Total Expert Accelerate 2021 LIVE BLOG – on fintech marketing for banks & lenders

Since its founding in 2012, Total Expert has become the category-leading marketing software fintech with 175 bank and lender customers, including many top American financial brands. This week, these banks and lenders are gathering at Total Expert’s Accelerate conference in Scottsdale, AZ, and I’m here to live blog it for my favorite 2 audiences:

1. My fellow lender/bank/fintech pros to give you some quick hits to help you improve your game.

2. The Basis Point’s consumer readers so you can see how banks and lenders market to you.

And let’s be very clear: Marketing is the driving force of the fintech era. Consider these fintech stats from CB Insights:

– 2Q21 was the largest fintech VC funding quarter on record, with $30.8 billion raised across 657 deals.

– This includes new fintech challenger banks serving consumers directly, and business-to-business (B2B) fintechs powering banks and lenders like Total Expert (which has “only” raised $75 million because it’s been so successful with its huge customer base).

– On the challenger bank funding, the big players are getting bigger: Of the 657 deals in 2Q21, 88 of these were $100M+ funding rounds, accounting for 70% of total funding.

– As of 2Q21, there are 131 Fintech Unicorns valued at $516 billion.

What does all of this mean?

It means the thousands of great banks and lenders already out there are competing with firms who have billions to spend on marketing.

Marketing is how they’re adding millions of customers.

Will the new banks and lenders keep all these customers long term?

Powering that lifetime customer journey is the main theme of the Total Expert Accelerate 2021 Conference.

The theme name is Elevate The Journey, and I’ll talk about that a lot in the quick hit posts below.

It all amounts to something I call the Rise of the Fintech Powered Incumbents, in which the B2B fintechs give the same marketing power to established players so they can out-disrupt the disruptors.

More on that in posts below too.

Use the ‘copy link’ button on each post to share with your colleagues and fellow banking and fintech fanatics.

Please chime in with comments and anything you want to see or hear in the comments below.

Teaching Banks & Lenders Great Marketing By Using Great Marketing

The Total Expert Accelerate 2021 conference theme of Elevate The Journey hit me right in the face when I arrived and checked in yesterday.

It was a sunny Sunday at the Scottsdale Fairmont Hotel, and I was definitely bummed to leave the family.

But I started seeing old friends from various banks and lenders spotted around the resort. This is my first big event since the pandemic, and there’s nothing like seeing people face to face.

Personal chemistry is real in all business relationships — especially those involving your finances.

But how do you mechanize that chemistry as a marketer, and make your audience feel cared for rather than marketed to?

Enter Total Expert.

When I checked in, first it was so great to see my old TE friends.

After the personal pleasantries, they got down to business.

They handed me this giant box that said “Your Journey Is About To Begin.”

I opened it to find several bags included, each one with instructions on when to open them.

It’s a handcrafted journey for each stage of the next few days.

Here’s the first one.

It was just plain and simple and personal for arrival to make the day go better.

Cool stuff.

And the sunscreen came in way handy here!

How To Make A Conference Party More Fun & Cool

As the evening set in last night, it came time for the opening reception.

I went back to my Total Expert Journey box, and found the next gift in the sequence.

It was this nametag — that lights up neon — and has a white pen to write stuff you want to talk about at the party.

As you can see, blockchain is my hot topic lately.

And this was a total hit at the party.

Some people put their company names.

Some people put that they wanted to talk about their pets or recent trips/locations they’ve visited.

Things like “My Dog” and “Kauai” led to wonderful conversations.

Spoiler alert 1: I had a blast connecting my “TV” topic to someone else’s “My Dog” topic by agreeing that Hollywood BETTER make a Secret Life of Pets pandemic themed movie — where some pets are psyched to have their humans home, and some are like: OK, yea you need to go back to work now. LOL!

Spoiler alert 2: Blockchain is still eluding most. More on that here. 🙂

FREE SUNGLASSES! Giveaways Always Win Friends & Influence People!

I opened my third journey package this morning before heading over to the main event.

And not only do I get a notebook (which my son will get since I’m all digital on note taking!), but TE upped the game majorly.

Check out this card for a sunglasses giveaway later today.

There’s almost nobody who doesn’t respond well to a cool, clever giveaway.

We all talk about open rates and click rates and how to to get customers and prospects to engage with you.

Never underestimate the power of a great giveaway.

Bravo to this.

Pics later when we get our shades 🙂

Stay tuned for conference content coming shortly…

The Quiet Before The Live Blogging Storm

Here’s the stage and the room.

My ancient iPhone doesn’t have wide angle (13 ProMax arriving soon!), but this room is really killer and full and wide.

Lots of stuff coming.

Total Expert CEO Joe Welu Opening Stats

Joe just ran through a bunch of key stats about just how much things are getting disrupted:

Crypto leader Coinbase now offering banking to its 68 million customers

PayPal added 100 million customers in 18 months & now adding banking

Startup banks maturing fast: 88 fintech VC rounds of $100m+ in 2Q alone

$54B in banking M&A deals YTD through September 2021

Lenders funded 13.7m loans in 2020. Will only fund 6.55m loans in 2022

72% purchase market with only 4.7m units makes 2022 most competitive since crisis

Slower homebuyer bidding wars still high at 58% in August 2021

First-time homebuyers make up only 37% in August 2021

88% of homebuyers still find home they buy through realtors

79% of homebuyers improve homes & U.S. now has $9.1t of tappable equity

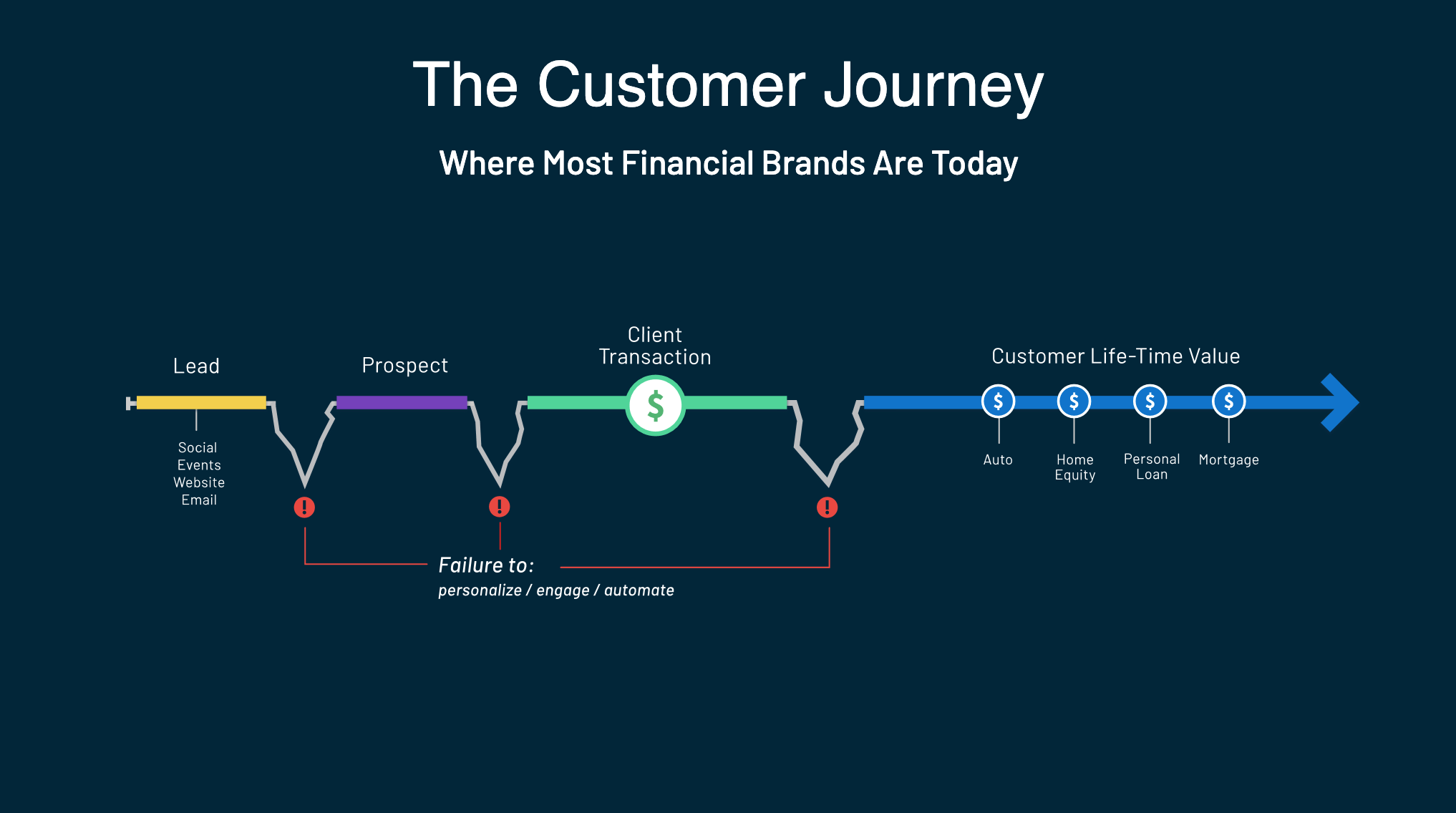

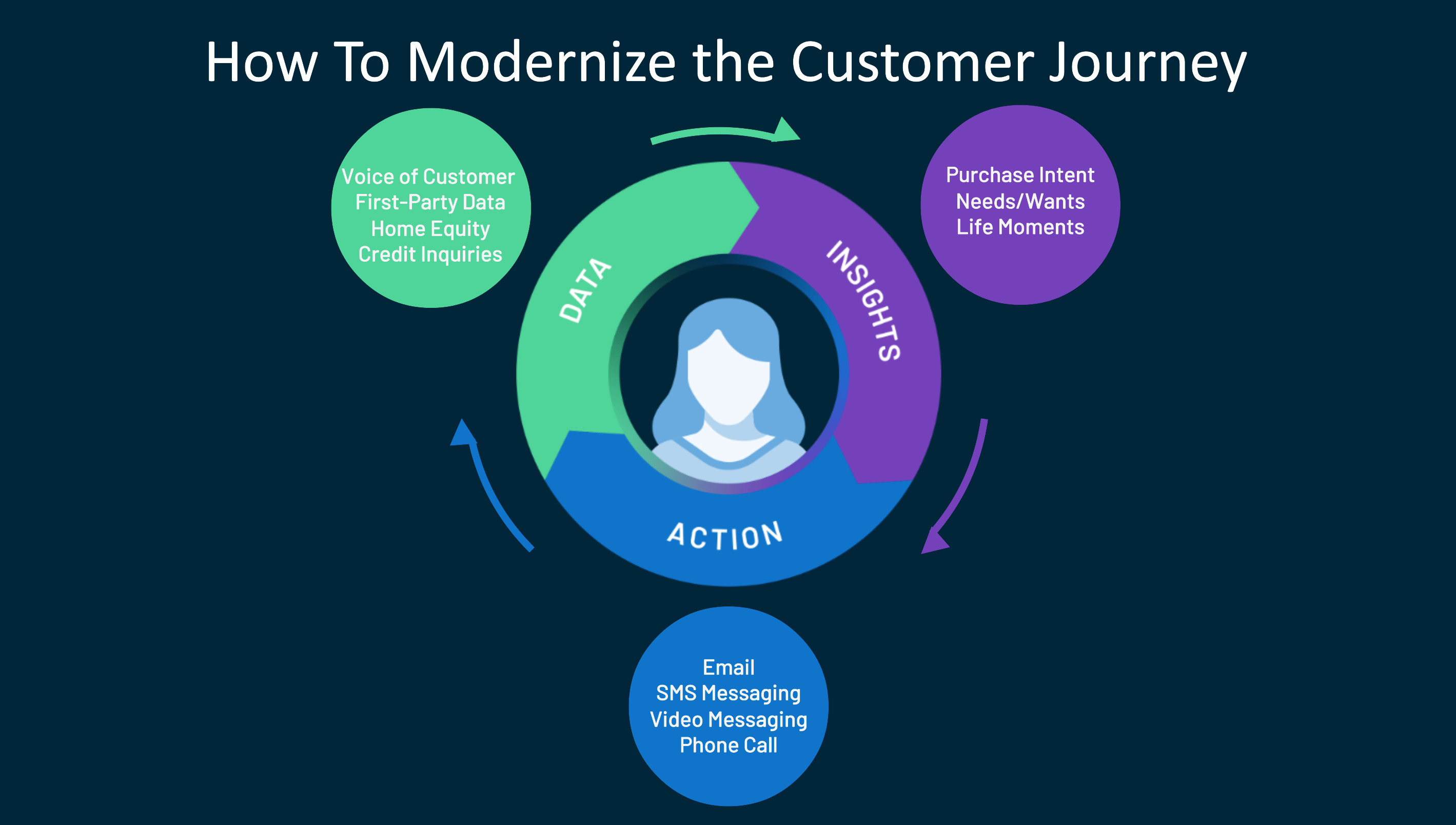

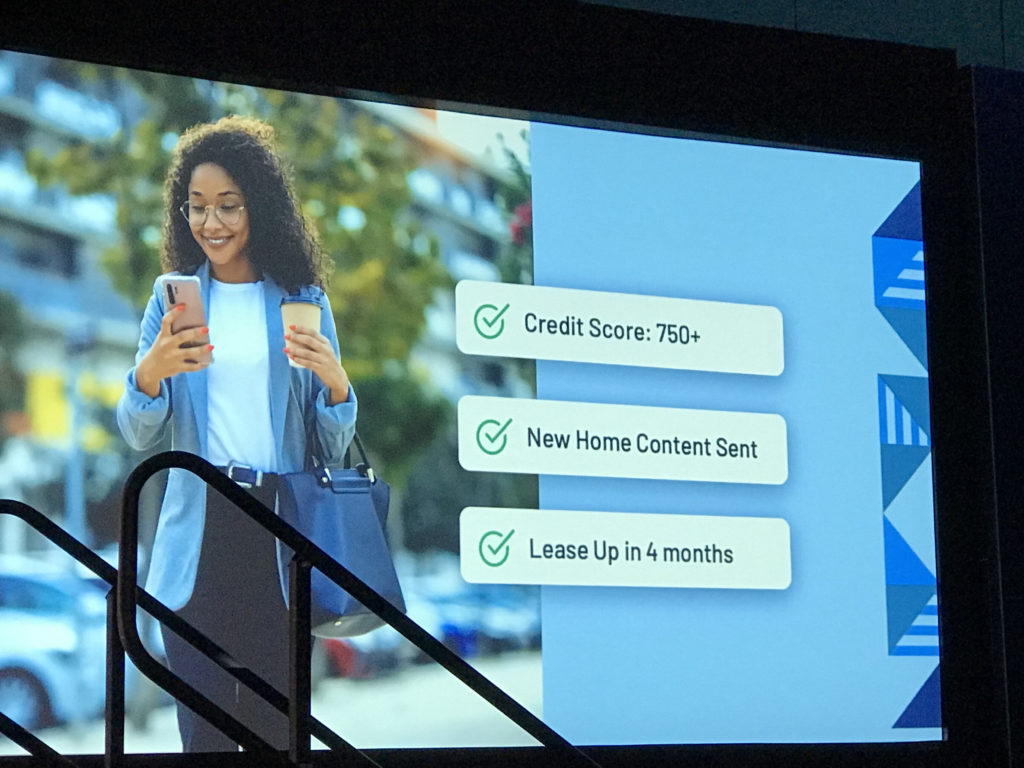

You Must Make Customer Journeys More Dynamic

It’s no longer a timeline or funnel for marketing. You have to engage with data and show empathy and continue this in a loop.

Images below for that.

This Data, Insights, Action flywheel must be the new journey with the customer at the center.

This helps Operationalize Empathy.

People need to know you care. How do you do this at an organizational level? This is what the challenger banks have done really well, and now it’s time to power this.

You have data, but do you actually have insights?

Do you really know what your customer wants to do?

What is their intent and how do you capture that in realtime?

How Do You Use Technology To Make Marketing More Human-First

Tech doesn’t replace humans, it super-powers humans, and here’s how the best banks & lenders are powering lifetime customer experience for their customers.

These Are A Few Integration Partners That Total Expert Orchestrates Into A Single Experience For Bank & Loan Consumers

Here’s the list of just a few great partners Total Expert works with to power the customer Journey.

It’s All About Empathy, and The Flip Side of Empathy Is Innovation – Guy Kawasaki

Keynote Guy Kawasaki is full of amazing quotes:

It’s truly all about empathy with the customer and that leads to innovation.

They’re 2 sides of the same coin. Organizations who can do this great will, in the words of my former boss Steve Jobs, bend the universe.

Guy Kawasaki – Ice Innovation Lessons (Yea, Like Blocks Of Ice)

Ice began as blocks in one place.

Then it was factories who could produce blocks.

Then it was refrigerators. This totally reinvented ice and cooling things.

The innovation lesson:

You must jump to the next curve, not just look to improve what already existed.

Guy Kawasaki: Lessons From Innovation of Cameras

Can you imagine Kodak’s boss back in the day saying: hey boss, I found a way for people to not buy film anymore.

No way!

The lesson:

If you don’t jump to the next curve and kill your own innovations, you might get killed on the curve you’re on.

Another example:

First version of Netflix was DVD, then it was streaming, then it was full vertical integration and producing the content they stream.

This is jumping curves successfully.

Guy Kawasaki: It’s All About Empathy

He told a story about a medical exec teaching team members to breathe through a straw.

Why?

Because this is the only way to know how asthma patients experience the world.

Customer empathy is not about reading studies, doing focus groups, it’s about walking a mile in the shoes of your customers.

Guy Kawasaki: “Therefore, What”

People in finance must do this:

See what you see about inefficiencies and/or innovations in your space, and ask:

“Therefore, what”

Example, if the loan process is still not totally fast despite all the innovation, therefore what do we need to do?

