Why Business Insider is wrong to say first time homebuyers are ‘royally screwed’

Business Insider (BI) pushed their First Time Homebuyers Are ‘Royally Screwed’ headline hard the past 10 days. It’s a master class in alarmist but clickable headline writing, which BI mastered long ago. But the headline is wrong and irresponsible.

The headline’s catchphrase is a quote from one 29 year old homebuyer interviewed for the story who’s really feeling this challenging moment in the housing cycle. That’s one out of 5.73 million opinions from those who bought homes last year.

However, the story contains 5 useful charts BI constructed very well from a recent National Association of Realtors (NAR) report on home buyer and seller trends for 2022. I’m adding comments to each of those five charts are below, as well as adding a link to the report and the BI story.

If you’re a homebuyer, don’t forget:

– Buying a home is the biggest investment you and most people will ever make. Of course it’s challenging.

– The 2022 period was one of the most challenging parts of the real estate cycle in decades with a 3%+ rate spike immediately after home prices rose 41% over the previous 2 years due to record low rates.

– But now existing home prices (which account for 87% of all home sales) are already down 11% from their July 2022 peak. The median price per NAR was $413,800 in July 2022, and was $366,900 in December 2022.

– Also rates are already down more than 1% from their October 20, 2022 peak of 7.375%. Rates will continue to moderate as the Fed fights inflation.

And now the charts:

===

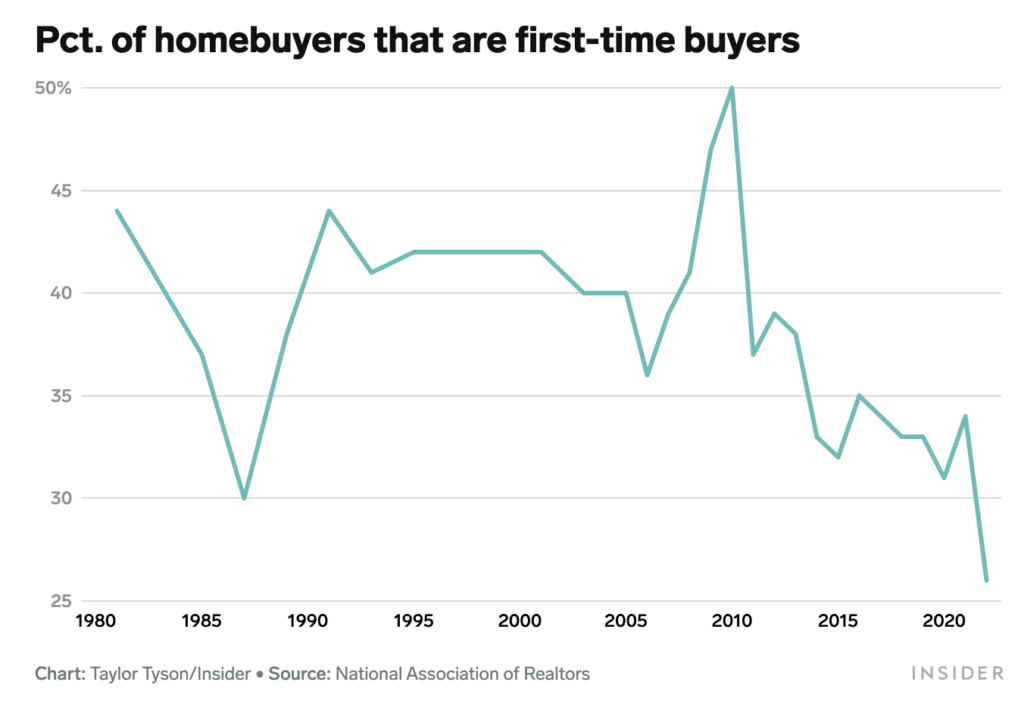

FIRST TIME HOMEBUYER CHART 1:

First-time homebuyers were 36 years old in 2022, the highest median age since NAR began this study in 1981. This comes after a period of record home prices, which as noted above, are now coming down.

