7 charts on U.S. job security, income, homebuying over next 12 months

Fannie Mae just released August 2019 survey results showing how we feel about our job security, income prospects, and home buying plans in the next 12 months.

This is closely modeled after other prominent consumer sentiment surveys, but focuses more directly on housing and income.

Here’s which results and charts matter, and which to ignore.

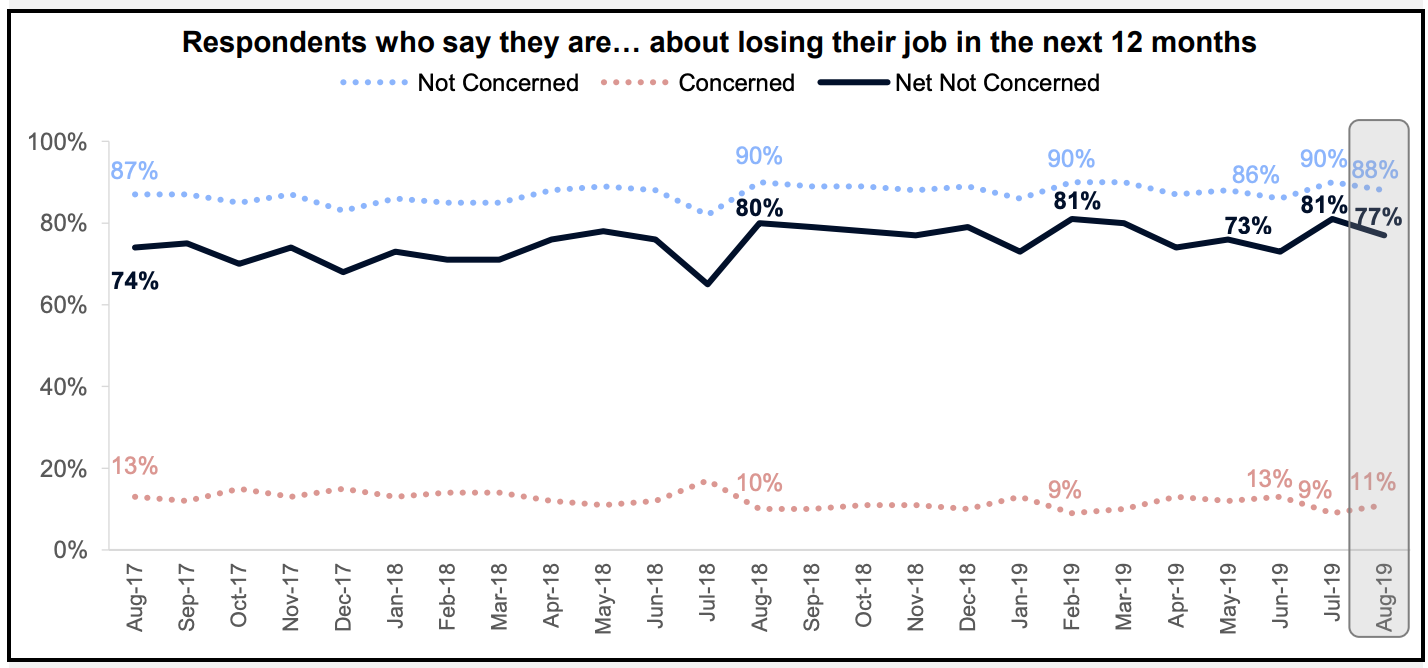

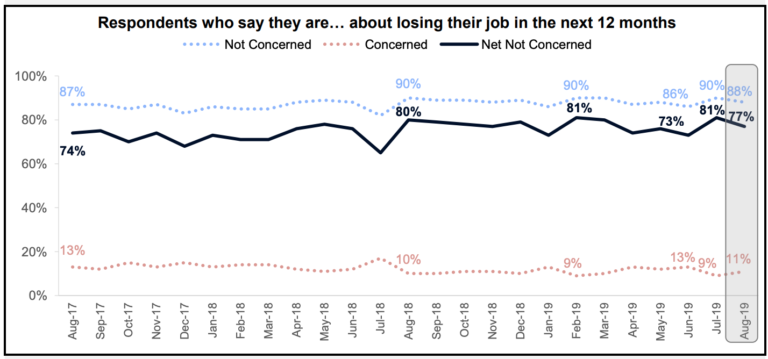

JOB SECURITY NEXT 12 MONTHS

– We feel very confident about our employment prospects.

– 88% of us say we’re not concerned about losing our job in the next 12 months.

