Will coronavirus mortgage & eviction relief prevent a total meltdown like in 2008?

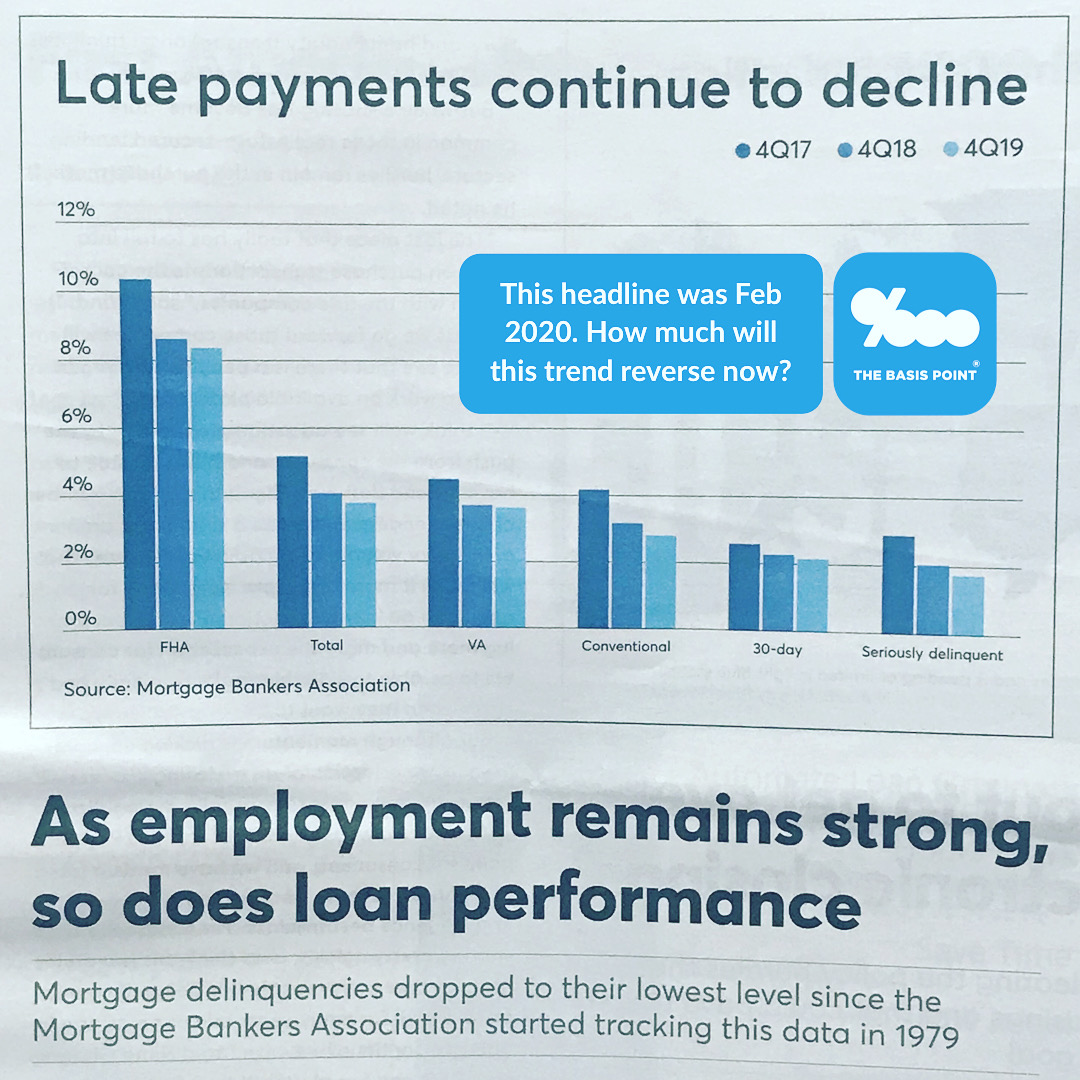

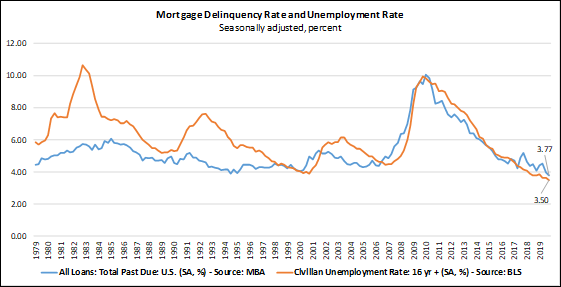

Everything has changed since this February National Mortgage News headline: As Unemployment Remains Strong, So Does Loan Performance. What happens to America’s 50-year lows in unemployment and 40-year lows in late mortgages after coronavirus? And most important, will coronavirus mortgage relief do a better job helping home owners and renters in 2020 than in 2018?