Empathy is key here too.

Do customers really get a lift from the digital process?

Or do they need something else?

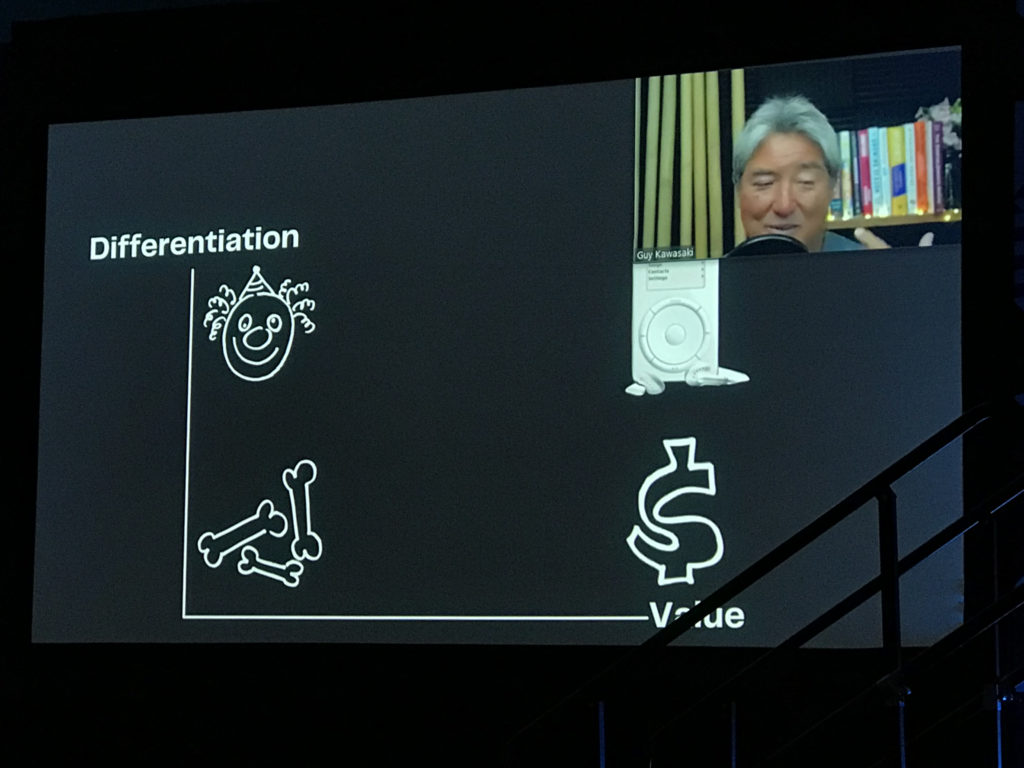

Guy Kawasaki: Get High And To The Right

This concept of Get High And To The Right applies in business and life.

On a graph, you need to do accomplish both Differentiation AND Value.

This is much harder than it looks.

The upper right of this graph is when you change the world.

Whatever you’re working MUST be both unique and valuable.

The iPod was a huge example.

Guy Kawasaki: Don’t Worry, Be Crappy

When you’re looking to Jump The Curve (see above), you can’t work on something perfect.

You must go live.

[This one resonates with me by the way — I spend too much time working on stuff behind the scenes instead of doing it out in the open]

If you wait for the perfect world, the world will pass you by.

This is easier in tech products, but in finance and healthcare, it’s obviously much higher risk.

But you can still go faster.

Especially with how you reach out to, engage with, and solicit feedback and goals from customers.

Since this is a marketing conference, you need to think about that last statement I just wrote.

You can’t just overhaul the finance world — look what’s happening with blockchain and crypto. It’s going so fast, but hasn’t really impacted the average finance consumer yet — and the regulators are swooping in.

So to Guy’s point, innovation isn’t only just finance products or technology to improve the process. Innovation is also how you learn about your customer.

This sentiment connects well to Joe’s Data, Insights, Action flywheel with the customer at the center (see above post on this)

Guy Kawasaki: Let 100 Flowers Blossom

Get your product into the market.

Let people use it. Let consumers use it. Let your team members use it.

They might discover ways to use it in ways you never thought of.

If that ever happens:

– Take the money

– Declare victory

– Reward people who are using it in new ways

– And make more stuff from them

Example: When Guy was at Apple, it was Pagemaker that might have saved Apple. They were focused on the hardware, but this software, which they weren’t proud of, turned out to be something that sucked in users.

They way it really works in Silicon Valley, is we throw stuff at the wall, and then draw a bullseye around where it stuck. You’ll always win that way!

Guy Kawasaki: Change Your Mind

Changing your mind isn’t a sign of weakness, it’s a sign of intelligence. All innovators must change their mind to find the best models.

Think about how hugely applicable this is to bank and lender marketing.

It’s all about experimentation.

Show the courage and you’ll find new, better ways to connect with customers.

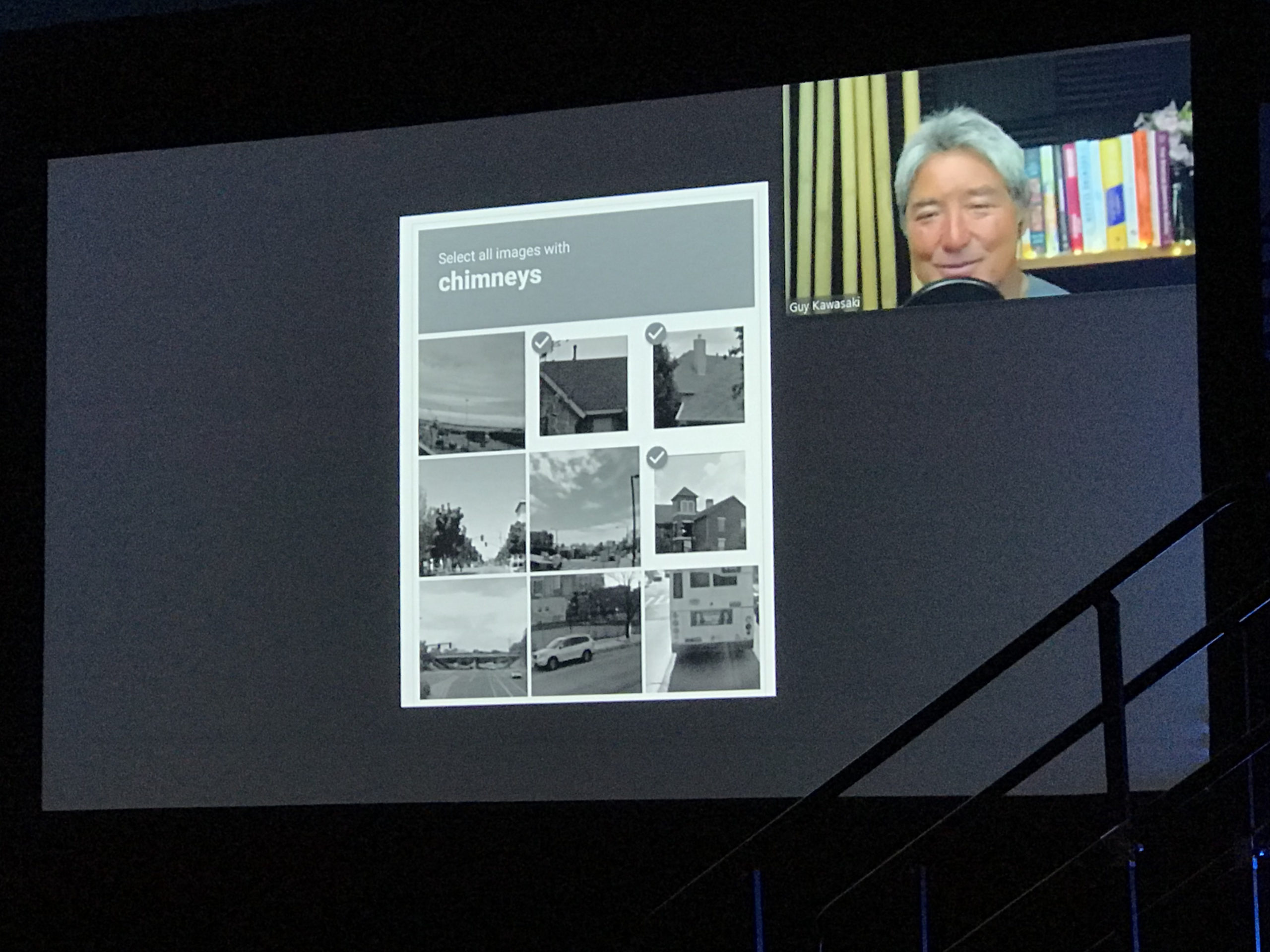

Guy Kawasaki: Remove Speedbumps

When you roll out new innovations, don’t give anyone anything to block them.

Don’t make your customers “breathe through a straw” (see above) do this.

How many people hate this image below? LOL.

This is a great example of speedbumps that cause people to bail out of your process.

Guy Kawasaki: Churn, Baby, Churn

Guy shared an example of when they launched the first Mac after years of development, they naively thought they were done.

But that’s when the work really begins.

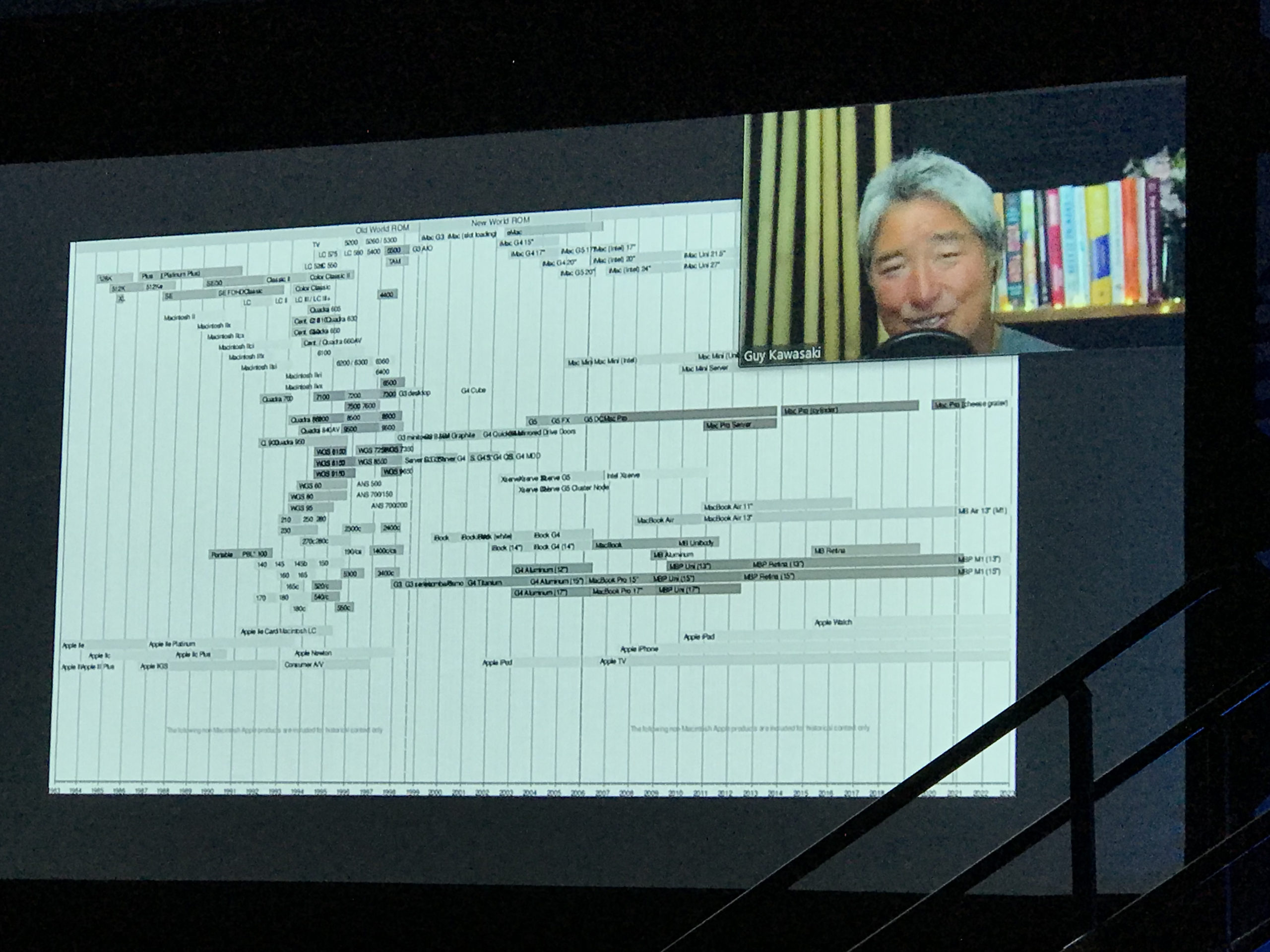

Here’s an image of the Apple product roadmap the past decade.

You must churn and add stuff, and maintain/enhance the things you have going already.

Guy Kawasaki: Ignore The Naysayers

There are 2 kinds of naysayers to ignore, the second one is more dangerous.

1. The Loser Bozo: the always-negative person who always has a reason something wont work

2. The Winner Bozo: the smart, rich, eloquent, successful person who doesn’t think your idea will work

It’s hard to deal with the second one, but you still have to have conviction in your ideas.

There are so many examples of how winner naysayers lost:

IMB and DEC heads said personal computers would never work

Western Union said the phone is irrelevant.

James Robert Lay on … Strategic Marketing Manifesto For Generating 10X More Loans And Deposits

James Robert Lay is a banking marketing consultant and this session is getting underway.

He posed a question to audience: do you like Change or not?

Mixed responses.

This was a lead in to:

We must transform the self to transform the team.

If we work from the inside out, it works better for transforming lives of people in the communities you’re serving.

Money Makes People Feel Confused, Frustrated, Overwhelmed

James Robert Lay shared a survey his company did for banks.

He said the top 3 ways people feel about money is:

Confused

Frustrated

Overwhelmed

61% think money is a major source of stress

31% of consumers lose sleep and feel stress over finances all the time (Stash.com)

49% of people are living paycheck to pay check

34% feel too embarrassed to talk finance because they think they’re worse off than peers (Stash.com)

20% don’t talk about money because they’re ashamed of their personal financial habits

===

Based on these stats, if we want to know how to help people, we need to ask:

– what people’s goals are

– what their dreams are

– you must listen to what they’re saying AND not saying

– empathy is reading what they’re not saying and get to the root of their goals

– this will let you learn how to help them

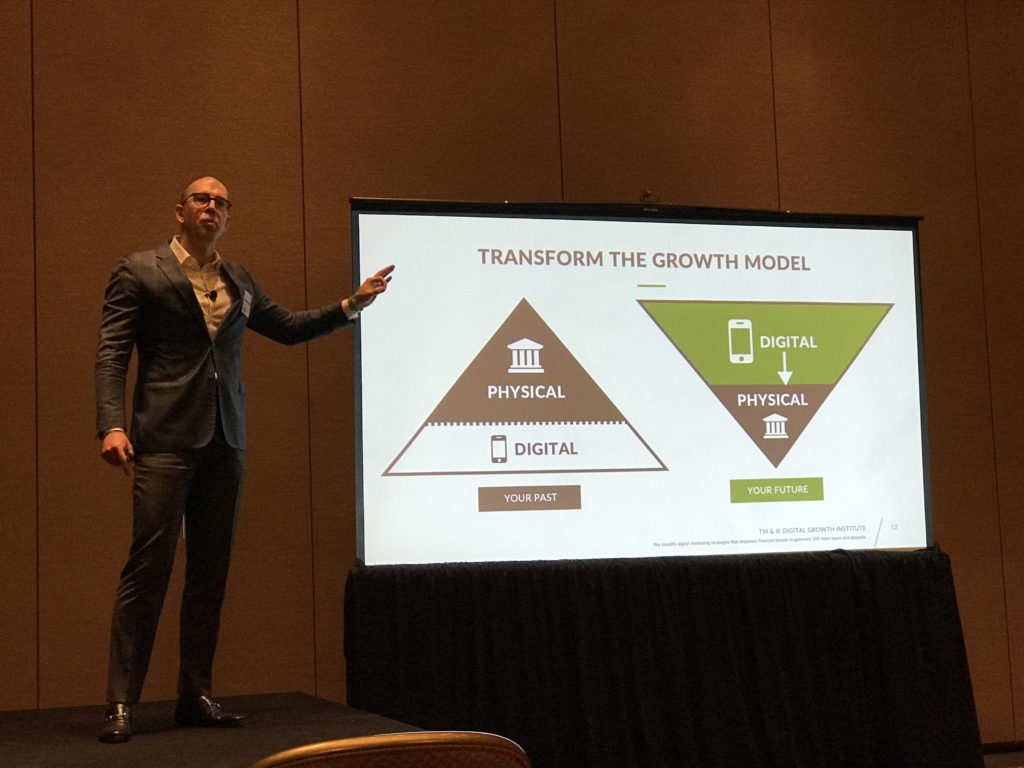

Transforming The Digital vs. Physical Growth Model – James Robert Lay

This is a good image of the physical and digital service model flipping over time.

Also he mentioned this equation as a basis for all of this:

AQ + EQ Will Be Greater Than IQ Over The Next 5 Years

How Do You Convert Real Human Contact To The Same Warm, Fun Experience In The Digital World? James Robert Lay

Being face to face with people as the pandemic wanes is wonderful.

But we’ve been able to reach more people through digital means.

