Why Did A Big Goldman Sachs Banker Say Big Banks Are Screwed?

Goldman Sachs has a three-year-old startup consumer bank called Marcus that’s already got more customers and deposits than most banks. So is it a scrappy startup, or a badass incumbent?

The answer is yes. Let’s dive in.

+++

At this week’s inaugural Fortune BrainstormFinance conference (because we need even more conferences!), the most notable quote was from a newer Goldman Sachs exec Adam Dell who’s squarely in the middle of the startup and incumbent banking worlds.

Dell said banks are either screwed or don’t know they’re screwed.

A notable quote indeed. But rich coming from a banking startup success poster child who launched his personal finance startup Clarity Money in October 2016 and sold it to Goldman Sachs in April 2018 after accumulating over a million customers.

+++

But seriously, Goldman Sachs is really in consumer banking?

Yep. One of the biggest business banks on the planet launched their consumer bank Marcus (named after co-founder Marcus Goldman) in 2016, then bought Dell’s startup two years later.

Marcus added 500k customers by 2018, then the Clarity deal added another million. Plus the deal got Marcus a shiny new digital-mobile storefront.

Since then, they’ve grown extremely fast.

As of now Marcus has 4 million customers, $4.7 billion on personal loan balances, an impressive $46 billion in deposits, and are the issuer of Apple’s sexy new credit card.

+++

I believe Dell’s “banks are screwed” sentiment is rooted in 2 questions:

1. CAN INCUMBENT BANKS MASTER CUSTOMER ACQUISITION AT SCALE?

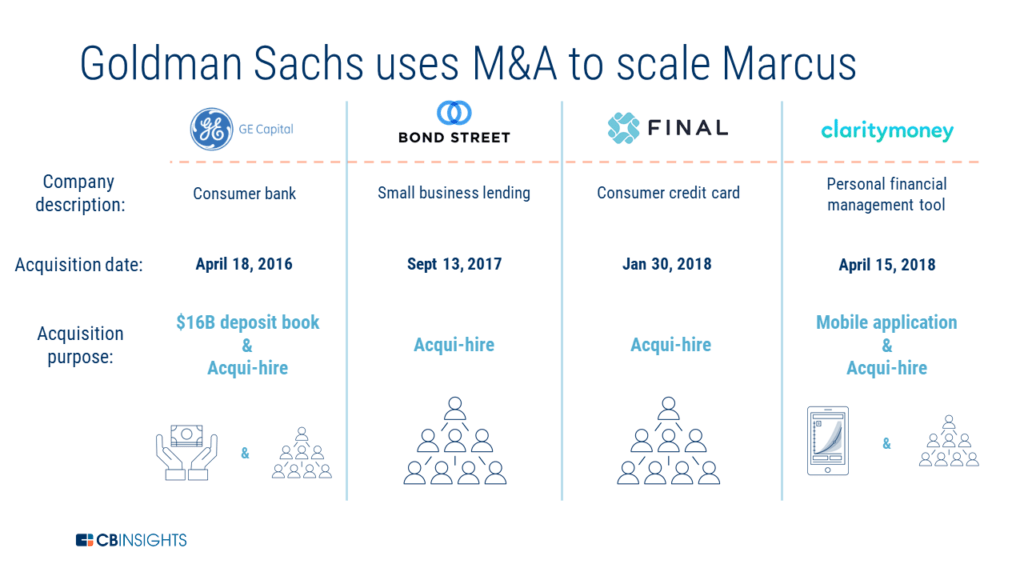

In the case of Marcus, not only did Goldman Sachs do smart deals like Clarity Money but they also kicked off in 2016 by acquiring $16 billion in deposits from a consumer bank GE was offloading. And before they announced their Apple credit card a few months ago, they acquired a startup team that was building a credit card.

Also the Marcus customer acquisition team hails from digital marketing leaders like Amazon, American Express, and Progressive.

And it’s brand head Dustin Cohn previously ran brands at consumer staples like Pepsi and Jockey, which is why Marcus ads are nothing like you’d expect from Goldman Sachs.

All this startup-y customer acquisition behavior powered by a big bank incumbent.

2. CAN INCUMBENT BANKS DELIVER THIS SLICK DIGITAL STOREFRONT & EXPERIENCE?

In short, yes. Just acquire the technology and/or teams to power your startup entity just like Goldman Sachs did.

+++

So there are three ways this will play out.

1. Scrappy startups will come for the banks like Dell implies.

2. Badass bank incumbents will power their own scrappy startups, a strategy that involves gobbling the good startups just like Goldman gobbled Dell’s startup.

3. Startups that just want to power banks with cool, easy, mobile customer experiences (examples are Blend and Plaid) rather than provide consumer financial services.

+++

Big banks like Wells Fargo and JP Morgan chase are mostly using scenario 3 so far to innovate.

As for scenario 2, can all banks execute as well as Goldman?

Not if they don’t adopt this DNA Marcus COO Omer Ismail shared last year:

“We’re a startup inside a 149 year old firm. When I come to work everyday, I have 30,000 fans at Goldman Sachs cheering for my success.”

For example, another giant bank — the #6 U.S. bank formed by the $66 billion merger of SunTrust and BB&T — is now trying to be startup-y by rebranding the bank Truist.

But a rebranding isn’t necessarily recoding to startup DNA, and those execs should think carefully about Dell’s warning.

We’ll keep watching that and Marcus and the rest of the ecosystem, and I’ll follow up shortly to discuss big bank vs. startup valuations. Hope you follow along.

___

Reference:

– If $66 billion SunTrust/BB&T merged brand Truist was a startup, would you hate it less?

– Credit card “created by Apple, not a bank” – powered by a giant bank

– Did you know a $2.7 billion company called Plaid secretly powers your mortgage?