Rates Drop Again As Fed’s Preferred Inflation Gauge Is Flat In May. Savings Rate Up To 4%. (TABLE)

Rates continue their run down this morning on doubts about the economy and the latest inflation report confirming tame prices. Overall Personal Consumption Expenditures, the Fed’s favorite measure of consumer inflation, were 0.2% in May and 1.9% year-over-year through May. Excluding volatile oil and food costs from the readings, “Core” PCE price index was unchanged for May and 1.3% YOY through May. The Fed looks closely at Core PCE excluding food and energy prices because of the price volatility of these two items, and the Fed’s zone for reasonable inflation is 1-2% per year. At 1.2%, Core inflation is within their comfort zone, and PCE inflation has been stable since summer 2009. Mortgage bonds are rallying once again to record levels, which pushes rates down to new record lows.

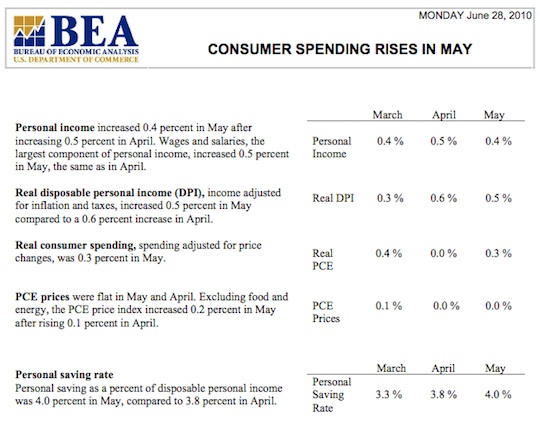

Personal income was up 0.4% in May, which is the same range of the last 4 months. Wages rose 0.5%, which is roughly the same monthly level for all of 2010. The household savings rate was 4%. This is up from 3.8% last month as consumers again get more cautious about the economy, but it’s still significantly down from the May 2009 all-time record of 6.9%. Below are all key details from the Personal Income & Outlays report. You can automatically create charts and download historical PCE data by scrolling to our data section on the right side of the site, or visiting our Data page.