Slightly higher rates barely slow mortgage application train

MBA Mortgage Applications (week ended 06/14/2019)

-Mortgage apps dropped 3.4% week over week on seasonally adjusted basis

-Applications for home purchase loans dropped 4% week over week

-Purchase apps up 4% from same time last year

-Average interest rate on 30-year fixed rose from 4.12% to 4.14%

-This rate data is backward-looking, though, so not necessarily indicative of rates you’d get this week

-Applications for refinance loans dropped 4% week over week

-Refis 50.2% of total mortgage activity last week, up from 49.8% week before

-Highest level of refi activity since January ’18

Quick takeaways:

This is a good mortgage apps report. We saw a tidal wave of purchases and refis last week because rates fell to super-low levels.

There was only a small slump in activity this week, so homeowners and buyers are still riding the low rate train.

If we saw a decrease this week that was as big as last week’s increase, that’d be cause for concern, but hopefully these applications in conjunction with good news in home construction data add some momentum to housing and the greater economy.

All the refi numbers tell us is that homeowners are hip to lower interest rates—refi numbers jump around a lot. They’re most useful as a proxy for the interest rate environment.

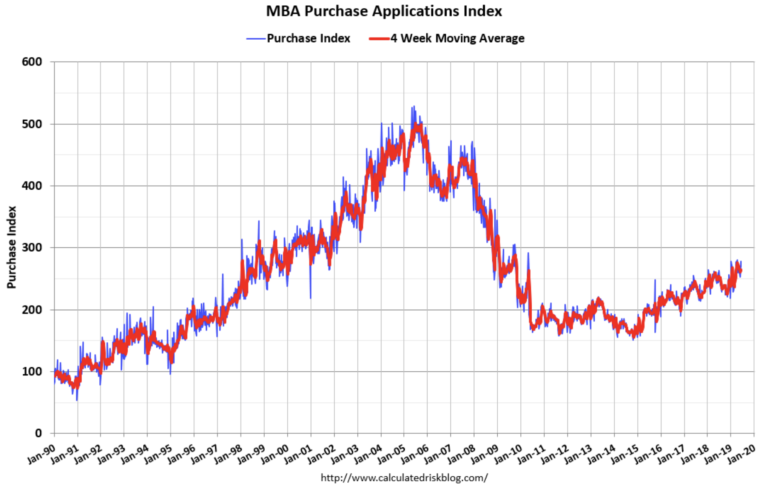

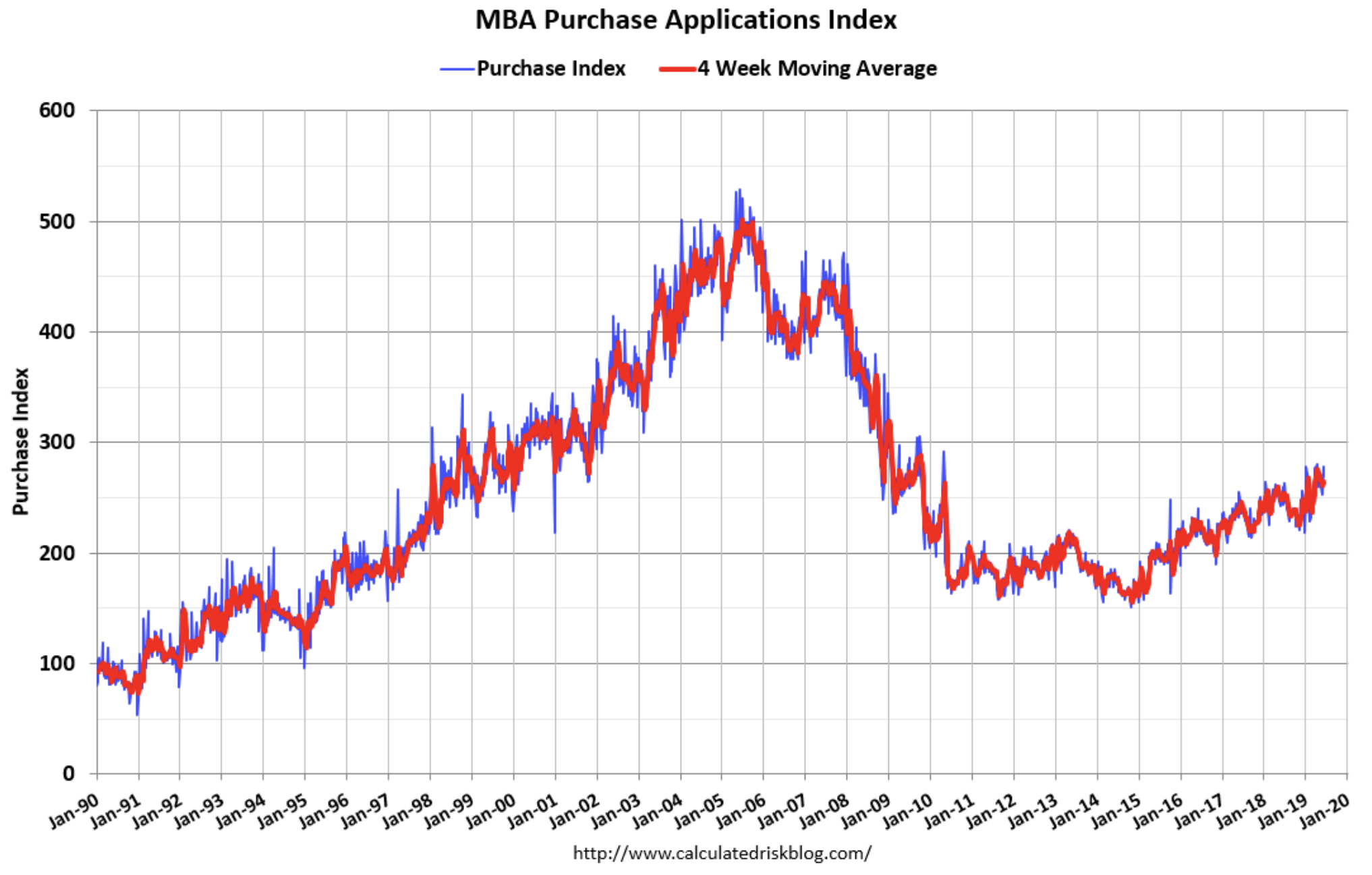

Thanks to Bill McBride at Calculated Risk for the above chart.