Yet his firm surveyed people on their feelings about digital growth, and the results are same as money results in post above. Digital growth makes people feel:

Confused

Frustrated

Overwhelmed

85% of banks and credit unions don’t have a digital growth plan

===

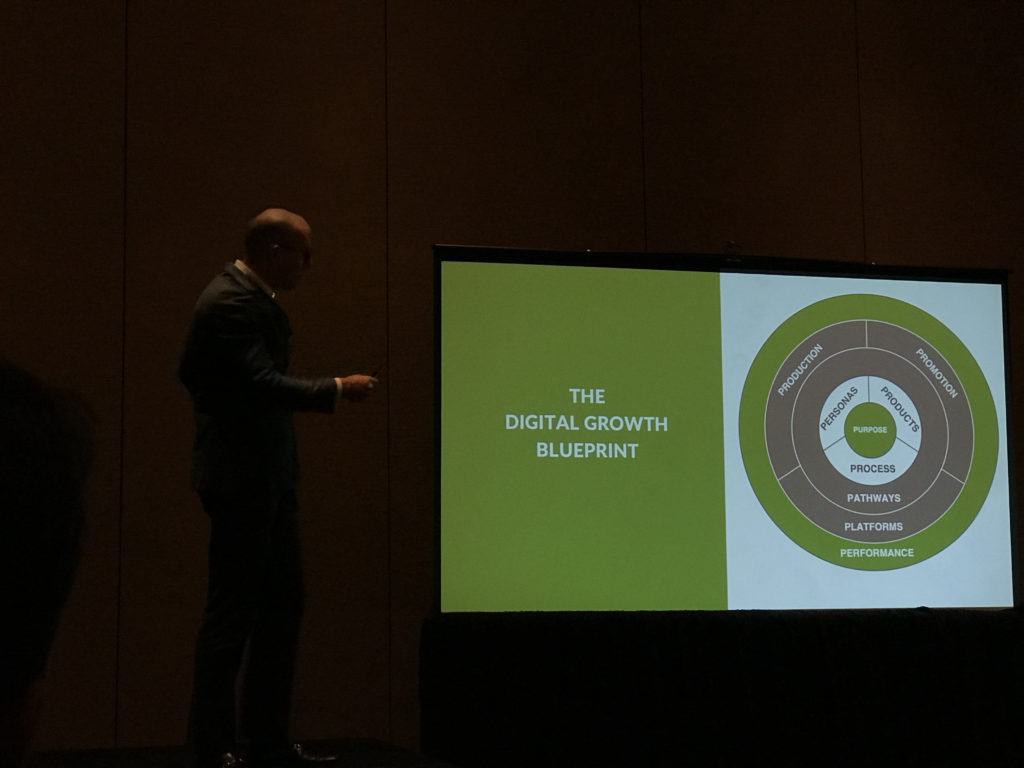

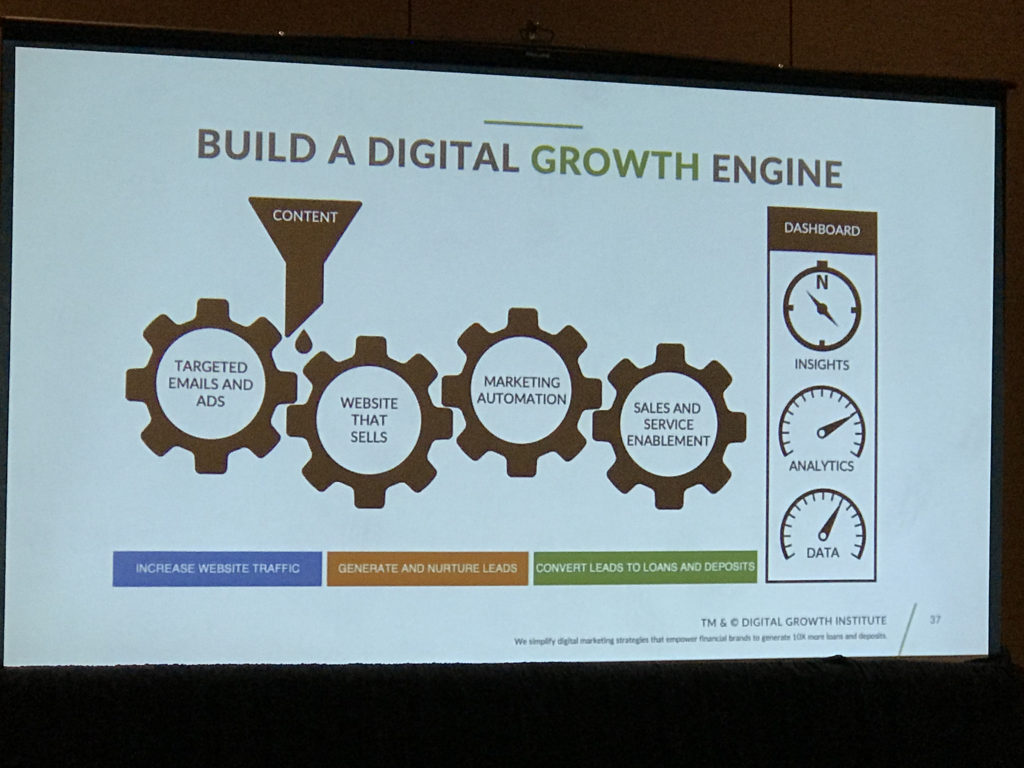

The solution is this Digital Growth Blueprint

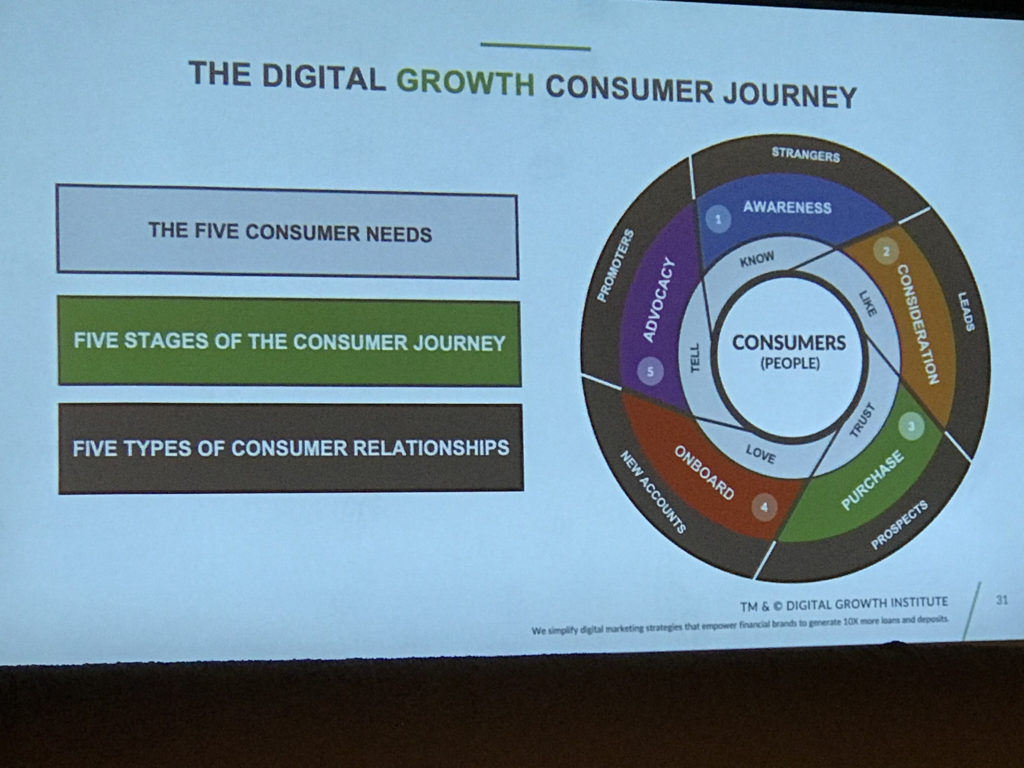

The Marketing Funnel Is Dead. Long Live The Journey. – James Robert Lay

Here’s a bunch of stats that all basically support the premise that it’s not about a simple funnel, but rather orchestrating a much more complicated digital journey for financial customers.

87% of consumer shopping journeys start online for a financial product but only 2% convert on first visit

92% of people who bought homes did research before they contacted a lender – Ellie Mae.

This is good and bad.

43% of consumers believe websites aren’t designed around end user needs, while 95% of product teams say it’s “somewhat” or “very” easy for users to use their site.

This stat above is totally LOL!

60% of mortgage customers visit more than one third party side when shopping for a loan (Journya)

Up to 97% of consumers abandon loan applications while 65-75% abandon new account applications.

92% of borrowers buy from one of the first 2 lenders they speak with (Denim Social). The faster you can make contact and engage, the more you’ll convert.

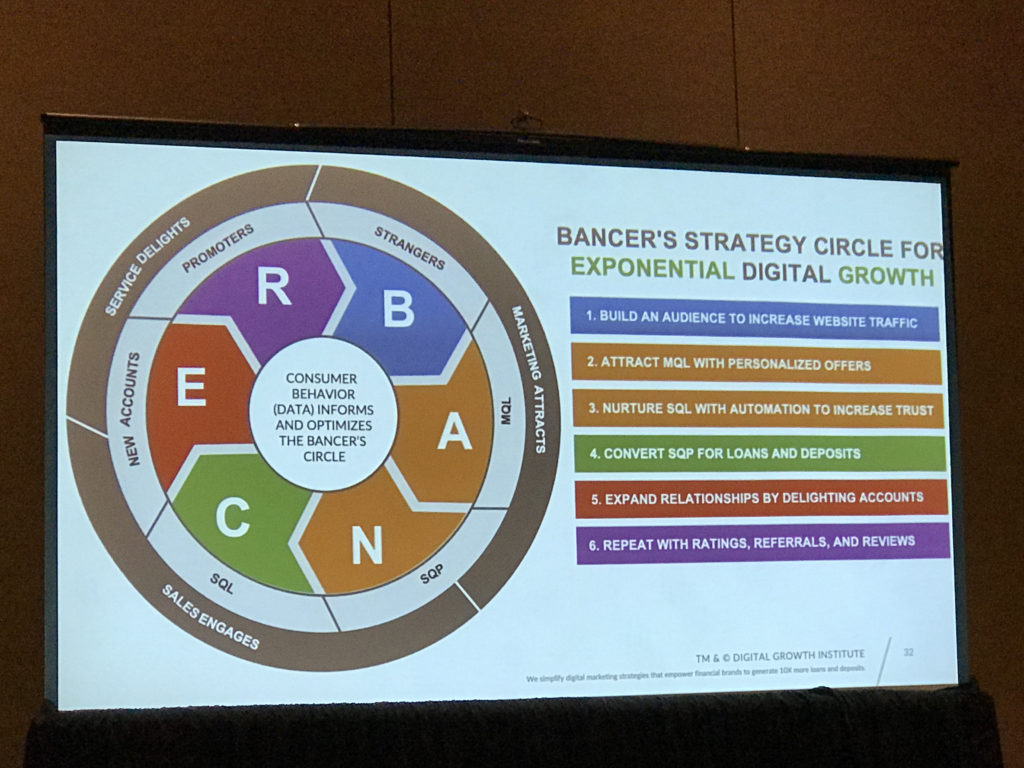

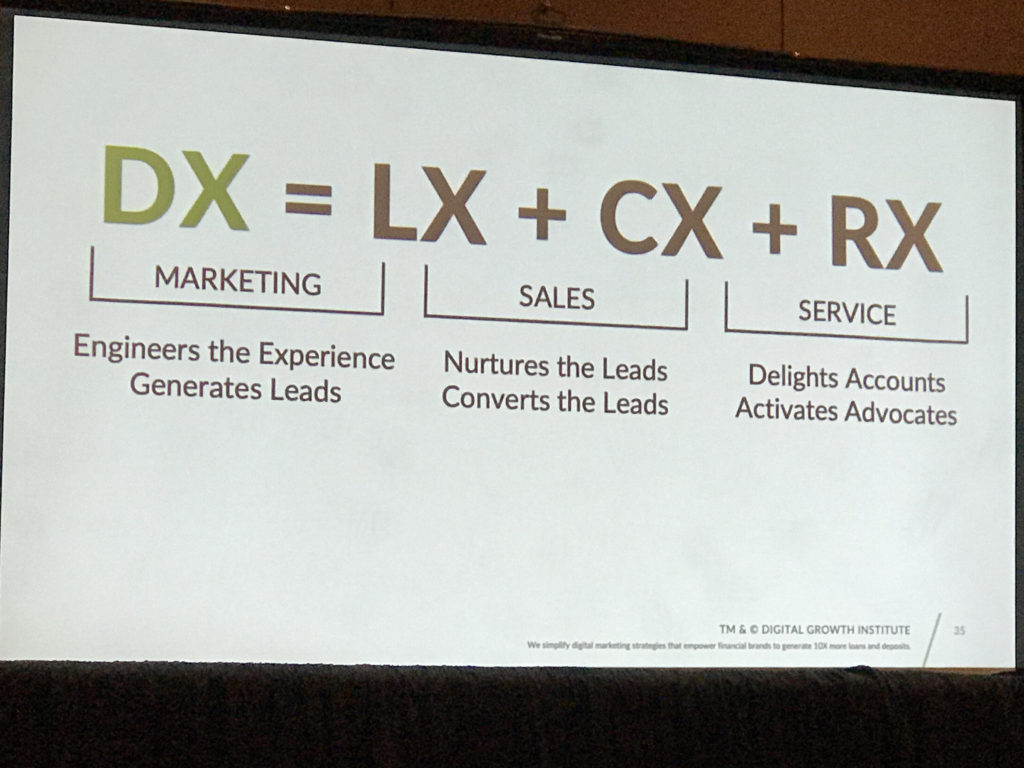

4 Visual Models For Lifetime Customer Engagement & Digital Marketing

James closed his presentation with all kinds of meaty models for how to build your marketing engine as a bank or lender.

Below are the 4 models I thought were the most valuable.

Lots to digest in all of these. I’ll come back another time — in another post — and do more, but here’s the models for you for now.

WOW!: Total Expert Powered $1 Trillion in Mortgages In Last 12 Months – Total Expert CPO Matt Tippets

Total Expert Chief Product Officer — formerly from marketing software giant Salesforce — shared some staggering usage stats in his Total Expert Accelerate keynote:

85k users

2.1 million tasks created on CRM side of platform

300% increase in campaigns on marketing automation

1 million SMS messages

300 million emails sent

5.5 million listing insights

3 million loans have been supported in last 12 months

This represents $1 trillion in loan production

This is almost 25% of total mortgage production in America

===

9 of 10 customers want empathy

82% of customers want education

86% of customers were extremely satisfied with their bank or lender when they truly felt the financial firm had their best interest in mind and understood our goals

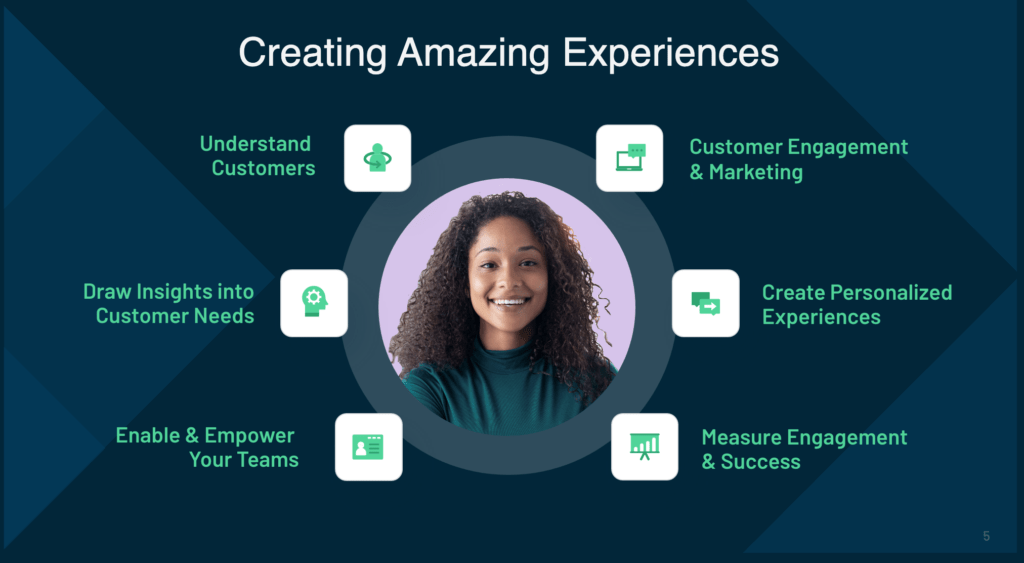

The 6 Things Needed To Create Amazing Experiences For Consumer Finance Consumers

Total Expert CPO Matt Tippets shared these 6 things needed — and that Total Expert powers for banks and lenders — to amaze bank and lender customers.