===

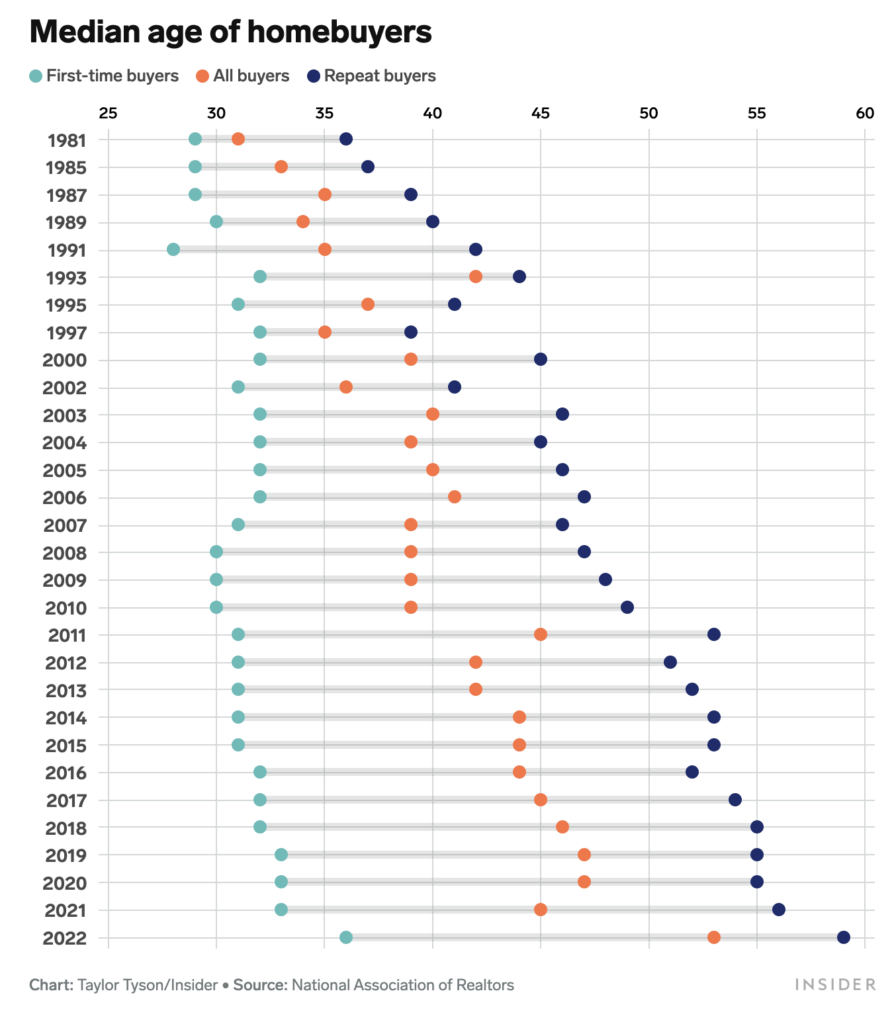

FIRST TIME HOMEBUYER CHART 2:

First time homebuyer median age was 29 in 1981, 30 in 2010, and 36 in 2022. This jump in 2022 has a lot to do with home prices rising 41% during the pandemic period.

