Bank of America U.S. Economic Outlook 4 Months Into Coronavirus

It’s been 4 months since coronavirus got serious in the U.S. It’s felt more like a year, and we’ve had 47.7 million jobless claims from early March until last Thursday.

Needless to say, the NBER declared a recession earlier this month. Here’s a twitter thread for those interested in how recessions get declared.

THREAD:

On NBER saying today that America entered a recession in March (and exactly how NBER defines a recession)…

Peak monthly U.S. economic activity occurred in February 2020, marking end of an expansion that began in June 2009 and the beginning of a recession.

— Julian Hebron (@TheBasisPoint) June 9, 2020

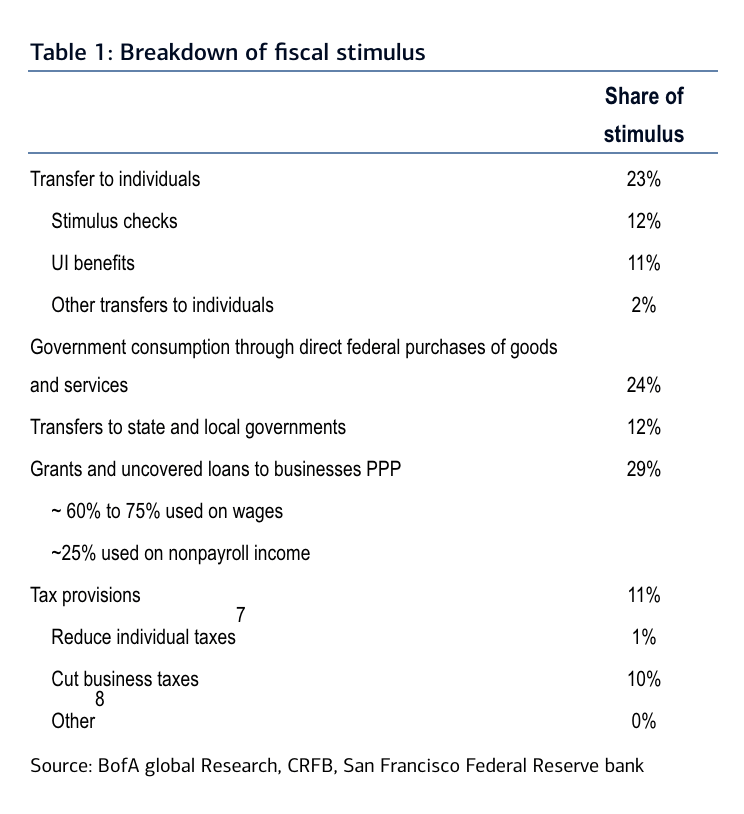