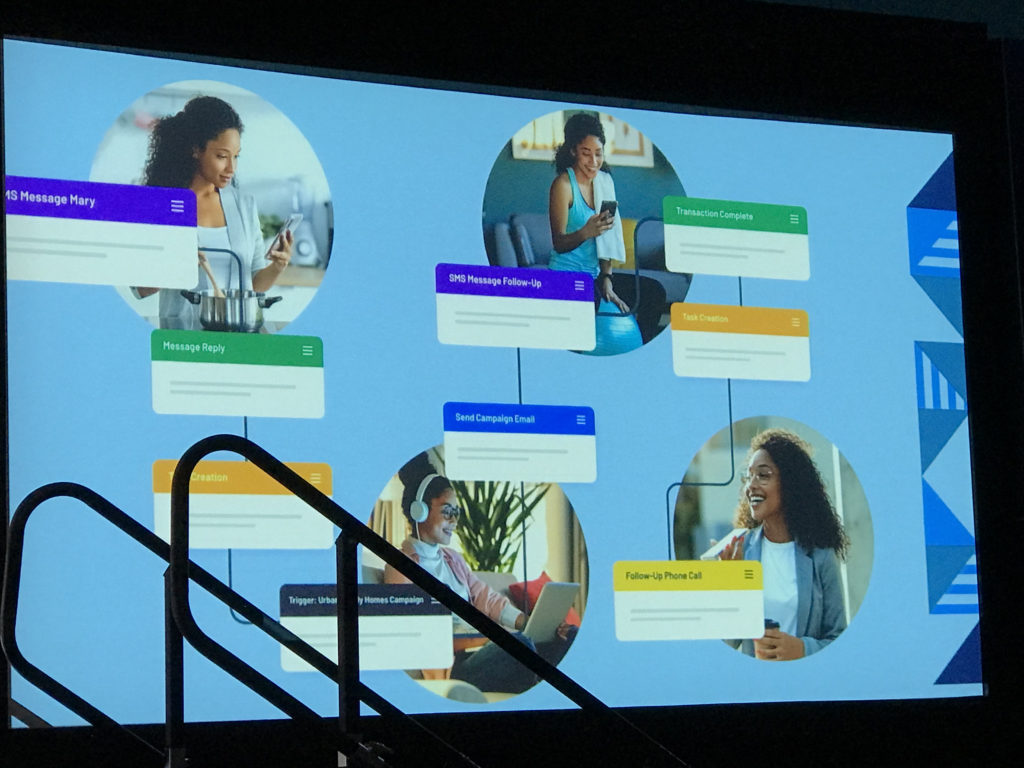

A Sample Customer Journey Of A Banking Customer

Matt Tippets ran down how a customer experience works.

In this case a single woman buys a home, and how did that experience go.

And if you are doing some of the things pictured well, then when she starts a family, you’ll also grow that relationship.

These slides visually break it down.

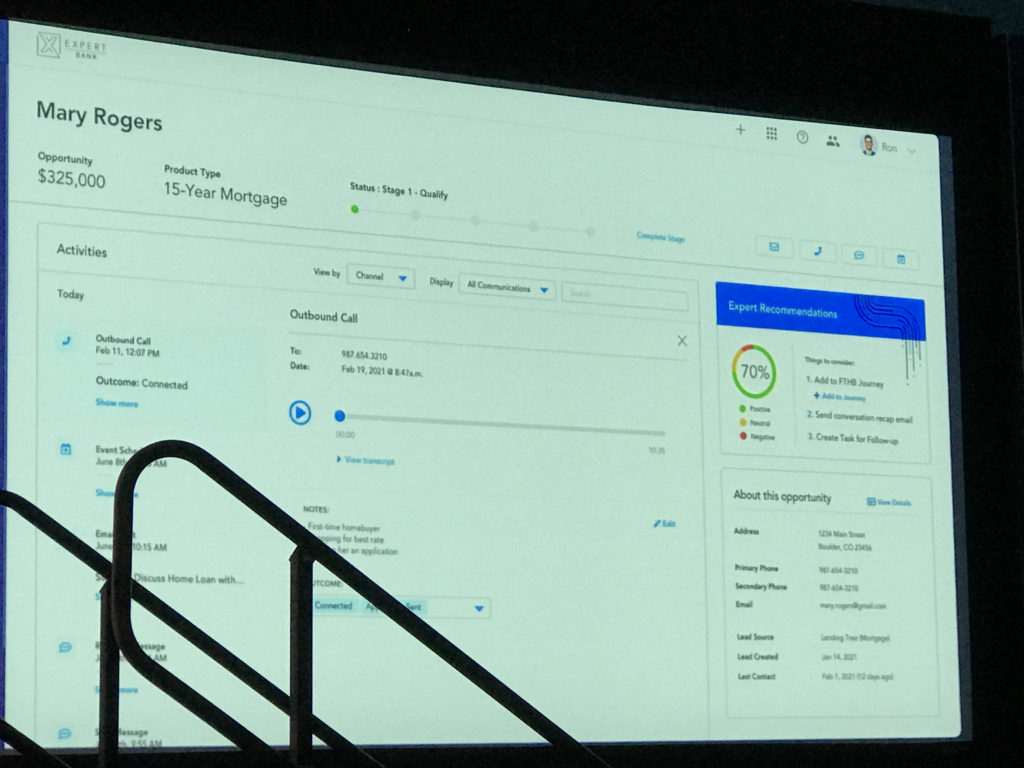

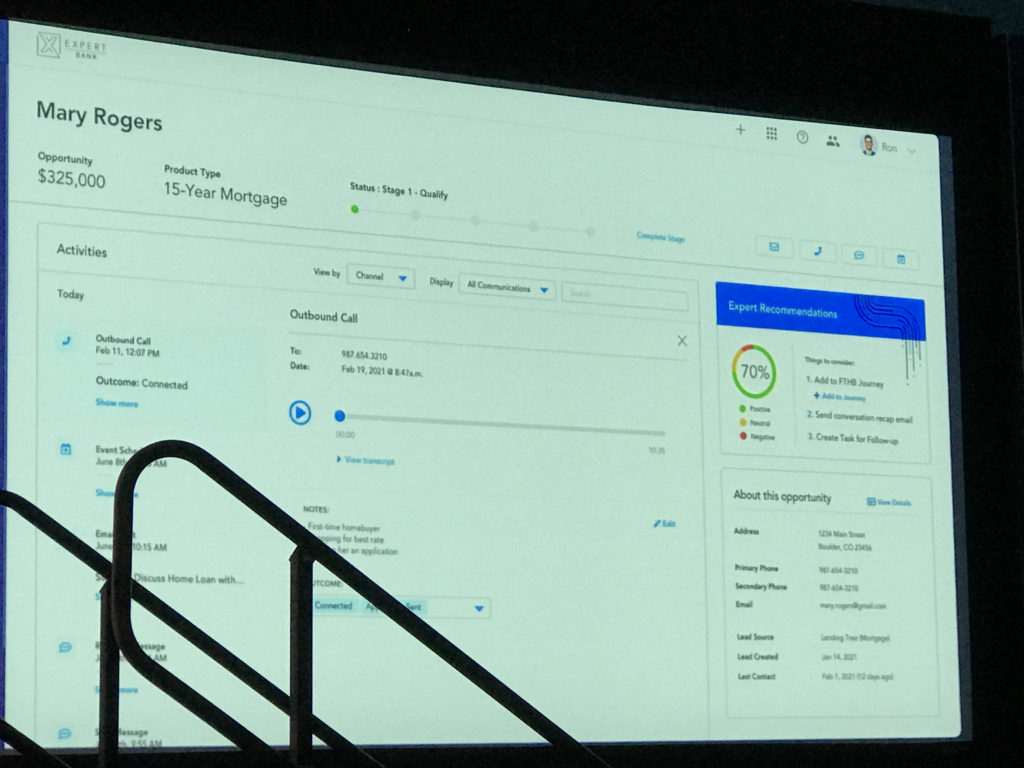

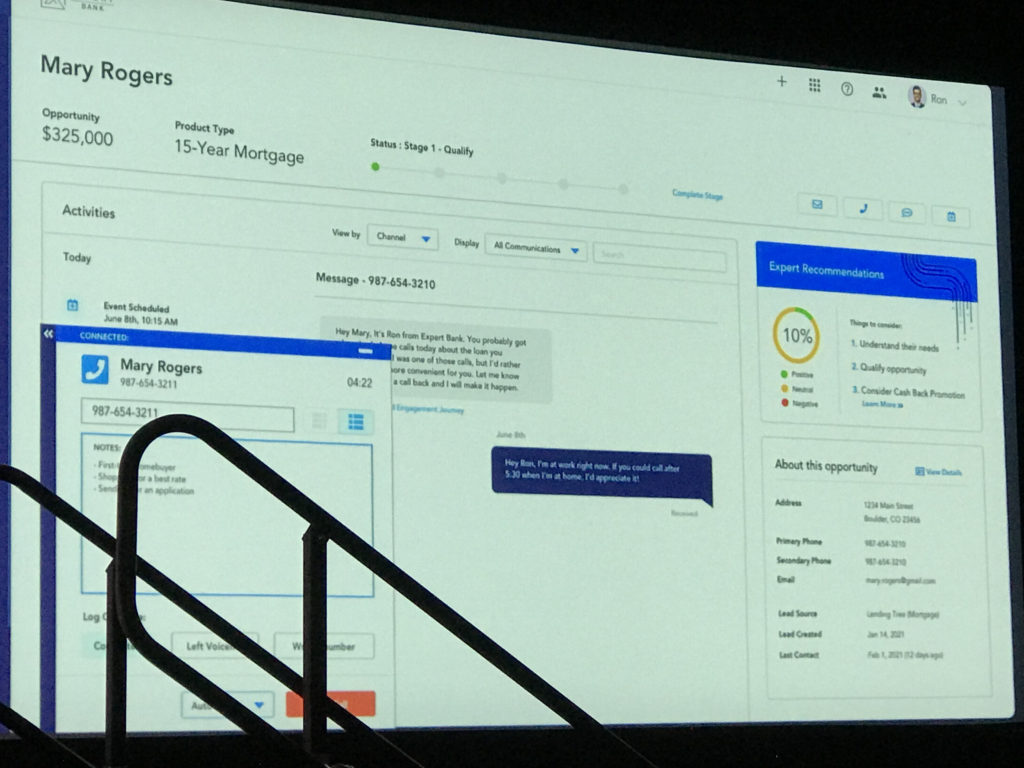

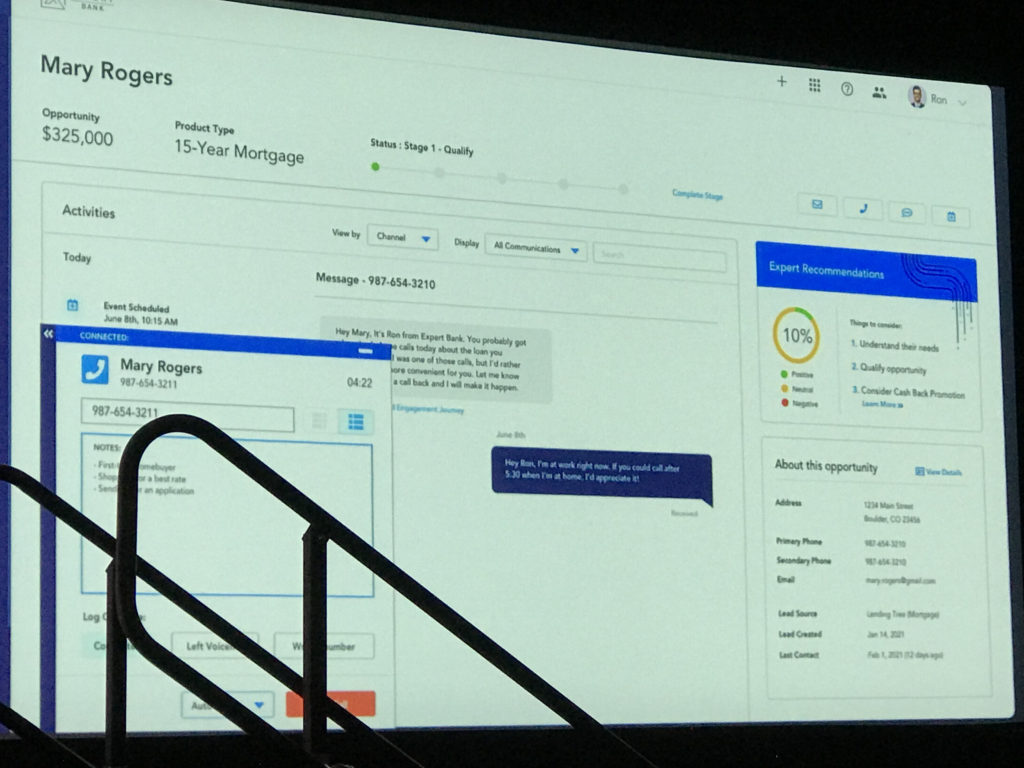

Lead Management Tools To Manage, Monitor, Connect With New Customers

Total Expert Product Lead Lora Osborn broke down some key points about customer behavior in the Acquisition phase:

Customers want instant engagement

But they also don’t want to be overwhelmed by too much communication.

Example:

Fill out a form on Lending Tree and they just call and call and call and call

A Total Expert powered relationship starts with a human written text

It shows sensitivity to her schedule

And this is far more likely to be engaged upon (more results stats coming later)

===

Lora described a workflow engine for how these leads come in.

A lead comes in

It goes to 4 designated loan officers

You can load balance leads to those loan officers based on what you know about them

[This workflow building was all drag and drop, demonstrated on screen]

This is how the experience described above happens

So the lead comes to the loan officer (LO)

The LO can see the lead, and send texts right from there, read texts already sent

And there’s a sentiment meter to show visually the client’s mood

Also there’s an interactive dialer so the LO can call that client from the same screen

LO can also log an outcome of all this.

Here are a couple screens showing some of what the LO sees.