===

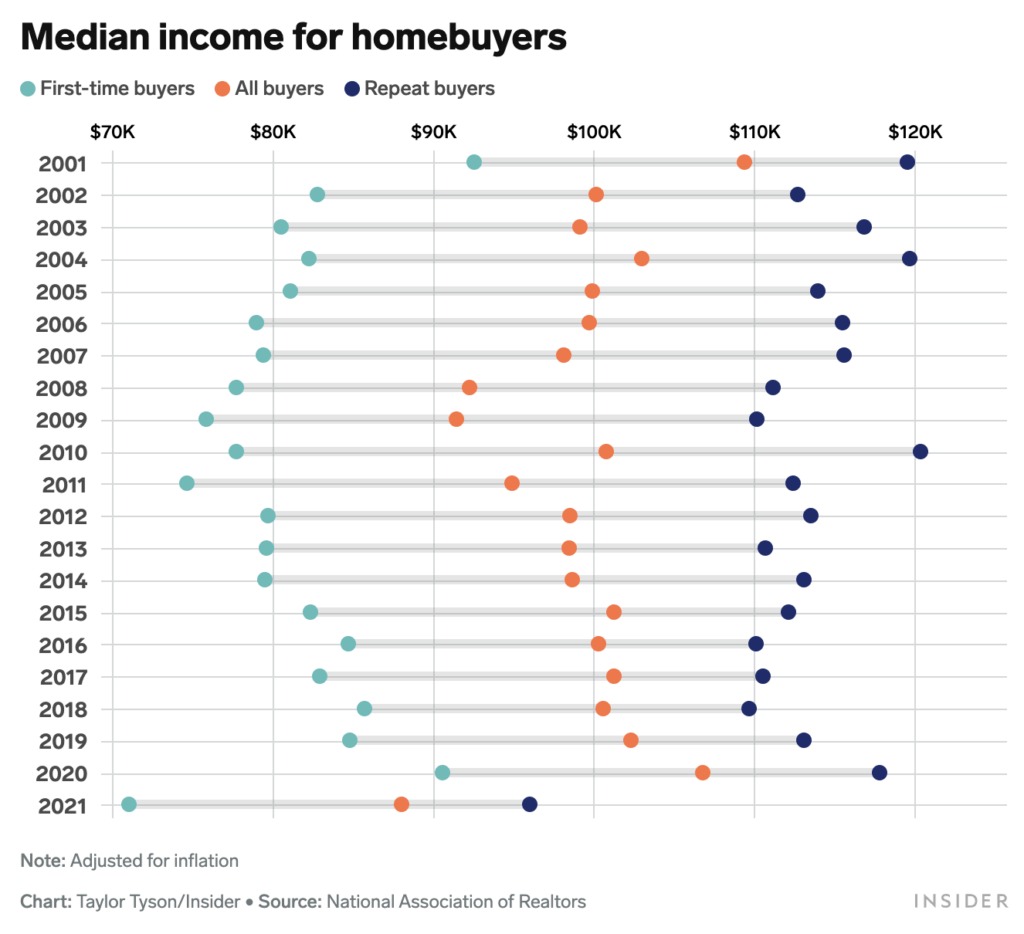

FIRST TIME HOMEBUYER CHART 3:

Median income for first time homebuyers was $70.1k in 2021 and $90.5k in 2021. Based on today’s median existing home price of $366,900, you’d need $91k to buy it with 10% down if you had $600 in bills for non-housing debt (like credit cards, student loans, car loans). If you don’t have these non-housing debts, you’d need $71k to make this 10% down purchase. And lenders would approve you for either of these scenarios. You need to talk to a lender — not consult headlines — to see how this kind of math works for you.