– Only 11% of us are concerned about job loss a year out.

– A different part of this survey showed 50% feel the economy is on right track and 41% feel it’s on the wrong track. This is pure conjecture, so I don’t think it matters much.

– But 88% feeling good about their job security matters more because people have a good feel for how their companies and industries are doing.

– Here’s the chart, and note that the 77% is the net-not-concerned about job loss. It’s derived from subtracting 11% concerned from 88% not concerned.

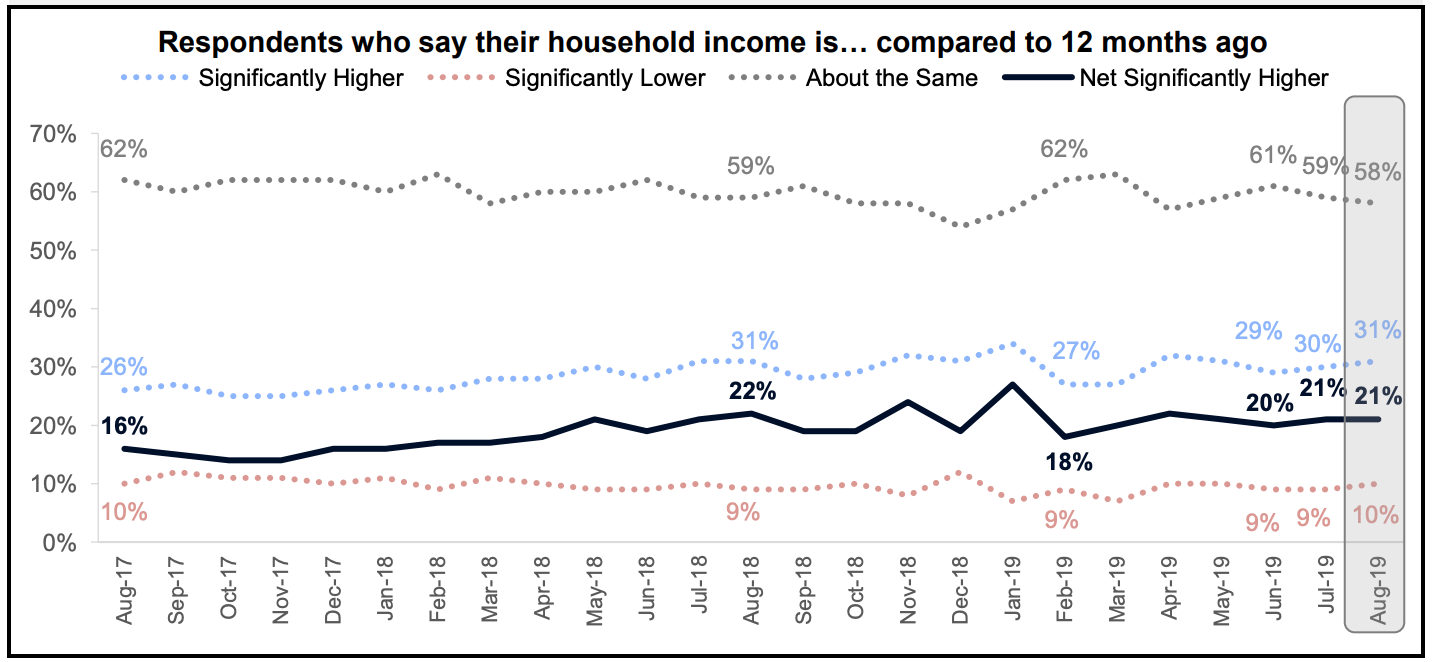

INCOME BETTER OR WORSE THAN 12 MONTHS AGO

– A majority of us (58%) are making the same money we were 12 months ago.

– Almost one-third of us (31%) feel our income is significantly higher.

– This is a positive note, and the stuff of rosy headlines. But survey respondents are just asked to check 1 of 3 boxes saying income is: significantly higher, significantly lower, about the same.

– So 31% feeling their incomes will be significantly higher sounds great on the surface. But “significantly higher” is subjective and we shouldn’t stretch to extrapolate economic trends from this.