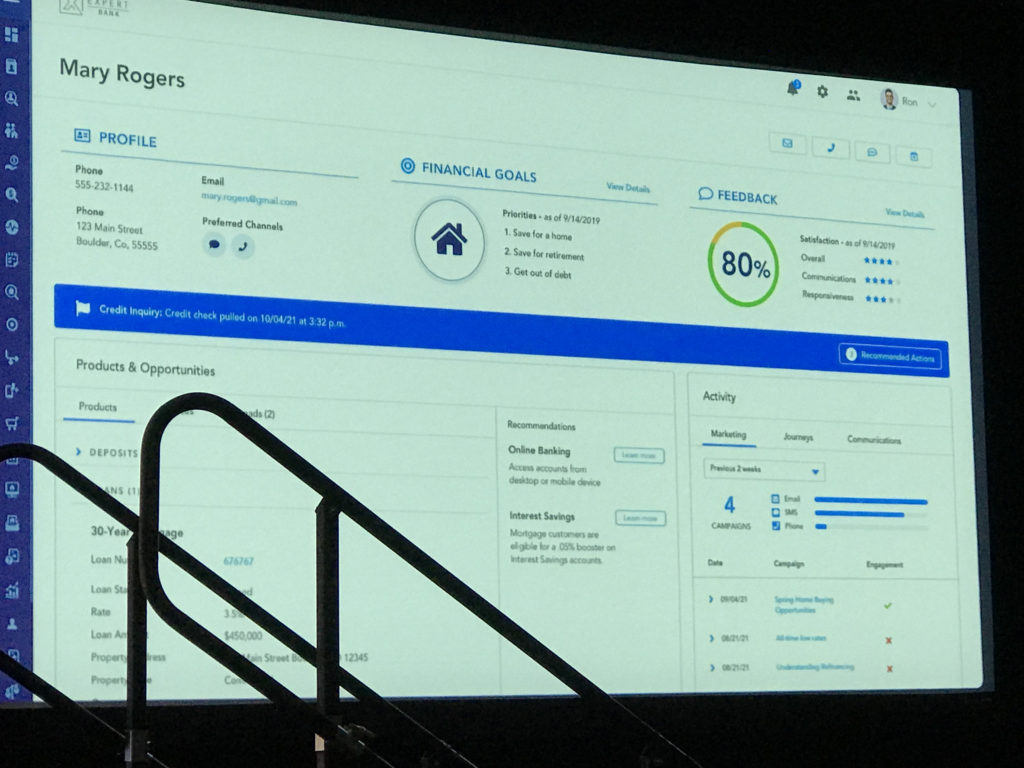

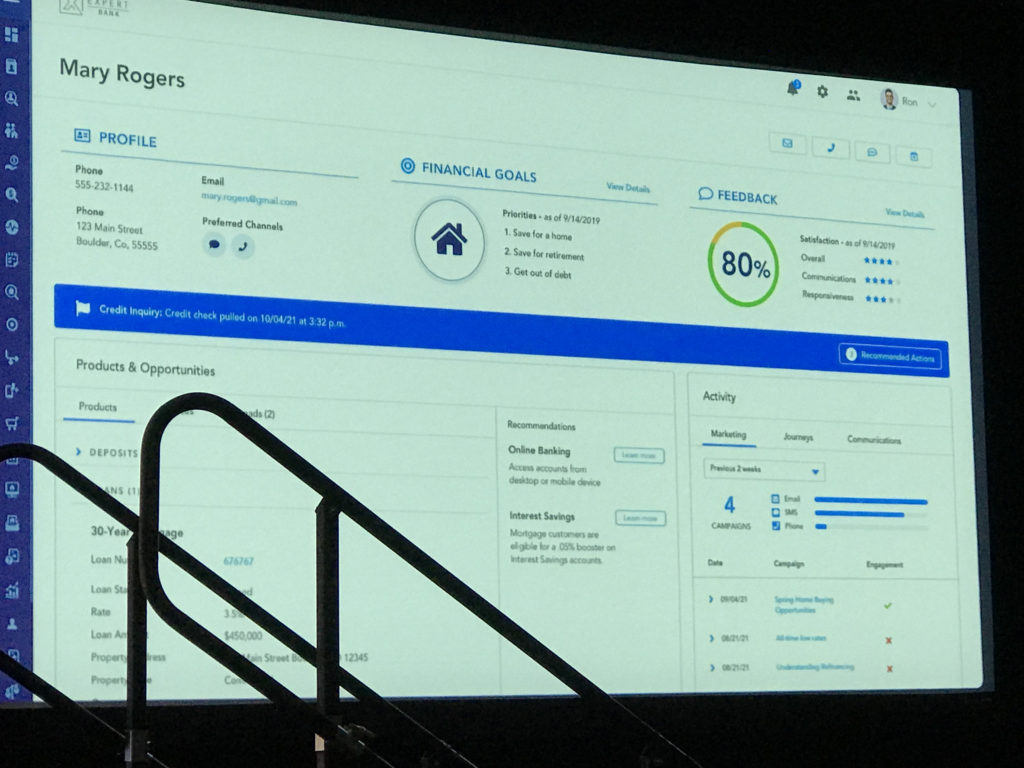

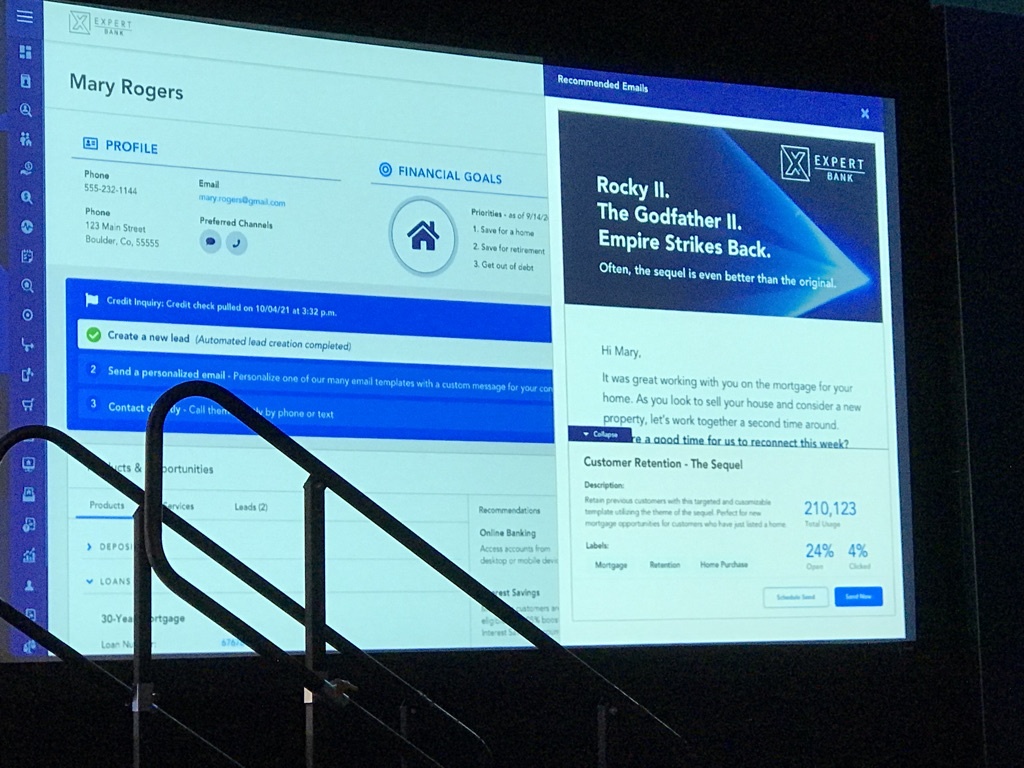

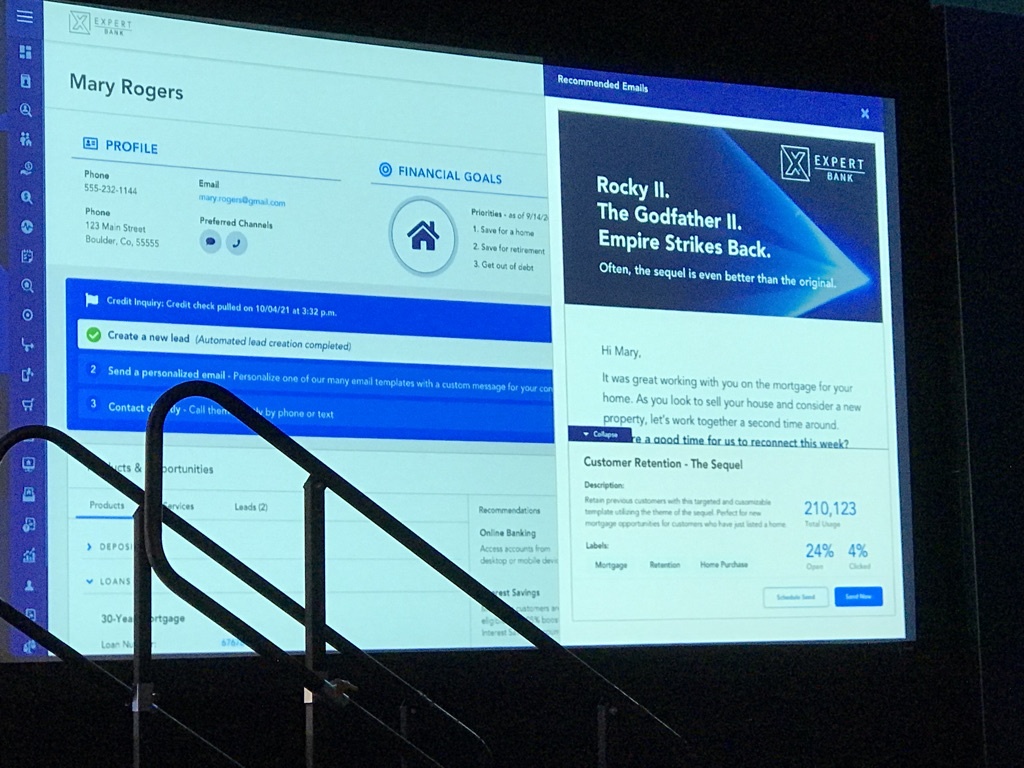

The Loan Officer Experience In Total Expert Circa 2021

Total Expert Product Lead Lora Osborn also shared how a loan officer works in the platform to watch leads, respond, and actually create outbound content all in one screen.

Here are 2 examples.

The second one is viewing and sending an email right from their lead page.

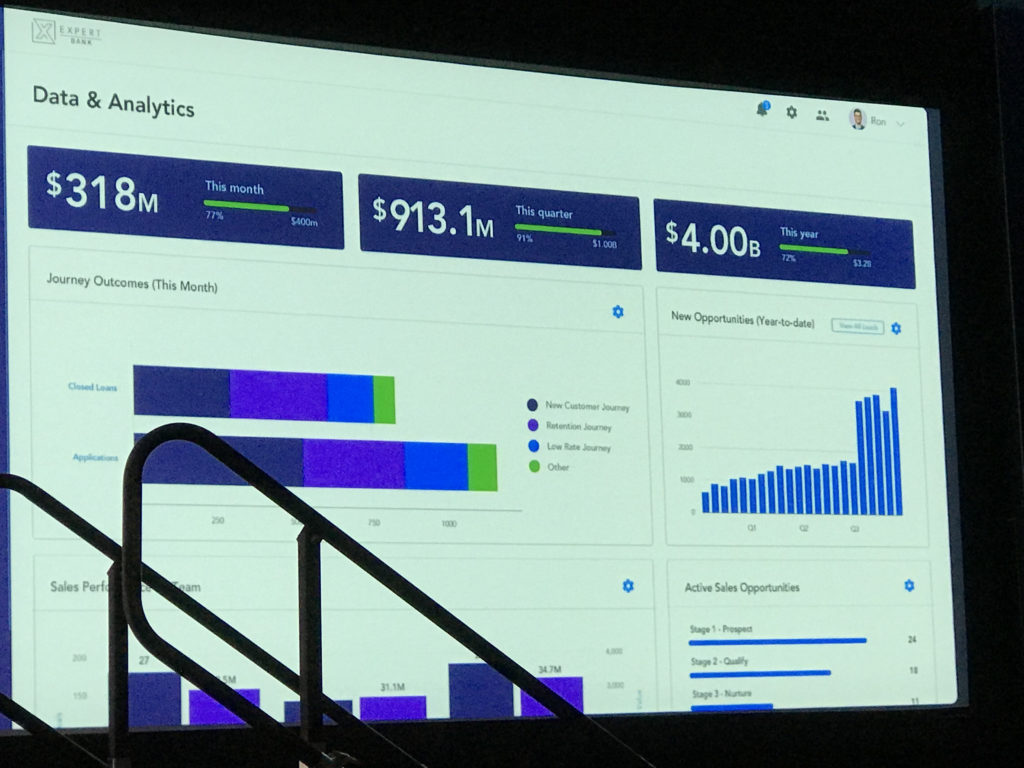

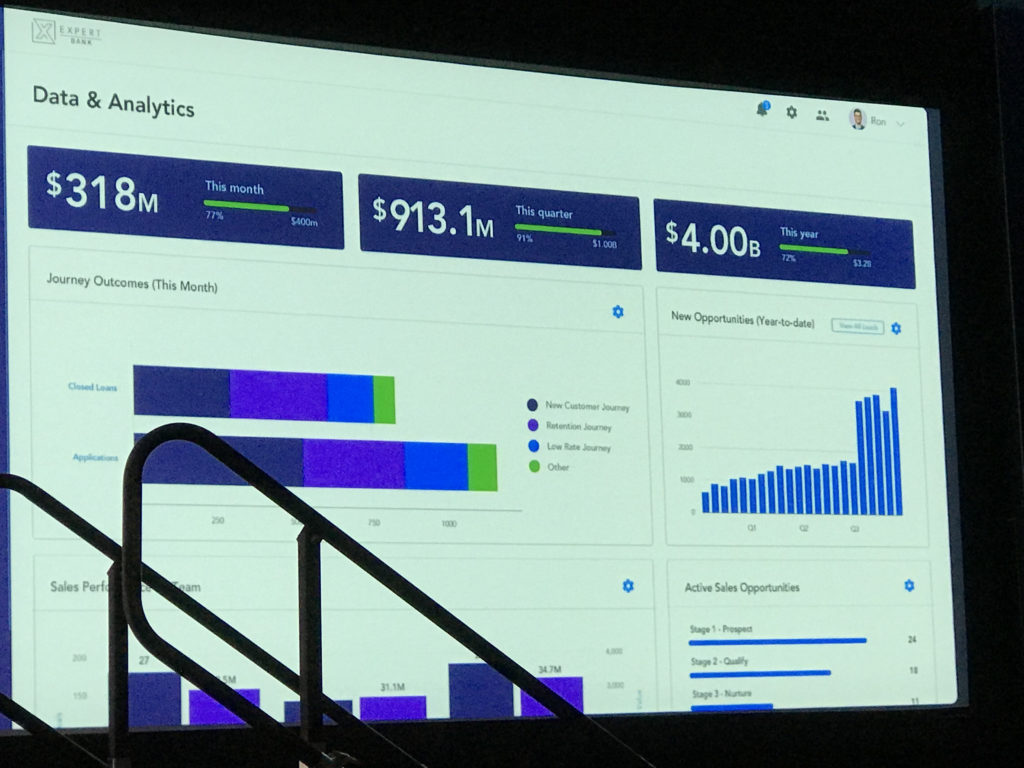

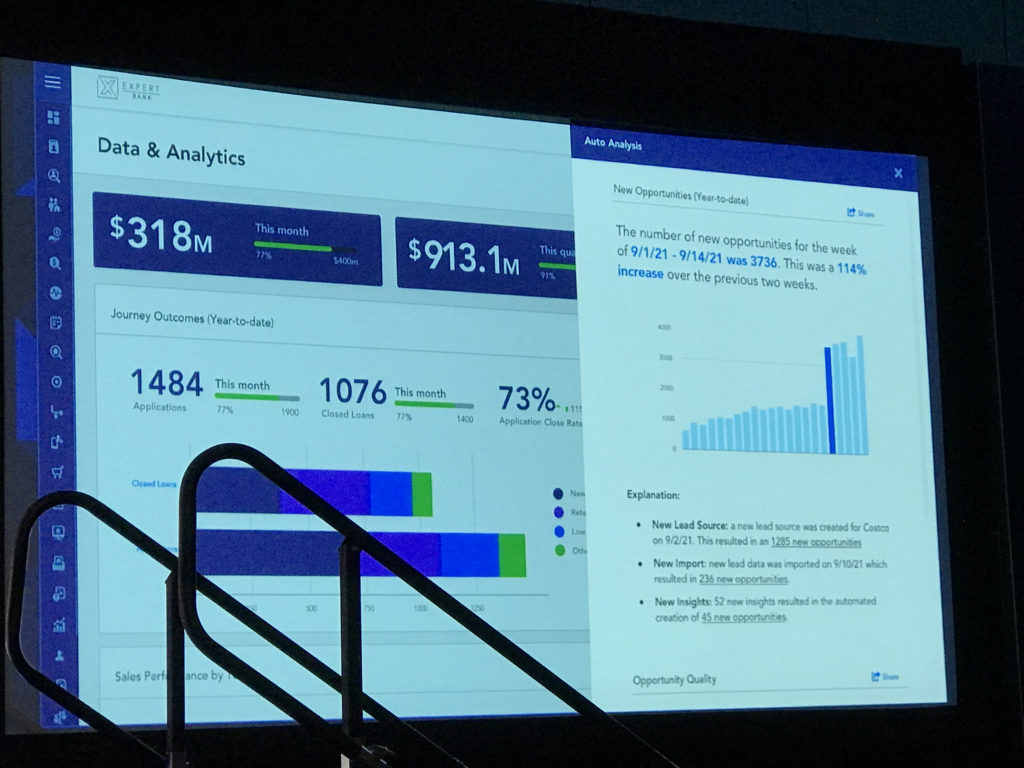

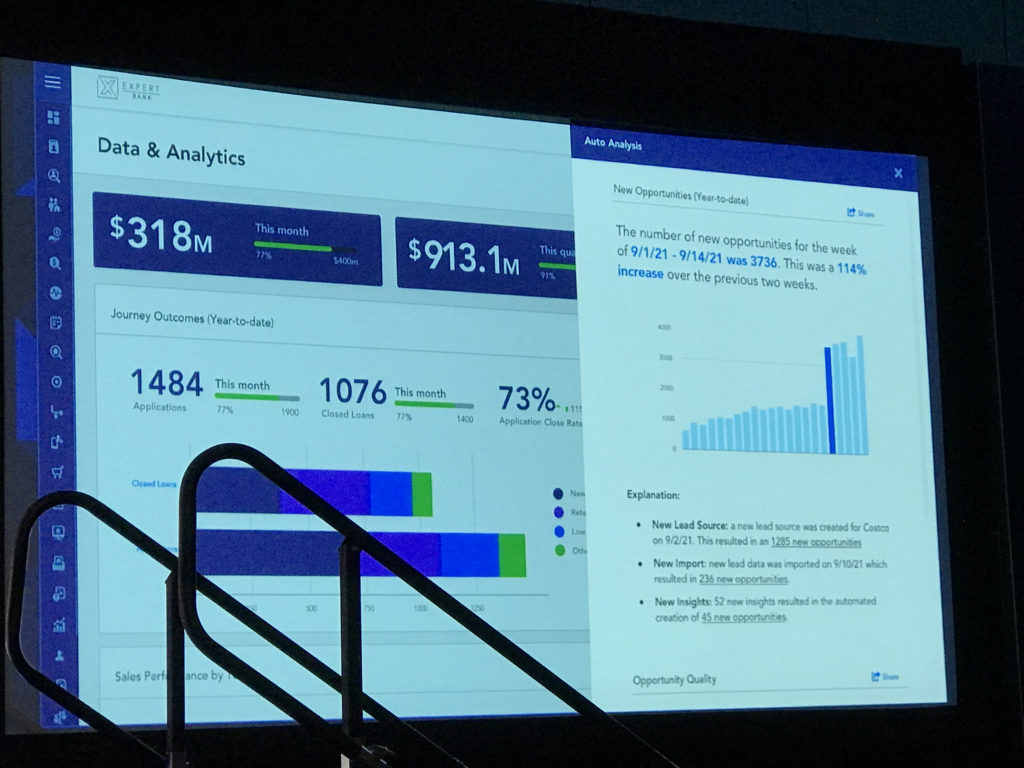

Descriptive, Prescriptive, Predictive Marketing Data and What Each One Does

Total Expert CPO Matt Tippets talked about the 3 kinds of data available for marketers.

Descriptive data to help see what’s been going on with your marketing.

Prescriptive data helps to give salesforces new opportunities.

Predictive data helps you plan what marketing will be most impactful next.

This is what the UX looks like for those items.

The first one is the dashboard.

The second one is insights from the dashboard, without leaving the dashboard.

The Stats That Matter On Consumer Behavior In Home Buying Circa October 2021 – by Total Expert’s Josh Lehr

Josh Lehr used to be with Zillow before Total Expert, and he knows the consumer experience cold. He surveyed consumers recently, and this is what he found.

===

Who makes the financial decisions and runs the financial processes in a household?

It’s about 50/50

===

53% of consumers are shopping during the work day. This could be

21% of people reach out over weekend

The rest are in the morning.

===

76% of consumers shopped more than 1 lender.

Combined with the stat above (most shopping during the day), this makes sense.

It also means lenders must have their head in the game at all times.

===

What’s most important to consumers?

Trust

Convenience

Low Rates

These results were the same from Gen Z to Boomers

===

What is Trust To A Consumer?

Teach Me: give me multiple options, and spend the time to actually help me understand each

Be Admirable: show me that your brand can be trusted.

Be Personable: show me that you care, and that you care about me as a person

===

What makes a lender convenient?

Be Available: in person or digitally

Be Responsive: always respond regardless of channel

Be Easy To Use: provide me with the tools

===

Do We All Need To Compete On Rate?

Be Competitive: have rates that are within reason

Be Transparent: Give me direct access to rates

Find A Balance: Don’t have to win, but need to make the cut

===

How Are Consumers Starting Their Search?