BRIEFING ON RECORD LOW UNEMPLOYMENT & LATE MORTGAGES

When 2020 started, the rate of late mortgage payments in America was the lowest since 1979. The MBA reported February 11, 2020 that only 3.77% of home loans had a late payment in 4Q 2019.

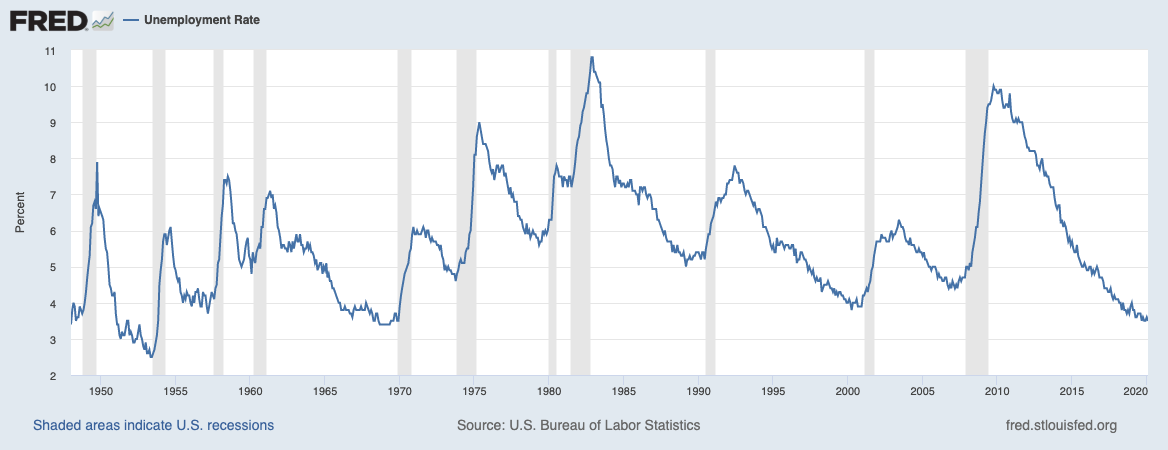

And February 2020, the American unemployment rate was 3.5%, the lowest since December 1969. Now some projections call for up to 3 million job losses between now and June 2020 alone. The highest single month of job loss in 2008 crisis was 800,000 in March 2009, and 6.9 million jobs lost September 2008 to December 2009.

Here’s a notable excerpt from CNBS’s roundup of projections as of March 20:

SurveyUSA indicated that 14 million people already have experienced temporary layoffs, while 2% of the workers have lost their jobs outright. A bright side: A Towers Watson survey said 52% of employers who experience a shutdown will continue to pay employees.

CORONAVIRUS MORTGAGE & EVICTION RELIEF TO PREVENT MELTDOWN

Another bright side is that we’re starting to get mass foreclosure and eviction relief to alleviate late payments and foreclosures.

Some ask: but what about renters?

This does impact renters.

Remember, landlords have mortgages to pay so it’s not just so simple as ordering landlords to let renters pause. The banks have to allow pausing of mortgage payments to help landlords help renters.

And that’s starting to happen.

Also the pausing of foreclosures is starting to happen.

This is critical because foreclosures displace renters, and lead to property price declines which cause more foreclosures and renter displacement.

This spirals fast.

In the 2008 crisis, the approach was to let people bleed out and apply over and over for mortgage aid.

Lender policy then was to advise people they couldn’t apply for aid until they started missing mortgage payments.

Sounds crazy but that’s what happened.

But it was a different kind of crisis. Home prices were artificially inflated, and loans were made without verifying borrowers’ ability to repay. So bad loans and overpriced homes were all hot potatoes.

Now the thesis is that this will be a temporary (albeit very severe) displacement so let’s try to provide a lifeline to as many in need as possible.

Hence the more up-front coronavirus mortgage relief that’s emerging.

More on these themes as we go forward and learn more in real time. In the meantime, here are some links on job loss, delinquency history, and mortgage relief.

Please reach out of you have thoughts, intel, and data on this matter.

___

Reference:

– As employment remains strong, so does mortgage loan performance

– Upcoming job losses will be unlike anything the US has ever seen

– Late mortgages at 40-yr low & unemployment at 50-yr low

– Fannie Mae, Freddie Mac, HUD Suspending All Foreclosures & Evictions

– Bank of America will allow borrowers to pause mortgage payments