Why mortgage rates spiked from 6% to 6.5% early-February 2023 & what’s next

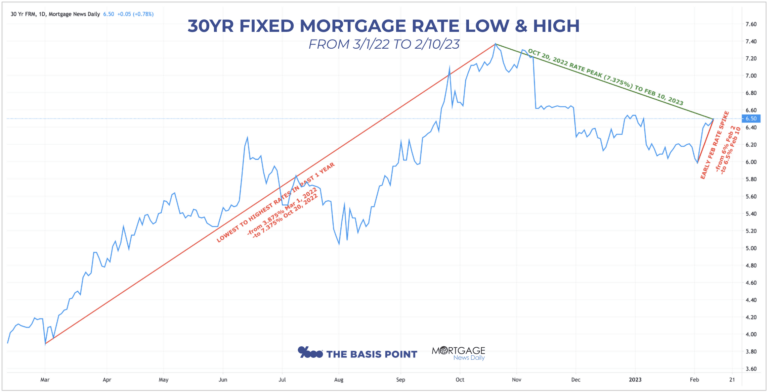

Mortgage rates came down significantly from their 7.375% peak October 20, 2022 to a 2023 low of 6% on February 2, 2023. But by February 10, mortgage rates jumped to 6.5%. Here’s why…

While the Fed’s hiking of overnight bank-to-bank lending rates to squash inflation created tons of RATES RISING! headlines in the final two months of 2022, the opposite began happening in mortgage rates.

The reason is mortgage rates fall when bond prices rise (and vice versa). So as mortgage bond investors saw the Fed’s commitment to squashing inflation by hiking short-term rates, they bought longer-term mortgage bonds from October through January.

This buying drives mortgage bond prices up and mortgage rates down.

But so far in February, this bond sentiment changed, as Mortgage News Daily’s Matt Graham explains:

[The rate drop] began in October when rates hit decades-long highs and finally began to make progress back toward lower levels. Inflation had been a pivotal component of the surge and inflation reports were starting to moderate in November and December.

[But] by falling as much as they had, [rates] were already playing a dangerous game of chicken with the Federal Reserve. The [mortgage bond] market had been betting that the Fed would be forced to cut short-term rates by the end of 2023 even though Fed members had repeatedly said rates wouldn’t top out for a few more months at minimum and then remain at the ceiling for a year or two. The market thought the Fed was bluffing or wrong. Either way, those defiant expectations helped mortgage rates hit 5 month lows last week.

Then Fed chair Jay Powell and FOMC voting member Christopher Waller reminded markets on February 7 and 8 that January’s super strong jobs report — +517k new jobs and crazy low 3.4% unemployment — meant inflation could remain persistent.

This is a big reason rates have spiked from 6% to 6.5% in early February.

The next critical rate catalyst will be the Valentine’s Day release of January CPI inflation this Tuesday.

December CPI inflation was 6.5%, down from a 9% peak in June 2022. If this holds steady or declines, mortgage rates could get a reprieve. But if CPI inflation goes higher, rates will surely follow.

Still, as you can see from the chart above, at 6.5% today, 30-year mortgage rates are almost 1% below the October 2022 peak.

And it’s flawed to hold out for rates returning to the 3% range like they were a year ago. Rates that low imply a weak economy, job losses, and less stability for your career.

Please comment here or reach out with questions.

___

Reference:

– Rates Played Chicken With The Fed and Lost (MND)

– Spirits up but so are rates as hot economy adds 517k new jobs with crazy low 3.4% unemployment

– Fed chair Powell says inflation is still a challenge they’re watching closely (CNBC)

– Fed Governor Christopher Waller warns that interest rates could go higher than expectations