93% are researching online

25% of them are contacting their existing bank

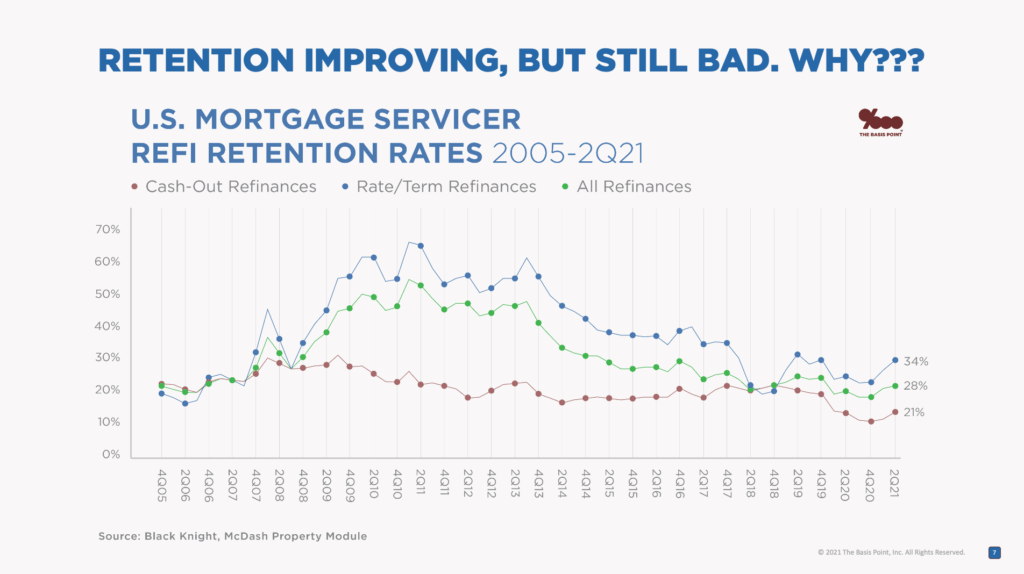

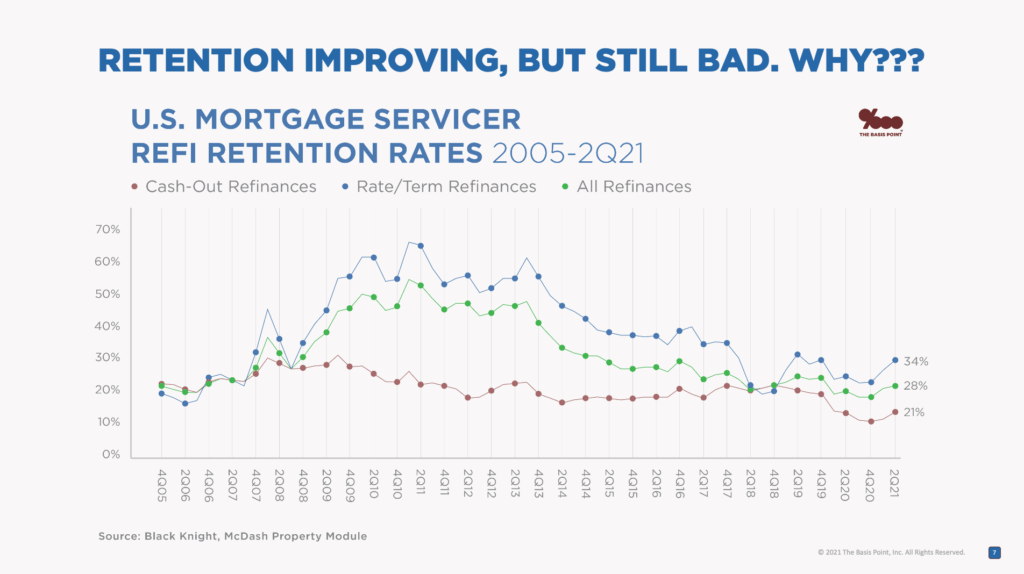

[Note: mortgage retention rate in America was 28% for 2Q21]

===

Other Consumer Insights

Purchase consumers came from real estate portals (Zillow, Redfin, Realtor.com)

Refi consumers preferred rate shopping portals

Older audiences want mortgage calcualtors

Younger audiences rely more on reviews.

===

Shopping For First Time Homebuyer

More Resources: Provide different tools for your customers. Your own site plus being present on other sites and social networks

55% of consumers don’t get a conventional product. So they need education on all the options available to them.

How Consumers Want To Be Communicated With During Mortgage & Homebuying Process – by Josh Lehr, Total Expert

Preferred Channel For Communication Throughout Entire Loan Process

50% email

Rest split between phone and text message

===

First Point Of Contact

54% prefer phone to run down questions and build trust

===

Communication Through the Loan Process

Most want email for regular updates

But they want to be called for immediate issues

Text and chat was only 12% in this result

Things That Resonate Most With Consumers – Josh Lehr, Total Expert

First time buyers stick with first contact IF the service is good.

Little things like birthdays and life event recognition still make a huge difference

Diversified digital presence — able to connect with consumers everywhere matters most to them

===

To conclude this session Josh mentioned that, in the coming months, Total Expert will be releasing more granular data on this survey they conducted.

If you want to get into details before then, you should hit Josh on LinkedIn.

He’s super technical and fun to talk data with.

I first met Josh when I was invited to present at a Zillow conference, and I knew I was in a room with a bunch of data experts and direct marketing experts, so I was trying to come strong.

It was very intimidating because technical, data driven marketers have zero tolerance for bullshit.

Josh gave me a good review after, but did point out a few nuances in my subject matter. And we’ve been tight ever since. So if you like getting into the details, definitely reach out to him (and me of course too!)

Top Lender Panel On How They’re Marketing To Consumers

Total Expert CPO Matt Tippets is leading a panel with 3 lenders who execute really well on different nuances of the business as follows:

-Dustin Morton, Vice President of Product & Strategy, Motto Mortgage – Motto is the in-house real estate partner of Re/Max real estate so they are very good at the realtor relationship nuances.

-Melissa Wright, Chief Sales and Marketing Officer, APM Mortgage – APM is known for being a pioneer in letting loan officers and teams brand themselves within the bigger corporate umbrella. This is incredibly difficult to do at scale, and Melissa is in charge of making this work perfectly.

-Katherine Campbell, Chief Digital Officer, Assurance Financial – Katherine runs digital strategy for a multi channel firm. On the one hand she delivers extremely strong personal branding sensibility for retail loan officers. But then she also just told me today they’re also building consumer-direct as a separate business line.

===

Dustin lets each Re/Max brokerage add loan officers seamlessly at the single loan officer level, and pre-conceived every level of their growth from more offices in the same city to moving states. They’ve opened 200+ shops and add 5-10 loan officers every month.

===

Melissa has retention approximately double the industry average of 28%

They do this with layering.

What does this mean?

We do triggers (credit, listing, etc) so LOs can have stuff to reach out to customers on in real time.

We have about a dozen different different automated journeys that communicate with customers based on their behavior.

Some of these journeys also include post close engagement.

These are largely catered to the “self-serve” loan officers who generate their own business instead of having the company give them the leads.

We did a huge shift in 2019 from a customer retention perspective.

There are 3 categories of LOs:

1. They’re all in with new change and innovation.

2. There’s the ones who will follow early successes on innovation but won’t jump in first.

3. There are the innovation resistors.

All orgs have this and we have this.

This happens with all marketing innovation, and we’re implementing AI-assisted underwriting and these 3 classes of LO are evident here too.

===

Katherine made a good point that as the market is shifting from $2 trillion refis to $649b refis next year and 73% of the market will be purchases, loan officers are very interested in marketing again.

Before we couldn’t get them to adopt the software we’re building for them all the time.

Now they’re really open to it across the board, from marketing to POS to anything we can do to help them.

But don’t offer cool tech just because it’s cool.

Instead, you have to define your loan officer and customer journeys and how you want their experience to be.

This is the best way to make tech buying decisions.

===

Dustin is onboarding new LOs all the time, so making this as easy as possible has been his North Star.

They do live help desk.

They do constant webinars to teach LOs how to do everything from using the marketing and origination tech to understanding loan guidelines so they can quote deals correctly.

I like listening to Dustin talk about LOs because he innately talks about LOs like they’re his customer. It’s not just a message point to him — it’s DNA. Love it.

He also mentioned how the support teams on the phone and webinars are former loan producers and processors, so they know what they’re doing.

This is giant for getting and keeping credibility with LOs.

“We also think a lot about how the UI of the software is a learning/training tool itself.”

Let’s say they go into a contact record in Total Expert and the phone number is wrong because it comes from the Loan Origination Software. So they show the LO how they can edit it, but also show where it came from so they can correct it at the source — or get help correcting it at the source.

They also build contextual help to explain screens that LOs are using.

Example: If a new LO doesn’t understand debt-to-income ratios, they have pop-up tutorials to explain this right on the place where DTI is shown on the borrower profile.

I think this is badass. And I’m guessing Dustin’s LOs do too.

===

Melissa’s perspective resonates with me because we both have the same background of being both sales and marketing execs.

She’s describing this process and how it wins her credibility with the LOs.

It’s service oriented.

But it’s also important to make sure marketing becomes a thought leader in her org rather than just merely responding to the whims of LOs.

===

How Do You Evaluate ROI of Marketing Tools When There’s So Many?

Katherine says there’s never too much, because you want best in class of everything.

But you have to watch to make sure certain things don’t overlap, and that it’s single sign on across the board so LOs don’t have so many places to go.

We need to demonstrate ROI for sure in 2022 or some of them will get cut.

Melissa added that you must make your tools integrate for single source.

She said whenever we look at a new tool, we do ask existing partners to show us what they’re working on to see if they can do it before we make a new decision.

Dustin said: More is not better. Because it’s going to change the LO experience, and in turn the customer experience. So we really do push back on tool requests to keep experience consistent.

===

What’s Your Special Sauce in Total Expert and Across Your Tech Stack

Melissa said they’re heavily into content driven model. So even if their stack is the same the content that goes out makes her firm special.

Also she said they customize their marketing, and loan origination tech stack to make it have a certain process that makes them able to do loans faster and cleaner for LOs and consumers.

Dustin said that everything works for LOs on day one. All the emails are ready to fire, all the campaigns are ready.

He said the LO has one task: upload your contacts and it’ll work on day one and you’re operational.

And he reiterated the training notes above.

Katherine also said they have special content that they push to customers, and that’s the difference maker.

Dustin also said they have an awards recognition system to highlight LOs who are getting great reviews.

This shows every other LO in the system who’s getting good rewards and how to connect with that other LO so they can network and trade ideas internally.

Gamification!

Melissa was all over this too, and said: Any gamification you can do always works.

Total Expert Marketing Team Again Schooling Us All On Great Marketing

In the first post of this live blog, I noted how the kick ass TE marketing team was schooling us on the art of engaging a customer on the journey.

This conference is a journey for us and the multi-part “Your Journey Begins Now” gift box continues tonight before I head out for this party after a long day of sessions.

[BTW, I got my free sunglasses, but haven’t taken a pic with them yet. Will do that tomorrow with the marketing team!]

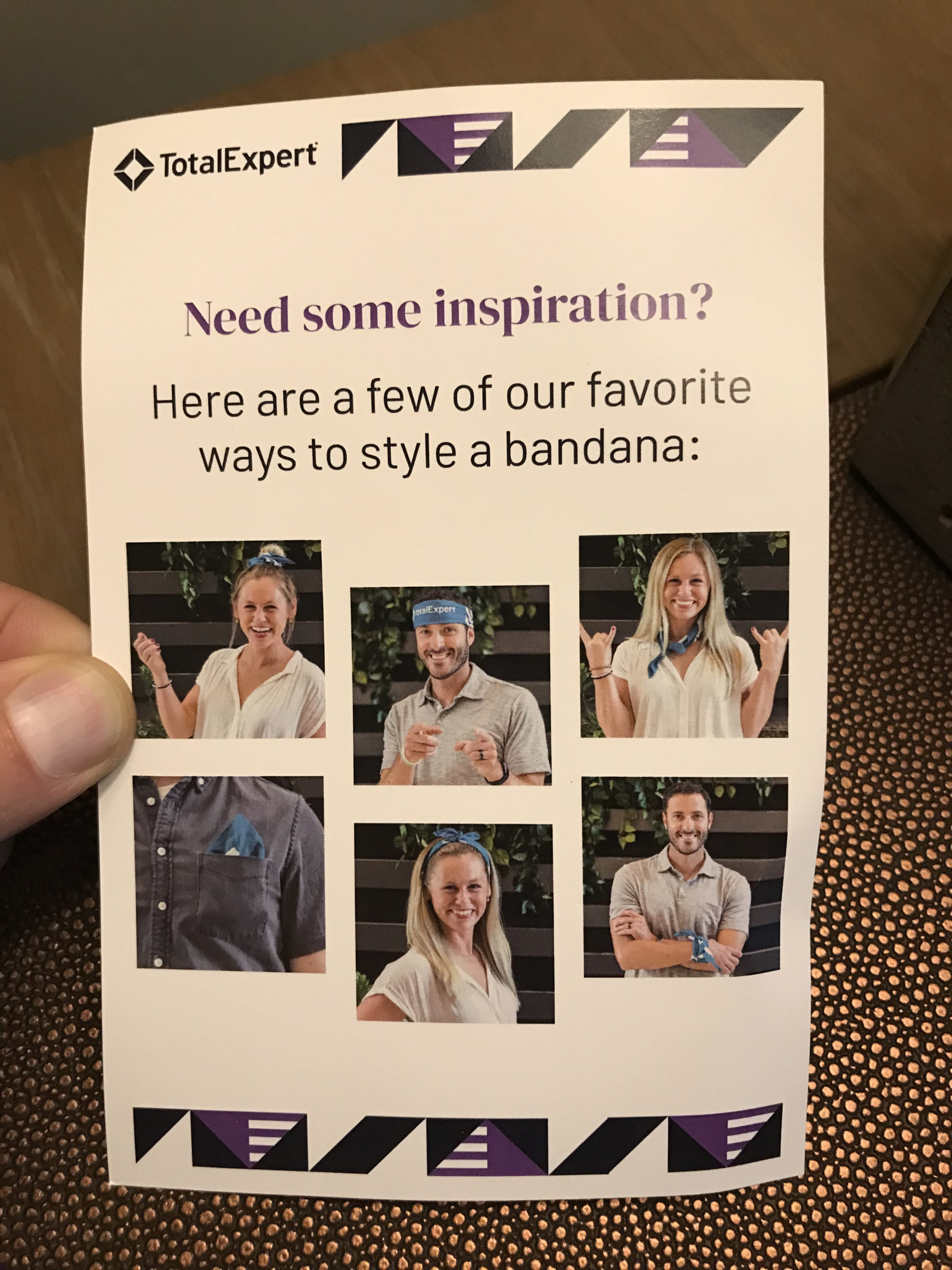

Check out what they did for us tonight!

I suspect this is a western party.

There’s bandana and the best part of the bandana is that Dan LeFevre and Bobbi Jo Dallas are personally modeling how we should wear the bandana to the party.

This is them on the back of the card!

Then as if that wasn’t cool enough…

They also have this Journey playlist on Spotify, because you know, journeys…

I’m listening to the Total Expert Accelerate Journey Spotify playlist now, and I recommend you do the same.

You can never miss with Journey.

Well, off to this party now.

Check out #Accelerate21 on LinkedIn for more.

And here’s a fun post with me and Dan earlier.

Notice one of the all-time-great photo bombs from Bobbi Jo in the background!

No Mercy When It Comes To Rocking A Conference The Right Way

I didn’t take a lot of pics at the party because it’s just so wonderful to be in the moment at my first big event since the pandemic has eased off.

Most of us have had a great run working remote.

The mortgage industry funded $4 trillion in loans last year working from home.

[Fun fact from an earlier post above: Total Expert powered marketing for $1 trillion of those loans.]

But there’s no better thing than getting together with industry colleagues and mixing it up.

The Total Expert Accelerate event’s Rock The Journey party featured a Journey tribute band that absolutely killed it.

And it was in this party venue that looked like a western town. See pic below.

Because of the western town, they gave us bandanas. See give box post above.

But for me and my friend Dan Catinella, head of digital strategy for Finance of America, we morphed the western look into more of a Cobra Kai look.

Here’s a pic — an instant classic.

Stay tuned for more posts coming today. No Mercy on The Basis Point live blogging.

“The Next Morning” Gift At Total Expert Accelerate Conference

Last night went super late for everyone.

It’s palpable how much people missed each other the last 18 months.

Rock The Journey party spilled into many different locations, ending of course at the central bar in this resort.

No pics for that to protect the guilty.

But here’s the Total Expert team’s give to us all this morning.

Liquid IV, LOL!

But note the cards that come with each of these gifts.

They’re obviously written ahead of time, but every single one meets each moment of this event perfectly.

This is a tightly orchestrated journey they’ve got us on.

And as I’ve said a few times, this is a strong example of a great marketing team showing a bunch of pro marketers and salespeople how it’s done.

Very cool.

I’m off to the next part of the live program.

Updates shortly…

The Expy Awards Is A Ceremony Honoring The Best Financial Marketers In The Total Expert Ecosystem

This was awesome, but it went fast, so I’m not posting images here, but below are all the categories and winners.

===

The Adopter

Civic Financial Services

Even with the best tech, if nobody adopts it, it’s nothing.

This winner got 94% adoption across their lending org, and increased repeat business 22% and did record volume 12 straight months.

===

The Automator

Prime Lending

They onboarded 120 loan officers, and let them hit the ground running day 1

They automated 35% of their journeys.

===

The Modernizer

Atlantic Bay Mortgage Group

They were inspired by Dominos Pizza Tracker

They created a similar concept to update customers throughout the loan process

86% open rates on these emails and texts.

===

Technology Trailblazer

Horicon Bank

They knew they needed lifetime customer relationships based on relevant outreach

They’re also helping TE upgrade their stack overall with their new innovations.

===

The Game Changer

United Community Bank

Harnessing data and putting it into action.

