Will hotter early-2023 inflation push mortgage rates back up to 7%?

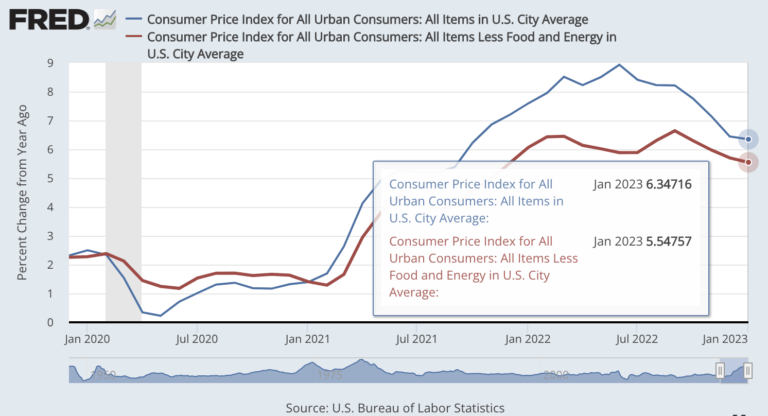

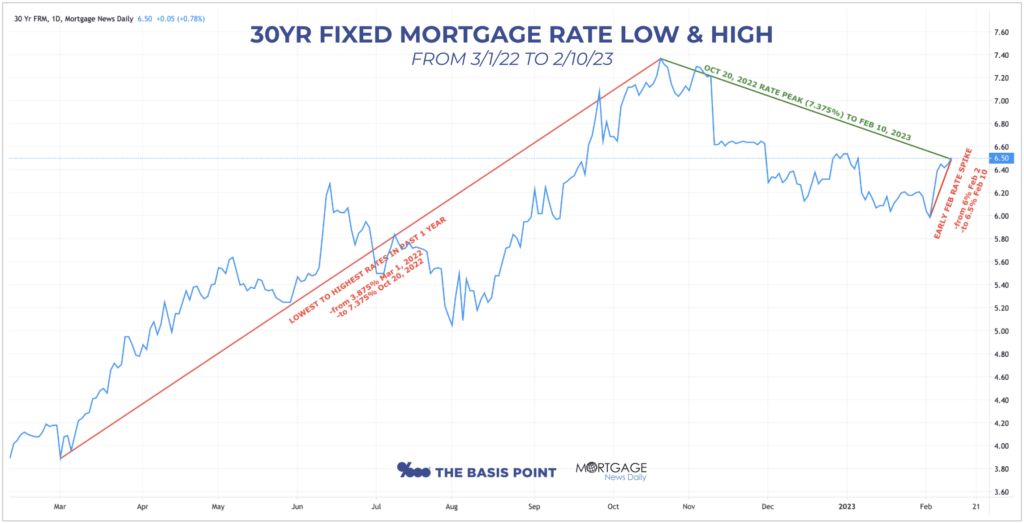

Going into last weekend on February 10, I noted how rates rose from 6% to 6.5% in February alone, and today’s hotter January CPI inflation report doesn’t help the case. If today’s mortgage bond selloff holds following January’s 6.4% headline CPI inflation and 5.6% Core inflation (excluding food and energy), mortgage rates would end up between 6.625% and 6.75%.

Today’s inflation report wasn’t a horrible surprise, but it was just 10 basis points lower than December CPI inflation for both the headline and Core numbers. The reason mortgage markets are selling is because inflation erodes future returns for bond investors. And rates rise when bond prices drop in a selloff.

As for home buying and selling strategy, I offered 3 tips for you all in a post yesterday (linked below). That post has some good notes for you, and the primary takeaway is that the housing market isn’t crashing.

It’s also worth noting that inflation, while dropping just slightly in January, isn’t increasing. So we’re generally moving — albeit slowly — in the right direction.

You can never say mortgage rates won’t hit 7% again, but if inflation keeps trending down — even at this slow December-to-January pace — that’s still the right direction, and would hopefully keep mortgage rates from spiking too much more.

That’s why the home buyer and seller tips post is worth reading. Unless you just want to bury your head in the snow for the rest of winter. Not wise if you have a life reason to buy or sell now. There are ways to make smart deals now near-term, as that post describes.

And here’s the rate trend chart I shared Friday which is worth revisiting for perspective.

The next big inflation report is the Fed’s preferred inflation measure Personal Consumption Expenditures Index (PCE inflation) on February 24.

Please comment below or reach out with questions.

___

Reference:

– 3 home buyer & seller tips in a 2023 market that’s declining but not crashing

– Why mortgage rates spiked from 6% to 6.5% early-February 2023