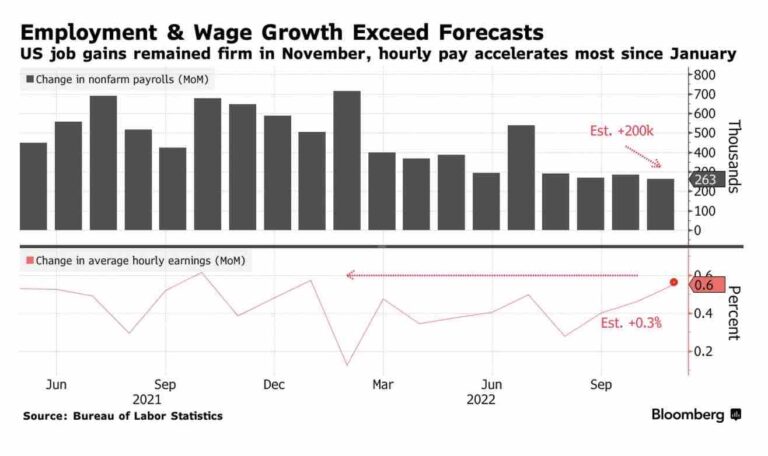

Rates rise on inflation & Fed hike pressure as Nov jobs grow 263k, wages up 0.6%

Today’s November jobs report showed more jobs (263k), less unemployment (3.7%), and higher wages (0.6% MoM, 5.1% YoY) than expected. This helps people but fuels inflation, so it’ll pressure the Fed to keep up its inflation battle with another rate hike December 14.

Rate markets trade ahead of what the Fed might do and rates are up today as mortgage bonds sell ahead of the Fed’s next rate decision in 12 days.

Mortgage rates were hanging in around 6.5% as two recent Fed-preferred inflation readings, Core CPI and Core PCE, moderated to 6.3% and 5.0%, respectively.

Today’s mortgage bond sell off might result in rates coming up to 6.625% or 6.75%.

For December 14, the Fed was expected to ease off a series of 75 basis point (0.75%) rate hikes, and only hike 50 basis points (0.5%), but this strong job market and resulting wage inflation complicates that — and rate markets will always trade ahead of that.

Hit me with any questions you have on this topic.

___

Reference:

– US Hiring and Wages Extend Strong Gains, Keeping Pressure on Fed (Bloomberg)

– Full November jobs report from Bureau of Labor Statistics