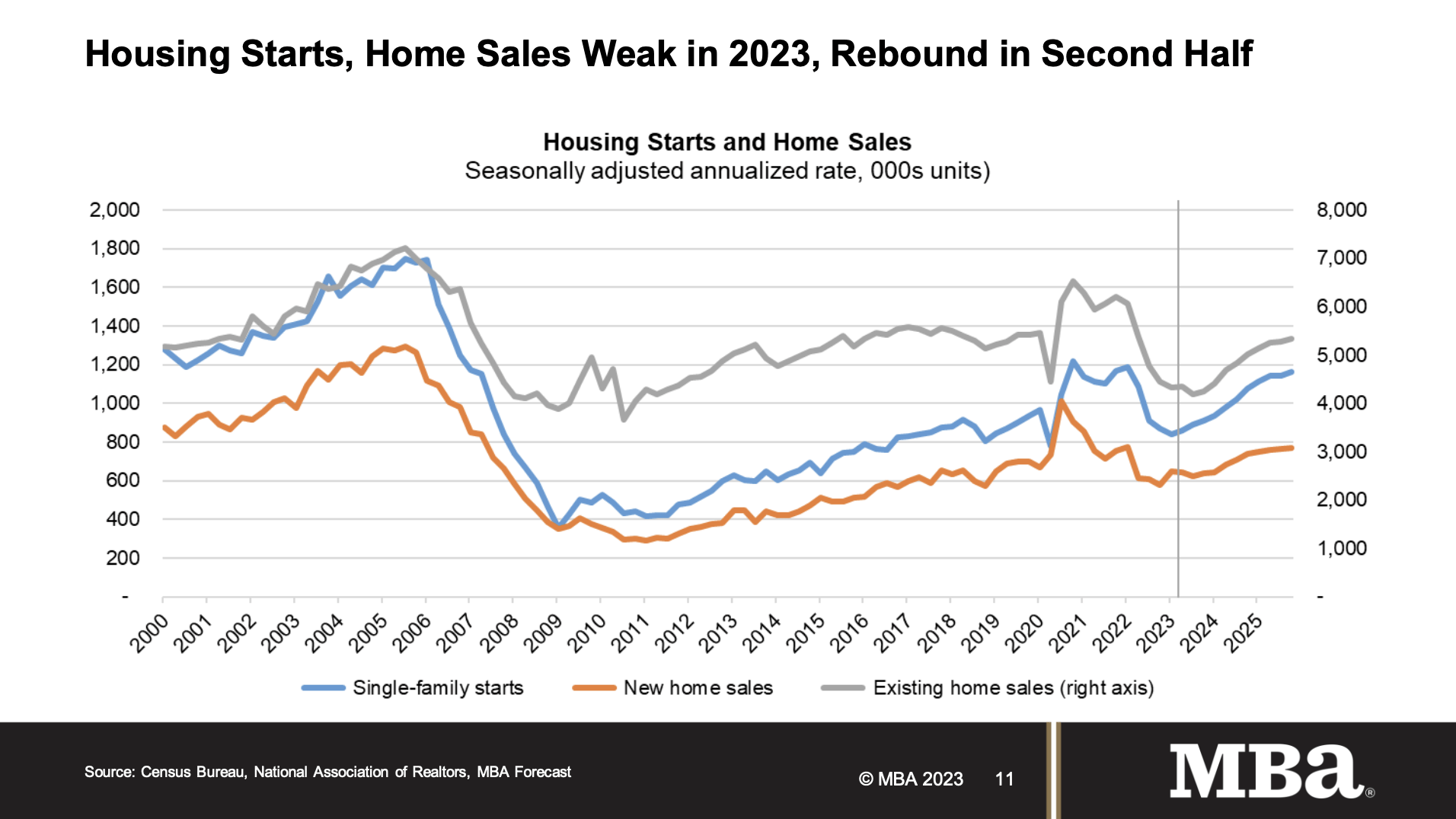

– Second, despite 14 of 15 months of declines, the MBA predicts home sales will rise in the coming years.

– Here’s the chart showing that trend. If home sales increase like this, home prices may rise again.

Please reach out with questions.

___

Reference:

– Newly built home prices $420,800 to start summer 2023. Can you afford this?

– 5.5% Core CPI way above Fed target. What now?

– Existing-Home Sales Dropped 3.4% in April (NAR)

* To arrive at these qualifying income numbers, The Basis Point uses 43% deb-to-income ratio that Federal regs allow for all mortgages of this size in America. We use Mortgage News Daily for rates.