BANK OF AMERICA BREAKDOWN OF CORONAVIRUS STIMULUS

BANK OF AMERICA U.S. ECONOMIC OUTLOOK

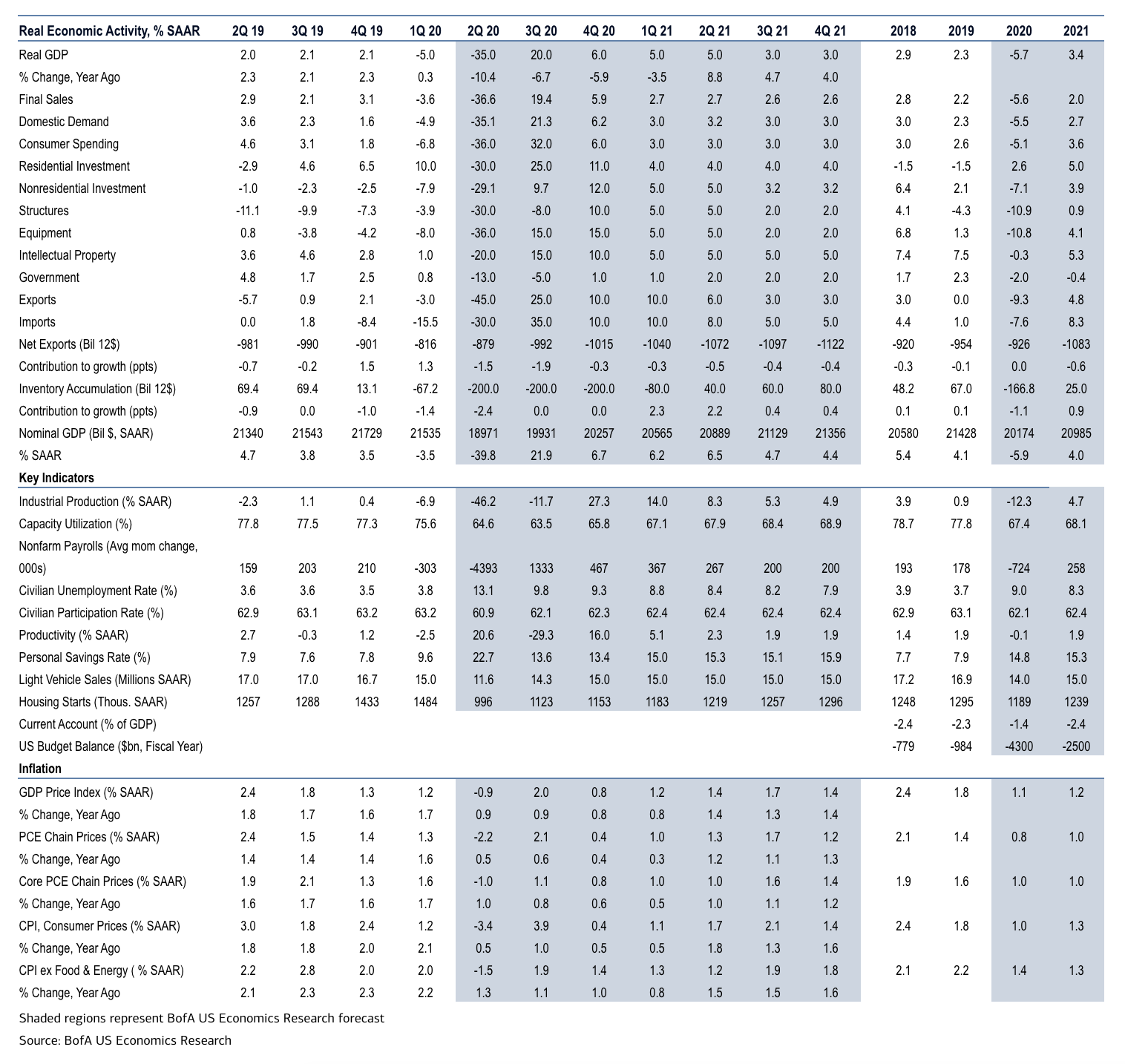

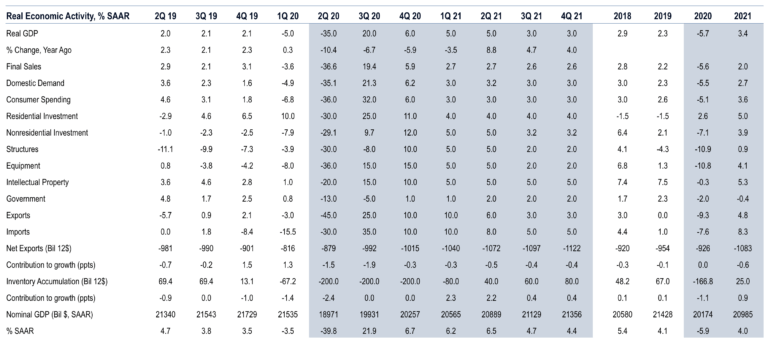

Below are a few key datasets on the economic outlook from Bank of America’s economics team as of this week. And here are a few highlights I think are worth calling out.

2020 & 2021 GDP

1Q 2020: -5%

2Q 2020: -35%

3Q 2020: +20%

4Q 2020: +6%

1Q 2021: +5%

2Q 2021: +5%

3Q 2021: +3%

4Q 2021: +3%

2020 & 2021 JOBS GROWTH (Avg MoM change, thousands)

1Q 2020: -303

2Q 2020: -4393

3Q 2020: +1333

4Q 2020: +467

1Q 2021: +367

2Q 2021: +267

3Q 2021: +200

4Q 2021: +200

And you can go here to track weekly jobless claims in real time.

