Betterment takes next step towards becoming First Bank Of Millennials

Despite most fintech startups saying they’re Not A Bank, the consumer fintech endgame was always about building a modern bank you control from your phone.

The playbook is to start with one product—like budgeting, checking/savings, lending, investing, or brokerage—then expand into other areas of your wallet.

ARE FINTECHS BANKS OR NOT BANKS?

Why don’t these firms call themselves banks? Because most of them aren’t.

If you don’t take deposits, you must comply with countless state and Federal regulations. But you don’t have to be a Federally chartered bank to provide other services like lending, investing, and brokerage.

So fintechs come to market with a certain non-depository product specialization. Then they acquire as many customers as possible. Finally they expand their services—and expand their regulatory compliance commensurately.

Now that giant fintech startups have raised billions and acquired millions of customers, they’re revealing their banking playbooks.

Latest case in point: Betterment, an AI-powered financial advisor for the Instagram generation that manages $18 billion for nearly 500,000 customers, announced a deal late July to offer checking accounts with NBKC Bank and debit cards with Visa.

The deal got obligatory WSJ and CNBC write ups saying Betterment is trying its hand at traditional banking. But since Betterment didn’t stumble like Robinhood when it tried to offer checking and savings accounts, the news didn’t really stick.

So let’s dive deeper.

REVERSING THE CUSTOMER JOURNEY

Betterment began in the so-called roboadvisor category that manages investments for customers using mostly machines rather than human wealth managers.

This is cheaper for Betterment and its customers. Human financial advisors (aka wealth managers) typically charge about 1% of money you have with them per year, whereas roboadvisors typically charge about 0.20% per year.

Wealth management is further down your banking product path from budgeting, brokerage, and lending that other finance startups began with.

