Why are people so pissed about all things money & economy?

This month, Gallup surveyed Americans on 5 economic measures, and in all cases, we think things will get worse rather than better in 2023. Why is this?

Here’s a look at how negative people are about 5 economic outlooks:

– 67% expect inflation to rise by summer

– Record-high 48% say stock market will decline by summer

– 41% think unemployment will rise from record lows by summer

– 43% think economic growth (GDP) will decline by summer

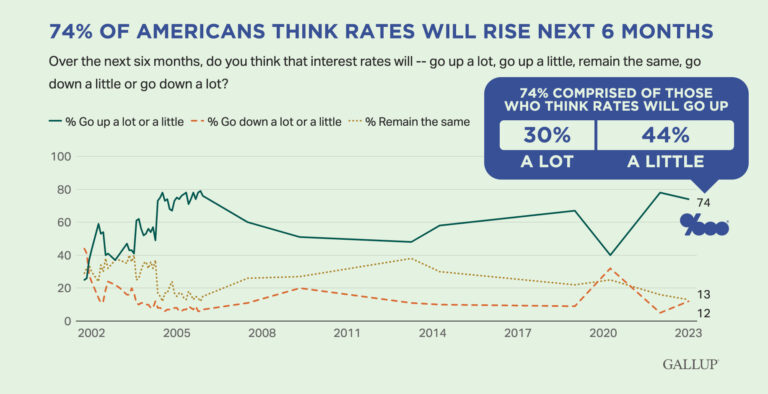

– 74% predict interest rate hikes in 2023, essentially unchanged from 2022

What frustrates me is that these sentiments conflict with each other.

Rates would drop, not rise, if the economy had slower or negative economic growth plus rising unemployment plus a declining stock market.

Why? Because when the economy cools, people do in fact lose their jobs, and stocks sell. Those three sentiments align. But what also happens is investors buy safer bonds in a market like this. And rates fall when bond prices rise on a buying rally. Also, inflation would typically cool in a slower economy.

Yup, I get some of you read that last sentence and think: “Yea, but stagflation.”

Sure, anything is possible. And when enough people think certain outcomes will happen, they can happen.

That’s why the Fed has repeatedly talked about holding short-term rates higher for longer to squash inflation before people just think that’s the way it’s going to be.

If any economic sentiment prevails, it can become self-fulfilling.

Life and work is hard, and sadly, we do often give in to our worst thoughts. That’s why I think people are across the board negative on all these measures, even if it’s not fully feasible economically.

I have no solution for this, I’m just expressing frustration about conflicting sentiments.

Not every economic measure can be demise. There are always upsides.

Two sides of every sentiment and every trade. That’s how markets work.

In any case, inflation is moderating — albeit slowly — as the Fed does its thankless job, and this could help rates drop between now and summer (but note a Basis Point reader added a key caveat to this in comments below).

And maybe that’ll give us some positivity for a brief spell in 2023, before we all start swallowing next year’s election message poison 24/7.

___

Reference:

– Americans Pessimistic About Inflation, Stock Market

– Tips for picking your career poison in our 25/8 work-life culture