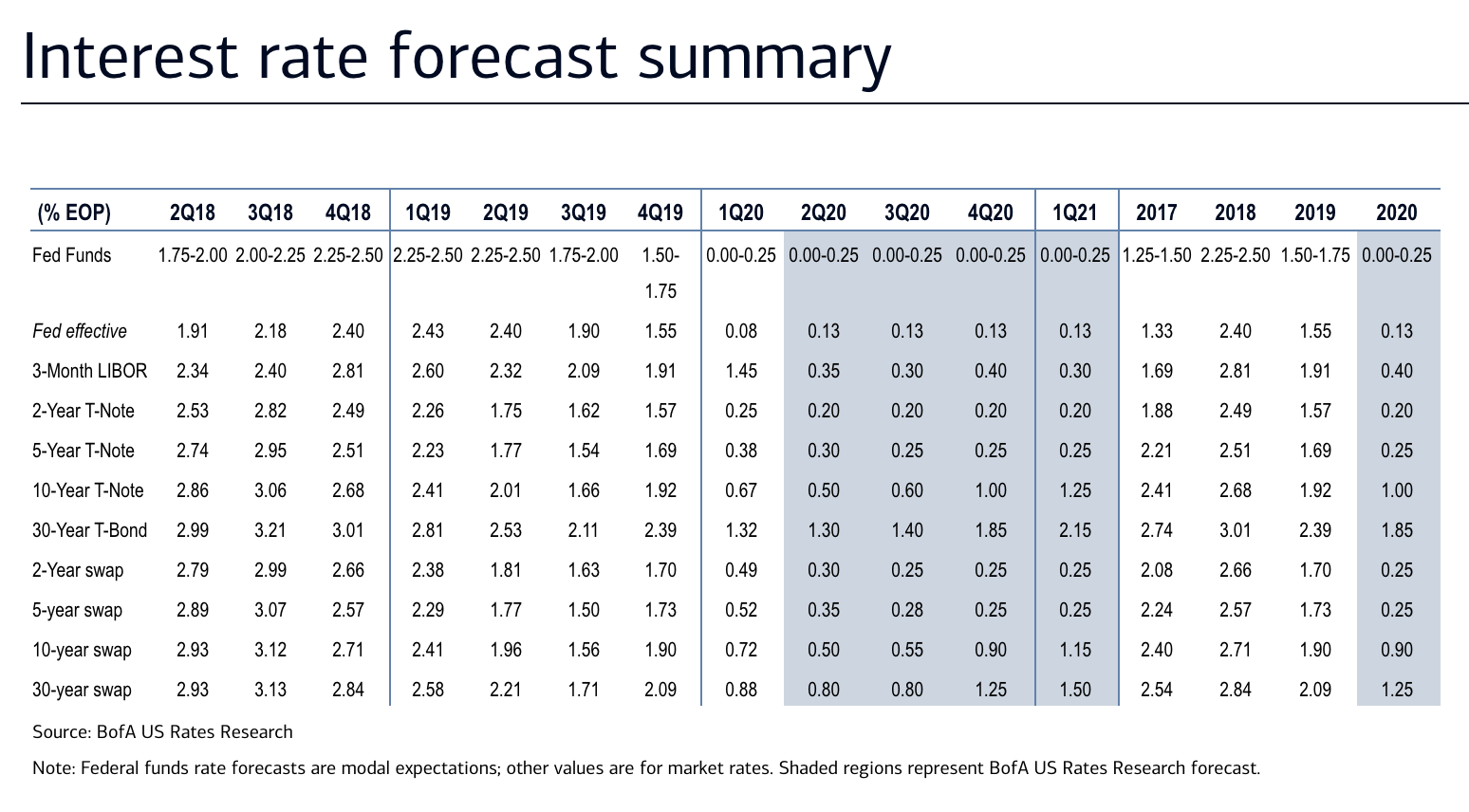

2020 & 1Q 2021 10-YEAR NOTE

1Q 2020: 0.67%

2Q 2020: 0.50%

3Q 2020: 0.60%

4Q 2020: 1.00%

1Q 2021: 1.25%