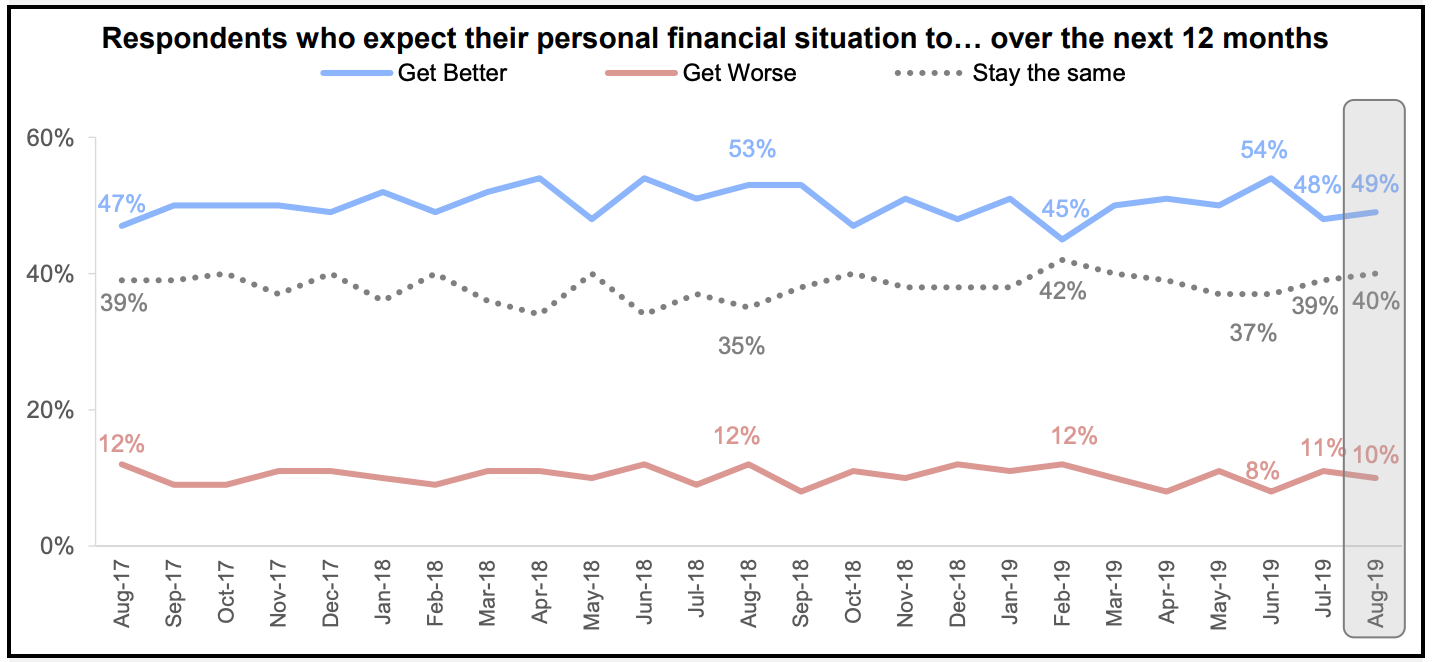

FINANCIAL SITUATION BETTER IN NEXT 12 MONTHS?

– About half (49%) of us think our financial situation will get better over the next 12 months.

– 40% of us think our financial situation will stay the same.

– And 10% of us think things will get worse.

– Tough to call relevance of this one.

– On the one hand, American Dreams and #hustle evangelism make everyone think we’re millionaires in the making.

– On the other hand, each person has a good feel for how things may play with their near-future job security and income goals.