Implemented LO campaigns to offer niche products to customers.

2000 new leads based on 8600 emails.

Closed $174m in volume.

===

The Journey Wiz

This is the master of the journeys that automate personalization.

There was actually 3 winners since so many adopted this in the last year.

Winner 1: Calvin Cook, Motto Mortgage

Winner 2: Jelaire Grillo, Prosperity Home Mortgage

Winner 3: Jake Pniewski, Finance of America Mortgage

===

TE CEO Joe Welu and Rebecca Marin hosted this.

Joe’s closing remarks were key:

Keep pushing us on what you need to make this platform better.

How To Create Superfans In Your Business – Epic Keynote by Brittany Hodak

Brittany Hodak is the keynote this morning on Creating Super Fans.

Today, coincidentally, is Customer Experience Day in America.

How perfect is that for a conference that’s all about exactly that.

The same thing that makes people fans of artists they love can be used in our world.

Super Fan Definition:

A customer who’s delighted with their experience, compelled to return to you, and tell others about you.

We must give people a reason to care to create super fans.

It costs 6-7 times more to acquire a new customer than retain an existing one.

83% of consumers trust recommendations from friends and family (American Express).

Brittany made a funny point on this one: shouldn’t it be higher and we should trust friends and family more?

===

Every Customer Is An Influencer

I really like this point.

You don’t find super fans, you must create them one story at a time.

Super fans are created at the intersection of your story and each customer’s story.

This is when you force someone to care and show the relevance to their life.

===

SUPERFANS SYSTEM

S: Start with your story

U: Understand their story

P: Personalize your communication with them

E: Exceed expectations with them

R: Repeat

===

S in Super

Start With Your Story

What is your superpower as a company?

American Airlines vs. Southwest example

Brittany recently switched from American to Southwest.

Was longtime AA user, but went to Southwest site once (About page) and found out how employee and customer focused their story is.

American About page has ZERO story. it’s just links and no personality.

The story is all about the history of aviation.

Deep into this story they talk about customers not as customers but as a “revenue source”

“We switched revenue sources from mail to passengers.”

This is an example of what not to do.

Another example in banking/mortgage space:

PrimeMortgage: Home Loans Made Simple.

This is super clear and all their other content comes from this.

Also she gave an example of Miller Light being the coldest beer: and then nobody else could really do this (though wasn’t that Coors? I’ll have to check later).

One of the keys to great storytelling is the details. You have to describe the make, model, year of the car.

You have to be specific but also succinct in your story.

===

U in Super

Understand Your Customer Story

People don’t care how much you know until they know how much you care. Teddy Roosevelt.

This says it all.

She told a story about setting up cable and had to provide a password to the rep and the password was Time Warner Sucks, and the answer was: wow I’m surprised that password was available.

Your customer’s story IS your story.

Also, your customer experience will never be better than your employee experience.

Tracking voice of employee data is as important to your success as tracking voice of employees.

She polled audience on whether people are doing this, and more than half said they weren’t doing this.

Opra:

I’ve talked to nearly 30k on this show and everyone wants validation.

People need to know that they’e seen and heard.

Validate people and make sure they know what they say matters to you.

===

P in SUPER

Personalize.

Like Journey says: Any way you need it, that’s the way you want it.

Superfandom is a 2 way street.

You need to connect your story to their story.

Taylor Swift is great at this.

Her big goal was for her debut album to go gold.

So she knew that she needed to connect her story to the stories of 500k people.

All of us need to create and share stories that connect to the stories of others.

High Tech Enables High Touch – this is an example of Civic, one if the lenders in the room .

Embracing automation to personalize at scale gives you more human high-touch time to cover things you can’t automate.

They have 94% adoption rate of Total Expert, and journey open rates up to 40%.

===

E in SUPER

Exceed expectations.

Book on the Platinum Rule: Treat Others The Way THEY Want To Be Treated.

86% of customers are willing to pay more for a great customer experience.

She then said this to bring some context about personalization:

“It doesn’t matter how great the steak is if Julian told you he wanted tofu.”

This is EPIC because last night at the party, Brittany asked me for a keyword for her to work into her presentation.

I sent her this: see if you can work TOFU into your talk. It can reference top of the funnel, but this crowd thinks the funnel is dead because the data/insights/action flywheel with customer at center has replaced it. So you can also just to a random health food reference.

She didn’t get this text until 6:30am this morning, and she worked it in seamlessly.

This is deep. She’s VERY good.

Last note in this section: she said everything is experience.

Having experienced how she creates experience first hand as part of this talk, I’m on board with this message.

===

R in SUPER

Repetition makes this all come together.

===

She did a segment on Chewy brand because it’s all about pet stories.

She told a story about ordering prescription dog food.

They required a prescription after the order to be uploaded.

They responded with a personal note in minutes talking about her dog’s name.

How?

Because someone read the prescription to find out her dog’s name.

Then she replied to say thanks, and was asked to upload a pic to become a VIP – very important paw.

And signed off the email with “over and snout” or “Chow.”

These things are what make a brand.

Later she looked at their site and they were very open about making customer experience their North Star.

They send out handwritten notes to their customers.

They had pictures of her dog painted and sent to her house.

This is truly special.

And it’s not lost on me that in telling this story, she’s being the influencer for Chewy right now simply because they impressed her and engaged with her in a special way.

Talking about a brand she’s a superfan of is a great way to bring home her superfan talk.

Great talk.

Hope this recap helps.

The Financial Marketers Dilemma: Personalization vs. Privacy

This is a great topic with Josh Lehr of Total Expert and Taylor Donnell, VP Partnerships at Jebbit

It is indeed a dilemma to find the balance of personalization and privacy.

They kicked off with some key stats.

79% of consumers worried about data security

55% of people are taking time to understand how their data is being used

What are consumers doing with this data?

41% of people are disabling cookies in their browser

1 in 10 consumers are installing ad blocking apps

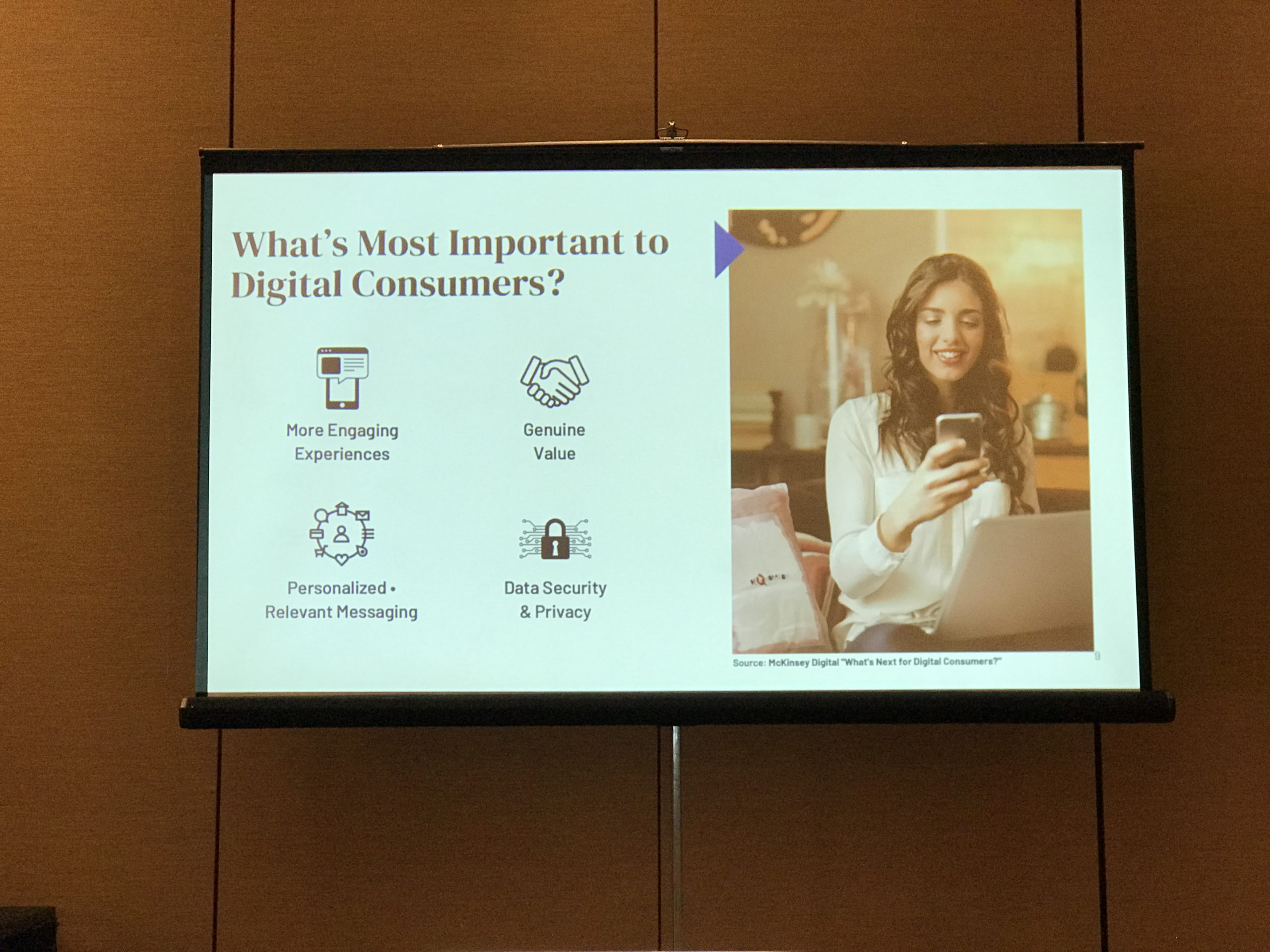

Also here’s what a McKinsey study revealed that’s most important to consumers:

===

The Good News

64% of people are willing to share personal data to get more relevant, personalized servives

44% of consumers trust financial firms with their data — this is high compared to other industries

===

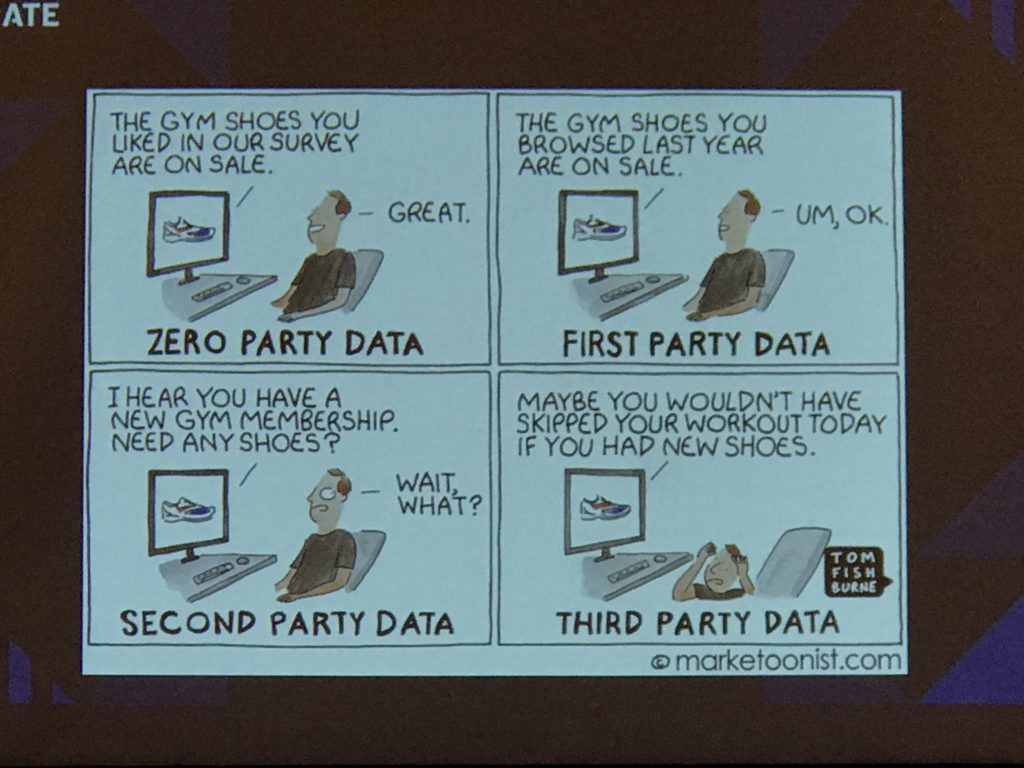

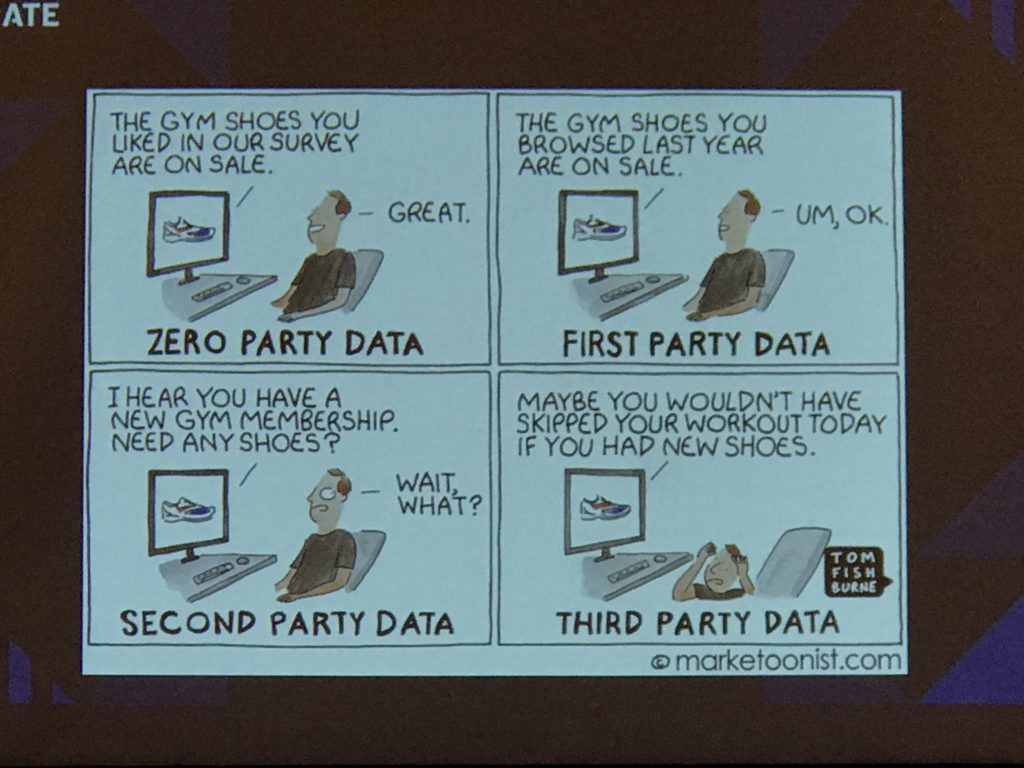

The Concept of Zero Party Data

Data that a customer intentionally and proactively shares with a business which includes personal preferences, purchase intentions, personal context, and how they want to be interacted with.

Josh gave an example of how people have trouble making decisions when online shopping.

How do orgs deal with this?

They can do quick-hit mini surveys for you to get at your intent and needs.

But this cartoon gets at the line of how it can go from personal to creepy.

===

So how do you get zero party data without being creepy.

There are 6 ways to do this:

1. Give me a recommendation

2. Save me time

3. Test me

4. Unlock a benefit for me

5. Teach me

6. Entertain me

You can build your marketing tactics around all of these things.

Stitch Fix is a good example of where they need all your measurements and personal information to send you clothes that are suited to you.

But this applies extremely well to banking and lending as well.

But you have to stick with making sure it serves them and not your brand.

Here are 6 ways to get zero party data:

1. Existing customers

2. On your site

3. Social

4. In Store

5. Search

6. Paid media

===

What Can You Do With Zero Party Data?

First you collect it. Notes on that above.

Then you need to connect it to your machine — like Total Expert for example.

Then you need to activate it from there

Data/insights/action is the cycle.

You can create the journeys and the outreach which marketers are all good at by now.

But the zero party data is what makes the action/activate part of the cycle more special now.

===

How Does This Apply In Financial Services

First Republic Bank (my bank!) actually used a data privacy study to educate customers on goals.

Here was the results:

59% engagement rate

83% completion rate

48% scanned to download app

1:04 average engagement – this is high online

Personal note: I don’t remember getting this promo from my bank, lol!

But it did drive killer education/engagement (and downloads!) for First Republic.

===

Dos and Don’ts For Zero Party Data

DO

Develop activation plan to inform marketing messages/journeys

Pair with 1st party data in CRM

Continue to collect/refresh to drive LTV

DON’T

Collect without delivering genuine value

Expect traditional surveys to enable you to collect zero party data at scale

Innovators Panel To Close Out Total Expert Accelerate – On Bank Branding & Vision Embedded In Your Marketing

This panel led by Total Expert CEO Joe Welu features these three execs:

Dan Catinella, Chief Digital Officer, Finance of America Mortgage

James Robert Lay, Best-Selling Author, Digital Growth Institute

Hunter Young, Founder, President, HIFI Agency

You know Dan from my Cobra Kai image above!

He’s kicking off by talking about loan servicing.

Finance of America didn’t serve loans until the pandemic started servicing loans.

Retention rates were hovering around the industry averages at the time (which were about 18% per Black Knight).

They rolled out SalesBoomerang to help with credit triggers and other signals to keep borrowers.

Insights come in, and those go to LOs who can then reach out.

Now retention is 60%!

The industry is now at 28%.

So Finance of America is tracking double the rate of industry retention.

===

James Robert Lay is a banking consultant.

Joe asked him how purpose powers future growth.

Purpose is going beyond what you do, and getting into the what and how you do and, critically, the who you do it for.

