To stem contagion, 11 big banks replenish billions depositors withdrew from First Republic

In coordination with regulators, 11 big banks will deposit $30 billion into First Republic Bank. This First Republic rescue is confirmed by a joint statement from the Treasury Department, Federal Reserve, FDIC, and OCC, which says:

Today, 11 banks announced $30 billion in deposits into First Republic Bank. This show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system.

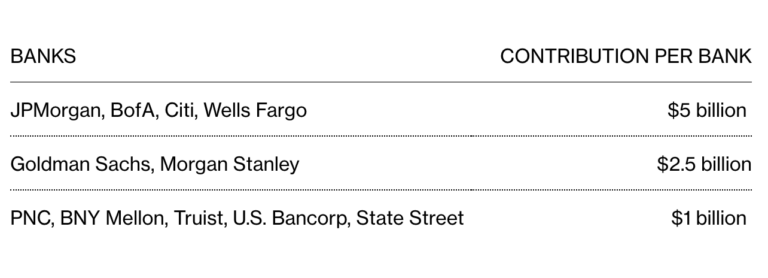

Bloomberg reported this about the 11 banks and their First Republic deposits:

– $5b, JP Morgan

– $5b, Bank of America

– $5b, Citibank

– $5b, Wells Fargo

– $2.5b, Goldman Sachs

– $2.5b, Morgan Stanley

– $1b, PNC Financial

– $1b, Bank of New York Mellon

– $1b, Truist

– $1b, U.S. Bank

– $1b, State Street

– $30b, TOTAL

WSJ noted this kind of broad based rescue could “protect the entire banking system from widespread panic by turning First Republic into a firewall.”

I agree. Here’s why.

Basically, a First Republic bank run depleted deposits of an otherwise stable bank with decades of sound risk management.

This happened in the wake of Silicon Valley Bank’s run that caused the FDIC to seize it.

It hit First Republic hard since Friday because they have a similar clientele of sophisticated consumer and business customers.

The 11 banks funding a First Republic rescue were on the deposit inflow side of First Republic’s outflows.

If these 11 banks didn’t do this, First Republic falls, tipping off the rest of the regional banks like dominoes.

Then the whole bank sector and broader economy teeters into 2008-land. Contagion.

So these banks basically ‘give back’ First Republic deposits to save the system and themselves.

It’s a strong show of coordination between banks and regulators in service of the economy and consumers.

The move is should stem contagion for consumers, and appears to be a decent deal for First Republic.

The 11 banks’ uninsured deposits at market rates must stay for at least 120 days.

Here’s what First Republic said in their announcement:

– As of March 15, 2023, the Bank had a cash position of approximately $34 billion

– [This is] not including the $30 billion of uninsured deposits from Bank of America, Citigroup, JPMorgan Chase, Wells Fargo, Goldman Sachs, Morgan Stanley, Bank of New York Mellon, PNC Bank, State Street, Truist, and U.S. Bank with an initial term of 120 days at market rates.

– From March 10 to March 15, 2023, Bank borrowings from the Federal Reserve varied from $20 billion to $109 billion at an overnight rate of 4.75%.

– Since close of business on March 9, 2023, the Bank has also increased short-term borrowings from the Federal Home Loan Bank by $10 billion at a rate of 5.09%.

Please comment or reach out with questions and intel.

___

Reference:

– First Republic rescue terms and details (First Republic)

– Treasury, Fed, FDIC, OCC joint statement on First Republic rescue

– Even if First Republic got sold, they’ve sold before (TheBasisPoint)

– First Republic bank run or rescue?: Risks & Strengths (TheBasisPoint)

– Updates from Bloomberg (paywall), WSJ (paywall), CNBC