Linkage: How the Fed will control rates from here

Non-banks have gained about half the market share for U.S. mortgages in recent years. Now big banks are getting their risk appetite back after a long run of legal settlements, and they’re getting their technological houses to deliver better customer experiences. But don’t count out nonbanks just yet, their profitability is growing, suggesting they keep getting the efficiency game down.

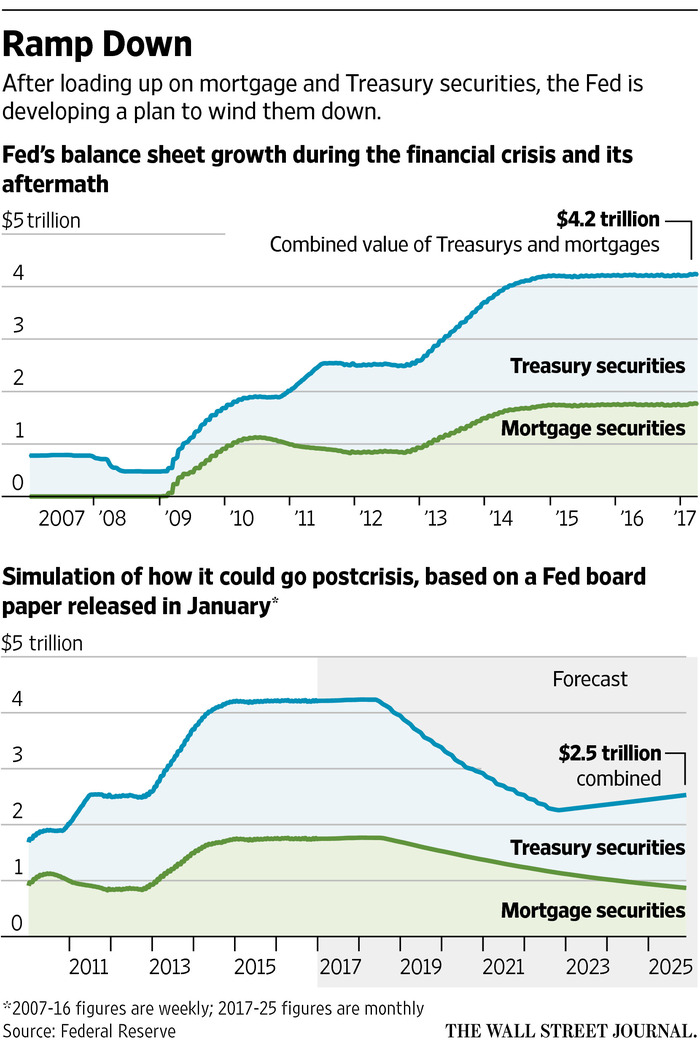

Meanwhile rates are at a low point for 2017, but the Fed is figuring out how to unwind their bond holdings a as a way to control rates. They’ve been investing in Treasury and mortgage bonds as a way to keep rates low since the crisis, and now they’re getting more serious about trimming these investments, which could prove more jarring to rates than adjusting overnight bank-to-bank lending rates (which is their traditional measure). This and much more in today’s links.