Toms Shoes is a good example where you buy one and give one.

In financial services, Aspiration is a neobank that ties banking to core social issues like climate change.

This brand is totally build around purpose.

They’ll attract some and repel others.

But they’re not a commoditized banking firm.

===

Joe asked Hunter about how you know if value is being created with your marketing campaigns.

Not every org can start with a clean slate like Aspiration.

They have legacy issues to deal with.

And even the idea of the campaign can be legacy based.

We have our annual calendars of things we promote year over year.

But what if you re-thought that whole thing.

It should all be based on customer behavior and engaging them on their goals.

This redefines the whole way in which you view campaigns and the content of those campaigns.

The top challenge is to go away from basic campaigning to custom, individual customer campaigning.

The tech has a lot to do with enabling it.

But also it requires culture change inside the banks and lenders.

Example: The Birthday Email

A lot of people have built a lot of business off the birthday email.

Yes, you’re driving business by being relevant to them, but is that as far as you want to take it?

When you think about how far you can take it from this, it’s just the beginning.

All the data you have on customers means you can come at them and show you know about them in countless other ways.

===

James Robert Lay

He jumped in on the above topic and pointed out that perfection is the enemy of progress.

We stick with birthday emails because they’re easy and we can’t go beyond that.

But you don’t have to build 100 new campaigns.

Just do one and see if it works as well as basic birthday check ins.

Joe noted that not going forward can also be because of a tech limitation inside banks.

But you can use your marketing platform to be nimble without redoing your tech stack!

===

Next, Joe asked Dan about changing behavior among loan officers and employees overall.

Dan talked about changing LOs from salespeople to advisors.

Advisory takes time, and so we’re getting more traction on people being open to automation of their marketing.

Example: a credit trigger comes in and you have to move fast to capture/retain that customer.

LO will get a trigger for this, and if they don’t respond, they are held accountable.

This is part of culture Dan is driving so the company can help generate leads but the LOs must be on it — even if they’re sourcing their own business as retail LOs.

==

James Robert Lay says a majority of tech transformation projects fail not because of the tech but because of the people and the adoption.

The 3 human fears cause this: Change, Failure, Unknown

Transformation comes from telling the truth.

If you guys want to get better at transformation, you need to change your org.

All the ROI they expect from spending and campaigns means nothing if you don’t get the transformation right.

===

Bill Dallas, president of Finance of America, asked about transforming from product centric to consumer centric.

Hunter said consumer centric is all about being able to measure ROI.

And to do this, you have to get great at marketing analytics and attribution or you’re never going to get anywhere.

===

Dan fielded a question from a new Total Expert customer about how go get 300 loan officers to adopt as fast as possible.

Training team is the key here.

Need to get top producers and influential loan officers on the platform and evangelizing.

Joe pointed out that just logging into the system as a metric isn’t a good adoption metric.

Instead, it’s all about deal and lead flow.

That’s the adoption goal.

===

I asked Dan how they’re holding them accountable, and he said it’s a huge shift.

They’re not spending a huge amount of time in Total Expert.

Instead it’s Total Expert feeding loan officers tasks to do, and that’s much more pragmatic.

Majority of time is spend in loan origination systems, structuring and quoting deals.

So in a way Total Expert is the invisible machine that’s feeding them tasks and that’s how you’re creating accountability while rewarding your salesforce with real deals.

===

Hunter gave a plug to the importance of zero party data covered by Josh earlier.

Key note I didn’t make in that post:

This is a new approach to voice of customer — by directly surveying them about intent instead of assuming you know based on data you have on them.

Total Expert has this feature called TrueIntent that does this in real time and at the individual customer level.

This is a huge breakthrough, and it’s something I did in my session — which I haven’t blogged yet. I can live blog with the best of them, but I haven’t figured out how to liveblog my own sessions, lol!

But I’ll come back and do that later.

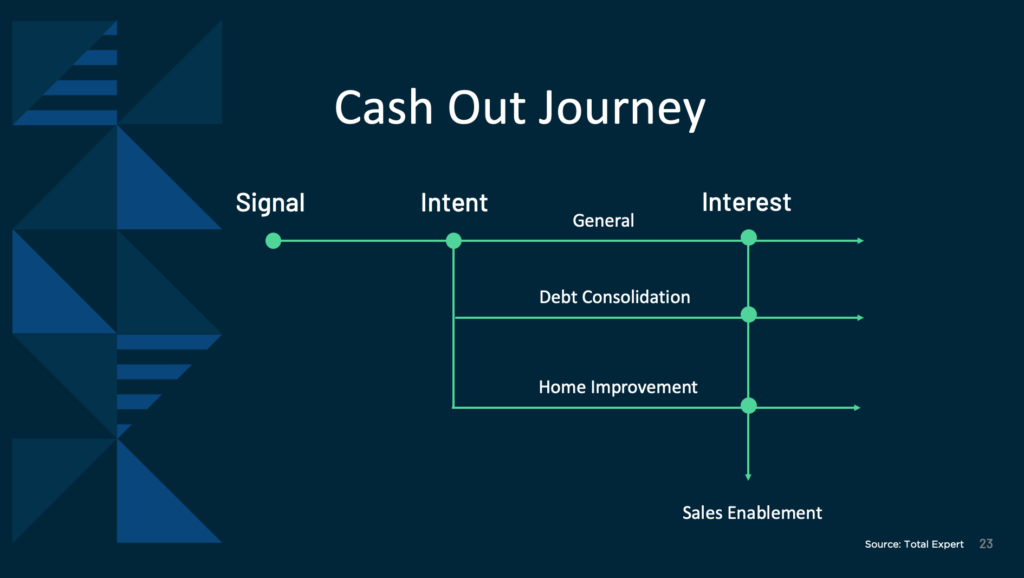

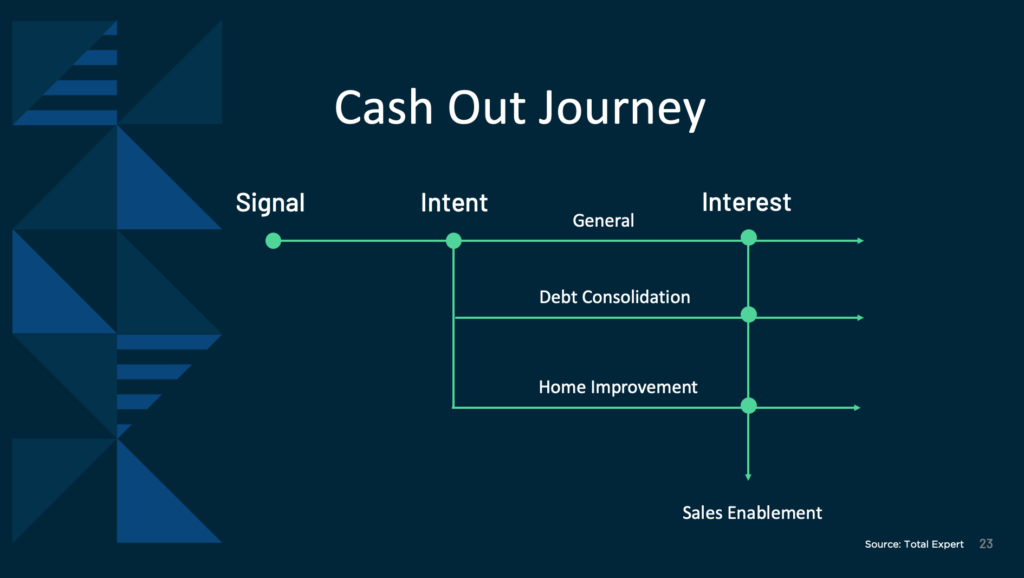

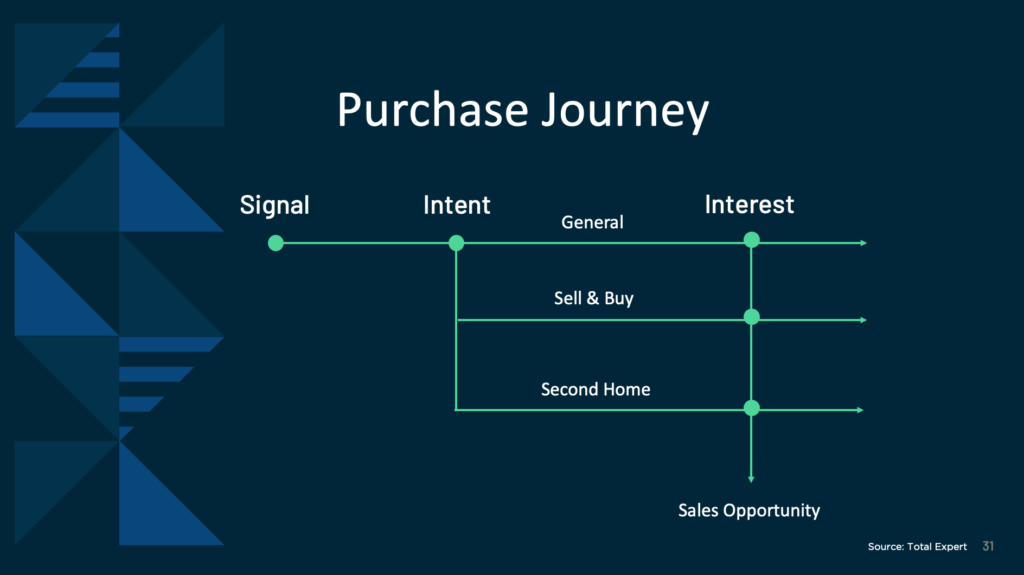

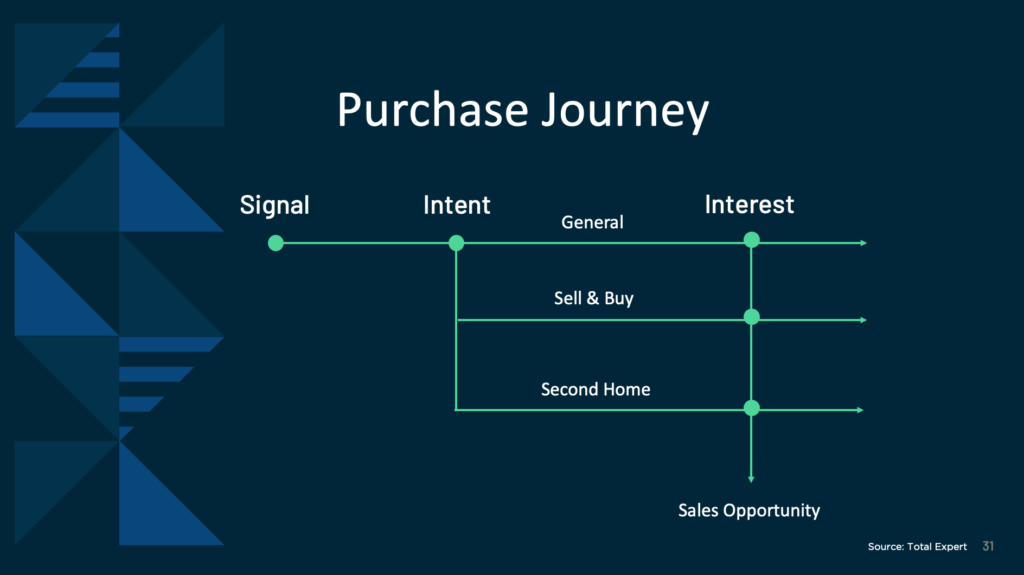

4 Bank & Lender Customer Retention Playbooks For 2022 – The Basis Point’s Julian Hebron & Total Expert’s Alec Catsuros

As noted above, I’m only now getting to a quick hit post on my Total Expert Accelerate session with Alec Catsuros.

We did 4 Bank & Lender Customer Retention Playbooks For 2022

The 4 playbooks were as follows:

– The Golden Age of Debt Consolidation Cash Out Refi Mortgages

– Home Improvement Cash Out Refi Mortgages In A Time Of Record Home Equity

– Trade Up Homebuyers In A Market Defined By Bidding Wars

– Second Home & Investment Property Buying In The Remote Work Era

Alec kicked us off with a tutorial on capturing borrower customer intent instead of just assuming — like me, a data geek always does — that borrowing consumers know what’s up current market trends.

He’s Total Expert’s scientist on marrying the stuff I do best — smart marketing messages with the right market timing to educate consumers — with the stuff he does best: making sure that consumers are on board with what you want to teach them.

He emphasized 3 points about this to the marketing pros in the room:

1. Start by listening to your consumers. Collect as much on-going information about changing needs of past customers as you can to trigger the orchestration of a new journey. This involves things like changes in their home equity, credit qualification, engagement with online assets, and listing behavior.

2. Use short, quick surveys to tell you more about the intent of customer and help you further personalize the journey. Imagine how much more impactful a journey could be if you paired the staged goals/desires of a customer with data on their financials.

3. Support your loan officers in targeting their past customer conversations when your marketing automation discovers signals and interest. Tasks generation and outcomes can be your best friend when targeted and actual action is taken.

===

Then I went through the latest customer retention data in the chart below.

Here are a few notes to describe this slide:

– Retention rates for lenders rose as high as the 50%+ range from 2008 to 2014

– But not because of tech advances

– It happened for two key reasons:

– (1) Less competition as many originators/servicers exited or failed during Great Recession

– (2) HARP and other streamline refis were easier to retain by servicers

– EOY 2020, lenders only retained 18% of all refinances, which is just 1 in 5 borrowers

– And it’s gotten a little better as of 2Q21 (now 28%), but this was largely driven by refinancing very recent vintages

– MORAL OF THE STORY: competition may always keep retention low

– Low customer retention consistent past few years & same from 2005-2007, before Great Recession

– Then and now, we have peak competition, with many more originators and servicers in the market.

– And now, there are 4 more reasons:

– (1) The rise of giant lead aggregators like LendingTree and Zillow makes it easier for borrowers to shop

– (2) Digital originations makes it faster for lenders to take in shoppers

– (3) One-stop shop models on lender side (Rocket) and real estate side (Opendoor, Redfin, etc.) are maturing/improving

– (4) Challenger banks are maturing – in 2Q alone, there were 88 fintech VC rounds of $100m+

===

Next up I ran down the 4 playbooks above with current data and slides.

I’ll spare all that here and just say this:

Refis go from $2.63 trillion last year to $649 billion next year.

That’s why cash out debt consolidation and cash out home improvement are the best playbooks for refis now.

Non-housing debt can be put into lower interest housing debt, credit scores are higher than ever, people are paying their loans more reliably than ever, and most important:

Tappable equity (meaning home equity that still leaves 20% equity left over after taking cash out) is $9.1 trillion in the U.S. right now.

Also people will spend $433 billion on home improvements this year.

So getting them that cash from home equity responsibly is the key.

===

On the purchase side, the market is steady.

American lenders funded $1.48 trillion in purchase loans last year.

They’ll fund $1.6 trillion in home purchase loans this year, and $1.73 trillion next year.

The trade up homebuyer benefits from a majority of home sales having bidding wars (now 58% of all deals).

But they also have to engage in these bidding wars as a buyer.

This is a lot of critical education all at once lenders must do or their clients will stray.

And in the work from home era, 55% of people want to work from home 3+ days per week which opens up the ability to buy homes elsewhere.

But they might do those as second homes or investment properties at first, then convert them to primary residences later when their employers confirm that long-term remote work is cool.

Again: lots of education and engagement is required here.

As is the need for measuring customer intent in real time.

===

Here’s how Alec broke down the playbooks from a marketing automation execution standpoint.

Please reach out to discuss this with me or Alec, and I’d be happy to run it down with you!

The Journey Begins At Departure – When One Customer Engagement Event Ends Another Begins

In this last post of The Basis Point’s live blog of Total Expert Accelerate, let’s start with the last gift in the journey gift box we all got. See image above for contents and message.

I just got back home to San Francisco and gave the goodies to my son.

Why? Because, like Peloton zealots talking about bikes they don’t ride, I’m your annoying friend who doesn’t eat sugar or carbs right now.

But my kid loved the snacks.

And I loved the gesture as I’ve noted in previous live blog posts about the gifts.

We spent two days and nights talking about bringing a human element to digital personalization, and doing it in an automated yet bespoke targeted way.

This is way hard for banks and lenders.

But I’d argue it’s WAY harder to bring that same human element to a scale physical event.

And when teams do pull it off, I bow deeply in respect.

Just like the card from our gift pack says in the image above:

“Even though the event is over, we’re excited to continue the journey with you.”

Cheers to that.

And cheers to this ridiculously talented Total Expert marketing team who put this whole thing together.

Marketers who can win over other marketers are total experts indeed.

Here are a few shout outs to the Total Expert Accelerate marketing team (there are so many more across the whole company so I’m sorry if I’ve missed folks):

– Rebecca Martin, Chief Marketing Officer

– Traci Saliterman, Experiential Events Producer

– Meghan Williams, Events & Field Marketing Director

– Courtney Hieb, Senior Communications Manager

– Tori Judd, Senior Design Lead

– Bobbi Jo Dallas, Customer Experience Manager & Brand Ambassador

– Angela Higgins, Senior Director Marketing

– Becca Snee, Senior Customer Marketing Specialist

– Katie Hickman, Strategic Communication & Marketing Lead

– Chris Jopp, Filmmaker, Director, Cameraman, Editor

– Donnie Kenneth, Creative Director

– Hilary Mayer, Senior Product Marketing Manager

– Jon Oja, Product Marketing Manager

– Lisa Niva, Senior Partner & Field Marketing Events Specialist

– Maxwell Freudenthal, Multimedia Producer

Here’s a pic of me with a few of this crew as one part of the journey ended.

Now the next phase begins as all banks, lenders, and fintechs in attendance put this knowledge to work.

I hope this live blog helps you do that, even if you weren’t at the event.

Please come visit The Basis Point again soon…