The Basis Point & Total Expert Pro Tips On Homebuyer’s Market 2023

This year, 3.4 million homebuyers (per MBA) will close smart deals as the market shifts in their favor. Translation: Homebuyer’s market 2023. But only if mortgage lenders and realtors work together to outweigh headlines that are mostly alarmist or behind the times. I recently did a quick-hit webinar with Total Expert’s Ryan Picchini to run down some slides on how the 2023 buyer’s market will play out. We hit inflation, recession, rates, and housing outlook. We also covered how lenders and realtors can best guide buyers and sellers to mutually successful deals. Good pro tips for home buyers, sellers, lenders, and realtors. Below are a few topics and teaser slides, and the session link has the rest.

===

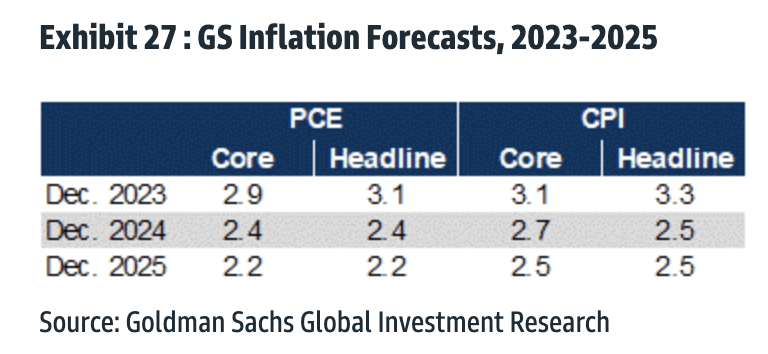

– The inflation outlook from Goldman Sachs has the Fed’s preferred Core PCE inflation at 2.9% by year-end. This has a lot to do with the Fed’s resolve to squash inflation.

===

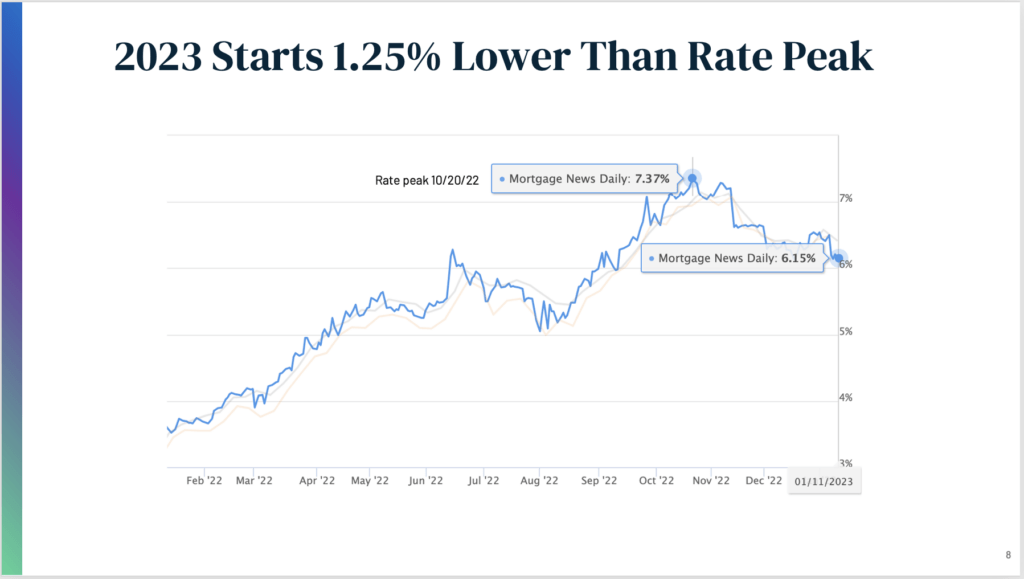

– The Fed’s inflation fight has already helped rates drop more than 1% to start 2023, which helps create a homebuyer’s market 2023. And it also helps sellers who’d need to buy new homes.