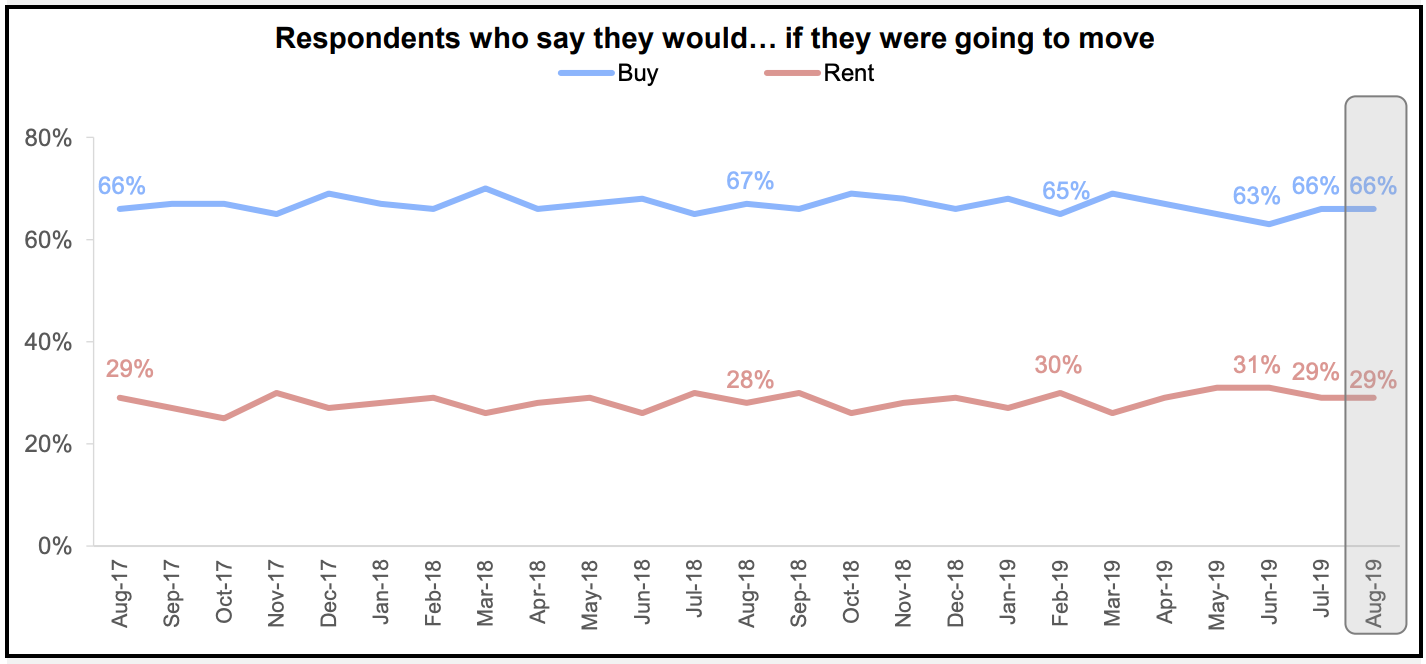

BUY OR RENT A HOME IF MOVING?

– Two-thirds (66%) of us say we’d buy a home if we’re going to move, and 29% said we’d rent.

– Going all the way back to when this monthly dataset began in June 2010, 66% of us on average have said we’d buy if we’re moving.

– This tracks pretty well with the national homeownership rate of 64.1% today and 64.8% on average from 2010-present.