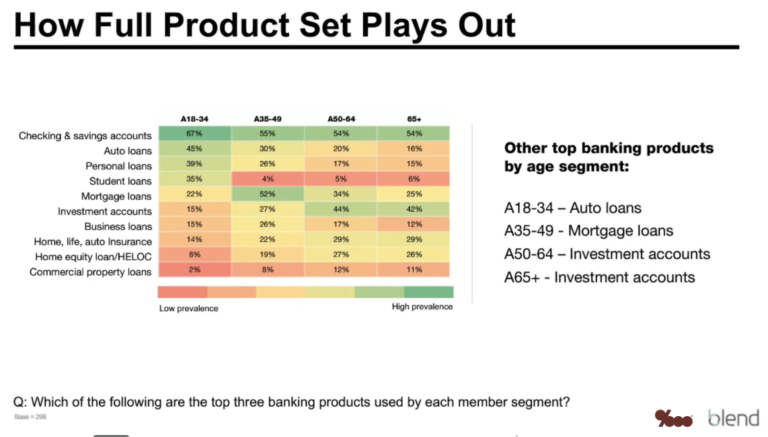

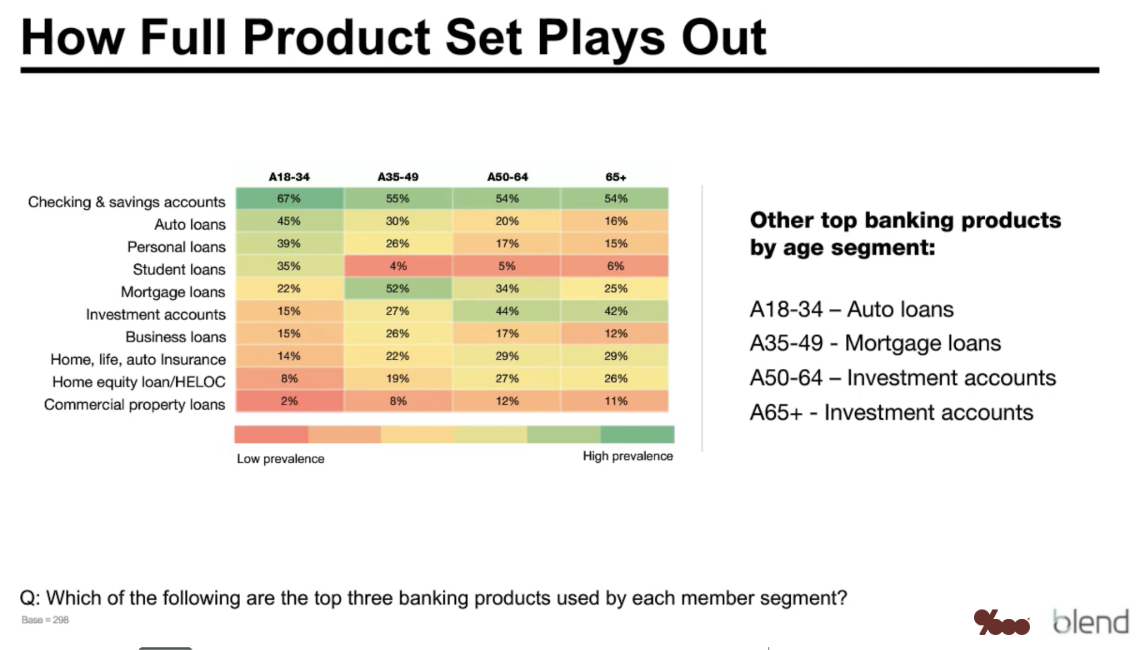

According to research The Basis Point did with Blend and Source Media this summer, your typical banking product journey goes like this:

– You open up a checking account and savings account when you’re younger and just need a place for your direct deposits to go.

– Then, when you’ve made a few bucks and want to finance that big car purchase, you call your existing bank or credit union.

– When you’re older still and ready to buy a home, you go back to the financial institution you already know. As long as they’ve done a good job serving and marketing to you. And once you’ve built up some assets and need help managing your wealth, you do the same.

Acorns, Stash, MoneyLion, and other consumer-facing startups know this path well. That’s why they all started their path to bankhood by adding checking and savings accounts to game-like investing and lending products.

But Betterment is going the opposite way, and following in the footsteps of companies like Wealthfront, Personal Capital, and Marcus by Goldman Sachs.

They’re starting by acquiring and serving customers with the most sophisticated wealth management needs. Then they’re working backwards to add checking, savings, debit card, and other products. And doing so by partnering with institutions that have all those regs covered.

BETTERMENT’S LONG GAME

Where could this go?

Well, your financial advisor knows where all your money is, so they’re in a good position to advise you on which financial products you should use.

They can advise you even better if they’ve got your savings and checking data. This tells them how much you make because your work auto-deposits go in there.

And their early pricing suggests they’ll win a lot of you as customers. It looks like their savings accounts will pay 0.10% to 0.15% more than the current average of U.S. savings accounts (more later on how they’re doing this).

So let’s say you’ve got your checking, savings, and investment money parked at Betterment and you’re ready to buy a home. What if Betterment could instantly offer you a mortgage because its technology is so good at analyzing all your other income and asset data?

That’s where all of this is going.

Betterment already has the expertise to offer high-end financial products like wealth management. It’s getting its foot in the door solving more basic needs like checking and savings with this NBKC deal.

If it can nail your needs—from checking to lending to investing—Betterment (and/or its peers noted above) might win the fintech consumer banking race.

This is a core theme as we move into the Fall. We’ll dig into valuations, deals between startups and incumbents, and what’s best for you the customer as this race plays out.

Subscribe and follow us as we go deeper.

___

Reference:

– Online wealth advisor Betterment launches checking and savings accounts (CNBC)

– Betterment/NBKC joins rush of robo-bank partnerships (American Banker)

– How Betterment Stayed on Top in 2018 and Plans to Stay There in 2019 (Financial Advisor IQ)