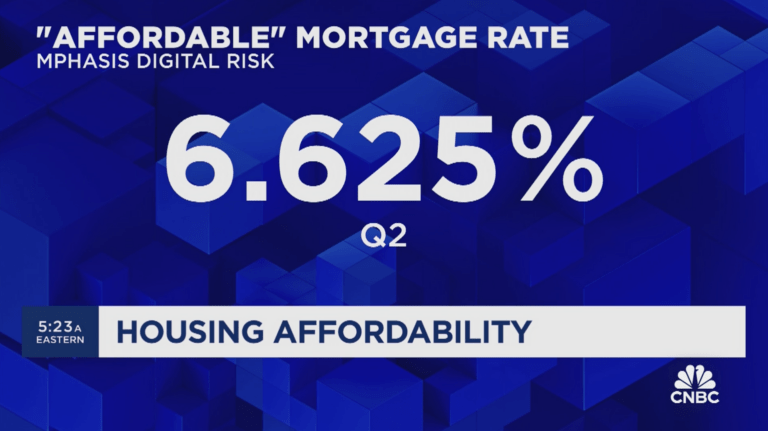

Why 6.625% Is An Affordable Mortgage Rate In 2024

Friend of The Basis Point and Mortgage Bankers Association (MBA) board member Jeff Taylor was just on CNBC talking about rates coming down from 7% now to 6% by year end. A key question from his discussion with anchor Frank Holland is whether 6.625% is an affordable mortgage rate in 2024. Let’s take a quick look.

Yes rates jumped up from 6.875% to 7.125% this week (per Mortgage News Daily) as January’s Core CPI inflation got stuck at 3.9% annualized, and the monthly figure rose from 0.3% to 0.4%.

Mortgage bonds sold sharply on that monthly inflation increase (it implies an annual rate of 4.8%), which is why mortgage rates spiked.

But this spike should prove short term. Inflation is moving down overall.

Accordingly, Jeff shared MBA’s projections for rates dropping in 2024 as follows:

6.9% for 1Q24

6.6% for 2Q24

6.3% for 2Q24

6.1% for 4Q24

This implies we’ll be at about 6.625% by the Spring homebuying season, which is 7 weeks away.

Spring 2024 homebuying season is looking the most positive since the COVID home price spike began in Spring 2020.

– Rates are down from their October 2023 peak of 8%, and as noted above, will likely be around 6.625% by April.

– Median existing home prices are down 7% from their June 2023 peak of $410,000 to $382,600.

-Median newly built home prices are down 17% from their October 2022 peak of $496,800 to $413,200.

– If we use 5% down at these prices and estimated 2Q rates of 6.625%, it takes between $102k (for existing home) to $109k (for newly built home) in household income to purchase at this price.

This is doable for millions of households.

MBA projects 3.68 million households will buy homes with financing this year.

And The Basis Point calculation above of income needed to buy with 5% down accounts for a household that already has $600/mo in non-housing debt bills. The calculation also uses an all-in monthly housing cost: principal and interest on the loan, plus property taxes, insurance, and mortgage insurance required when putting less than 20% down.

So while I get media must be provocative by putting “Affordable” in quotes to subtly imply homes aren’t affordable at 6.625%, CNBC’s on-screen graphic editors are wrong on this one.

Mortgage rates at 6.625% this Spring are affordable, as the math above shows.

The decision for you as a homebuyer is timing.

You can be sure home prices will start rising again if rates do indeed drop all the way to 6% by year-end.

The link to Jeff and Frank’s conversation on CNBC is below.

Chime in with any questions.

Mortgage rates spiked this week as inflation ticked up. But here's the case for mid-6% rates by Spring and math on why this is affordable.

___

Check It Out:

– Mortgage bond market will rally well before the Fed cuts rates, says Jeff Taylor