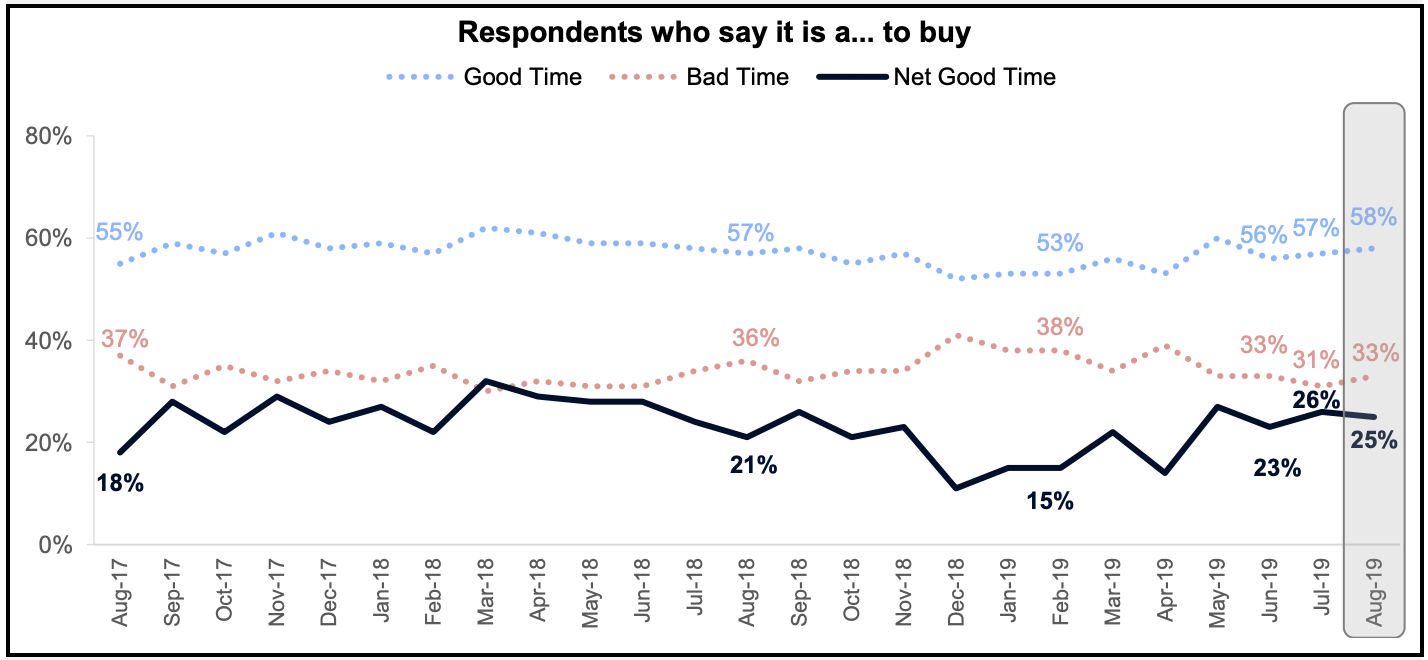

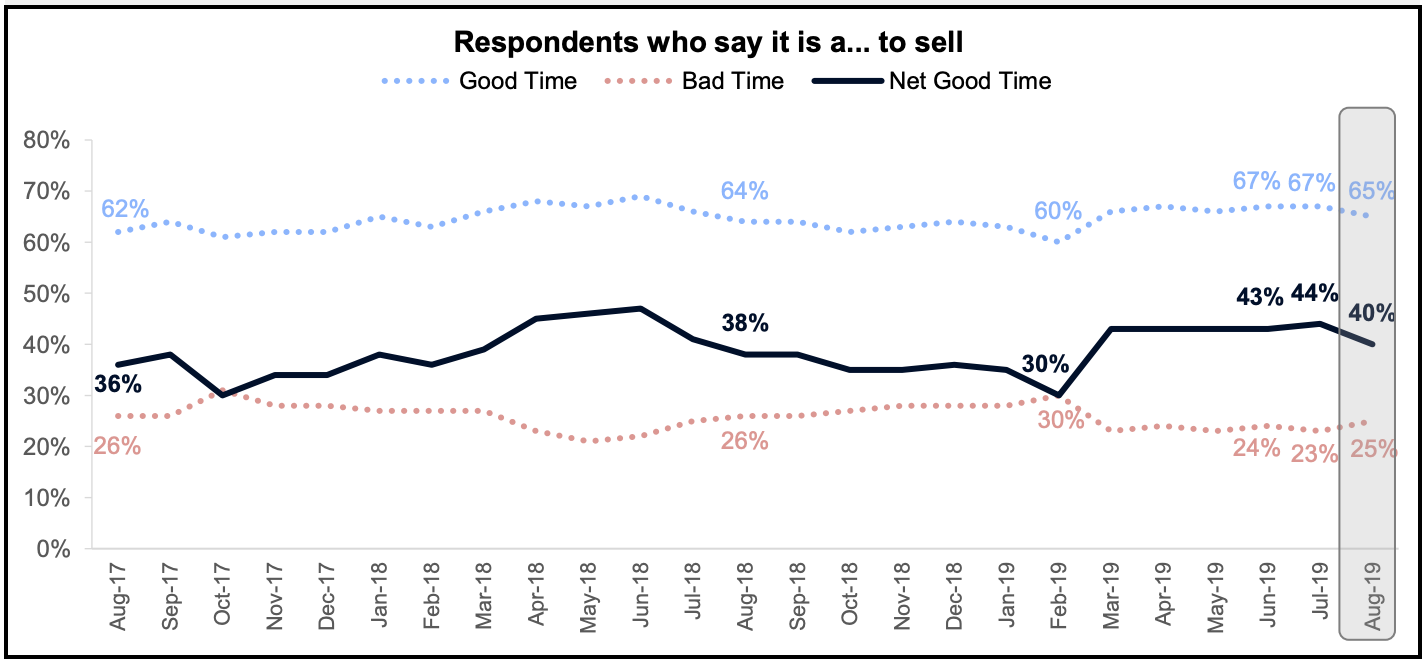

REALTOR JOB SECURITY: “IT’S A GOOD TIME TO BUY (OR SELL)!”

– Realtors repping buyers get job security by promoting it’s a good time to buy.

– Realtors repping sellers get job security by promoting it’s a good time to sell.

– I’m not saying this is the reason for a majority of us thinking it’s a good time to buy AND sell.

– But 58% of us think it’s a good time to buy and 65% of us think it’s a good time to sell!

– In all seriousness, this data gets more interesting when we average sentiment back to June 2010.

– Since then, 65% on average have said it’s a good time to buy a home. Pretty consistent homebuyer sentiment. Which again, tracks well with homebuyer and homeownership stats above.

– But only 41% on average have said it’s a good time to sell since 2010.