===

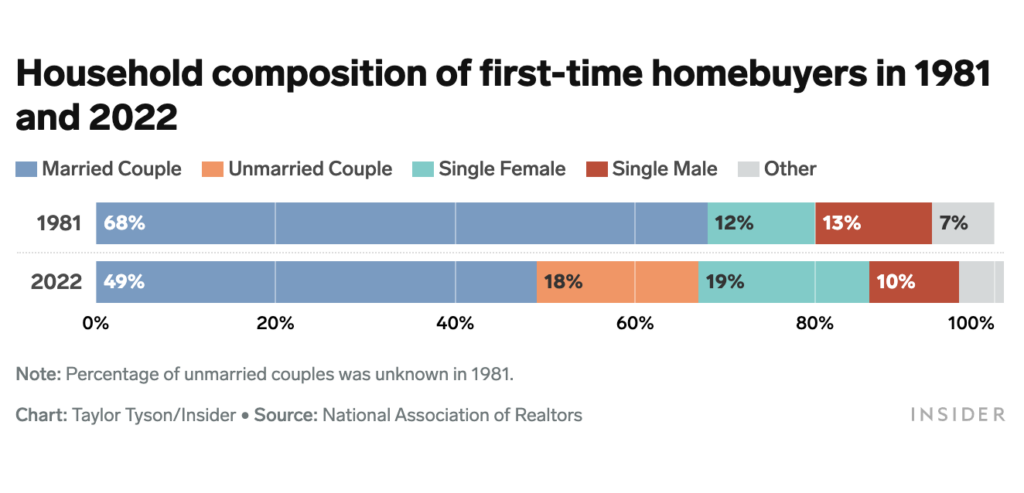

FIRST TIME HOMEBUYER CHART 4:

As for the percent of couples buying homes together, there’s no trend change from 1981 (68%) to 2022 (67%). The difference, which is more societal than economic, is that now there are more unmarried couples buying together. Lenders don’t care whether you’re married or not, it’s only about combined debt-to-income (DTI) ratios. Which is just a fancy way of saying lenders qualify borrowers by looking at housing and non-housing monthly debt as a percentage of your income. The stated Federal loan approval rule says lenders can approve loans up to a 43% DTI, but there are exceptions to this. Also notable in this chart: a growing trend of single buyers who are women.

===

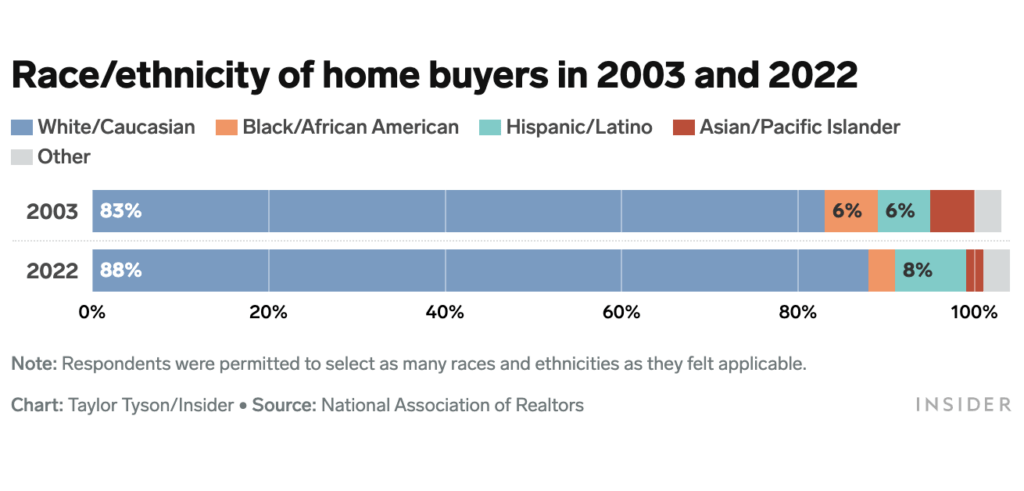

FIRST TIME HOMEBUYER CHART 5:

This unchanged trend sucks. I recently wrote about how Wells Fargo is refocusing it’s mortgage business on minority communities. They’re America’s top mortgage servicer and third largest mortgage lender, so I hope this has some market impact and influences other lenders to do the same.

===

To all you homebuyers, stay strong out there, stay tuned to The Basis Point to zoom in on trends that actually help you, and please reach out or comment with questions.

And to BI, great job on the charts. And I get the headline game, but don’t be irresponsible.

___

Reference:

– First Time Homebuyers Are “Royally Screwed” (BusinessInsider)

– Highlights from NAR’s 2022 Home Buyer & Seller Profile Report