===

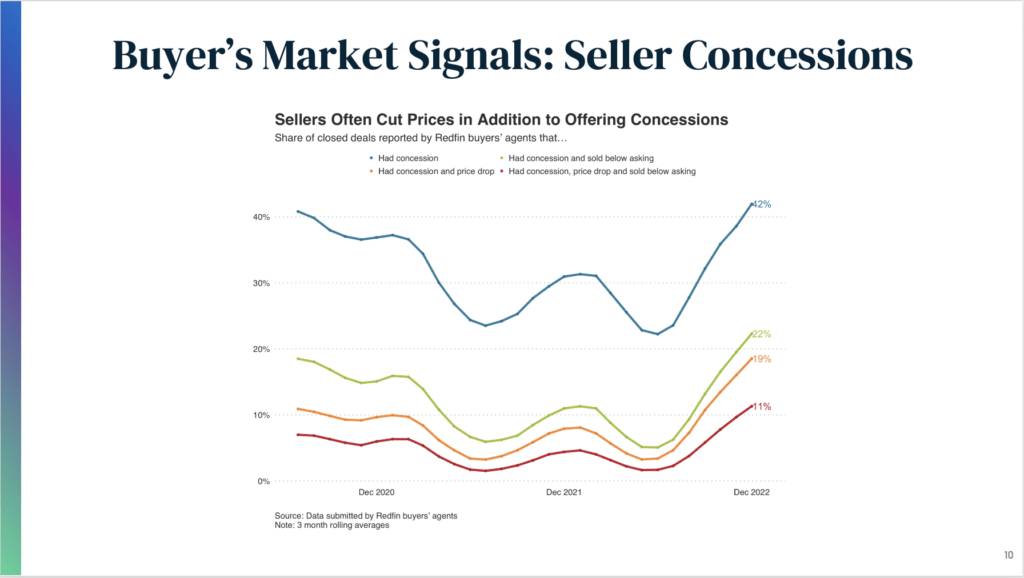

– The Fed’s inflation fight has also caused existing home sales to slow 11 months, which has brought prices down 11% to $366,900 (per NAR). This is starting to get back into affordable territory. Existing home sales are 87% of all home sales. New home sales comprise the rest, and with new home sales builders are making lots of concessions for buyers. And across new and existing home sales, 42% of deals have had seller concessions recently.

===

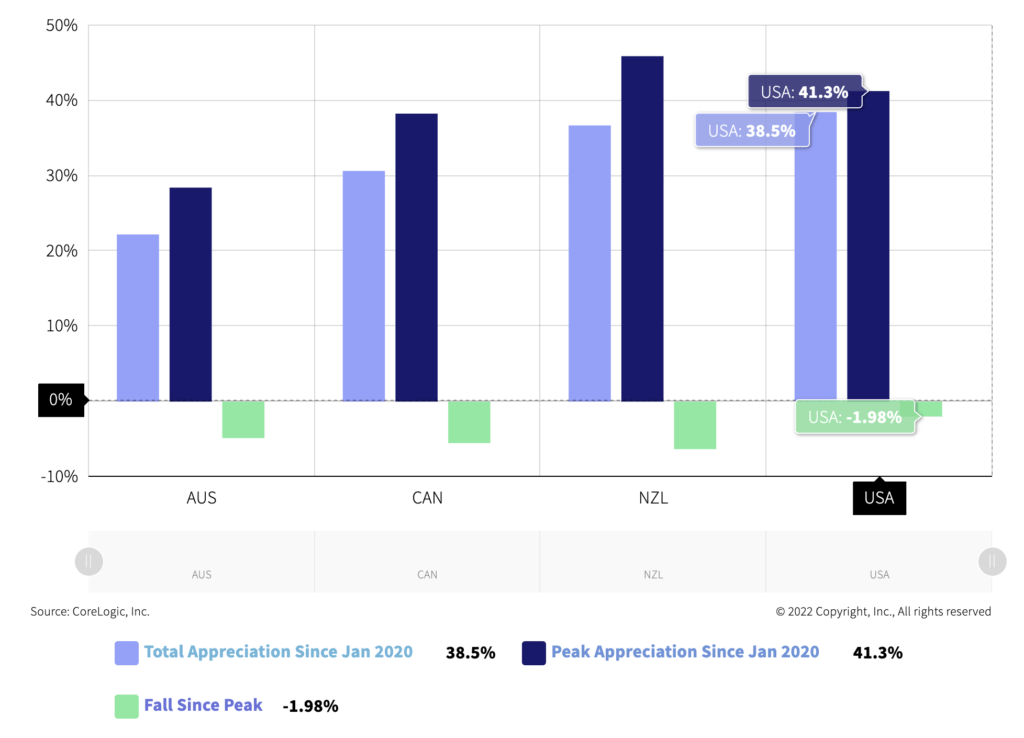

– As for home prices, a healthy buyer’s market should have lower prices for buyers but not a crash for sellers. The chart below shows home prices rising 41% during pandemic period. So a 10% to 20% drop sounds bad, but it would just take us back to 2021 prices. Also this plays out locally so you just have to work with your realtor and lender to do price analysis in your area. Headlines don’t help you here.

===

Hit the link below for rest of slides. Thanks to Ryan Picchini and all our friends at Total Expert for having The Basis Point on their program. For those who don’t know, Total Expert is a fintech company that powers marketing for lenders and banks.

Please comment below or reach out with questions on homebuyer’s market 2023.

___

Reference:

– VIDEO: The Basis Point & Total Expert Pro Tips On Homebuyer’s Market 2023 In Housing

– First time homebuyers aren’t ‘royally screwed’ — these 5 charts show what’s really up