– The monthly percentages for those who thought it was a good time to sell were really low — between 8% and 21% — between June 2010 and December 2012.

– This was a period when home prices were still digging out from the crisis.

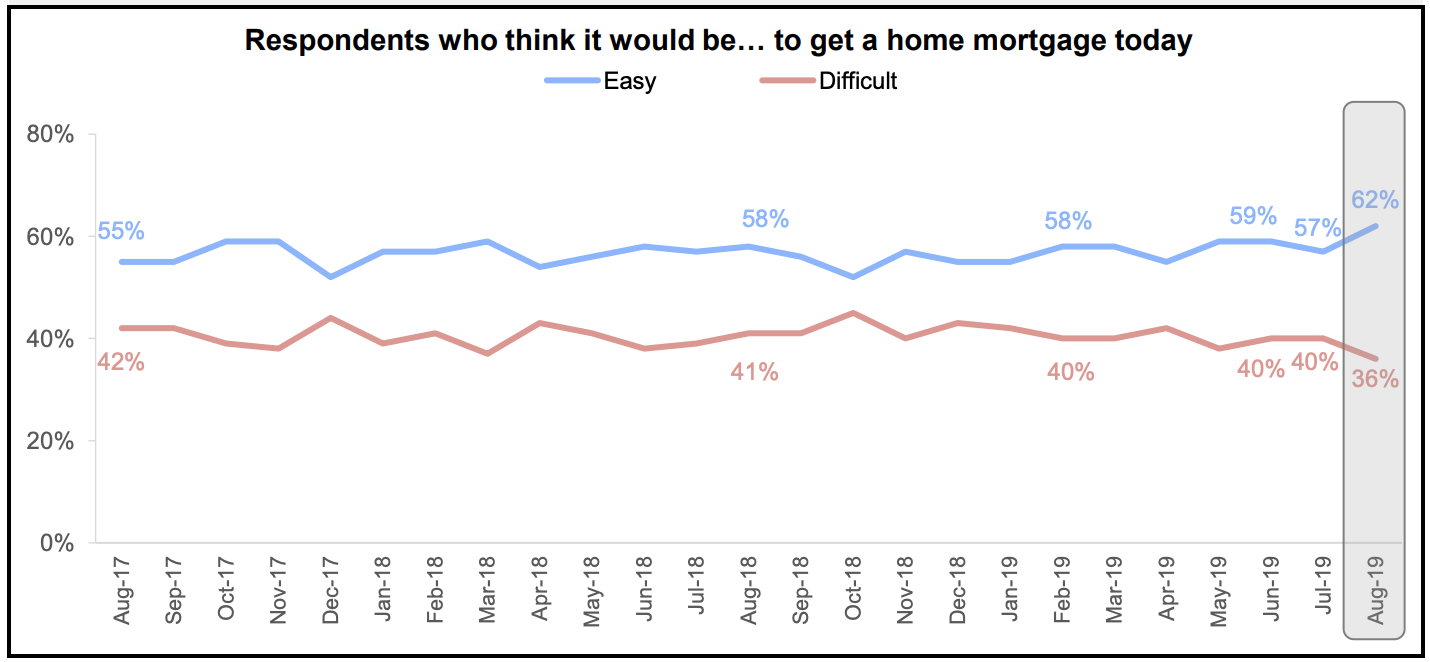

MORTGAGE TECHNOLOGY IS MAKING LOANS EASIER

– Job security for mortgage tech folks looks the best since survey inception.

– 62% of us think getting a mortgage today would be easy. This is the highest since the survey began in June 2010.

– 36% of us think getting a mortgage today would be difficult. This is the lowest since the survey began.

DOES EVERYONE’S RATE & HOME PRICE OPINION MATTER?

– This survey also shows percentages of us who think home prices will rise, fall, and hold.

– And it shows whether we think rates will rise, fall, and hold.

– I’m excluding those because I don’t think the average consumer’s opinion of rates and home prices is as important as the stats above.

– As noted above, people have a good feel for their job/income prospects, and desire to buy versus rent. These are important sentiments to watch.

– Fannie Mae statisticians disagree. They believe people’s view of rates and home prices impacts their homebuying decisions.

– They’re probably right, but I like to focus on these other areas of sentiment.

– See full set of charts and Fannie’s homebuyer sentiment calculations in link below.

___

Reference:

– Fannie Mae Housing, Job, Income Sentiment Survey 2019-09

– Billionaire capitalist Ray Dalio on why capitalism isn’t working