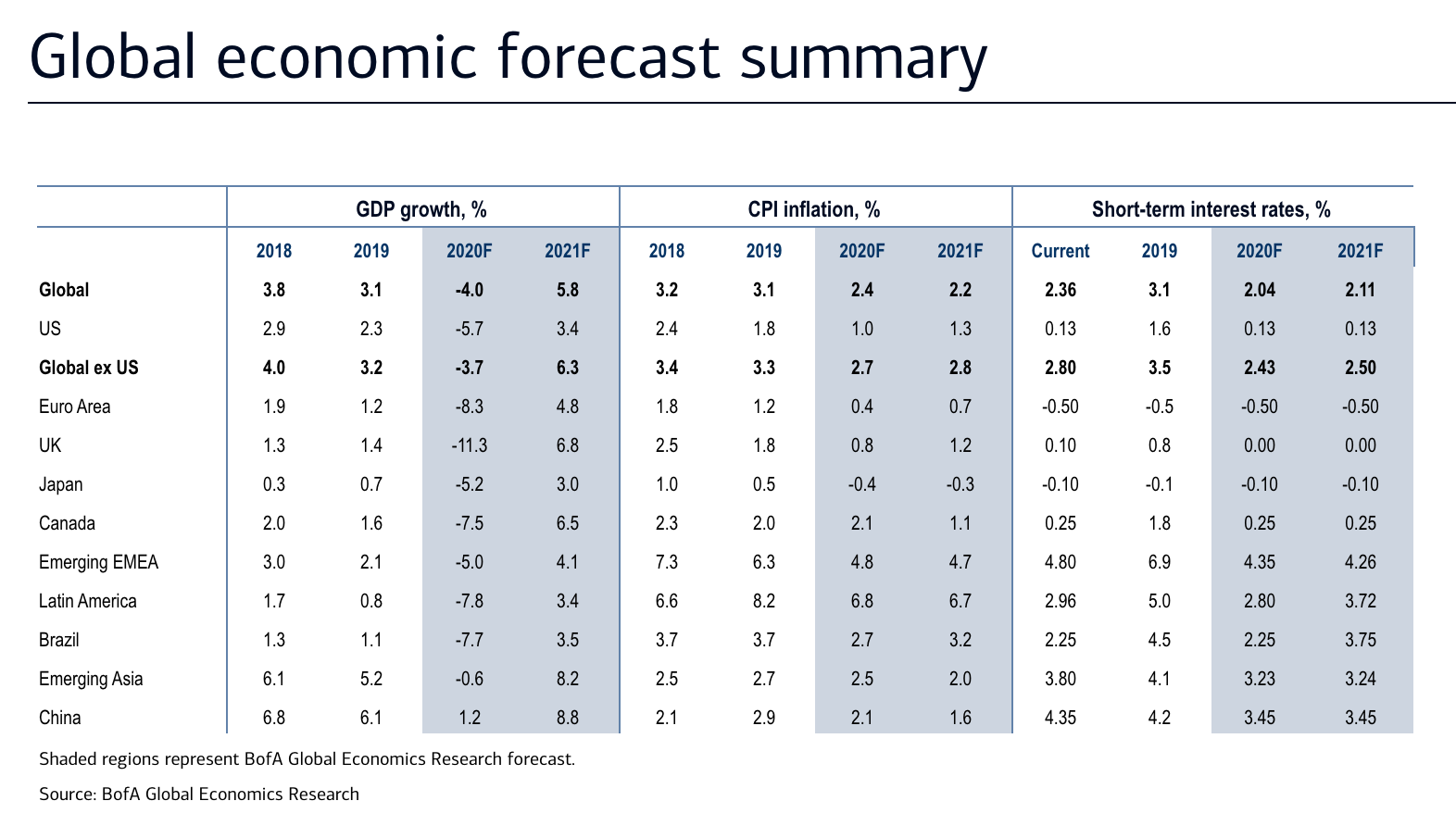

BANK OF AMERICA GLOBAL ECONOMIC OUTLOOK

___

Related:

– Goldman Sachs U.S. Economic Outlook 4 Months Into Coronavirus